Contents

|

|

On the 1st November 2018, being the same day when the Virtual Financial Assets Act, 2018 (“VFA Act”) and the Virtual Financial Asset Regulations (Legal Notice 357 of 2018)) came into force, the Malta Commissioner for Revenue issued guidelines on the income tax, stamp duty and VAT treatment of transactions or arrangements involving Distributed Ledger Technology (“DLT”) Assets. In this guide, we provide a summary of Malta’s cryptocurrency tax guidelines.

Contents

Malta’s Cryptocurrency Tax: Introduction

On the 1st of November 2018, the Malta Commissioner for Revenue has issued guidelines on the income tax, stamp duty and VAT treatment of those transactions or arrangement which involve DLT Assets. Three sets of guidelines were issued covering income tax, stamp duty, and VAT separately. A categorization of DLT assets was made common to all three guidelines whereby DLT assets were categorized into coins and tokens, with the latter further subdivided into financial tokens and utility tokens.

The VFA Act introduces a regime that regulates a new class of digital assets, known as DLT assets, together with ancillary services and product offerings relating to such DLT Assets, including Virtual Financial Assets, Initial Coin Offerings (hereinafter referred to as “ICOs”), Exchanges, and Virtual Financial Asset Agents and Service Providers.

The VFA Act defines initial virtual financial asset offerings or as they are more commonly known, ICOs as ‘a method of raising funds whereby an issuer is issuing virtual financial assets and is offering them in exchange for funds’.

Virtual tokens, or ‘utility tokens’, are defined as DLT assets that have no utility, value or application outside of the DLT platform on which they were issued and may only be redeemed for funds on the platform directly by the issuer of the DLT asset.

All three tax guideline documents clarify that the income tax, stamp duty and VAT treatment of any type of DLT asset will not necessarily be determined by its categorization, but will depend on the purpose for and the context in which it is used.

Malta’s Cryptocurrency Tax: Initial Coin Offerings

The Guidelines provide that for income tax purposes the proceeds from raising finance in an initial offering or token generation event should not be treated as income of the issuer and the issue of new tokens should neither be treated as a transfer for capital gains tax purposes.

From a VAT perspective, the VAT guidelines provide that based on the assumption that at the point of issuing an ICO, no specific good or service is identified, nor a corresponding price for a supply could be fixed, nor would it be possible to determine whether the project to the undertaken by the issuer of the ICO would be realized – then such ICO may not necessarily constitute a chargeable event for VAT purpose and hence should be treated as outside the scope of VAT.

Where however the tokens issued at ICO stage would give rights to identified goods or services for a specified consideration, a chargeable event would arise and the rules applicable to utility / financial tokens should be followed.

Malta’s Cryptocurrency Tax: Financial and Utility Tokens

For the purpose of the guidelines issued, tokens were divided into financial tokens and utility tokens as well as tokens having characteristics of both, being referred to as hybrid tokens.

Financial tokens refer to DLT Assets exhibiting qualities that are similar to equities, debentures, units in collective investment schemes, or derivatives and including Financial Instruments. Utility tokens refer to DLT Assets whose utility, value or application is restricted solely to the acquisition of goods or services either solely within the DLT platform on or in relation to which they are issued or within a limited network of DLT platforms.

For income tax purposes returns derived from financial tokens, whether received in fiat or in cryptocurrency or in kind, should be treated as income. In relation to the transfer of tokens, the tax treatment should depend on whether the transfer is a trading transaction or is a transfer of a capital asset. Whilst trading profits are taxable, capital gains are only taxable in so far as the token meets the definition of ‘securities’ in the Income Tax Act.

From a VAT point of view, the VAT guideline document provide that in the case of financial tokens issued simply to raise capital, the issue would not give rise to any VAT implications in the hands of the issuer for the reason that the raising of finance in itself does not constitute a supply of goods or services for consideration. In the case of utility tokens whereby a token issued carries an obligation to be accepted as consideration or part thereof for a supply of a good or a service, such token would have the characteristics of a voucher and should be treated in the same manner as vouchers for VAT purposes. A distinction must be made between single-purpose or multi-purpose tokens/ vouchers in this case.

For hybrid tokens, containing the features of both financial and utility tokens, the guidelines provide that where a hybrid token is used in a particular case as a utility token then it is to be treated as such, while if in another occasion the same token is used as a coin, then it needs to be treated as such.

Malta’s Cryptocurrency Tax: Transactions in Coins

For income tax purposes the distinction between trading and capital transactions should be made in determining whether a transaction involving coins is taxable or otherwise. The guidelines provide that profits realized from the business of exchanging coins should be treated in the same manner as profits derived from the business of exchanging fiat currency and hence subject to income tax whilst coins should fall outside the scope of taxation of capital gains.

For VAT purposes the exchange of cryptocurrencies for other cryptocurrencies or for fiat money where such exchange constitutes a supply of services for consideration should be exempt from VAT under the exemptions provided for transactions in currency and related services.

With respect to the determination of a coin’s value, the guidelines provide that this should be established by reference to the rate published by the relevant Maltese authorities, and where such is not available be reference to the average quoted price on three reputable exchanges, on the date of the relevant transaction or event, or such other methodology to the satisfaction of the Commissioner for Revenue.

Digital Wallets

In order to establish the VAT treatment of digital wallet providers, the guidelines provide that where the providers require the payment of fees for allowing coin users to hold and operate a cryptocurrency and hence create rights and obligations in relation to the means of payment in question, the services of digital wallet providers should be VAT exempt under the exemption for transactions in currency and related services. If the service provided by digital wallet providers do not constitute transactions concerning currency as mentioned above and neither are transactions concerning payments or transfers for the purposes of item 3(3), Part Two, 5th Schedule to the VAT Act, or transactions in securities for the purposes of item 3(5), Part Two, 5th Schedule to the VAT Act, then the services would classify as taxable. For the avoidance of doubt, a mere technological service would be taxable.

Mining

For income tax purposes, the guidelines mention that gains or profits on revenue account from the mining of cryptocurrency represent income.

In relation to VAT on mining activities, the guidelines provide for two instances, that is where mining constitutes a service for which compensation arises in the nature of newly minted coins, mining normally does not have a particular recipient of such service thereby, in that case, falling outside the scope of VAT on the basis that there would be no direct link between the compensation received and the service rendered and, there would be no reciprocal performance between a supplier and a receiver. On the other hand, should miners receive payment for other activities, such as for the provision of services in connection with the verification of a specific transaction for which a specific charge to a specific customer is made, a chargeable event for VAT purposes would be triggered. In that case, in so far that such service would be deemed to take place in Malta, Maltese VAT would be applicable at the standard rate.

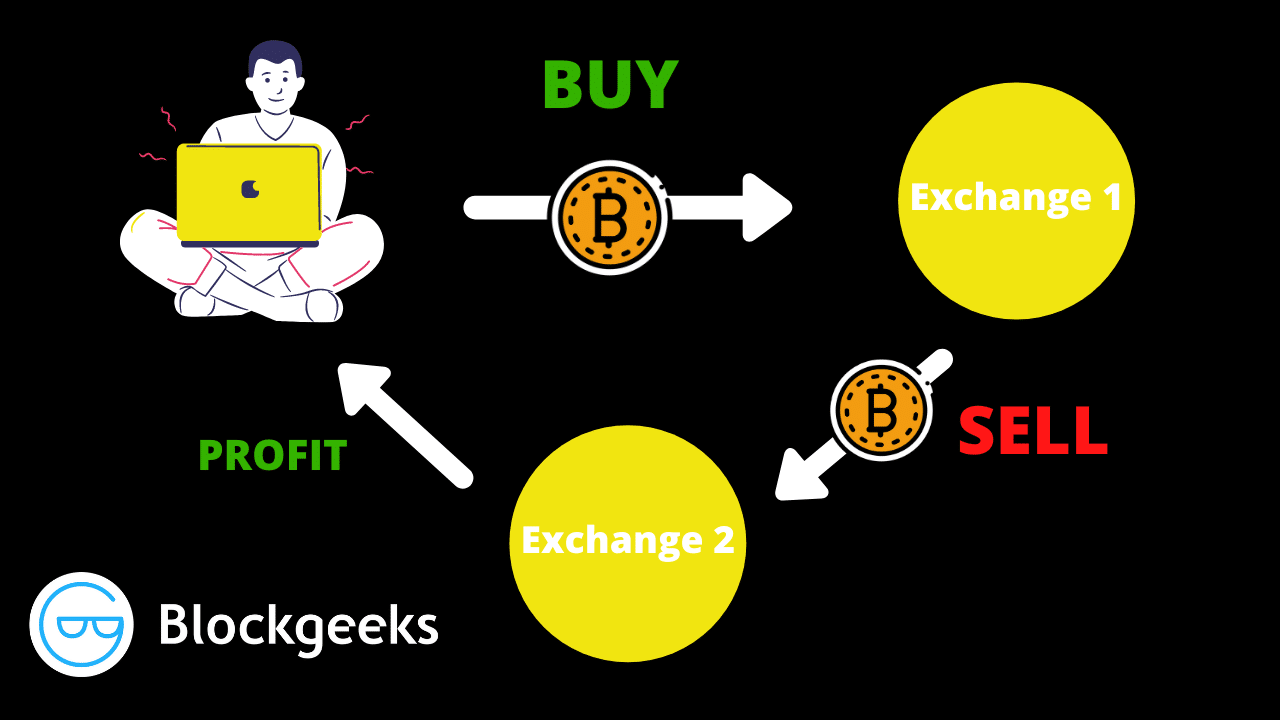

Exchange Platforms

Providers of exchange platforms realizing profits from the provision of the platform, should be treated like normal companies and hence chargeable to tax under the normal rules and principles applicable to Malta corporate entities.

For VAT purposes, the provision of a trading/exchange facility in consideration for the payment of a user/transaction fee or commission constitutes a supply of services for consideration. Like any other transaction, for VAT purposes, a supply of services falling within the scope of Malta VAT would be taxable, unless an exemption applies. The VAT treatment (as taxable or exempt) of trading/exchange platform services would depend on the nature of the service supplied, which would have to be determined on a case-by-case basis. factors that must be looked at include and are not limited to what the underlying service consists of, mainly if merely a technological service or if there is involvement in the transfer or exchange which might lead to the transaction being VAT exempt.

Stamp duty

The stamp duty treatment of transactions involving DLT assets is determined by analyzing whether the DLT assets in question that have the same characteristics as “marketable securities” as defined in the Act, they shall be subject to duty in accordance with the applicable provisions of the Duty on Documents and Transfers Act.

Malta’s Cryptocurrency Tax: Conclusion

Whilst the guidelines issued provide for clarity in the application of existing rules and regulations, each case must be treated separately to establish the income tax, VAT and stamp duty treatment of a transaction.

The guidelines also clarify that when a payment is made or received in a cryptocurrency, for income tax purposes it should not be treated differently than a payment in any other currency. Accordingly, for businesses that accept payment for goods or services in cryptocurrency, there is no change to when revenue is recognized or the manner in which taxable profits are calculated. The same applies to payments of remuneration, such as salaries or wages, and therefore such should be regarded as taxable in terms of the general principles. When a payment is made by means of the transfer of a financial or a utility token, it will be treated like any other payment in kind.

Interested in Malta’s Crypto Regulations? Check out these articles:

- Malta’s Regulations for Crypto Service Providers

- Malta’s Crypto Regulatory Framework

- What is an IVFAO in Malta’s Regulations

![Canadian Bitcoin Exchange Comparison [Most updated Guide]](https://blockgeeks.com/wp-content/uploads/2020/10/image3.png)

Hello Jonathan! I have a question: If I create a token based on Ethereum Blockchain (with a smart contract) will be considered automatically as “Utility Token” or can be just considered a “Coin”? Or depending on use? Thank you very much!

Hi Joe! It all depends on the use, irrespective of the underlying protocol being utilised. If the token has no right which can be assimilated to rights granted under traditional financial instruments such as securities, then it stands a good chance of being treated as a “Utility Token”.

Great read and does anyone have any information on U.S. regulations?

Indeed 2019 is the year of regulation

Unfortunately here mining is banned by GOVT.

Thank you Blockgeeks for the interesting topic!

I am wondering if this regulation is only applicable to Maltese companies having the activities in subject, or is it also applicable to a foreign company (within EU or in other regions) that have a global customer base (including Maltese customers)?. Thank you so much!

Jonathan Galea What do you think?

Thanks

Hi Crystal! Apologies for the late reply. This regulation is only applicable to Maltese companies being tax resident in Malta i.e. having substance in Malta.

Oh, I got it. Thank you Jonathan and Blockgeeks team!

Just within Malta