Contents

|

|

Cardano vs Ethereum are two leading blockchain platforms that have gained significant attention in the world of cryptocurrency and decentralized applications (dApps). These platforms have revolutionized the way we use apps, with Bitcoin being the most popular cryptocurrency. As the creation and development of cryptocurrencies and blockchain technology continue to reshape various industries, many investors and developers find themselves comparing Cardano and Ethereum, two popular decentralized application platforms, to determine which platform is better suited for their needs in the world of bitcoin.

Understanding the differences and similarities between Cardano and Ethereum, two popular cryptocurrencies, is crucial for making informed decisions about investment opportunities, application development, and utilizing the power of blockchain technology. Whether you are interested in investing in bitcoin or exploring other cryptocurrencies, taking the time to understand these key players in the market is essential. Both software platforms offer a series of services and applications, but their underlying philosophies, mechanisms, and design vary significantly. When considering time and investment choices, it is important to understand these differences.

By delving into these aspects, such as the ethereum foundation, software, philosophy, and pow, we aim to provide you with valuable insights that will help you navigate the world of blockchain investments effectively.

Contents

Cardano vs. Ethereum: A Comparison

When comparing Cardano and Ethereum in terms of their work blockchain and blockchain network, there are several key points to consider. Both platforms utilize software to power their respective networks. Let’s explore the main differences between these two cryptocurrencies, Ethereum and Blockchain, in terms of technology, governance, and scalability, and understand how these variances impact their respective ecosystems.

Technology

Cardano, with its scientific approach to blockchain development, is well-regarded in the field of eth. It utilizes a layered architecture that separates the settlement chain layer from the computational chain layer. This design allows for greater flexibility and security within the chain platform. On the other hand, Ethereum follows a single-layer chain architecture where both settlement and computation occur on the same layer.

Cardano employs a proof-of-stake consensus mechanism called Ouroboros, which aims to be more energy-efficient compared to Ethereum‘s current proof-of-work system. The implementation of Ouroboros ensures that transactions on the Cardano blockchain are validated by participants who hold a stake in the network.

Governance

In terms of governance, Cardano takes a more decentralized approach compared to Ethereum. It emphasizes community involvement through its unique voting system. Stakeholders can participate in decision-making processes by submitting proposals and voting on important protocol upgrades or changes.

Ethereum has traditionally relied on a more centralized governance model with decisions made by core developers and foundation members. However, there have been recent efforts within the Ethereum community to transition towards a more decentralized governance structure through initiatives like Ethereum Improvement Proposals (EIPs) and decentralized autonomous organizations (DAOs).

Scalability

Scalability has been a significant challenge for both Cardano and Ethereum due to their increasing popularity and usage. However, they employ different strategies to address this issue.

Cardano aims to achieve scalability through its use of sidechains or “hydra heads.” These sidechains allow for parallel processing of transactions while maintaining interoperability with the main Cardano blockchain. This approach enables higher transaction throughput without compromising security and decentralization.

Ethereum, on the other hand, is undergoing a major upgrade known as Ethereum 2.0 or ETH2, which aims to improve scalability through the implementation of a new consensus mechanism called proof-of-stake (PoS). This upgrade will also introduce shard chains, allowing for increased transaction processing capacity.

How Ethereum Differs from Cardano

Early Mover Advantage

Ethereum, being one of the earliest blockchain platforms, has a significant advantage in terms of its position and influence in the industry. It was launched back in 2015 and quickly gained popularity among developers and users alike. Its early adoption allowed it to establish a strong network effect, attracting a large community and fostering the development of numerous decentralized applications (dApps) on its platform.

On the other hand, Cardano is a relatively newer player in the blockchain space. Launched in 2017 by IOHK, it aims to provide a more secure and scalable infrastructure for decentralized applications. While Cardano may lack Ethereum‘s first-mover advantage, it compensates with its rigorous academic approach and commitment to scientific research.

.

Development Processes: Decentralized vs Centralized

Another distinguishing factor between Ethereum and Cardano is their development processes. Ethereum’s development is driven by its creator, Vitalik Buterin, along with an open-source community of developers worldwide. Updates or changes to Ethereum‘s protocol require a consensus among the community, which can sometimes lead to delays or disagreements.

In contrast, Cardano takes a more structured and methodical approach to development. It follows a peer-reviewed research process, where proposals are thoroughly examined and validated by experts before implementation. This rigorous approach ensures that changes made to Cardano’s protocol are well-vetted and scientifically grounded.

Cardano is divided into different layers: the settlement layer (Cardano SL) and the computation layer (Cardano CL). This separation allows for greater flexibility and modularity in development, enabling easier upgrades without disrupting the entire network.

Key Similarities between Cardano and Ethereum

Shared Goals: Decentralization, Security, and Smart Contract Functionality

Cardano and Ethereum may have their differences, but they also share some common goals. One of these shared objectives is decentralization. Both platforms aim to create a decentralized ecosystem where power is distributed among the network participants rather than being concentrated in the hands of a few entities. By achieving decentralization, they strive to eliminate single points of failure and enhance the security and resilience of their networks.

Another similarity between Cardano and Ethereum lies in their focus on security. Both platforms recognize the critical importance of ensuring the safety of user funds and protecting against potential vulnerabilities or attacks. They employ various measures such as rigorous code audits, bug bounties, and regular upgrades to address security issues promptly.

Furthermore, both Cardano and Ethereum offer smart contract functionality. Smart contracts are self-executing contracts with predefined conditions that automatically execute when those conditions are met. This feature enables developers to build decentralized applications (dApps) on top of these platforms, opening up a world of possibilities for innovative solutions across various industries.

Commitment to Fostering Innovation through Developer Communities

Both Cardano and Ethereum understand the significance of developer communities in driving innovation within their ecosystems. They actively encourage developers to contribute by providing tools, resources, and support for building on their respective platforms.

Ethereum has established itself as a pioneer in this regard with its vast developer community. It offers an extensive set of development tools like Solidity (a programming language), Remix IDE (an integrated development environment), and Truffle Suite (a development framework). These tools empower developers to create smart contracts and dApps efficiently.

Similarly, Cardano places great emphasis on fostering its own developer community through initiatives like Project Catalyst. This program allows developers to submit proposals for funding projects that will contribute to the growth of the Cardano ecosystem. By involving developers directly in decision-making processes, Cardano aims to create a collaborative environment that encourages innovation and drives the platform forward.

Importance of Interoperability for Both Ecosystems

Interoperability is a crucial aspect for both Cardano and Ethereum. It refers to the ability of different blockchain networks to communicate and interact with each other seamlessly. Achieving interoperability allows for the exchange of assets, data, and services across multiple platforms, enhancing the overall functionality and usability of the blockchain ecosystem.

Cardano recognizes this importance and has been working on its own interoperability solution called “Hydra.” This technology aims to enable seamless communication between different blockchains while maintaining security and scalability.

Ethereum, on the other hand, has made significant progress in achieving interoperability through projects like Polkadot and Cosmos. These initiatives focus on creating bridges between various blockchains, facilitating cross-chain transactions and data transfers.

Advantages of Cardano

Academic Research and Scientific Rigor

Cardano sets itself apart by placing a strong emphasis on academic research and scientific rigor throughout its development process. This means that the team behind Cardano is committed to conducting thorough research, analyzing data, and implementing evidence-based solutions. By taking this approach, Cardano aims to ensure that its platform is built on solid foundations, making it more reliable and secure.

Ouroboros: Enhanced Security and Scalability

One of the key advantages of Cardano is its unique proof-of-stake algorithm called Ouroboros. Unlike other blockchain networks that rely on energy-intensive mining processes, Cardano uses a more efficient consensus mechanism. Ouroboros allows users to participate in the network’s security and validation process based on the number of coins they hold. This not only reduces energy consumption but also enhances the overall security and scalability of the network.

With Ouroboros, Cardano achieves a high level of decentralization by ensuring that no single entity has control over the majority of the network’s resources. This helps prevent malicious attacks and makes it more difficult for any individual or group to manipulate the system for their own gain.

Multi-Layered Architecture for Seamless Upgrades

Cardano’s multi-layered architecture is designed with future upgrades in mind. The platform consists of two main layers: the settlement layer and the computation layer. The settlement layer handles transactions and ensures secure value transfer, while the computation layer enables smart contracts and decentralized applications (dApps) to run on top of Cardano.

This modular design allows for seamless upgrades without disrupting existing functionalities or compromising security. It enables developers to introduce new features or improvements to specific layers without affecting the entire ecosystem. As a result, Cardano can adapt to changing needs and technological advancements while maintaining stability.

By embracing a multi-layered architecture, Cardano provides flexibility for developers who want to build and deploy their own dApps on the platform. This opens up a world of possibilities for innovation and collaboration within the Cardano ecosystem.

Disadvantages of Cardano

Slower Pace of Development

Cardano, while a promising blockchain project, has faced criticism for its relatively slower pace of development compared to other platforms like Ethereum. Some users and investors have expressed concerns that the team behind Cardano may not be able to deliver updates and improvements at the same speed as their competitors. This could potentially impact the platform’s ability to keep up with the rapidly evolving blockchain landscape.

Challenges for New Projects

Another potential disadvantage of Cardano is the challenges faced by new projects seeking to build on top of its infrastructure. As Cardano is still evolving and developing, there may be limitations or uncertainties in terms of compatibility and stability. This can make it more difficult for developers to create and launch their own decentralized applications (dApps) on the platform.

Furthermore, due to its relatively smaller user base compared to more established platforms like Ethereum, new projects building on Cardano may struggle to gain traction and attract users. Network effects play a significant role in the success of blockchain platforms, and lower adoption rates could limit the growth potential for projects built on Cardano.

Lower Adoption Rates

While Cardano has made significant strides in establishing itself as a reputable blockchain platform, it still lags behind Ethereum in terms of adoption rates. Ethereum has a larger community of developers, users, and projects already built on its network. This wider adoption provides a network effect that attracts more participants and increases liquidity within the ecosystem.

The lower adoption rates for Cardano can result in limited opportunities for collaboration between different projects within its ecosystem. It may take longer for developers to access necessary resources or find support from an active community when troubleshooting issues or seeking guidance.

Advantages of Ethereum

Extensive Ecosystem of dApps

Ethereum has established itself as a leading blockchain platform, thanks to its extensive ecosystem of decentralized applications (dApps). These dApps cover various sectors such as finance, gaming, and supply chain management. With Ethereum‘s smart contract functionality, developers can create innovative and autonomous applications that run on the blockchain.

Strong Community Support

One key factor contributing to Ethereum‘s success is its strong community support. The Ethereum Foundation, a non-profit organization dedicated to the development and promotion of the platform, has played a crucial role in fostering this support. The foundation provides grants for research and development projects, which encourages innovation within the Ethereum ecosystem.

Moreover, the active and passionate community surrounding Ethereum has contributed significantly to its growth over the years. Developers from around the world collaborate on GitHub repositories, share ideas on forums like Reddit and Discord, and organize conferences such as Devcon to discuss advancements in blockchain technology. This vibrant community ensures that Ethereum remains at the forefront of blockchain innovation.

Scalability Solutions

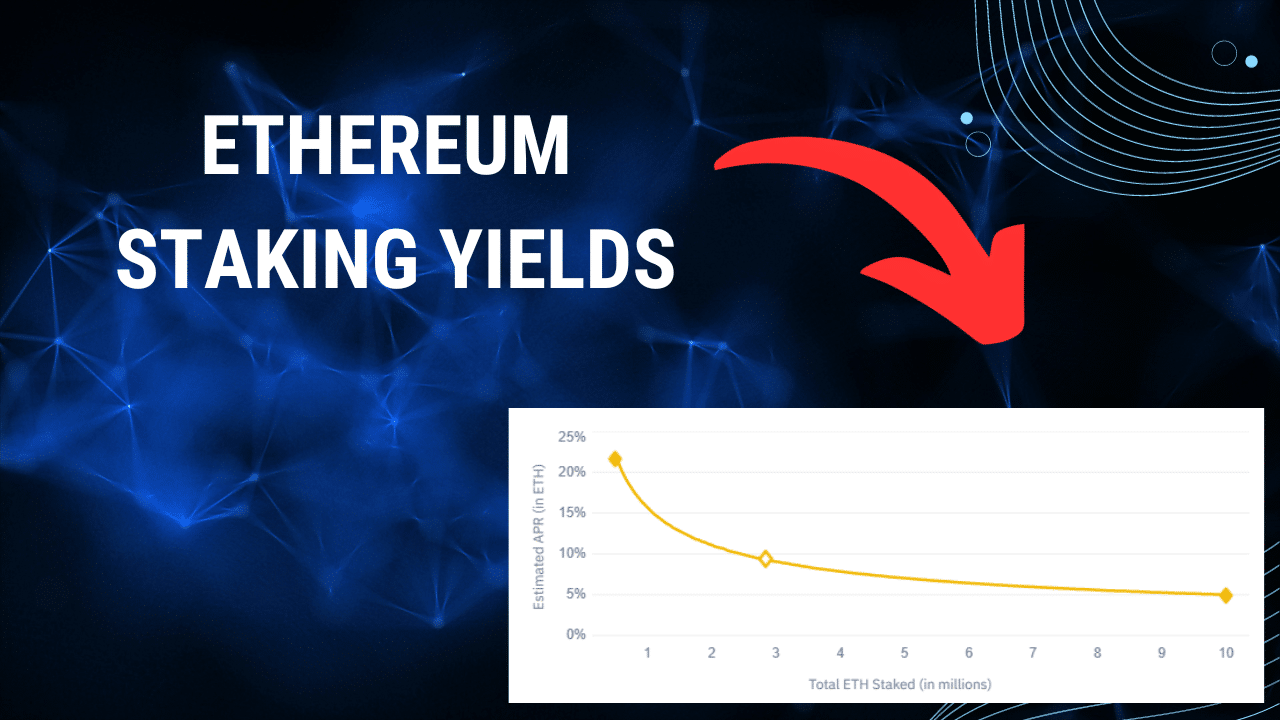

Scalability has been an ongoing challenge for many blockchain networks, including Ethereum. However, several solutions are being implemented to address this issue. Layer 2 protocols like Plasma and state channels allow for off-chain transactions while ensuring security through periodic validation on the main Ethereum blockchain.

Furthermore, Ethereum 2.0 is a major upgrade currently underway that aims to enhance scalability by transitioning from a proof-of-work (PoW) consensus mechanism to proof-of-stake (PoS). This upgrade will introduce shard chains that can process transactions in parallel, significantly increasing network capacity.

Pioneering Decentralized Finance (DeFi)

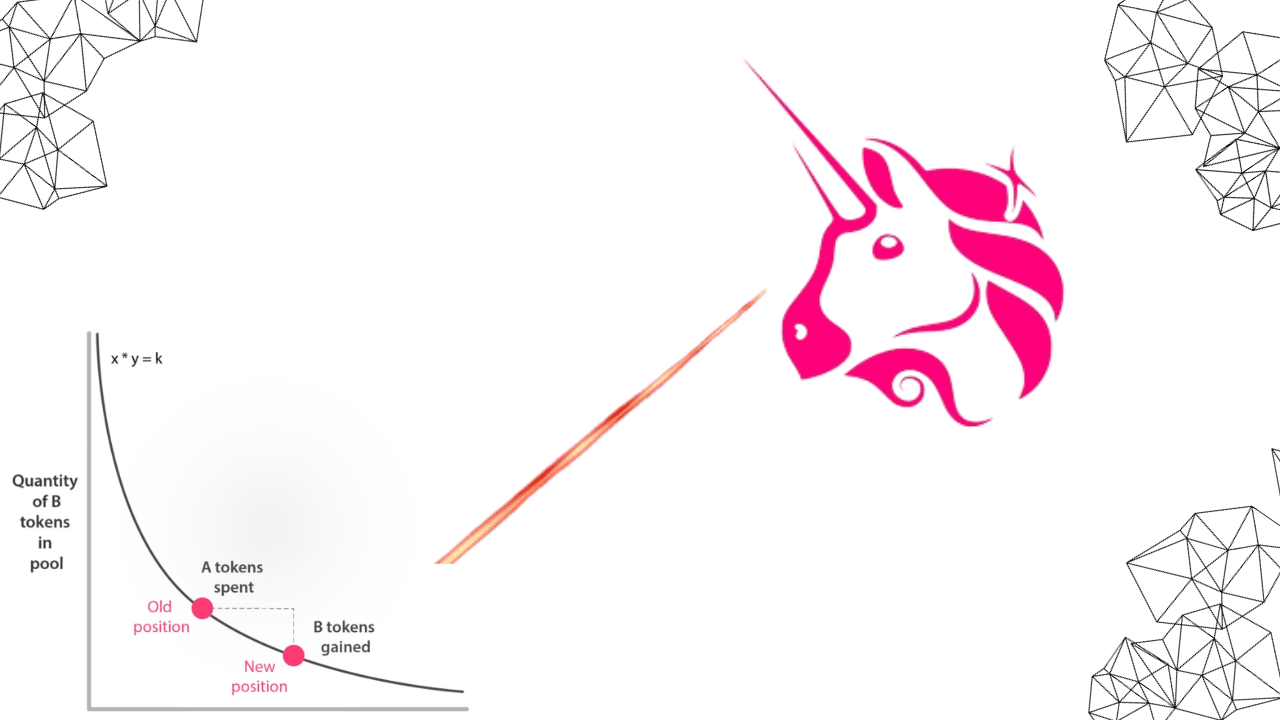

Ethereum has paved the way for decentralized finance (DeFi), revolutionizing traditional financial systems by enabling peer-to-peer transactions without intermediaries. DeFi applications built on top of Ethereum offer various services like lending platforms, decentralized exchanges (DEXs), and stablecoins.

The native cryptocurrency of Ethereum, Ether (ETH), plays a crucial role in the DeFi ecosystem. It serves as collateral for loans, facilitates liquidity on DEXs, and powers decentralized applications. The rise of DeFi has attracted significant attention from both retail and institutional investors, further fueling Ethereum‘s growth.

Mover Advantage

Being one of the first blockchain platforms to gain widespread adoption, Ethereum has a significant mover advantage over its competitors. Its established network effect, developer community, and extensive dApp ecosystem make it an attractive choice for businesses and developers looking to build on the blockchain.

While other blockchains like Cardano offer promising features and advancements, Ethereum‘s head start gives it an edge in terms of adoption and infrastructure development. However, competition within the blockchain space is fierce, with new platforms emerging regularly. Therefore, Ethereum must continue to innovate and evolve to maintain its position as a leading blockchain platform.

Disadvantages of Ethereum

Scalability Limitations

One major concern with Ethereum is its current scalability limitations. As the network has grown in popularity, it has experienced issues such as high gas fees and network congestion. Gas fees are transaction fees paid by users to execute smart contracts or transfer tokens on the Ethereum network. The increasing demand for transactions has led to a surge in gas fees, making it costly for users to interact with the platform.

Security Risks with Smart Contracts

Another potential disadvantage of Ethereum lies in the security risks associated with smart contracts. While smart contracts offer decentralized and automated execution of agreements, they are not immune to vulnerabilities. One notorious example is the infamous DAO attack in 2016, where an exploit allowed hackers to drain millions of dollars from a decentralized autonomous organization (DAO) built on top of Ethereum. This incident highlighted the need for thorough auditing and testing of smart contracts before they are deployed on the blockchain.

Challenges for Developers

Developers working with Ethereum often face challenges due to frequent updates and changes in the protocol. As Ethereum evolves, new versions are released that may introduce breaking changes or require developers to modify their applications accordingly. These updates can be time-consuming and may disrupt ongoing projects or require additional resources for maintenance and adaptation.

Furthermore, developing on Ethereum requires learning Solidity, a programming language specific to writing smart contracts on the platform. This creates a barrier for developers who are already proficient in other languages but need to invest time and effort into acquiring Solidity skills.

Account Fees

While account fees were not mentioned as an explicit talking point, it’s worth noting that Ethereum does have costs associated with creating and managing user accounts. When users want to interact with decentralized applications (dApps) or perform transactions on Ethereum, they need to create an account through which they can access these services. However, creating an account requires paying a small fee known as “gas” which covers the computational resources needed to create and maintain the account.

Although these fees are generally low, they can still be a barrier for users with limited financial means or those who frequently interact with the network. This aspect should be taken into consideration when evaluating Ethereum‘s usability and accessibility.

Conclusion

So, after comparing Cardano and Ethereum, it’s clear that both platforms have their strengths and weaknesses. Cardano offers a more secure and scalable blockchain with its unique proof-of-stake consensus mechanism, while Ethereum has the advantage of being the first-mover in the smart contract space and enjoys widespread adoption.

Ultimately, the choice between Cardano and Ethereum depends on your specific needs and priorities. If you value security and scalability, Cardano may be the better option for you. On the other hand, if you prioritize network effects and a robust ecosystem, Ethereum might be the way to go.

Regardless of which platform you choose, it’s important to stay informed about the latest developments and advancements in this rapidly evolving industry. Keep an eye on both Cardano and Ethereum as they continue to innovate and push the boundaries of what’s possible with blockchain technology.

FAQs

What is Cardano?

Cardano is a blockchain platform that aims to provide a secure and scalable infrastructure for the development of decentralized applications (dApps). It utilizes a proof-of-stake consensus algorithm, allowing users to participate in the network’s governance through staking their ADA tokens.

What is Ethereum?

Ethereum is a decentralized blockchain platform that enables the creation and execution of smart contracts. It introduced the concept of programmable money, allowing developers to build various applications on top of its blockchain using its native cryptocurrency called Ether (ETH).

How does Cardano differ from Ethereum?

While both Cardano and Ethereum are blockchain platforms, they differ in their underlying technology. Cardano uses a unique proof-of-stake consensus algorithm called Ouroboros, which aims to enhance security and scalability. Cardano focuses on academic research and peer-reviewed development to ensure robustness.

Which platform has better scalability, Cardano or Ethereum?

Cardano aims to address scalability issues by utilizing a layered architecture that separates transactions from smart contract execution. This approach allows for greater scalability potential compared to Ethereum‘s current design. However, it’s important to note that both platforms are actively working on improving scalability.

Are there any advantages of using Cardano over Ethereum?

One advantage of using Cardano over Ethereum is its commitment to formal methods and scientific research-driven development. This approach enhances security and reduces the risk of vulnerabilities in smart contracts. Cardano’s modular design enables easier upgrades without disrupting the entire network.

Navigation

Navigation