Contents

When we hear the word “wallet,” we often think of a container wherein we can store physical money.

Cryptocurrencies don’t have a physical form and the way you control the ownership of your tokens is through your private keys. These require a special wallet to store and control your crypto assets.

That’s why your choice of Crypto wallet is absolutely critical.

To help you with that, we’ve done a comprehensive analysis of the top Crypto hardware wallets and ranked them by every possible factor to provide the New Blockgeeks Awards for Top Hardware Wallet

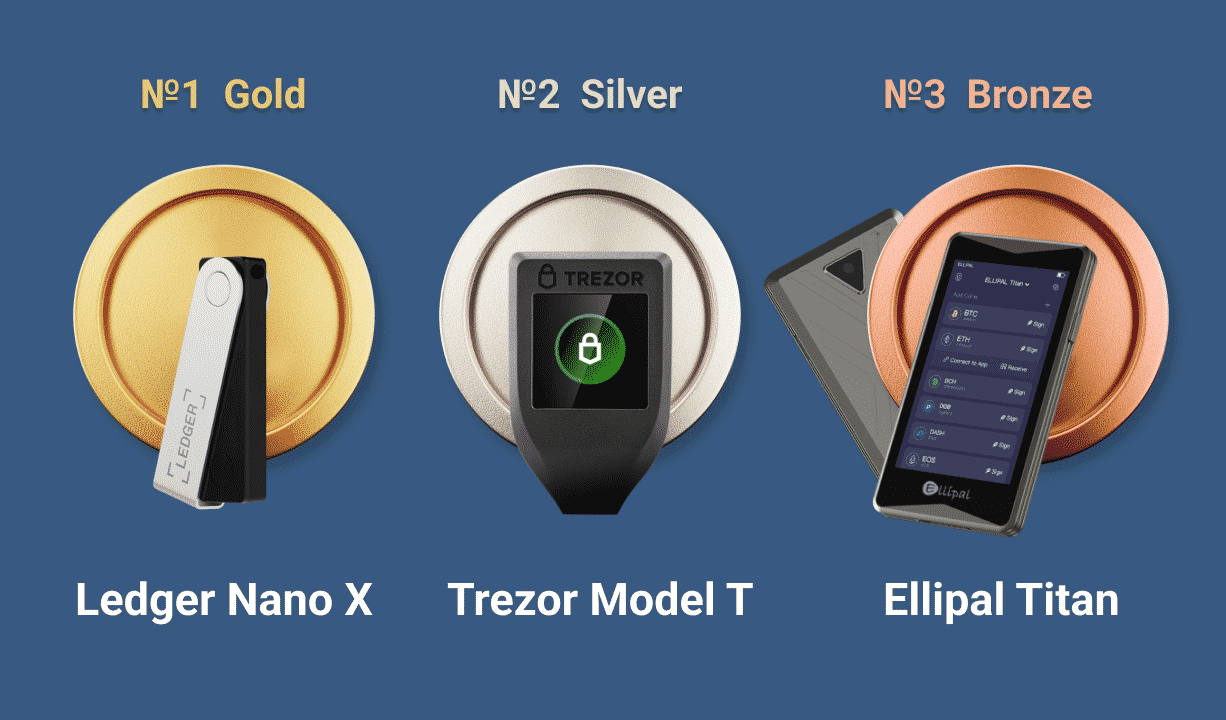

Using our unique methodology, applying both qualitative and quantitative analysis of the top 10 hardware wallets, we’ve ranked and awarded the TOP 3 hardware wallets to help you make the best decision to store your crypto:

The results:

We have awarded the three best hardware wallets with Gold, Silver, and Bronze awards based on our comprehensive review and quantitative analysis of popularity against each listed hardware wallet below.

Blockgeeks Awards for Best Hardware Wallets in 2022!

Contents

#1 Gold: Ledger Nano X

Models Reviewed: Ledger Nano S & Ledger Nano X

Price Range: $70 to $159

Google Rating: 3.9

Amazon Rating: 4.6/5

Coins Supported: BTC, ETH (and ERC-20 tokens), XRP, BCH, Litecoin, Polkadot, Binance (and BEP20 tokens), Tezos, Cardano, Monero, Dash, see full list here

Overview:

First one to top our hardware wallet list with Blockgeeks Gold Award is Ledger Nano X!

Ledger Nano X has a legitimate claim of being the best hardware wallet in the market right now. It is a widely-used hardware wallet that looks like a compact USB device based on a smart card, and roughly the size of a small flash drive, measuring at 72mm × 18.6mm × 11.75mm (2.83 x 0.73 x 0.46 inches) and weighing in at 34g.

It looks really good and is very secure. Its Bluetooth feature allows users to use the Nano X with their phone, or laptop, without the need of a wired connection. Its battery time allows 8 hour standby mode.

We also reviewed Ledger Nano S. to describe it in simple words, Ledger Nano X is an upgraded version of Nano S. It is a compact USB device based on a smart card. It is roughly the size of a small flash drive, measuring 39 x 13 x 4mm (1.53 x 0.51 x 0.16in) and weighing in at just 5.9g.

The most significant difference between Nano X and Nano S is that the former can hold multiple cryptocurrencies at once. In the Nano S, the users had to manually install and remove the apps to use a particular wallet. However, users can install multiple crypto wallets in Nano X at the same time.

#2 Silver: Trezor Model T

Models Reviewed: Model One & Model T

Price Range: $60 to $215

Google Rating: 3.8

Amazon Rating: 4.4/5

Coins Supported: BTC, ETH (and ERC-20 tokens), Binance Coin (and BEP20 tokens), Cardano, Ripple, Dogecoin, Avalanche, Litecoin, BCH, ETC, Tezos, Monero, see full list here

Overview:

Trezor hardware wallets utilise modern cryptography to secure crypto assets. It provides clear instructions and a USB cable, ready to plug in and use immediately.

It can be used with Android devices through apps such as Trezor Wallet, Mycelium, and Multibit HD. These wallets build an isolated environment for offline transaction signing, and minimizes the risk of private key discovery, even if the PC is infected by malware.

The PIN system in Trezor also has an inbuilt system that prevents any brute-force hacking attempts. After each incorrect guess, the waiting time between the guesses is raised by a power of two. If you’ve ever gotten your phone code wrong and had to wait a few minutes, you understand the discouragement, with Trezor protecting your assets, making 30 wrong guesses will take as much 17 years.

The entire wallet is backed up with the 24 words generated on setup. The original 24-word seed is generated using RNG (Random Number Generator) from the device and the computer. The seed is generated offline and displayed on the wallet’s screen, which ensures that the seed is never on an internet-connected device.

If you ever lose your Trezor wallet, then you can simply recover it with the 24-word seed and passphrase.

#3 Bronze: Ellipal Titan

Models Reviewed: Ellipal Titan

Price Range: $119 to $199

Google Rating: 4.7

Amazon Rating: 4.3/5

Coins Supported: BTC, ETH (and ERC-20 tokens), Binance Coin (and BEP20 tokens), Cardano, XRP, Dogecoin, Polkadot, BCH, Litecoin, ETC, see full list here

Overview:

Ellipal Titan looks and feels like a small mobile phone reinforced with aluminium alloy, measuring at 118 x 66 x 9.7mm with an LCD measuring at 3.97inches, it’s resistant to any physical abuse. It is also IP65 rated dust proof and water proof.

It offers the most secure air-gapped technology and hardware together. It works seamlessly with its companion app; allowing you to manage your accounts, connect to exchanges through your smartphone, and keep you updated with real-time market information.

It does not connect to the internet and is built with no online components or ports, which means it is absolutely protected against remote and online attacks.

It has a unique built-in security adapter design. All you have to do is insert the Ellipal security adapter to the bottom of the device, then insert the charging cable to the adapter – allowing you to update and charge your device offline.

It has also created a universal OCCW (Open Cross Chain Wallet) Protocol which allows the wallet to support multi-chain account systems and multi-cryptocurrency. Visual interface ensures the data exchange process is under your full awareness and total control.

It will also auto wipe all your data if it detects any breach and can be restored on another device by using the 12-word mnemonics.

Our Methodology

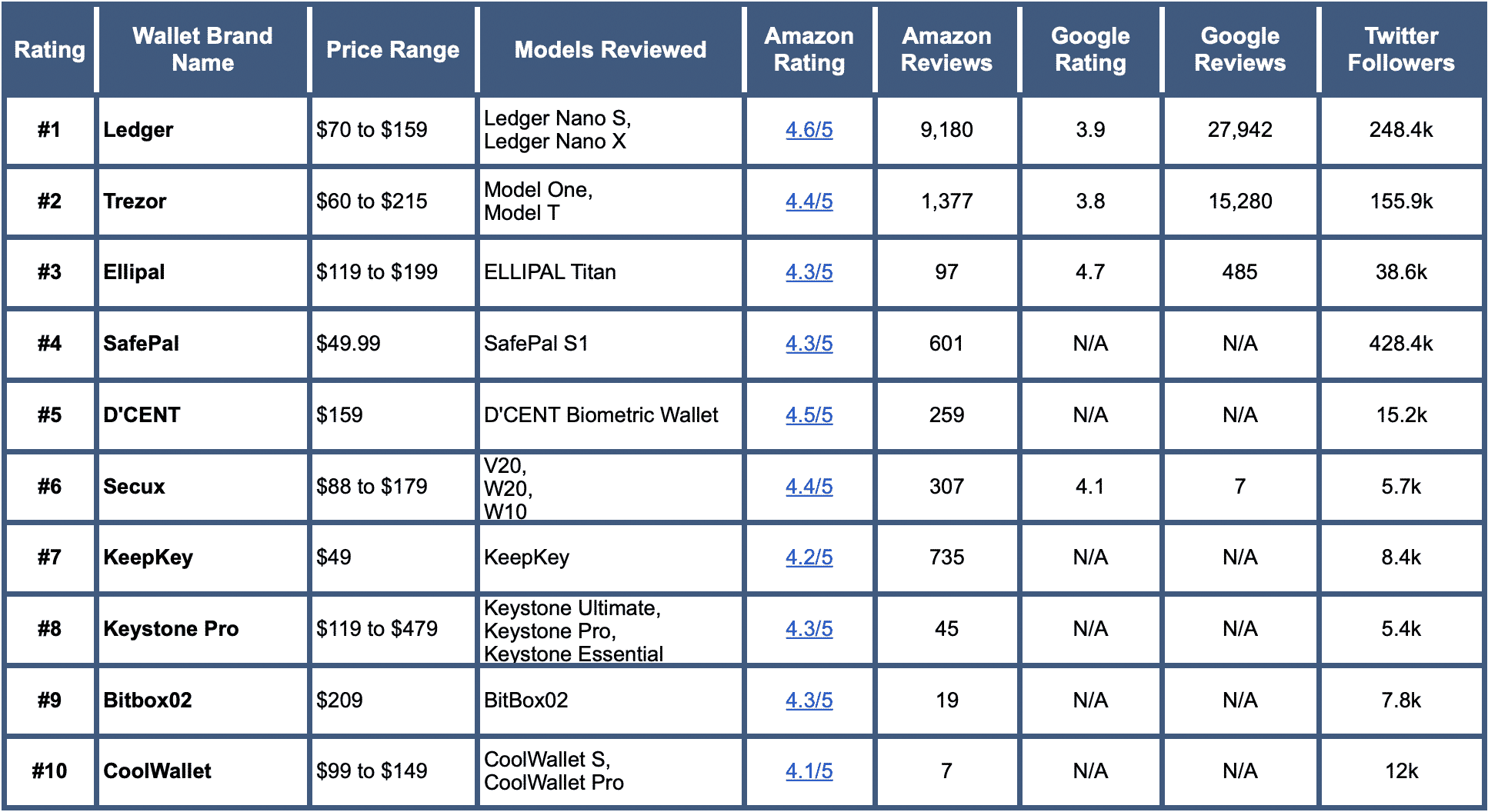

This research involved shortlisting the top hardware wallets and analyzing the top 10 to rank the best wallets by security, value for money and popularity in managing crypto assets offline.

Our analysis included both popular and more obscure hardware wallets to research their specifications and quantify their usage.

We had specific qualitative and quantitative factors that were accounted for in our research including:

- Wallet security

- Costs

- Supported tokens

- Customer Reviews in Google and Amazon

As well as popularity factors such as:

- Number of Amazon and Google ratings

- Twitter followers

How do you decide which wallet to pick?

That’s an easy one, keep on reading!

You need to understand all your options before putting your finger on anyone. To begin with, find out the difference between two types of crypto wallets which are:

- Hot wallets (metamask, coinbase wallet, edge wallet)

- Cold wallets

Hot Wallets

These are crypto wallets that are actively connected to the internet. While it is easy to transact using these wallets, they are highly vulnerable to cyberattacks.

Hot wallets also have two categories:

- Software wallets like metamask, and

- Exchange wallets like binance.

With exchange wallets, you do not have access to your private key, leaving your cryptos at the mercy of some other exchange/entity.

Elon Musk once tweeted that, “Any crypto wallet that won’t give you your private keys should be avoided at all costs.”

Meanwhile with software wallets, while you do have your private key giving you full control over your crypto assets, your wallet and keys are online, and are therefore vulnerable to theft.

However, both hot wallets need an internet connection to allow access, making your cryptos vulnerable to a potential hack.

Cold Wallets

These are crypto wallets that are not connected to the internet, eliminating the risk of being hacked.

Paper wallets and Hardware wallets are an example of cold wallets.

If you want the safest and most secure solution to store and manage your cryptocurrencies, then cold wallets are your safest bet.

Hardware wallets combine the safety of cold wallets, along with the ease of transactions of hot wallets.

Hardware wallets are one of the most convenient and safest options out there for storing your cryptocurrency.

A hardware wallet is a type of cryptocurrency wallet where you can store your private keys in a secure physical device and only you have access to it.

Once you understand the difference between the types of crypto wallets, you make your first decision on the type of wallet you want to choose.

What’s your safest bet?

Cryptocurrencies stored in a hardware wallet are kept offline, meaning that they can’t be hacked and are the most safest option available. Now that you’re here and decided to go with a hardware wallet, we at Blockgeeks have listed 10 best hardware wallets and awarded the top 3 with NEW Blockgeeks Awards.

Below we have the continuation of our 10 best hardware wallets list that is worth exploring if you want to diversify your options.

#4 SafePal S1

Models Reviewed: SafePal S1

Price Range: $49.99

Google Rating: NA

Amazon Rating: 4.3 /5

Coins Supported: BTC, ETH (and ERC-20), Binance (BNB), Ripple, Dogecoin, Polkadot, Solana, BCH, Litecoin, ETC, see full list here

Overview:

Safepal is powered with an air-gapped signing mechanism, with no bluetooth, WiFi, NFC, or other radiofrequency that may let hackers access your cryptos. It’s 100% offline cold storage.

SafePal’s S1 hardware wallet is the size of a credit card with a 1.3’ high resolution IPS screen, built by a world-leading security architect for a seamless user-experience.

It is embedded with EAL 5+ secure element and a true random number generator, keeping your private key safe. It enables you to secure, send, buy, swap, and exchange crypto in the easiest way.

Once paired with the SafePal App, you will be able to unlock powerful features such as token swap, decentralized exchange and dapps login, etc.

Its self-destruct mechanism will destroy all your data from the device when a suspicious activity is detected. And since It supports BIP39/44 seed phrase recovery, you will be able to recover your funds with the mnemonic phrase.

#5 D’CENT Biometric Wallet

Models Reviewed: Biometric Wallet

Price Range: $159

Google Rating: NA

Amazon Rating: 4.5/5

Coins Supported: BTC, ETH, XRP, BCH, Zcash, Litecoin, Dash, Binance Coin (BNB), ETC, Tron, see full list here

Overview:

D’Cent is a highly convenient cold storage solution for all your crypto assets. It’s a Bluetooth enabled hardware wallet that keeps your private keys protected and offers a superior on-the-go experience using iOS and Android mobile app.

Its conveniently portable measuring at 4.3 x 7.7 x 1.1cm and weighing at 36g with a 128×128 Pixels OLED display. Its large OLED display shows full transaction details from a single screen, with multiple buttons for easier navigation, and a lithium ion battery to maximize battery life for longer usage time.

It offers a certified Secure chip (EAL5+) and built-in Fingerprint sensor for highly secured transactions. Allowing you to secure your crypto transactions with biometric verification.

Its operating system allows high flexibility to add new coins and features to satisfy market requirements, making it one of the few that are quick to adapt to the growing demand.

#6 SecuX V20

Models Reviewed: SecuX V20, SecuX W20 & SecuX W10

Price Range: $88 to $179

Google Rating: 4.1

Amazon Rating: 4.4/5

Coins Supported: BTC, BCH, ETH (and ERC-20), Litecoin, Ripple, Stellar, Binance Coin (and BEP20), Dash, Dogecoin, Cardano, Tron (and TRC-10, TRC-20),see full list here

Overview:

SecuX offers three models for cold storage. Their first hardware wallet was W10, which received an upgraded model in the form of W20. Recently, SecuX launched their latest hardware wallet; V20.

V20 is the highest-end upgrade that SecuX has to offer. It has a complete suite of security features in place, from protected production chain, to tamper resistant packaging, right down to its military grade, CC EAL 5+ certified secure element for keeping your crypto assets safe and unassailable.

Its rugged aluminium case ensures years of protection, making it one of the most durable hardware wallets out there.

You can connect it via USB or use Bluetooth to connect to your PC or mobile phone (supported on both, android & iOS) through the dedicated SecuX mobile app. It enables you to send and receive your cryptos.

Its 2.8” full colour touch screen has an on-screen keyboard. It also comes with on-screen verification of addresses, and gives you protection from malicious threats.

V20’s streamlined interface ensures the security of your assets, and its simple firmware update process is more streamlined than the competitors to ensure smooth updates, maximizing security and usability.

#7 KeepKey

Models Reviewed: KeepKey

Price Range: $49

Google Rating: NA

Amazon Rating: 4.2/5

Coins Supported: Binance Coin, Ethereum, Bitcoin, Litecoin, Dash, Dogecoin, OmiseGo.

Overview:

KeepKey is huge in size compared to other hardware wallets. It has the dimensions of 38 x 93.5 x 12.2 mm. At the front, it has a large 3.12″ OLED screen which is protected by a polycarbonate casing. On the back, the wallet is built out of aluminium.

Slightly cheaper in cost than the others, KeepKey offers Bank-Grade Security for your cryptos.

It’s the primary choice for those who are on a budget and are looking for something that offers quality grade features with affordable prices.

It has no operating system, so there’s nothing for viruses or malware to latch on to and attack.

The wallet has a single button on top, which is used for confirming or canceling transactions. While it can be powered by a power bank or a charger, it needs to be connected to the KeepKey Chrome App to operate.

#8 Keystone Pro

Models Reviewed: Keystone Ultimate, Keystone Pro & Keystone Essential

Price Range: $119 to $479

Google Rating: NA

Amazon Rating: 4.3/5

Coins Supported: BTC, ETH, XRP, Polkadot, BCH, LTC, Huobi Token, TRX, Dash, see full list here

Overview:

Keystone offers three versions of its hardware wallet:

- Keystone Ultimate,

- Keystone Pro

- KeystoneEssential

Ultimate is designed for organizational users, Pro for frequent users, and Essential for long term hodlers.

These wallets are perfect for the type of users they are designed for. However, its Pro version is quite popular amongst frequent users.

Keystone Pro comes with 110% air-gapped hardware technology. You can safely send and receive crypto assets via QR code as your private key remains stored in the secure element.

The firmware of the Secure Element, hardware design (circuit diagram and BOM), hardware wallet application layer, and some parts of the hardware wallet operating system layer are open sourced.

It comes with a 4 inch touch screen and fingerprint sensor, has rechargeable AAA battery support with Type-C charging. Without the AAA batteries, it weighs 115g with the fiberglass body material, measuring at 112mm x 65mm x 18mm.

Its self-destruct mechanism allows the device to destroy your data from the device as soon as a malicious activity is detected. The users can recover their lost data through their seed phrases on any Keystone hardware wallet or other compatible hardware wallets that also utilise seed phrases.

#9 Bitbox02

Models Reviewed: BitBox02

Price Range: $209

Google Rating: NA

Amazon Rating: 4.3/5

Coins Supported: Bitcoin, Litecoin, Ethereum and ERC-20 tokens

Overview:

Bitbox02 hardware wallet has been best described by Business Insider as the best hardware wallet for beginners. It’s perfect for users to get started with crypto.

It allows you to securely buy, store, and use your cryptocurrencies.

With ingenious touch sensors and a crisp display, BitBox02 is measured at 7.09 x 4.72 x 0.98 inches, weighing-in at 138.9g. It comes with a USB-C port which you can conveniently connect with your PC. The setup process is seamless and absolutely stress-free so that it’s one less thing the user needs to worry about.

All security-related operations take place directly on the BitBox02; the computer or smartphone never comes into contact with the user’s private keys.

The BitBox02’s built-in screen displays all important information so that users can access information independently. Keeping the device safe from online hackers.

It comes with a USB-C to USB-A adapter which you can use to conveniently connect your PC. And with a USB-C connector, you can even connect your Android smartphone.

#10 Cool Wallet Pro

Models Reviewed: CoolWallet S & CoolWallet Pro

Price Range: $99 to $149

Google Rating: NA

Amazon Rating: 4.1/5

Coins Supported: Bitcoin, Ethereum, Litecoin, XRP, Bitcoin Cash, Horizen, ICX, ERC20 tokens.

Overview:

CoolWallet offers state-of-the-art hardware wallets. It comes with a unique and sleek design without compromising its decentralised security protocols.

CoolWallet Pro is a credit card-sized Bluetooth cold wallet that stores your cryptocurrency in secure cold storage that fits inside your actual wallet.

It comes with its own charging port and has a bluetooth connection which allows it to connect with any android or iOS device through its dedicated application.

The encrypted bluetooth connection in CoolWallet Pro enables the most convenient crypto on-the-go experience.

It measures at 85.6(L) x 54(H) x 0.8(T) mm and weighs in at 65g, with 22.50mm x 13.50mm display window. It also has a button placed on the card that guarantees a button lifetime of 100,000 pushes.

It comes with Military grade Secure Element (SE) chip which makes the wallet tamper proof. While providing users with the best possible security, convenience, and functionality for managing their cryptocurrencies and tokens.

Final Verdict

Cold wallets/hardware wallets are the right way to store your crypto assets. Keeping your cryptos safe from online hackers and ensuring you have full control of how you manage your cryptocurrency, these wallets provide the security and peace of mind you need to invest in your crypto assets effeciently.

And to make your decision faster, we have created this comprehensive list of 10 Best hardware wallets in 2022.

From which we have awarded top 3 hardware wallets with the prestigious Blockgeeks Awards!

- Gold Award: Ledger Nano X

- Silver Award: Trezor Model T

- Bronze Award: Ellipal Titan

Our comprehnive analysis of all the qualitative and quantitative factors, enabled us to create this list and identified three most-accounted-for features for which these wallets are popular amongst its users. These are:

- Most Secure: Trezor Model T (Blockgeeks Silver Award)

- Most Versatile: Ledger Nano X (Blockgeeks Gold Award)

- Most Affordable: KeepKey

Hope this guide navigates you towards the right decision and enlighten you towards the best in market.

Very good and well explained! Thanks…

Very useful info.

Very informative. Good overview for someone new to cryptocurrency.

So the KeepKey would work fine?

Yes, it would

Thank you Blockgeeks for the useful info. I’m wondering if there is any risk of hardware being broken or suddenly stop working? In that case, are the keys recoverable? Thank you so much!

No matter what you own your private keys and can use them on any “other” wallet for the most part to recover