Navigation

Navigation

Meet tBTC: Bringing Bitcoin Into Ethereum’s Booming DeFi Ecosystem

|

|

Over the past few months, decentralized finance, best known as “DeFi,” has become one of the crypto industry’s most tantalizing sectors. Case in point: there are some that have dubbed it one of the killer use cases of blockchain technology.

Thus far, DeFi has involved Ethereum, and Ethereum only. This meant that Bitcoin — largely regarded as the “reserve asset” of the cryptocurrency market — has been left out of the DeFi equation.

Until now, anyway.

Meet tBTC, Bitcoin on Ethereum

In a deal announced Thursday in a press release, Thesis — the development studio behind Bitcoin consumer app Fold — revealed that it had raised $7.7 million in a round led by Paradigm Capital, with other venture funds chipping in. This is the company’s second public round, which was preceded by a $12 million round that saw legendary Silicon Valley firm Andreessen Horowitz (also known as a16z) bid support for the crypto upstart.

This recent round will allow Thesis to move forward with tBTC, an open-source project built by the company and partners like Summa, which will be the first application on the Keep network — an Ethereum layer that is focused on keeping on-chain data private. More on that later.

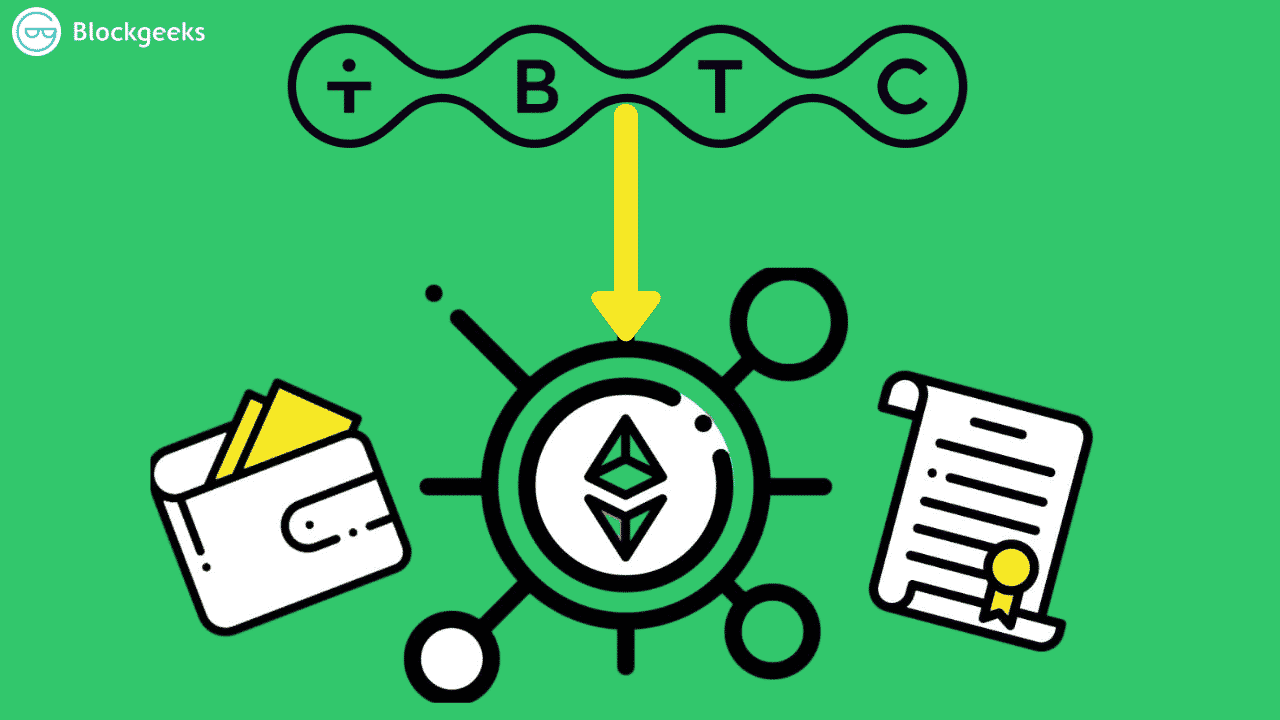

tBTC’s predicate is to be a decentralized representation of Bitcoin on the Ethereum blockchain, allowing the foremost cryptocurrency to be used in the world of crypto-based financial services, best represented by Defi.

Importantly, “Bitcoin on Ethereum” projects already exist — there is already $6.7 million worth of Wrapped Bitcoin (WBTC), whose BTC is custodied by a centralized party in BitGo — though tBTC is the first non-custodial attempt at representing Bitcoin on the Ethereum blockchain.

The project’s website indicates that the mainnet launch of tBTC will take place on April 27th, which follows months of testing on the Ropsten testnet.

How Does It Work?

This new cryptocurrency accomplishes this through contracts on Thesis’ Keep network, which (amongst other applications) allows an owner of Bitcoin to deposit their coin into a designated secure address, then receive newly-minted tBTC in an Ethereum wallet of their choice. Each tBTC is fully backed by Bitcoin at a rate of 1:1. And each private key of the Bitcoin addresses affiliated with tBTC are secured via Keep,

Importantly, holders can also redeem their tBTC for Bitcoin; minting this coin is not a one-way road.

This is decisively different than the other BTC-on-ETH systems that are currently in circulation.

For instance, with Wrapped Bitcoin, those that want to mint the token will need to send Bitcoin to the aforementioned custodian in BitGo, which, while a top custodian in the digital asset space, is a centralized party at the end of the day. Also, WBTC purportedly mandates merchants to conduct KYC and AML procedures when sending WBTC to a user who requests it, further degrading crypto’s predicate as a key to a pseudonymous and private financial ecosystem.

The Importance of This Bitcoin-Ethereum ‘Bridge’

So what’s the big deal about bringing Bitcoin to Ethereum-based decentralized finance? Well, as a tBTC spec document reads:

“The goal of tBTC is the creation an ERC-20 token that maintains the most important property of Bitcoin — its status as ‘hard money’.”

As it stands, Bitcoin is undoubtedly the reserve asset of the cryptocurrency ecosystem; despite its volatility, it is the most tried-and-true digital asset in the entire industry, acting as one of the most active networks, the most-well recognized cryptocurrency, and the most valuable blockchain.

With tBTC and other projects like it, decentralized exchanges and other Defi applications — especially lending protocols and second-layer scaling solutions — can leverage Bitcoin’s liquidity and “hard money” status, thereby increasing their functionality and popularity.

Steven Becker, president of MakerDAO, explained to Bloomberg in a recent interview this very thought, remarking that the joining of Bitcoin and Ethereum will allow the blockchain economy to swell:

“tBTC is brilliant because ultimately it links two major concepts together. [Bitcoin and Ethereum working together] is how all these networks are going to come together to create the on-chain economy.”

And to put a cherry on the top of the tBTC cake, this cryptocurrency brings us one step closer to what Vitalik Buterin, the original creator of Ethereum, is looking for: a “proper (trustless, serverless, maximally Uniswap-like UX) ETH <-> BTC decentralized exchange.”

We should put resources toward a proper (trustless, serverless, maximally Uniswap-like UX) ETH <-> BTC decentralized exchange. It's embarrassing that we still can't easily move between the two largest crypto ecosystems trustlessly.

— vitalik.eth (@VitalikButerin) March 24, 2020