Contents

|

|

Cryptocurrency exchanges are the lifeblood of the digital asset ecosystem. With the increasing popularity of cryptocurrencies, there has been a surge in the number of exchanges available in the market. However, not all exchanges are created equal. Choosing the right cryptocurrency exchange is crucial for successful trading and investment.

We will delve into their user-friendly interfaces, competitive fees, and robust customer support services. Whether you’re a seasoned trader or just starting out in the world of cryptocurrencies, this article will guide you towards finding a reliable platform to meet your trading needs.

Stay tuned as we provide an in-depth analysis of each exchange’s features, benefits, and terms of service. Get ready to embark on an exciting journey through the realm of cryptocurrency exchanges!

Contents

Understanding Cryptocurrency Exchanges

Cryptocurrency exchanges are online platforms that enable users to buy, sell, and trade digital currencies. These exchanges act as intermediaries, facilitating transactions between buyers and sellers by matching their orders. They provide a convenient and secure way for individuals to enter the world of cryptocurrencies.

One of the primary functions of cryptocurrency exchanges is to offer wallets for storing digital currencies. These wallets allow users to securely hold their cryptocurrencies until they are ready to be traded or used for other purposes. By providing this service, exchanges ensure that users have a safe place to store their assets.

In addition to wallet services, exchanges offer various trading features that enhance the overall user experience. For instance, some exchanges like Coinbase Advanced Trade provide advanced trading options such as limit orders and stop-loss orders. These features give users more control over their trades and allow them to set specific parameters for buying or selling cryptocurrencies.

Another popular exchange known for its advanced trading capabilities is Liquid Exchange. It offers margin trading, which allows users to borrow funds from the exchange itself in order to amplify their trading positions. This feature can be beneficial for experienced traders who want to maximize their potential profits but also carries additional risks due to increased exposure.

Cryptocurrency exchanges also provide a wide range of trading pairs, allowing users to trade one cryptocurrency for another. This gives traders flexibility and enables them to take advantage of different market opportunities. For example, if someone wants to convert Bitcoin into Ethereum or vice versa, they can easily do so on an exchange that supports both currencies.

It’s important for individuals interested in using cryptocurrency exchanges to conduct thorough research before choosing a platform. Factors such as security measures, user interface, customer support, and fees should all be taken into consideration when selecting an exchange.

To summarize:

-

Cryptocurrency exchanges serve as online platforms where individuals can buy, sell, and trade digital currencies.

-

They offer wallet services for secure storage of cryptocurrencies.

-

Exchanges provide advanced trading features like limit orders, stop-loss orders, and margin trading.

-

They support various trading pairs, allowing users to trade one cryptocurrency for another.

-

It’s crucial to research and evaluate different exchanges based on factors such as security, user interface, customer support, and fees before making a decision.

Factors to Consider When Choosing a Crypto Exchange

There are several important factors that you should consider. These factors will help ensure that the exchange you choose meets your specific trading needs and provides a secure and user-friendly experience. Let’s explore these factors in more detail.

Security Measures

One of the most crucial considerations when selecting a crypto exchange is the security measures it employs. Look for exchanges that offer robust security features such as two-factor authentication (2FA) and cold storage. Two-factor authentication adds an extra layer of protection by requiring users to provide additional verification, typically through their mobile devices. Cold storage refers to keeping the majority of funds offline, away from potential hacking attempts.

Liquidity, Fees, and Supported Cryptocurrencies

Liquidity plays a significant role in determining how easily you can buy or sell cryptocurrencies on an exchange. Higher liquidity means there is a larger pool of buyers and sellers, resulting in faster transactions and potentially better prices. Consider the fees charged by the exchange for trading activities as they can vary widely between platforms.

It is also essential to check if the exchange supports the cryptocurrencies you intend to trade. While some exchanges offer a wide range of digital assets, others may have more limited options. Make sure that your desired cryptocurrencies are listed on the platform before proceeding.

User-Friendly Interface and Customer Support

A user-friendly interface can greatly enhance your trading experience by making it easier to navigate through different functionalities on the exchange platform. Look for exchanges with intuitive interfaces that provide clear instructions for buying, selling, and managing your digital assets.

Customer support is another critical factor to consider when choosing a crypto exchange. In case you encounter any issues or have questions about your account or transactions, having responsive customer support can make all the difference in resolving problems promptly.

Regulatory Compliance

Regulatory compliance is becoming increasingly important within the cryptocurrency industry as governments around the world develop regulations to protect investors and combat illicit activities. Choosing an exchange that adheres to regulatory requirements can provide you with a higher level of confidence in the platform’s legitimacy and security.

It’s worth noting that these factors may vary in importance depending on your individual trading goals and preferences. Consider what matters most to you and prioritize accordingly when evaluating different cryptocurrency exchanges.

Different Types of Crypto Exchanges

Centralized exchanges (CEX)

Centralized exchanges, or CEXs, are the most common type of cryptocurrency exchange. They function similarly to traditional stock markets, with intermediaries facilitating transactions between buyers and sellers. These intermediaries play a crucial role in maintaining order books and executing trades on behalf of users.

One advantage of centralized exchanges is their user-friendly interface, making them accessible even to beginners in the crypto space. They often support a wide range of cryptocurrencies, allowing users to trade popular cryptos like Bitcoin and Ethereum. Centralized exchanges offer various order types such as market orders and limit orders, giving traders flexibility in executing their trades.

However, it’s important to note that centralized exchanges require users to deposit their funds into the platform before trading. This means that users relinquish control over their private keys and rely on the security measures implemented by the exchange itself. While many centralized exchanges have robust security protocols in place, there is still a risk of hacking or theft.

Decentralized exchanges (DEX)

Decentralized exchanges, or DEXs, operate on blockchain technology without relying on intermediaries. They enable peer-to-peer trading directly between individuals without the need for a central authority overseeing transactions. This decentralized nature aligns with one of the core principles behind cryptocurrencies: removing reliance on third parties.

One significant advantage of DEXs is that they provide users with full control over their funds since trades occur directly from personal wallets. This eliminates the need for users to trust an exchange with their assets. DEXs often prioritize privacy and anonymity since they do not require extensive user verification processes.

However, decentralized exchanges may have limitations. Since there is no central authority managing order books, it can be challenging for DEXs to match buy and sell orders efficiently. As a result, traders may experience slippage or delays in executing their trades.

Hybrid exchanges

Hybrid exchanges combine features of both centralized and decentralized platforms, offering a middle ground for traders. These exchanges aim to provide the benefits of decentralization while also addressing some of the limitations faced by DEXs.

For example, hybrid exchanges may allow users to retain control over their private keys while still offering order matching and liquidity services similar to centralized exchanges. This can result in improved trading experiences for individuals who value security and privacy but also require efficient order execution.

Evaluating the Best Cryptocurrency Exchanges of 2023

To determine the best cryptocurrency exchanges, it is essential to analyze several factors. These include security, liquidity, fees, user experience, and the range of supported coins. Reviews from reputable sources can provide valuable insights into the strengths and weaknesses of different platforms. Lastly, considering user feedback on reliability, customer support, and overall satisfaction is crucial in making an informed decision.

Analyzing Factors for Evaluation

Security is paramount when selecting a cryptocurrency exchange. It is important to choose platforms that implement robust security measures such as two-factor authentication (2FA), cold storage wallets for storing funds offline, and encryption protocols to safeguard user data.

Liquidity refers to the ability to buy or sell cryptocurrencies quickly without causing significant price fluctuations. High liquidity ensures that traders can execute their transactions efficiently and at fair market prices. Therefore, choosing exchanges with high trading volumes and a wide range of listed cryptocurrencies can enhance trading experiences.

Fees are another critical factor to consider when evaluating cryptocurrency exchanges. Different platforms have varying fee structures for depositing funds, executing trades, and withdrawing cryptocurrencies. It is advisable to compare fees across multiple exchanges to find a platform that offers competitive rates without compromising on other essential features.

User experience plays a vital role in determining the overall quality of an exchange. A well-designed interface with intuitive navigation makes it easier for users to trade cryptocurrencies seamlessly. Features like real-time market data updates, order book depth charts, and customizable trading interfaces contribute significantly to a positive user experience.

Supported coins are also crucial when choosing an exchange since not all platforms offer access to every cryptocurrency available in the market. Traders should ensure that their preferred exchange supports the specific coins they wish to trade or invest in.

Leveraging Reviews from Reputable Sources

In addition to analyzing key factors independently, it is beneficial to consult reviews from reputable sources within the crypto community. These reviews often provide comprehensive assessments of exchanges, highlighting their strengths and weaknesses. They can offer valuable insights into the platform’s performance, security measures, customer support quality, and overall user satisfaction.

By considering multiple reviews from trusted sources, traders can gain a more well-rounded understanding of an exchange’s pros and cons. This information enables them to make informed decisions based on their specific needs and preferences.

Considering User Feedback

User feedback is crucial in evaluating the reliability and customer support quality of cryptocurrency exchanges.

Ensuring Security on Crypto Exchanges

Cryptocurrency exchanges are popular platforms for buying, selling, and trading digital currencies. However, with the increasing prevalence of cyber threats, it is crucial to prioritize security when choosing a crypto exchange. Here are some key measures that the best cryptocurrency exchanges implement to ensure robust security:

Strong Security Measures

To protect users’ funds and personal information, reputable crypto exchanges employ various security measures. One essential feature is SSL encryption, which safeguards data transmission between users and the exchange’s servers. This encryption ensures that sensitive information remains confidential and inaccessible to unauthorized parties.

Top exchanges utilize multi-signature wallets. These wallets require multiple private keys to authorize transactions, making it significantly more difficult for hackers to gain access to users’ funds. Regular audits are also conducted by third-party firms to assess an exchange’s security practices and identify any vulnerabilities.

Two-Factor Authentication (2FA)

Two-factor authentication adds an extra layer of protection against unauthorized access on crypto exchanges. With 2FA enabled, users must provide a second form of verification in addition to their password when logging in or performing certain actions on the platform. This commonly involves entering a unique code generated by an authentication app on their mobile device.

By implementing 2FA, crypto exchanges significantly reduce the risk of unauthorized individuals gaining control over user accounts. Even if a hacker manages to obtain a user’s password through phishing or other means, they would still need the second factor (e.g., the code from the app) to gain access.

Offline or Cold Wallet Storage

One effective method employed by secure crypto exchanges is storing funds in offline or cold wallets. These wallets are not connected to the internet when not in use, minimizing the risk of hacking or theft associated with online storage methods.

Offline storage ensures that even if there is a security breach on the exchange’s servers, users’ funds remain safe as they are stored in separate offline devices. This approach provides an added layer of protection against potential vulnerabilities in the exchange’s online systems.

Global Crypto Exchanges: A Comprehensive

Today there are a host of platforms to choose from, but not all exchanges are created equal. This list is based on user reviews as well as a host of other criteria such as user-friendliness, accessibility, fees, and security. Here are ten of the best crypto exchanges in no specific order.

Best cryptocurrency exchange list:

Bitbuy.ca

Bitbuy.ca is a Canadian owned and operated digital currency platform. Originally founded as InstaBT in 2013, the company’s mission is to provide convenient, dependable and secure access to bitcoin and other digital currencies. Customer service, ease of use, and quick turnaround times for deposits and withdrawals are pillars of this platform. They cater to beginners as well as experienced traders, and are one of Canada’s quickest growing buy/sell platforms. A great choice for users looking to buy and hold crypto, or users looking for a reliable on-ramp to turn their fiat into crypto quickly and easily.

Pros

- Great customer service

- Fast registration and verification

- Quick processing of CAD deposits and withdrawals

- Only exchange to offer 1:1 BTC insurance in Canada

- Low fees

Cons

- Only offers BTC, ETH, LTC, BCH, XRP, XLM, EOS, (AAVE + LINK to be added soon)

- Only available to Canadians

Bybit.com

Established in March 2018, Bybit is one of the fastest-growing cryptocurrency exchanges, with more than 3 million registered users. Bybit strives to be the most reliable exchange for trading digital assets. The ByFi Center presents emerging DeFi opportunities, such as ETH Cloud Mining, CRV/USDT liquidity pool DeFi Mining and ETH/USDT Dual Asset Mining with Uniswap V3. Bybit CEO and cofounder Ben Zhou is a vocal advocate of blockchain technology and is actively involved in the crypto community on Twitter.

Bybit Pros:

- 24/7 multilingual customer support

- 99.99% system functionality

- Powerful API-market data pushed every 20 minutes

- 100K TPS matching engine — never worry about overloads

- Significant market depth

- Spot, derivatives and DeFi trading

Bybit Cons

- Not available for the following local markets: United States, Korea, Singapore, China, Québec (Canada), Cuba, Iran, Syria and Sudan.

ChangeNOW

ChangeNOW is a registration-free instant cryptocurrency exchange platform for limitless crypto conversions. ChangeNOW has been on the market for more than a year now and has earned a reputation for reliable service with great rates. The exchange platform does not require account creation, processing fast transactions for more than 170 cryptos, as well as fiat-to-crypto purchases. ChangeNOW stays honest with its customers and collects no hidden or inflated fees. The timing of the transaction remains rather short. Depending on the transaction volume, the processing speed can take as little as 2 minutes.

Pros

- Registration-free – no account needed

- More than 170 cryptocurrency coins and tokens listed – more than 36000 trading pairs

- No limits – no maximum exchange amount

- 2 cryptocurrency exchange flows: standard and fixed-rate

- Convenient purchase with credit cards

- 24/7 support

- Mobile application

Cons

- No leverage. ChangeNOW does not offer leveraged trading on cryptocurrencies

Coinjar

Pros:

- iOS & Android apps that let you trade

- Free & fast bank transfers

- Fees 0.1% – 1% depending on trading volumes

- Established in 2013

- Good customer support

- No leverage trading available.

- ID verification is required in order to trade.

OKEx

OKEx.com is a cryptocurrency exchange that allows users to buy, sell, and trade Bitcoin, Ethereum, and

other cryptocurrencies safely and easily. The intuitive platform with sleek user-interface makes it easy to

do market buys, check cryptocurrency prices, and more. The exchange focuses not only on spot and

margin trading, but also has advanced features for derivatives like futures, perpetual swaps, and

options.

The Malta-based exchange operates in over 100 countries providing cryptocurrency liquidity and market

buying options to millions of users and supports hundreds of different trading pairs.

Pros:

● Free registration and easy to use

● Over 400 trading pairs with high liquidity

● Low fees with incentives for market makers

● Many different payment methods supported

● Great user-interface with sleek design

● Trusted and well-known exchange

● 24/7 customer support

Cons:

● Not available in some countries

● Some advanced features may intimidate beginners

● No fiat on-ramp

Coinbase

Backed by trusted investors and used by millions of customers globally, Coinbase is one of the most popular and best crypto exchanges in the world. Coinbase platform makes it easy to securely buy, use, store, and trade digital currency. Users can purchase bitcoins, Ether and now Litecoin from Coinbase through a digital wallet available on Android & iPhone or through trading with other users on the company’s Global Digital Asset Exchange (GDAX) subsidiary. They can easily sell their. crypto as well and receive money directly into their bank account. GDAX currently operates in the United States, Europe, UK, Canada, Australia, and Singapore. GDAX does not currently charge any transfer fees for moving funds between your Coinbase account and GDAX account. For now, the selection of tradable currencies will, however, depend on the country you live in. Check out the Coinbase FAQ and GDAX FAQ

- Pros: Good reputation, security, high trading volume, easy to use, reasonable fees, beginner friendly, stored currency is covered by Coinbase insurance. It’s easy for novice users to trade and buy bitcoin since it allows fiat currency trading.

- Cons: Customer support, limited payment methods, limited countries supported, non-uniform rollout of services worldwide, GDAX suitable for technical traders only.

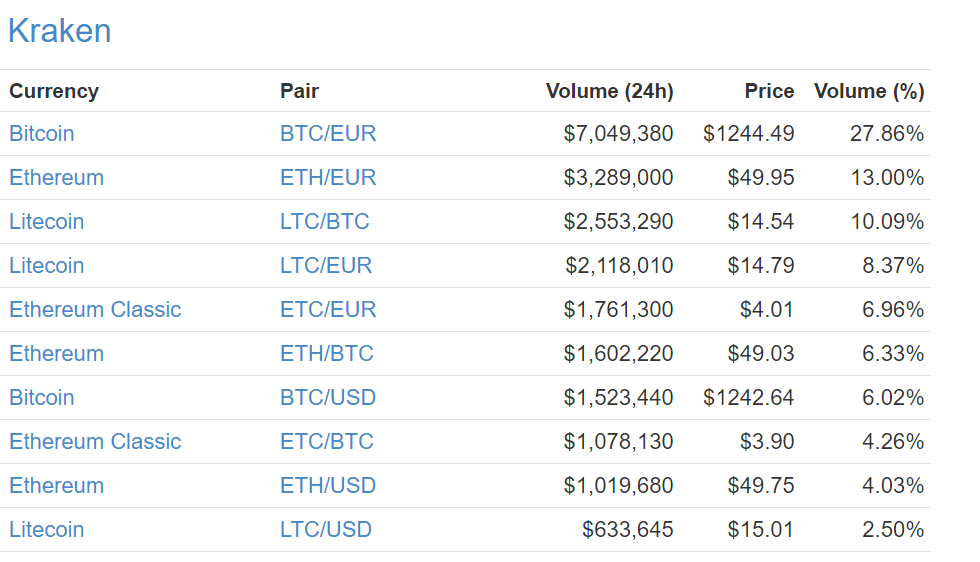

Kraken

Founded in 2011, Kraken is the largest cryptocurrency exchange in euro volume and liquidity and is a partner in the first cryptocurrency bank. Kraken lets you buy and sell bitcoins and trade between bitcoins and euros, US Dollars, Canadian Dollars, British Pounds and Japanese Yen. It’s also possible to trade digital currencies other than Bitcoin like Ethereum, Monero, ethereum Classic, Augur REP tokens, ICONOMI, Zcash, Litecoin, Dogecoin, Ripple and Stellar/Lumens. For more experienced users, Kraken offers margin trading and a host of other trading features. Kraken is a great choice for more experienced traders. Check out the Kraken FAQ.

While the crypto exchange is based out of San Francisco, USA, they still have one of the largest Euro-to-crypto markets in the world. Kraken is available to residents of the US, Canada, Japan, and various European nations. Kraken does not currently accept deposits via credit cards, debit cards, PayPal, or similar services. In 2014, Kraken became the number one exchange in the world when it comes to Euro trade volume. They also pioneered the first verifiable cryptographic proof of reserves audit system and was also listed on the Bloomberg Terminal within the same year. It has a solid, yet non-beginner-friendly crypto trading platform.

- Pros: Good reputation, easy to use, high trading volume, decent exchange rates, low transaction fees, minimal deposit fees, feature-rich, great user support, secure, supported worldwide.

- Cons: Limited payment methods (does not currently accept cash, debit card, credit cards, PayPal), or similar services., not suitable for beginners who want to get started with trading, unintuitive user interface.

Cex.io

Cex.io is one of the best cryptocurrency exchange that provides multiple payment options for using bitcoin and other cryptocurrencies. The platform lets users easily trade fiat money with cryptocurrencies and conversely cryptocurrencies for fiat money. So, if you are a beginner, this is one of the best crypto exchanges that you can use to get started. For those looking to trade bitcoins professionally, the platform offers personalized and user-friendly trading dashboards and margin trading. Alternatively, this crypto exchange also offers a brokerage service that provides novice traders in an extremely simple way to buy bitcoin at prices that are more or less in line with the market rate. The Cex.io website is secure and intuitive and cryptocurrencies can be stored in safe cold storage. Check out the Cex.io FAQ

- Pros: Good reputation, good mobile product, supports credit cards, beginner-friendly, decent exchange rate, supported worldwide, API solutions for automated trading. Available in the US, Europe, Hong Kong, and certain countries in South America. Allows crypto trading with multiple options, including debit card, USD EUR.

- Cons: Strict verification rules, fees vary with the payment method.

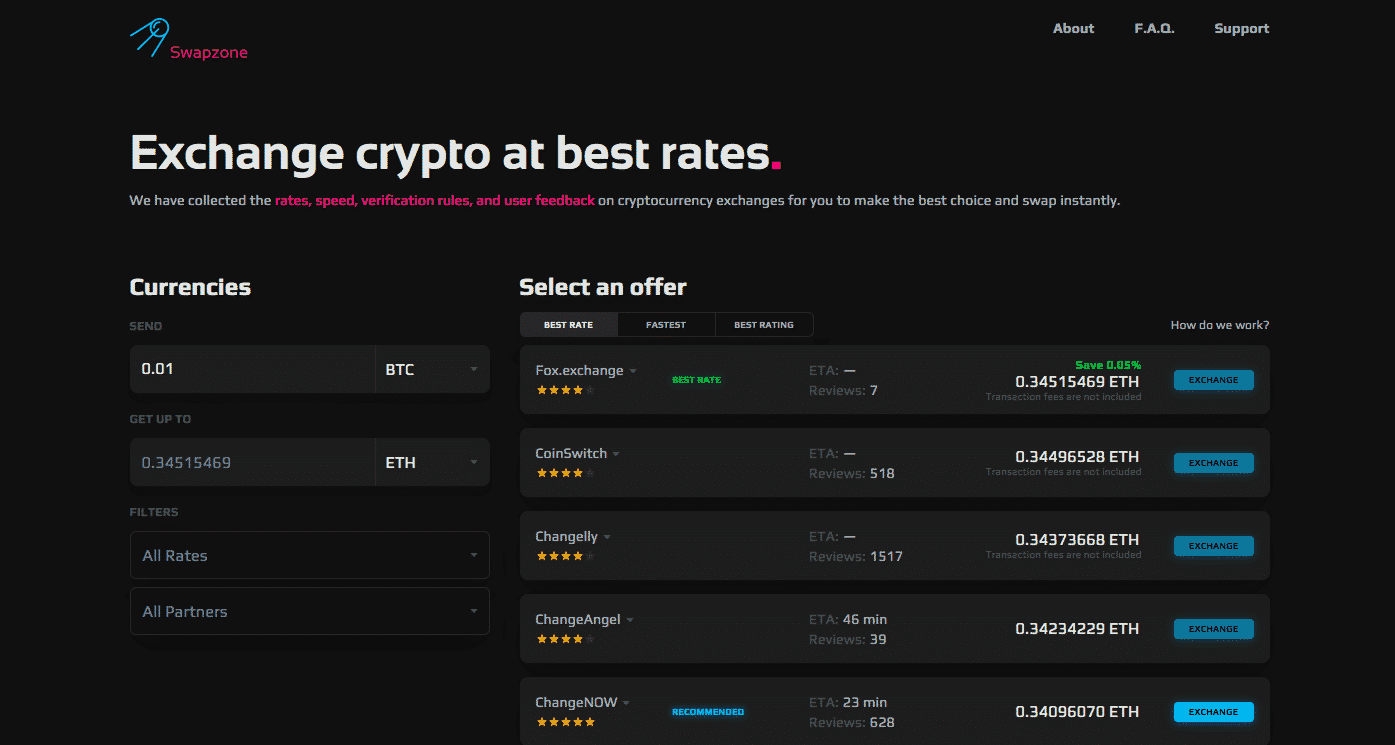

Swapzone

Swapzone is a cryptocurrency exchange aggregator. Our job is providing the users with a platform allowing them to make an informed choice when exchanging crypto assets. To make this possible, we gather the information on the service providers, select the parameters for comparison, aggregate and sort out the deals. and present all the options in one interface. We aim for making the swap space transparent, understandable and, most importantly,

unified.

How to use Swapzone?

We are creating a common user flow for non-custodial exchange services. By uniting different interfaces into one, Swapzone acts as a bridge connecting the exchanges to the user.

Pros

- Non-custodial

- Wide range of coins and tokens to choose from (including Stablecoins)

- Multiple exchange partners with the possibility to choose among service providers

- Exchange offers sorted by the best rate, time and service rating

- All the communication with the services held through Swapzone – we are here to help

Cons

- Geared towards advanced users

ShapeShift

ShapeShift one of the leading cryptocurrency exchange that supports a variety of cryptocurrencies including Bitcoin, Ethereum, Monero, Zcash, Dash, Dogecoin and many others. Shapeshift is great for those who want to make instant straightforward trades without signing up for an account or relying on a platform to hold their funds. ShapeShift does not allow users to purchase crypto’s with debit cards, credit cards or any other payment system. This crypto platform has a no fiat policy and only allows for the exchange between bitcoin and the other supported cryptocurrencies. Visit the Shapeshift FAQ

- Pros: Good reputation, beginner-friendly, Dozens of Cryptos available for exchange, fast, reasonable prices that can allow you to get started with trading.

- Cons: Average mobile app, no fiat currencies, limited payment method and tools.

LocalBitcoin

LocalBitcoin is a P2P Bitcoin exchange with buyers and sellers in thousands of cities around the world. With LocalBitcoins, you can meet up with people in your local area and buy or sell bitcoins in cash, send money through PayPal, Skrill or Dwolla or arrange to deposit cash at a bank branch. LocalBitcoins only take a commission of 1% from the sellers who set their own exchange rates. To ensure trading is secure, LocalBitcoins takes a number of precautions. To start, the platform rates each trader with a reputation rank and publicly displays past activities. Also, once a trade is requested, the money is held on LocalBitcoins’ escrow service. After the seller confirms the trade is completed the funds are released. If something does happen to go wrong, LocalBitcoins has a support and conflict resolution team to resolve conflicts between buyers and sellers. Check out LocalBitcoins FAQ.

This cryptocurrency excahnge uses 2-factor authentication or 2FA to add extra security. This is a handy addition that will help prevent account hacks. This feature is not activated by default. It has to be done by the user. It keeps a record of the IP address of the computer which was used for account creation. The exchange will also keep a record of the browser which is constantly used for logging into the account. If the user uses a new IP address (say they move to a new location), then a verification process is done via email to confirm identity. All the transaction done between the parties uses LBC as an escrow to store the funds. The funds are only released when the transaction has been confirmed to be complete.

- Pros: No ID required, beginner friendly, usually free, instant transfers, available worldwide.

- Cons: Hard to buy large amounts of bitcoin, high exchanges rates.

Binance

If your focus is to conduct crypto-to-crypto trading, Binance is one of the best options. Ranked as one of the most popular cryptocurrency exchanges worldwide, they provide you with impressive offerings along with an extremely low trading fee. Although the Binance platform is a young entrant into the market, it is rapidly growing, and holds a huge selection of altcoins with Bitcoin, Ethereum, and Tether pairings.

The exchange offers its own coin termed as BNB (Binance coin). Being a centralized exchange, you can get decent discounts while conducting trade with their token. Binance offers a standard trading fee of only 0.1% which can even be reduced further if the payment is made with in BNB.

- Pros: Ubiquitous platform, platform token, very cheap to transact, available worldwide.

- Cons: No fiat trading, limited payment options.

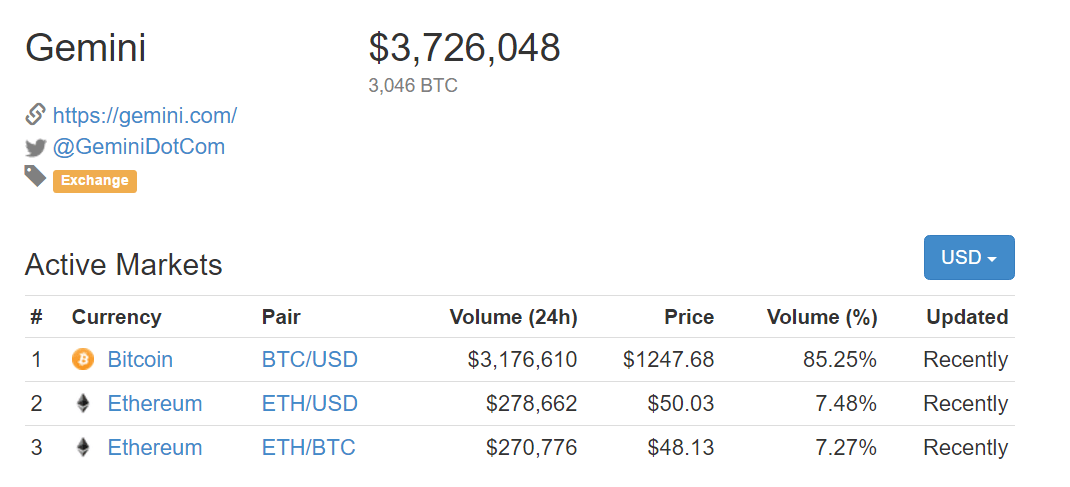

Gemini

Co-founded by Tyler and Cameron Winklevoss, Gemini is a fully regulated licensed US bitcoin and Ether exchange. That means Gemini’s capital requirements and regulatory standards are similar to a bank. Also, all US dollar deposits are held at a FDIC-insured bank and the majority of digital currency is held in cold storage. Gemini trades in three currencies, US dollars, bitcoin, and ether, so the platform does not serve traders of the plethora of other cryptocurrencies.

The exchange operates via a maker-taker fee schedule with discounts available for high volume traders. All deposits and withdrawals are free of charge. The platform is only fully available to customers in the United States, Canada, Hong Kong, Japan, Singapore, South Korea and the UK.

Check out Gemini’s FAQ

- Pros: Security & Compliance, slick/minimalistic, high trading volume, and user-friendly design, great analytics, high liquidity and one of the more reputable crypto exchanges.

- Cons: Limited currencies, small community, average customer support, limited worldwide availability, no margin trading.

Huobi

Located in San Francisco, Huobi is operated by HBUS Holdco, Inc. (“HBUS”), a U.S. company and strategic partner of Huobi Global, one of the world’s best cryptocurrency exchange. At the time of writing, Huobi is only available to Chinese and US residents excluding those residing in Alabama, Arizona, Connecticut, Georgia, Louisiana, New York, North Carolina, Hawaii, Vermont, Washington, and all U.S. Territories. Huobi offers a plethora of token trading options (Over 50 pairings). As we all know, crypto doesn’t sleep and neither does Huobi as they offer their customers 24/7 free customer support. Fees for USD trades are .1% regardless of being maker or taker, all crypto to crypto trades is .05%. Huobi has offices in Hong Kong, Korea, and Japan.

Huobi supports a wide range of cryptocurrencies and ICO tokens including all major coins like bitcoin (BTC), bitcoin Cash (BCH), bitcoin Gold (BTG), Dash (DASH), EOS (EOS), Ethereum (ETH), Ethereum Classic (ETC), Lisk (LSK), ICON (ICX), Litecoin (LTC), NEO (NEO), NEM (XEM), Qtum (QTUM), Ripple (XRP), Tether (USDT), Zcash (ZEC), Tron (TRX), etc. Huobi offers more than 100 altcoin trading pairs and offers trading by BTC, ETH, and USDT. Apart from Huobi.pro the firm has also launched Huobi Autonomous Digital Asset Exchange (HADAX). While the pro site list more than 100 cryptocurrencies and tokens, HADAX though being just more than a few month’s old lists a wide array of small coins and tokens. HADAX allows traders to vote for the tokens they want to see on the platform by using Huobi tokens.

Pros: One of the best customer support, high-quality analytics, high liquidity, easy to use trading platform.

Cons: Only Available to Chinese and Some US Residents

Bisq

Unlike other names on the list, Bisq isn’t exactly an exchange. Instead, it is an open-source desktop application that allows you to buy and sell bitcoin in exchange for national currencies or altcoins. Bisq uses a peer-to-peer network that connects buyers and sellers directly with each other. There are no intermediaries.

Fees

Trading fees are 0.1% for makers and 0.7% for takers if paid in BTC and slashed in half if paid in BSQ. However, keep in mind that you will still need to pay mining fees for on-chain transactions. On top of that, you must lock up a certain amount as a security deposit into an escrow. The security deposit economically incentivizes the buyers and sellers to follow the rules of the protocol.

Different Payment Methods

You can buy crypto in Bisq using US dollars via cash deposit, electronic transfer, or the Zelle payment system. However, do note that you can’t buy crypto in Bisq with a credit card.

Pros:

- Decentralized exchange, so no single point of failure.

- Different cash payment options.

- No geo-restrictions.

- Instant approval.

- You are in control of your money.

Cons:

- It may not be beginner-friendly.

- The application is a little basic.

Robinhood

Robinhood is a popular US-based, zero-fee broker that was established in 2013. IT is regulated by top financial watchdogs such as the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Robinhood initially took the stock trading market by storm. Then In 2018, the Robinhood Crypto exchange was introduced to handle cryptocurrencies.

Robinhood Crypto

Robinhood’s commission-free rule applies to crypts as well. So you can use any funds you’ve deposited into your brokerage account to purchase cryptocurrencies through Robinhood Crypto. Through the exchange, you can buy Bitcoin, Ethereum, Dogecoin. Bitcoin Cash, Bitcoin SV, Ethereum Classic, Litecoin. Bitcoin Gold, Dash, Lisk, Monero, Neo, OmiseGo, Qtum, Ripple, Stellar, and Zcash.

Having said that, Robinhood crypto has a major issue. You can’t transfer crypto in or out of your account, meaning you can’t pay with cryptos or send it to others. If you want to withdraw, you will need to convert your crypto to fiat and then withdraw it out of the app. However, all this will change with the launch of the Robinhood crypto wallet. The wallet will allow users to move crypto in and out of their accounts.

Pros

- 0 commission fees.

- The platform is easy and intuitive.

- Robinhood has a great mobile and web trading platforms.

- Robinhood is also a great gateway into ETF and stock trading.

Cons

- Robinhood has been criticized for poor customer support.

- As of now, you can’t transfer crypto in or out of the account.

- Tends to underperform during periods of high demand.

eToro

eToro is one of the largest growing social trading and multi-asset brokerage companies globally and was founded by Yoni Assia, Ronen Assia, and David Ring. eToro is exceptionally safe, and top-tier financial authorities regulate its UK and Australian arms. Among its many services, eToro is well-known for its automated portfolios, aka, CopyPortfolios.

What is a CopyPortfolio?

CopyPortfolio is an instrument that acts like multiple traders are working for you simultaneously. The minimum amount required to invest in CopyPortfolios is $5,000. In addition, every CopyProtfolio automatically rebalances itself to allow your traders to diversify the user’s exposure and minimize long-term risk optimally. eToro gives you three types of CopyPortfolios:

- Top Trader CopyPortfolio: This is a trader-only portfolio where each of the trader copied as part of the portfolio is selected based on the CopyPortfolio’s strategy.

- Market CopyPortfolio: This CopyPortfolio uses a combination of CFD stocks, commodities, or ETFs bundled together as per a predefined theme.

- Partner CopyPortfolio: These are the CopyPortfolios made by eToro’s partners partners – Tipranks, WeSave, and Meitav Dash.

Pros

- eToro offers you exposure to a vast range of cryptos.

- The minimum funding required to lock up in your accounts is low.

- CopyPortfolio allows users to trade using the strategies of successful traders.

Cons

- eToro isn’t available in all US states.

Crypto.com

Crypto.com is a cryptocurrency and payment platform. The company was founded in 2016 and is headquartered in Hong Kong. The company was founded by Kris Marszalek, Rafael Melo, Gary Or, and Bobby Bao. More recently, you must have heard of them because of their high-profile Formula 1 sponsorship. The Crypto.com App is extremely popular and has been downloaded by ~10 million users globally on the Google Play Store. Crypto.com charges 0.04% – 0.4% for maker fees and 0.1% – 0.4% taker fees. It also charges 2.99% for credit card purchases.

Crypto.com Card

Crypto.com offers its users a prepaid Visa card that can allow you to spend your crypto holdings easily. The card has five reward tiers based on how much CRO (the native Crypto.com token) you own.

Each tier has some forms of service or rewards like Spotify, Netflix, some amount of free ATM withdrawals, etc. Cardholders can get cashback between 1% to 8%. Do keep in mind that the cashback, in this case, means CRO tokens and not fiat cash.

Pros

- Low trading fees.

- Has a Visa card with good rewards.

- You can earn interest on your crypto.

- Good variety of coins.

- Strong and robust security.

- Buy and sell NFTs.

Cons

- Can be very difficult to navigate if you are a beginner.

- Sub par customer service.

- Lacks good educations resources

Opening a Cryptocurrency Exchange Account: Step-by-Step Guide

To begin your journey in the world of cryptocurrencies, you need to open an account with a reputable cryptocurrency exchange. Follow this step-by-step guide to get started.

Choose a Reputable Exchange

Start by researching and selecting a reputable cryptocurrency exchange that aligns with your needs. Look for exchanges that have a solid track record, positive user reviews, and strong security measures in place. Once you’ve chosen an exchange, visit their website to begin the account creation process.

Provide Necessary Personal Information

During the account creation process, you will be required to provide some personal information. This typically includes your full name, email address, and sometimes even your phone number. Be sure to enter accurate information as it will be used for verification purposes later on.

Complete Identity Verification

To ensure the security of your account and comply with regulatory requirements, most cryptocurrency exchanges require users to complete identity verification. This involves submitting documents such as a government-issued ID (passport or driver’s license) and proof of address (utility bill or bank statement). Follow the instructions provided by the exchange to upload these documents securely.

Set Up Security Measures

Protecting your cryptocurrency holdings is crucial in this digital landscape. As part of setting up your account, take advantage of the security features offered by the exchange. Enable two-factor authentication (2FA) using an app like Google Authenticator or Authy. This adds an extra layer of security by requiring a unique code generated on your mobile device when logging in or making transactions.

Consider using a hardware wallet for storing your cryptocurrencies offline. These devices offer enhanced security against online threats and hacking attempts.

Fund Your Account

Once you’ve completed the necessary steps above, it’s time to fund your cryptocurrency exchange account. There are two primary methods for doing this:

-

Deposit Cryptocurrencies: If you already own cryptocurrencies, you can transfer them to your exchange account. The exchange will provide you with a unique wallet address for each type of cryptocurrency they support. Use this address to initiate the transfer from your personal wallet or another exchange.

-

Link a Bank Account: Some exchanges also offer the option to link your bank account for fiat currency transfers. This allows you to buy cryptocurrencies using traditional currencies like USD or EUR. Follow the instructions provided by the exchange to securely link your bank account and make deposits.

Revenue Models of Cryptocurrency Exchanges

Cryptocurrency exchanges are platforms where users can buy, sell, and trade various digital currencies. But have you ever wondered how these exchanges make money?

Trading Fees: The Primary Revenue Source

The primary source of revenue for most cryptocurrency exchanges is trading fees. When users execute trades on these platforms, they are charged a small fee based on the transaction volume. These fees can vary from exchange to exchange but typically range from 0.1% to 0.5% per trade.

Additional Services Offered

In addition to trading fees, many cryptocurrency exchanges offer additional services that contribute to their revenue streams. Some platforms provide margin trading, allowing users to borrow funds and trade with leverage. This service comes with interest charges and fees for using borrowed funds.

Other exchanges offer futures contracts, enabling traders to speculate on the future price movements of cryptocurrencies. By charging fees for these derivative products, exchanges generate additional income.

Furthermore, certain platforms have lending programs where users can lend their cryptocurrencies to other traders in exchange for interest payments. These interest rates contribute to the revenue generated by the exchange.

Listing Fees: A Contribution to Revenue

Another way cryptocurrency exchanges generate revenue is through listing fees charged to cryptocurrency projects seeking to be listed on their platform. These listing fees ensure that only legitimate and established projects are listed and help cover the costs associated with due diligence and security measures.

While some exchanges charge exorbitant listing fees, others have adopted more transparent and reasonable fee structures. It’s important for projects considering a listing on an exchange to carefully evaluate the associated costs and benefits before making a decision.

Balancing User Funds Security with Revenue Generation

Cryptocurrency exchanges must strike a delicate balance between generating revenue and ensuring the security of user funds. While trading fees are essential for sustaining operations and providing quality services, excessively high fees can deter traders from using the platform.

To attract high-volume traders, some exchanges offer reduced trading fees for those who trade in large volumes. This encourages increased trading activity and boosts overall revenue.

Exchanges may charge withdrawal fees when users transfer their funds from the exchange to their personal wallets. These fees cover transaction costs on the blockchain network and help prevent abuse of the withdrawal system.

Additional Advice for Navigating Cryptocurrencies

Stay updated with market trends and news related to cryptocurrencies and blockchain technology.

Staying informed about the latest developments in the cryptocurrency market is crucial for any investor. By keeping up with market trends and news, you can make more informed decisions. Stay tuned to reputable sources that provide accurate and up-to-date information on cryptocurrencies, such as industry-leading publications, financial news websites, and official announcements from cryptocurrency projects.

Diversify your portfolio by investing in different cryptocurrencies rather than focusing on just one.

Diversification is a key strategy. Instead of putting all your eggs in one basket, consider investing in a variety of cryptocurrencies. This approach helps mitigate risk by spreading out your investments across different assets. It also allows you to take advantage of potential growth opportunities in multiple markets. Research different coins and tokens, assess their potential value, and create a well-diversified portfolio that aligns with your investment goals.

Use reputable wallets and secure backup methods to protect your digital assets.

Safeguarding your digital currencies is paramount in the world of cryptocurrencies. To ensure the security of your crypto holdings, use reputable wallets that offer robust security features. Look for wallets that utilize advanced encryption techniques and have a strong track record of protecting users’ funds. Consider implementing secure backup methods such as hardware wallets or offline storage solutions like paper wallets or cold storage devices.

When selecting a wallet provider or storage method, be cautious of phishing attempts or fraudulent schemes that could compromise the safety of your crypto assets. Always verify the authenticity of wallet providers before entrusting them with your digital currencies.

By following these best practices for securing your crypto assets, you can minimize the risk of unauthorized access or loss due to hacking or other security breaches.

Conclusion

We have discussed the factors to consider when choosing an exchange, the different types available, and even evaluated some of the best exchanges in 2023. We have covered crucial topics such as security measures, global exchanges, opening an account, revenue models, and provided additional advice for navigating cryptocurrencies.

Now armed with this knowledge, it’s time for you to take action and dive into the world of cryptocurrency trading. Choose an exchange that aligns with your needs and goals, considering factors like security, user experience, and available features. Remember to stay informed about market trends and always exercise caution when investing. As the crypto landscape continues to evolve, staying adaptable and well-informed will be key to making sound decisions. So go ahead, seize the opportunities that await you in the exciting realm of cryptocurrency exchanges!

Frequently Asked Questions

What are the best cryptocurrency exchanges?

The best cryptocurrency exchanges are platforms where you can buy, sell, and trade digital currencies. Some popular options include Binance, Coinbase, Kraken, and Bitstamp. These exchanges offer a wide range of cryptocurrencies, robust security measures, user-friendly interfaces, and competitive fees.

How do I choose the right cryptocurrency exchange?

When choosing a cryptocurrency exchange, consider factors like security measures, available cryptocurrencies, user interface, fees, customer support, and user reviews. Look for exchanges that prioritize strong security protocols to protect your funds and personal information.

Can I trust cryptocurrency exchanges with my money?

While most reputable cryptocurrency exchanges have implemented strict security measures to protect users’ funds, it’s important to exercise caution. Research the exchange’s reputation by reading reviews and checking if they have experienced any major security breaches in the past. Consider using hardware wallets for added security.

Are there any beginner-friendly cryptocurrency exchanges?

Yes! Many cryptocurrency exchanges cater to beginners by offering intuitive interfaces and educational resources. Exchanges like Coinbase and Binance have user-friendly platforms that make it easy for newcomers to navigate the world of cryptocurrencies.

How can I ensure the safety of my funds on a cryptocurrency exchange?

To ensure the safety of your funds on a cryptocurrency exchange:

-

Enable two-factor authentication (2FA) for an extra layer of security.

-

Use strong unique passwords for your exchange account.

-

Store your cryptocurrencies in offline wallets or hardware wallets whenever possible.

-

Regularly update your devices’ software and use reliable antivirus software.

![The Best Cryptocurrency Exchanges: [Most Comprehensive Guide List]](https://blockgeeks.com/wp-content/uploads/2017/04/exchanges.jpg)

![The Best Cryptocurrency Exchanges: [Most Comprehensive Guide List]](https://blockgeeks.com/wp-content/uploads/2017/07/invest.jpg)

Nice article! I trade on Binance and BitMEX with Quantower trading platform that gives me access to both exchanges. For professional analysis I use Volume Profiles, Order Flow surface for searching the most reliable levels for my Entry and Exit points.

Investing in bitcoin can make one a billionaire in a short period of time. It also helps anyone to escape sudden inflation by investing or saving your money in a bitcoin wallet in order to escape failed government monetary policy. Bitcoins can be sent across the globe, no bank can block payments or close your account. There are lots of benefits investing in bitcoins, you just have to be very careful and smart while investing in bitcoin. So I will advice anyone who’s willing and want to make a huge profit in a short period of time in bitcoin to contact 24hoursbitcoinmining@gmail.com Also if you need consultancy about any digital currency, mining of bitcoin or retrieve stolen wallet, lost passwords contact digital currency I just benefited from his service few weeks ago and i’m very sure he’s willing and ready to help anyone too

The article is well informative! Most of the traders are looking for the best crypto exchange to start trading. Now they would have an idea in my mind. In the mean time, if you are an Entrepreneur looking to start a crypto exchange, you can get in touch with Zab Technologies!

In looking for an alternative to coinbase I found this article very helpful.

I used to have a Coinbase account and used it a lot in the beginnings along with my Blockchain account but now I prefer using either DEXs (though the term is not always used accurately) and accountless instant exchangers for dealing with crypto, where I transact from wallets where no one except for me can access the private keys. There are several options to choose from but my favorite and actually the one I use the most nowadays is ChangeNOW (second on the list above).

Great article Rosic! It would be great to see an updated article about exchanges, where you can cover new exchanges as well. I would love seeing exchanges as p2pb2b, LAtoken or

http://www.btc-exchange.com

That is great. I have also used many of them. But Lately, after the Binance Hack, I had become slightly sceptical about many of these exchanges in terms of security and control. I researched on new exchanges that are more secure. I came across XDAT. They are an EU compliant fiat to crypto exchange. They are easy to use, pretty secure and very transparent exchange. I have been trading on their exchange and wanted to add that they are quite responsive when it comes to customer support. I will recommend people to use XDAT as an exchange for trading and investing in crypto.

Thanks for the great article. I’ve used some of indicated exchanges but I prefer to use Fumgo more. On https://fumgo.com I just set a target and wait till order will be closed. I don’t need to check the prices every minute on several exchanges – my bot does everything instead of me. It’s very simple and easy in use. Recommend you to check it out!

It is strange that I didn’t see here a review about Lukki exchange. This is a fairly new exchange, but it has already gained trust and love from traders. From myself I can say that I am also very impressed after working with this platform. Of the merits: Convenient interface, meager commission, excellent customer service. But the main difference is that the Platform combines a monotonous trading process with an exciting gamification (pass the levels, earn scores, get rewards and monetize your achievements). I haven’t seen flaws yet. Time will tell. But judging by the previous projects of this team there is a great future.

very good review and feedback… I have been using half of them,. if ok, would recommend this exchange – Trade Token X , one I could trust and managed by prof team. customer service is great here compared to the other ones… I had tough time with some of the top exchanges when it comes to Cust service responses.

I’ve dealt with several of these exchanges, and Gemini was by far the worst experience. Nothing personal against the Winklevosses, but it seems whoever did the hiring favored hiring based on connections like friends, rather than their ability to have effective customer service. Back when I started using it they only had a single guy handling all the customer service and he was extremely incompetent and lacked basic logic skills as far as problem resolutions. Unless something changes, this exchange is going to struggle because effective customer service has a large impact on how many people will ultimately support this company. Caution is advised.

Thanks for giving this useful guidelines about the best cryptocurrency exchange, i would like the way, which you used to represent this post by giving all pros and cons about the exchange..Really share much more post with us.

I have share one more site zedxe.com that i used for getting the information about the exchange.

I would recommend trying coins247.io. They’re a fairly new company, but their staff has a wealth of experience and are very knowledgeable. My experience with them thus far has been quite pleasant since the staff a eager to assist with any queries and their platform is quite simple to navigate. I also haven’t had any issues accessing my funds. They handle everything in a timely manner.

Changenow looks like a really good service, at least I haven’t had any problems with them all the time. No registration and limits, this is a good offer for users.

Indeed, I also used changenow and was pleased. It is very quick and easy.

With bitcoin mining declines in value, It simply goes with the whole concept of the mining platform, can we really be assured of cryptocurrency as the future? With the entry of Etherium though, cryptocurrency is again alive and kicking. What do you think is the next currency? I can’t wait to see where this currencies go and what currency rate would be! will it replace the physical money? I love the future!

Hello, I`m very glad that I`ve found this list of exchanges. Could you please check and rate CoinDeal? I’m thinking hard about registration there and I want somebody with cryptocurrency experience to give an opinion on it for me. Thanks! It seems to me, CoinDeal becomes very promising, relatively new platform exchange.

I used many of this list, but to my surprise, I did not see changenow.io here. This is strange, since it is a reliable and convenient platform for quick swapping of coins without registering. I hope you correct your list by adding changenow.io

I prefer to trade on decentralized exchanges. For myself, I made a choice in the form of ethnermium.Ñom. They have a huge number of coins. There are no minimum restrictions on trade and fees are so insignificant that you will not notice them. I also think the advantage of the easy creation of a wallet like MeW and easy integration with metamasks and a high level of security

I like Binance except the customer service is painfully slow. Many traders have recently signed up with Correx.io, based in Canada. Think Binance, but with exceptional customer service.

I found that with Binance too so I switched to XCH4NGE. Got a response from them in minutes when I had questions and the fees were better so just another advantage of me switching

thank you for detailed information!

But I think systems like EXMO or Orangecoin much better

Why is it that when I read review articles there is nothing but praises about the exchanges featured in the article like in this one or the one I read earlier

Now, when I scroll to the comments section I can see nothing but complaints and scam alerts on every single of those exchanges!

Can somebody explain this type of behavior in both cases? By that, I mean what makes the person that wrote the review so happy to use the exchange when on the other side there are so many complaints.

Or… and I believe this one is more probable – There are people paid by competitors to undermine reputations. Am I wrong?

I mean no disrespect to the people that have lost their money on any of these exchanges just to find they are alone in their misery because the exchanges don’t care, I am just curious what is going on here…

Which is the best cryptocurrency exchange in Ethiopia?

Merry Bo – your link sends me to some Asian site that of course I can’t read.

Johnnieme, do you still think Bianance is the best exchange for cryptocurrencies? I am ready to invest and trying to decide which exchange to go with. Thank you.

Dear friends!

We are happy to introduce our new Anybits.com project. It is a crypto-to-crypto exchange with 15 most popular cryptocurrencies available for trading.

You can log in using your Bitsane login and password.Â

Sincerely,Â

Bitsane Team

guys am in Tanzania, East Africa, am looking for an exchange that is not restricting this region !?

anyone with an idea please help

It’s so detail,Thanks .

and there other new exchange like bityep.com, bitcointrading etc.

I prefer dealing with decentralized exchanges (an exchange without the regulatory hurdle) like bitshares.org’s DEX. The wallets are supported and hosted by several programs like Openledger, Cryptonomex, Compumatrix and other sites from various countries worldwide.

BITSANE.COM – new exchange of crypto-currencies

Bitsane presents the most technologically advanced platform in the industry to date.

Bitsane offers a minimalistic, user-friendly interface for maximum usability. Our platform provides super-fast execution of trade transactions for major currency pairs, such as Bitcoin, Bitcoin Cash, Litecoin, Ethereum, Dash, Iconomi, Ripple to traditional currencies USD and EUR. The number of trading instruments is constantly expanding. In addition to the aforementioned crypto currencies, deposits and withdrawals are available via SWIFT (in dollars) and SEPA (in Euros), OKPay and AdvCash payment systems.

With the hacks and security breaches encountered by many cryptocurrency platforms in recent years, we take the platform’s security very seriously. Our developers have created a state-of-the-art security which has network protection, network backup, a strong, modern infrastructure, cold storage and advanced monitoring.

These extra measures of security ensure that our customers’ funds and stored data are protected and secure at all times.

At any point of time, a qualified and experienced customer support service is at your disposal.

Not only do we provide web-based training and an exchange platform, we also enable access to mobile users. The platform can be accessed from any mobile device, allowing you to execute trades from anywhere in the world with the Internet connection.

We provide a strong investment platform, enabling users to participate in margin trading and margin lending while receiving automated trading assistance. Our developers are currently working on enhancing Bitsane’s investment features.

The platform is constantly evolving and we will be grateful for all thoughts, error messages, wishes and comments on the work of our exchange.

Sincerely,

Bitsane Team

Hi there! I’ve just come across this topic and I wonder if you’re gonna launch an app in the near future, any thoughts? Any answer would be greatly appreciated.

Try CoinSwitch.co , they aggregate all major exchanges like Changelly/Bittrex/Shapeshift etc so they provide the best rates without charging any extra fee.

They support 5000+ cryptocurrency pairs.

FYI, not only is BTC-e.com seized by Homeland Security (I realize you didn’t mention them here)

BUT CEX is only allowed to operate in 44 states and my state of Georgia is one of the 6 that have not opened up to CEX yet.

That is how I have interpreted the notice that said my account has been declined because the service is not offered in my state yet.

SO , before you waste your time, check that first.

and yes, that was funny and so true.

just crickets around here for a week or more. 🙂

Where the hell am I? A topic like this provokes just one comment? In two weeks? o_O

And no mention of Bittrex? Where’s the real crypto forum?

great info!

BITFLARE LIMITED

NEW STABLE INVESTMENT COMPANY LAUNCHED.

https://goo.gl/FTzmhf

HOURLY 0.15% 3.60% Daily

Min Deposit: 0.001 BTC

Min Withdrawal: 0.0001 BTC

Come back anytime after 24 hours fees 5%

ewwwwwwwwwwwwwwwwwwwwwww