Contents

|

|

In March 2020, Ethereum’s decentralized finance ecosystem got its latest player: Balancer.

The thing is, it wasn’t fully decentralized at launch: like other early-stage “DeFi” protocols, Balancer’s direction was largely determined by a company. In this case, it was Balancer Labs, which raised $3 million in a seed round in March 2020.

That’s not to say that the startup’s intentions were bad. It’s just that at the time, Ethereum addresses using the protocol were unable to assert change over the protocol.

If Balancer worked in a way they didn’t like, they were out of luck. Enter the Balancer token, which trades in the crypto market under the ticker “BAL.”

BAL, we will talk about later.

First, a brief breakdown of Balancer the protocol.

Contents

Balancer: an Ethereum-Based Automated Market Maker Protocol

Balancer is a decentralized finance protocol based on Ethereum that allows for automatic market-making.

More broadly, a traditional market maker/liquidity provider buys and sells financial instruments, providing liquidity to a market and profiting from the spread between the bid and ask prices. Thus, an automatic market maker (AMM) is a market-making “agent that is controlled by algorithms that define rules for trades.”

Combining Ethereum with AMMs, the assets in a market, the algorithm controlling that market, and the ability to create a market, become decentralized.

Balancer isn’t the first DeFi protocol to support automatic market-making — there are platforms such as Uniswap and Curve.

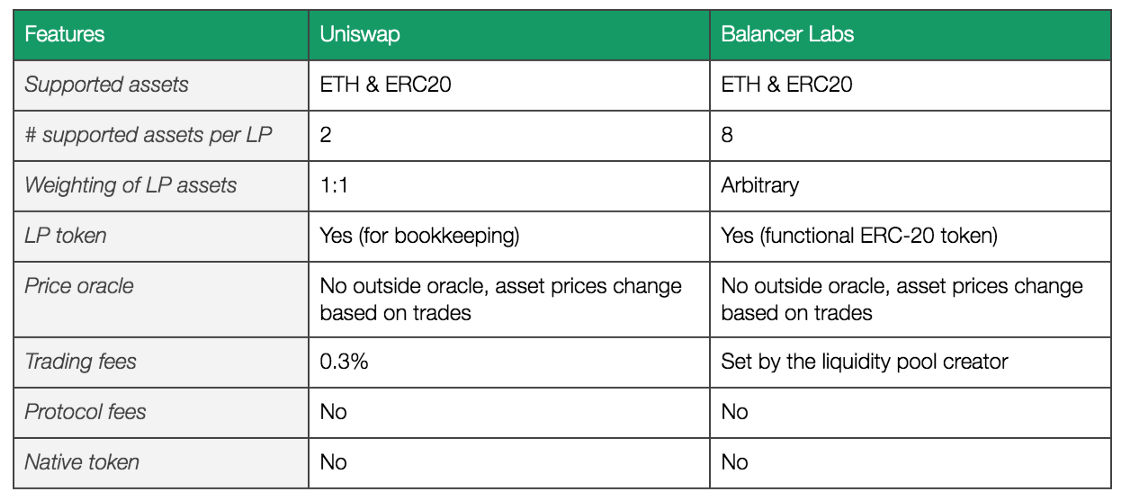

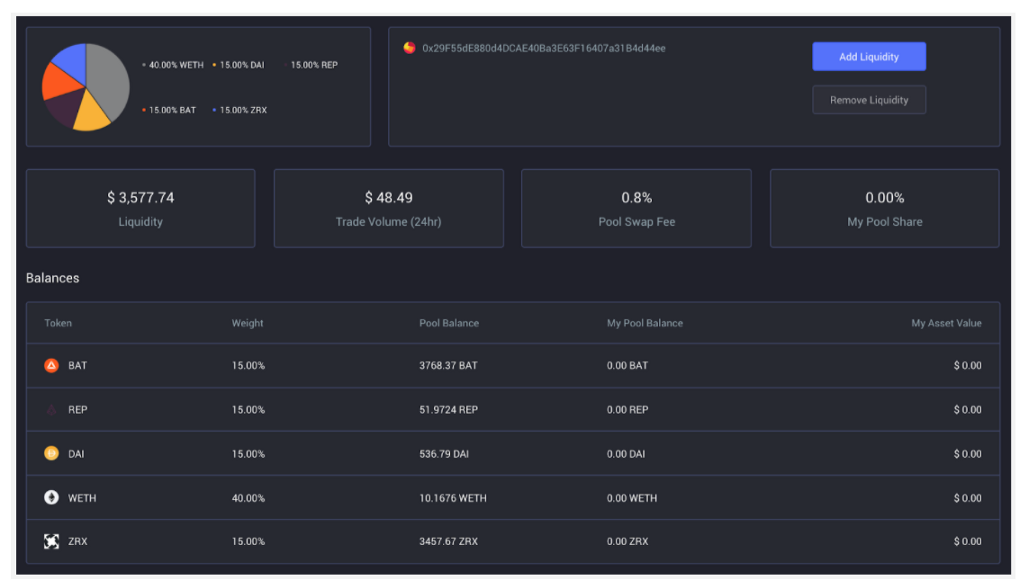

What makes Balancer unique is that the protocol supports up to eight assets per market (weighting of supported assets is arbitrary), along with custom trading fees set by the creator of the pool. The differences between Uniswap and Balancer Labs can be seen below in the table from Token Terminal.

Users can then use pools in two ways:

- Providing liquidity: Users can deposit supported assets into pools, providing liquidity to users of the pool. Those that deposit assets can earn a fee, though due to volatility and other factors, there are cases where liquidity providers can lose some of their assets.

- Trading: Users can trade tokens in a decentralized manner through pools, with Balancer’s smart order routing system ensuring the exchange of cryptocurrency at low fees and at quick speeds.

Unlike centralized exchanges like Coinbase and Binance, which use order books to derive prices, the price of tokens in a pool is based on their deviation from their set weighting.

Balancer Labs believes that this system of sourcing liquidity has the ability to create a “flywheel” network effect resulting in increased liquidity, traders, fees, and profits for LPs.

Due to Balancer’s flexible parameters, pools can do much more than provide a place for crypto holders to exchange their assets.

Balancer Labs has released pool schematics, such as one for Liquidity Bootstrapping Pools or one for pools that attempt to remove the risk of LPs losing their assets.

What is BAL?

As aforementioned, BAL is the native governance token of Balancer. The team behind the DeFi protocol sees this as a necessary step to “decentralized and diversify governance.”

“We believe BAL tokens are the vehicle to drive alignment and participation in the protocol. BAL tokens are not an investment; BAL token holders should be people that interface with the protocol in some way, are committed to its future development, and want a seat at the governance table.”

BAL holders will be able to “help guide the protocol to its fullest potential.” Balancer specifically names deploying the protocol on blockchains other than Ethereum, implementing layer two solutions, introducing fees at the protocol level to generate revenue, and more as examples of actions BAL holders can make.

There is currently not a formal governance structure in place, though when launched, Balancer’s may be similar to that of other protocols. Other DeFi protocols have the following governance structure:

- Users identify an issue when using the protocol and share observations online.

- Users narrow down the best ways to address the issue via public forums.

- Users create and present a technical specification of a solution to the issue.

- It’s presented to the community, then voted on.

- If the proposal gets a majority of votes and/or reaches a certain threshold, it is implemented.

Blockgeeks will update this guide as more information on the governance system is released.

How Do You Get the Crypto?

The total supply of BAL will eventually be 100 million coins.

As it stands, the supply of the cryptocurrency is closer to 35 and a half million coins. The current breakdown of this is as follows:

- 25 million is for stakeholders in Balancer Labs: the founding team, those that will own stock options (ex. future employees, current employees that earn the privilege), advisors, and investors. 2.5 million of the 25 million is allocated to act as stock options.

- 5 million goes to the Balancer Ecosystem Fund, which will be deployed to “attract and incentivize strategic partners that will help the Balancer ecosystem grow and thrive.” The direction of this fund will be controlled by BAL holders.

- 5 million goes to the Fundraising Fund, which will give Balancer Labs more runway in the future to support “operations and growth.”

- The ~500,000 is the BAL generated by “liquidity mining” as of this article’s writing.

In June, Balancer activated “liquidity mining,” which will distribute the 65 million coins not mentioned above. Every week 145,000 BALs, or approximately 7.5M per year, are distributed through this process. At this rate, it will take around nine years to fully distribute the altcoin.

Earning the cryptocurrency is as simple as providing liquidity to a pool, then receiving rewards paid out every week. Liquidity mining is currently enabled for all pools, as long as a “USD price can be extracted from CoinGecko for at least 2 tokens present in their liquidity pools.”

The current reward model in place incentivizes pool creators to keep transaction fees low, which should attract more liquidity and entitles LPs to claim more BAL.

The way in which BAL is distributed is subject to change, depending on the direction holders of the crypto want to take the Balancer protocol. As the company wrote:

“How much of these will actually be distributed — in what schedule, under which rules — is ultimately a decision to be made by BAL holders. Governance can decide to speed up the distribution of BAL if governors see fit.”

The altcoin can also be obtained through crypto exchanges. BAL is currently supported by Balancer’s pools, Uniswap pools, and centralized exchanges such as FTX, Poloniex, and Bibox.

The Elephant in the Room: The $500,000 Hack of a Balancer Pool

Balancer and its respective altcoin may have merit but it’s worth addressing the elephant in the room: the recent hack of a Balancer pool.

For those that missed the memo, a brief recap.

On June 28th, word began to spread online that a decentralized finance hack had taken place. Steven Zhang, a crypto asset researcher working for The Block, suggested that it was a hack of a Balancer pool.

“Apparently someone drained a Balancer pool made up of WETH and STA and got away with $500k worth of WETH,” Zheng wrote, becoming one of the first to spread news of this via Twitter.

Apparently someone drained a Balancer Pool made up of WETH and STA and got away with $500k worth of WETH. pic.twitter.com/SKshyDXagi

— Steven (@Dogetoshi) June 28, 2020

Zhang cited statements shared via Telegram and Discord by Statera admins and Mike McDonald, the CTO of Balancer Labs. The statements suggested that at least one liquidity pool was “mostly” drained but others were affected.

After the dust settled hours later, the details and extent of the Balancer hack were confirmed after analysts broke down Ethereum blockchain data.

The operators of the decentralized exchange aggregator 1inch revealed that more than $500,000 worth of Wrapped Ethereum, Statera (STA), Synthetix, Wrapped Bitcoin, and Chainlink, and other altcoins were stolen during the attack.

1inch also elaborated on the intricacies of the attack, which actually affected two Balancer pools.

At a high level, this is what happened:

- Due to Balancer being decentralized, anyone can create a pool for any crypto asset/with any parameters.

- Ethereum users created pools for transfer fee/deflationary tokens, which burn a portion of the coins sent in transactions. They did this despite warnings from Balancer Labs of the risks of deflationary tokens in pools.

- An attacker obtained a large sum of Wrapped Ethereum through dYdX, used those coins to trade WETH and STA back and forth. Due to the deflationary model, the pool’s STA balance reached one weiSTA (one-billionth of a coin).

- Due to how pools work, the one weiSTA was trading at an extremely high price relative to other tokens in the pool. The cryptocurrency was then used to easily drain the other tokens in the pool.

- Repeat for the second pool, which contained Ethereum-based crypto asset called STONK.

1inch has classified the attacker as a “very sophisticated smart contract engineer with extensive knowledge and understanding of the leading DeFi protocols” due to the complexity of the attack. As of this article’s writing, the attacker is still at large due to their use of an Ethereum token mixer.

Balancer Labs also responded, corroborating what took place.

It was announced that Balancer Labs blacklisted transfer fee tokens like STA, began work on “adding more documentation around the risks” of pools and “maliciously designed tokens,” and commenced a third planned security audit.

In a second update published a day after the attack, Balancer Labs CEO Fernando Martinelli revealed more about Balancer’s next steps.

Along with increasing the size of Balancer’s bug bounty program, Martinelli revealed that the team intends to “fully reimburse” all LPs affected in the crypto hack.

This was presented not as a precedent for the company to reimburse future losses, but because the team felt they “could and should have done better” to avoid this situation.

After thorough discussions with the community, the Balancer Labs team decided that it will fully reimburse all the liquidity providers who lost funds in the attack of yesterday. We will also pay out the highest bug bounty available for @Hex_Capital

More details on the…

— Balancer Labs (@BalancerLabs) June 29, 2020

This statement was made in reference to a bug bounty report from Hex Capital obtained by Balancer Labs on May 6th.

The report outlined the attack that just occurred, but the team did not intend to directly act on it due to the “enormous amount of funds” and gas involved.

Hence, the intent to reimburse the crypto assets stolen in the attack.

In that announcement, no intentions were announced to go after the attacker. This may be due to the fact that there is no legal precedent to go after someone who leveraged an exploit to drain a public, permissionless, and censorship-resistant smart contract.

Part of a Wider DeFi Trend

BAL’s launch is part of a wider trend of protocols attempting to achieve true decentralization by launching governance crypto assets.

A few weeks after Balancer Labs announced its intentions to distribute BAL in June, money-market protocol Compound followed suit with COMP. Like BAL, COMP is a token that allows its holders to influence the direction of the Ethereum-based application through a governance framework.

On June 30th, Curve (Curve.fi) announced the launch of Curve DAO and the CRV governance token.

This topic, along with other DeFi protocols and coins, will be covered in later breakdowns.

Navigation

Navigation