Contents

Contents

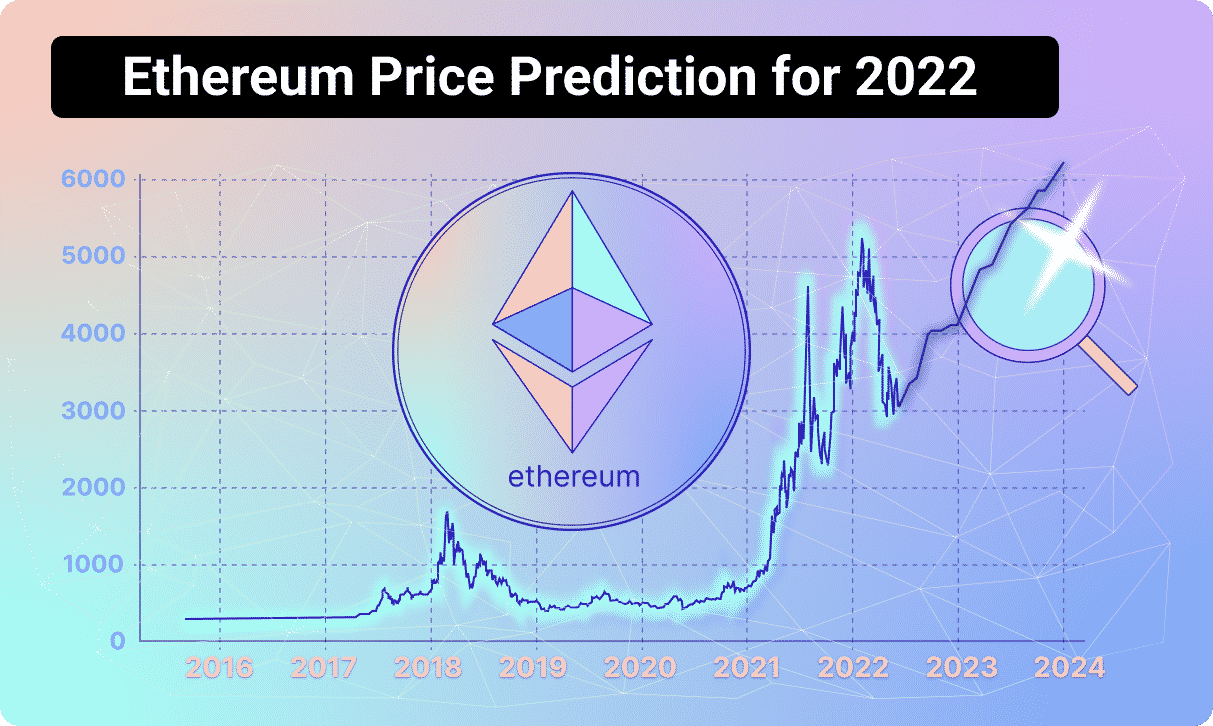

ETH 2022 Predictions

With the mainstream adoption of the blockchain for dApps and NFTs, prominent traders and investors continue to predict that ether’s value will go up in the long term.

Billionaire investor Mark Cuban tweeted in October 2021 that he sees more development potential in Ethereum than Bitcoin.

So what will the price of ETH be in 2022? The truth is no one knows, but most experts are generally bullish with predicted prices ranging from $6,500 to $15,000 in 2022 and much higher in the longer term!

The best method of making up your mind for investment is to “do your own research” (DOYR) but we don’t all have time. Keep reading on for eight predictions from prominent investment or crypto influencer sources.

Following these predictions, we’ll take a dive deeper into the influencing factors and the exciting history of Ethereum.

Wallet Investor

The recent ETH price prediction by Wallet Investor expects ETH value to rise to $5,351 by the end of 2022 and gives a long-term projected Ethereum growth in five years to be valued at $15,785.

Mark McGlone of Bloomberg

Another significant prediction has been announced by the Bloomberg Intelligence analyst Mike McGlone. He predicts, “Ethereum breaching $5,000 resistance.”

Cathie Wood, Ark Invest

Cathie Wood, the founder of Ark Invest, made a long term prediction for Ethereum. The predictions were based on its value at $2,480 per coin. The forecast expects that ETH will soar over 7000% in value – surpassing $20 million market cap by 2030, with each coin valued around $170,000 – $180,000.

Ian Balina of Token Metrics

A seasoned crypto investor and the founder of Token Metrics, Ian Balina predicts that ETH could go as high as $8,000. Her prediction comes with the high hopes of Consensus Layer releasing in the second or third quarter of 2022.

Ian Balina says and I quote, “Ethereum is the clear leader but other blockchains are onboarding new users at a faster pace due to Ethereum’s high gas fees and low transaction speed.”

Coinpedia

Coinpedia’s prediction is rooting for ETH to end the year somewhere between $6,500 – $7,500.

Their prediction is relative to the success of Consensus Layer. They expect the upgrades to significantly improve the network for users to mint and develop products. And since the gas fees are notoriously high and as the number of users has increased within the network, this upgrade is needed more than ever.

Finder.com

Finder’s latest Report on Ethereum Price Prediction has revealed a prediction that Ethereum will peak at $7,609 in 2022. And based on a survey they conducted with a jury of crypto experts, ETH will end the year at $6,500.

Nikhil Shamapant

Nikhil Shamapant predicts an 18-month price target for Ethereum of $150,000 per ETH—more than 30 times the current level. Nikhil believes this will be driven by two upcoming changes to the underlying Ethereum protocol that will cut the supply of ETH.

According to Nikhil, the changes will be implemented in two stages, with EIP-1559 being adopted in the second quarter of 2022 and culminating with proof-of-stake transition in late 2022, when Ethereum transforms from a store of value to the preferred savings vehicle for crypto.

Influencing factors

The value of Ethereum is influenced by a number of factors, including its utility as a platform for developing new tools, apps and NFTs, the number of users who are actively using the network, and the level of institutional interest in the cryptocurrency.

As of April 2022, the value of ethereum is at $3,438 with a market cap of more than $400B.

Due to the recent developments with the Russian-Ukrainian conflict, crypto prices plunged and there’s more volatility in the market, with Ethereum losing over 12% of its value but then quickly gaining it back.

In times of war, this kind of volatility is certain regardless of any asset class.

External factors aside, Ethereum is moving towards greener operations and immense scaling capabilities with its PoS (Proof of Stake) system, “ETH 2.0”. This has recently been rebranded as the “Consensus Layer”.

The current implementation is based on PoW (Proof of Work) like bitcoin. To learn more about this, read How Does Ethereum Mining Work?

In a recent attempt to get away from the popular “ETH 2.0” moniker, the Ethereum Foundation has ditched ETH 1 and ETH 2 terminologies to avoid confusion and better explain what’s actually happening.

Here’s the new naming:

- ETH 1 = execution layer

- ETH 2 = consensus layer.

This upgrade is expected to help Ethereum scale, cut costs and speed up transaction times once it is released.

Many crypto experts and analysts are predicting the value of Ethereum to shoot up as soon as the Consensus Layer is released.

So, what has happened so far with the Consensus Layer in 2021? Here’s everything you need to know.

Ethereum in 2021: The Jump Towards Consensus Layer

Smart contract expert Joseph Chowbest describes the difference between Execution Layer and Consensus Layer as the same between a road vs. a highway.

Consensus Layer will greatly improve the scalability, throughput, and security of the whole network without eliminating any data history or transaction records.

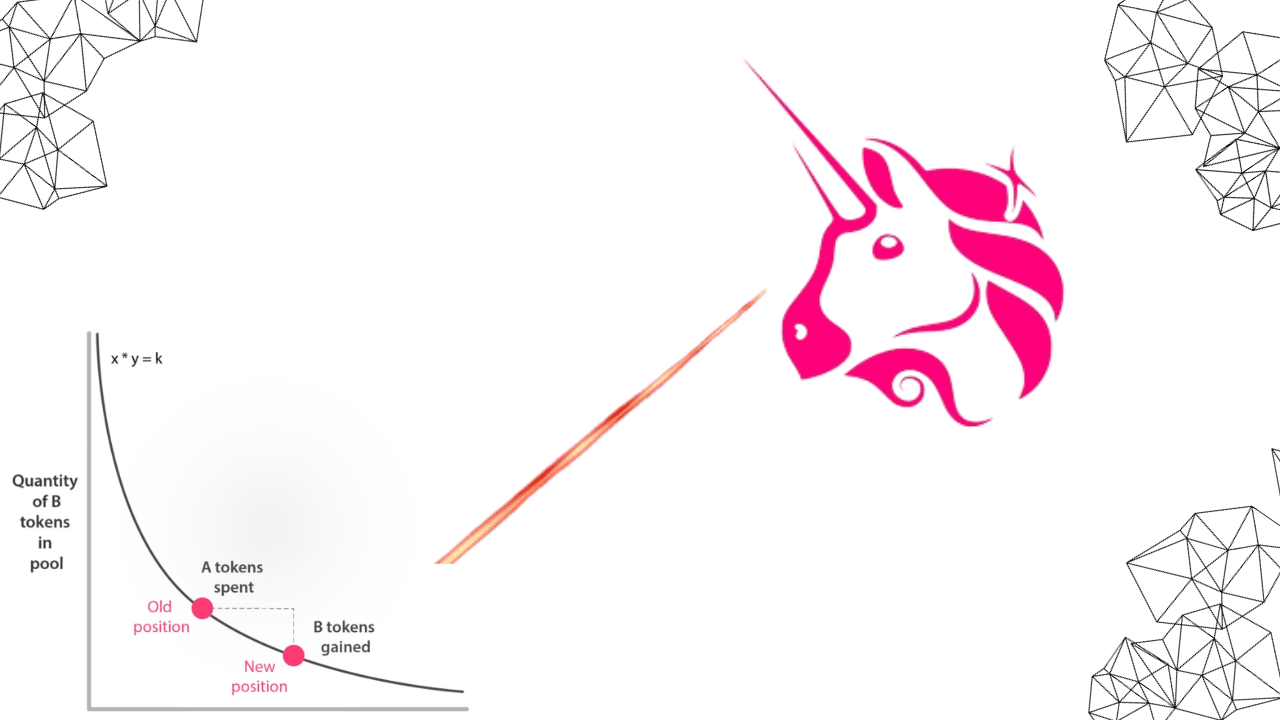

The most significant change that Consensus Layer will be bringing in is the transition from proof of work (POW) to a proof of stake (POS) blockchain. Proof of work is a secure yet highly wasteful process that has prevented ETH blockchain applications from scaling up. With POS, Consensus Layer will be able to turn the entire mining process virtual. Instead of relying on their processor’s strength, proof of stake will depend on the stake that a user locks up in the platform. The greater the stake, the greater their “hashing power.”

Along with this change in consensus, and the fact that each component of Consensus Layer is being worked on in parallel, there are factors that influence when the Consensus Layer launch will occur. The Beacon Chain, Merge, and Shard chains are the three components involved.

The Beacon Chain went live on 1st December 2021, which uses PoS on Ethereum. It is not yet part of the mainnet and will operate in parallel until The Merge occurs in the second quarter of 2022, marking the end of PoW for Ethereum. Meanwhile, Shard chains, in particular, are an exciting innovation that should scale up Ethereum exponentially as it will expand Ethereum’s transaction and data storage capabilities, which are expected to be ready by 2023.

Consensus Layer will be launching in phases – Phase 0, Phase 1, Phase 1.5, and Phase 2.

- Phase 0: During this stage, Ethereum launched the beacon chain and triggered the PoS implementation. The beacon chain starts the proof of stake implementation and gets launched when – 524 288 ETH tokens are staked on the deposit contract, and the number of registered validators has crossed 16,384. Each validator must stake 32 ETH into the deposit contract to successfully participate in the system.

- Phase 1: During this stage, the main blockchain gets partitioned into 64 shard chains that run parallel to each other. The processing power of the network is channeled across these shard chains simultaneously.

- Phase 1.5: Between phases 1 and 2, the original POW chain gets merged with the beacon chain to create a hybrid consensus system. The original POW chain becomes one of the 64 sharded blockchains.

- Phase 2: Following the POS transition, Consensus Layer will bring in other features like roll-ups and additional layer-2 fine-tuning.

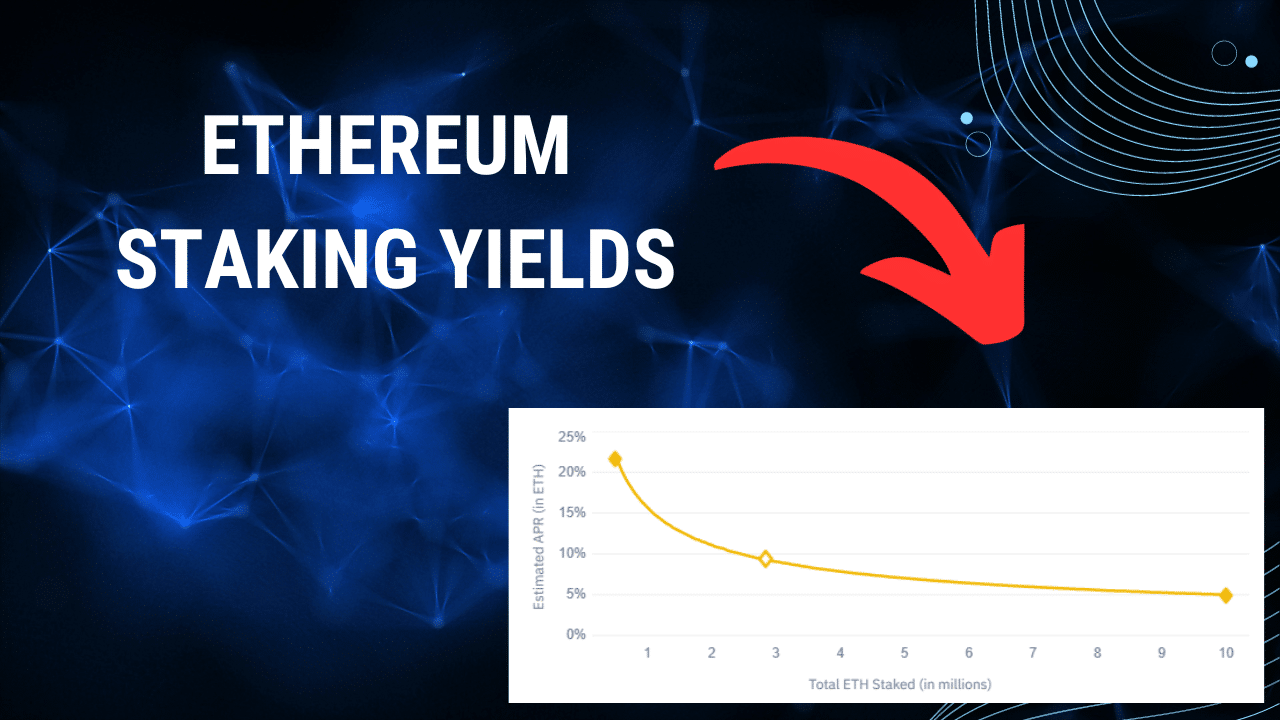

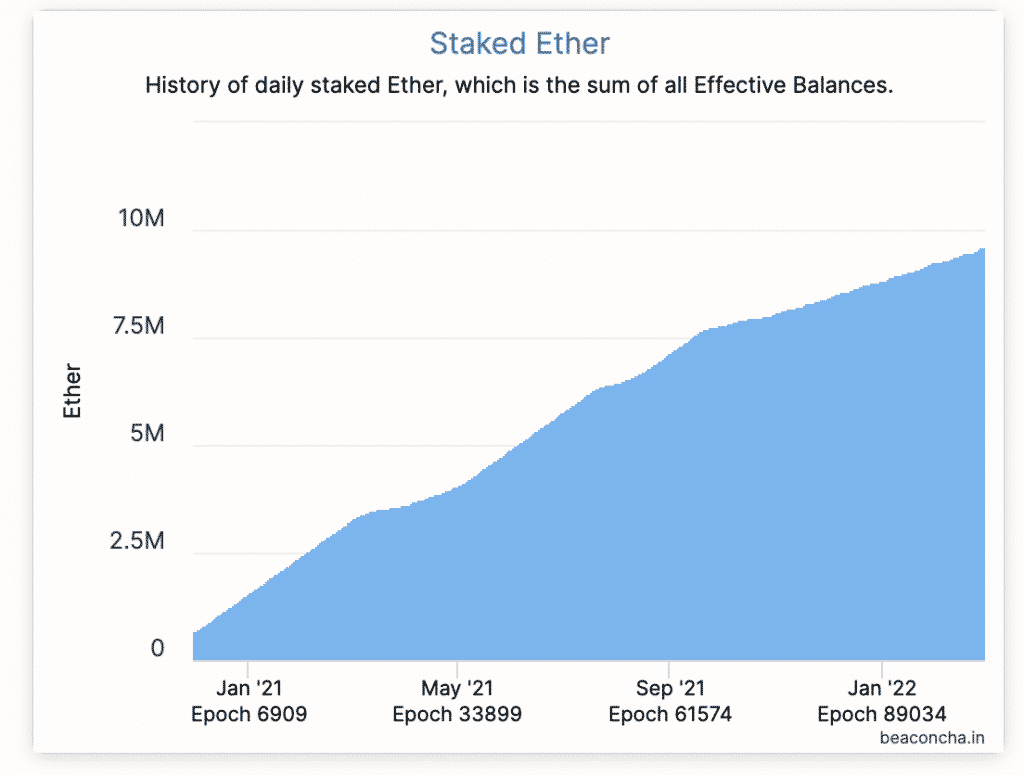

As of March 2022, the Consensus Layer had about $30 billion worth of Ether (ETH) staked. Over the course of 2021, the blockchain witnessed an increase in staked ETH from under 500K ETH to almost 8 million.

Keep in mind, staked ETH is not for sale, therefore reducing the supply side of the equation, and will be a significant factor in increasing prices.

The Biggest Change – Changing from PoW to PoS

Ethereum currently runs on the same protocol as Bitcoin – proof-of-work (PoW). This is how PoS works:

- Miners solve cryptographic puzzles to “mine” a block to add to the blockchain.

- This process requires an immense amount of energy and computational usage. The puzzles have been designed in a way that makes it hard and taxing on the system.

- When a miner solves the puzzle, they present their block to the network for verification.

- Verifying whether the block belongs to the chain or not is an extremely simple process.

While PoS provides an immense amount of security and stability to the system, it has three major issues:

- First and foremost, proof of work is an extremely inefficient process because of the sheer amount of power and energy that it eats up.

- It’s slow and makes the underlying protocol extremely unscalable.

- People and organizations that can afford faster and more powerful ASICs usually have a better chance of mining than the others. Theoretically speaking, these big mining pools can simply team up with each other and launch a 51% on the bitcoin network.

Ethereum will be improving upon their protocol by going up from PoW to PoS. ETH will be using the Casper protocol to implement its PoS mechanism. This is how PoS under Casper would work:

- The validators stake a portion of their Ethers as stake.

- After that, they will start validating the blocks. Meaning, when they discover a block which they think can be added to the chain, they will validate it by placing a bet on it.

- If the block gets appended, then the validators will get a reward proportionate to their bets.

- However, if a validator acts in a malicious manner and tries to do a “nothing at stake”, they will immediately be reprimanded, and all of their stake is going to get slashed.

- As you can see, Casper is designed to work in a trustless system and be more Byzantine Fault Tolerant.

- Anyone who acts in a malicious/Byzantine manner will get immediately punished by having their stake slashed off. This is where it differs from most other POS protocols. Malicious elements have something to lose so it is impossible for there to be nothing at stake.

EIP 1559 – a reduction of supply

In August 2021, Ethereum launched the London hard fork upgrade. The update consisted of five Ethereum Improvement Proposals (EIPs). EIP-1559 was one of them, and it sought to improve mining speed for its native currency Ether (ETH) by incentivizing it.

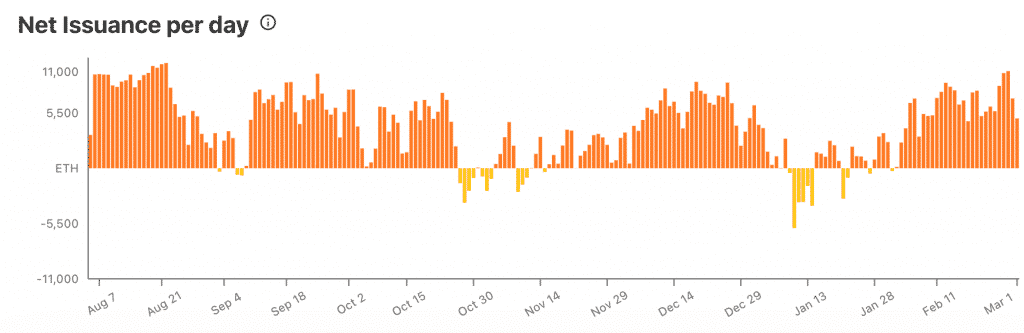

EIP 1559 proposes a modification to the way mining rewards are calculated, in an effort to decrease the amount of new ETH entering the market each day.

Under the current system, a certain percentage of each block mined is set aside as a reward for the miner. This EIP would instead create a deflationary model, wherein a portion of each transaction is burned, resulting in a net issuance of ETH that is negative on some days.

Supporters of EIP 1559 believe that the change would be beneficial for the Ethereum ecosystem as a whole. They believe that it would help to ensure that the value of ETH remains stable, and also encourages long-term investments in ETH.

While there is some disagreement over whether or not the change is necessary, most people agree that it would be a positive step for the Ethereum community.

https://watchtheburn.com/insights

Staking on the consensus layer

As of March 2022, the total amount of ETH staked is about eight million. Until the consensus layer goes live, it’s not possible to unstake existing staked ETH, potentially causing many would-be stakers to wait.

Once Ethereum changes to a completely PoS network, it’s possible the amount of ETH staked will increase. Along with the further decrease in daily issuance this could cause a supply crunch which would cause the price of ETH to spike.

Remember, Ethereum holders are incentivized to stake ETH because they earn a reward for validating transactions and keeping the network secure. As staking increases, the supply is further reduced.

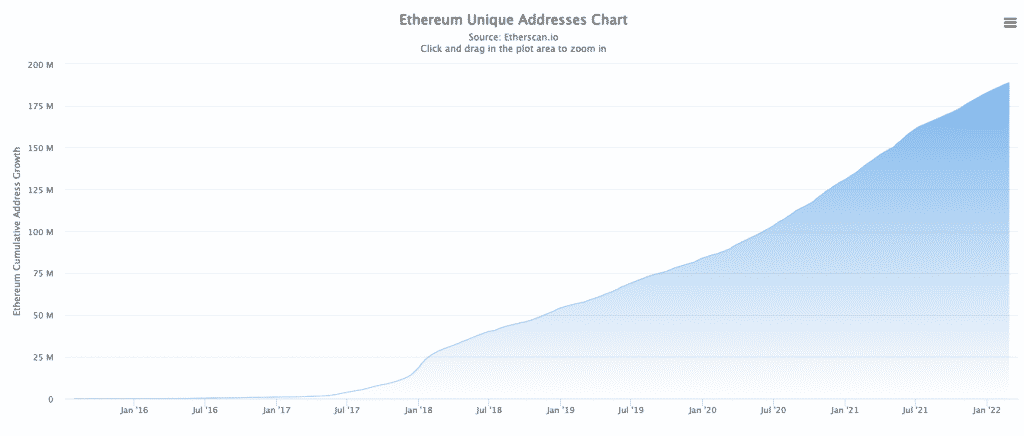

Network Growth – an increase in demand

The value of a network is the square of its users. The growth in usage of Ethereum is remarkable and as demand increases, with reducing supply from staking and burning, this will undoubtedly have an effect on price.

https://etherscan.io/chart/address

The Triple Halving

The name “Triple Halving” refers to the occurrence of a supply squeeze, which reduces the number of ETH tokens in circulation (equivalent to three Bitcoin halvings), and is rapidly approaching as Ethereum‘s on-chain activity rises.

Halvings lower the rate at which new coins are generated, thus reducing the amount of new supply available, even as demand rises. This has some ramifications for investors, since other assets with a limited or finite supply, such as gold, can have high demand and push prices higher.

“Halving” creates scarcity which pushes the price of the coin up. The more scarce the coin, the more valuable it becomes. That’s what’s expected from Ethereum’s Triple Halving as it proves to become a deflationationary asset, as it cuts from 4.3% annually to 0.43% which is going to be considerably less than amount of ETH burnt from gas fees.

Ethereum‘s Triple Halving is happening as circulating supply plunges. Downtrend in Ethereum reserves across exchanges continues and supply shock is brewing in ETH.

Web3 and NFTs!

Web3 is an open-access version of the internet based on blockchain technology that allows for more transparent financial transactions by users, greater data ownership by individuals, and cryptocurrency payments that allow users to own most of the infrastructure.

And with NFT marketplaces exploding on the Ethereum blockchain, the network has become even busier, slower and expensive. When there are more users on the Ethereum network, it means more support for your investment’s value, however, it results in more competition pulling users away as the network gets busier, slower and expensive. But that may not be the case once the Consensus Layer is released.

Ethereum faces competition from other blockchains who are also developing the infrastructure necessary for Web3 to become a reality. These competitors may be able to offer faster or cheaper alternatives, which could impact Ethereum‘s market share over time.

Enter Layer 2s

In 2021, the growth of Layer 2 solutions exploded. Layer 2s are systems that use a Layer 1 Blockchain, such as Ethereum, to supply security and finality to transactions without having to launch and grow the network of a Layer 1 from scratch.

Layer 2s basically “roll up” transactions and post them to the Layer 1 in batches. Layer 2s can do many of the same things that are done on Layer 1, but faster and cheaper. If these systems continue their growth and become even more popular, these will secure the future of Ethereum because they require the base layer to operate.

The end result is crypto users have fast, secure transactions at a small fraction of the cost of using Ethereum directly. This further cements the long-term bullish case for Ethereum.

The right time to invest!

Quite recently, Finder polled a 33-person jury of crypto experts and analysts that predicted Ethereum’s value to surpass $11,000 at the end of 2025 and nearly $26,000 by the end of 2030.

52% of the panel thinks now is a good time to buy ethereum while 30% urge investors to “hold.” However, 19% feel it’s appropriate to sell Ethereum right now.

Moreover, 80% of respondents expect the launch of ethereum‘s long-awaited PoS system, will lead to an increase in the price of ethereum.

One of the panelist and CoinSmart chief executive Justin Hartzman said, “If the ethereum 2.0 model (Consensus Layer) is successful and proof-of-stake is properly implemented, we can expect ethereum to moon real hard,

Joseph Raczynski, who’s a Thomson Reuters technologist and also one of the panellists at the Finder’s 33-person jury, thinks that the value of Ethereum can reach an all time high of $8000 by the end of 2022 and soar to %15000 by 2025.

Since majority of the jury believes in high-prospects for Ethereum, it only makes sense that its the right time to invest.

Conclusion

Currently, Ethereum is the second largest cryptocurrency by market cap. It has a lot of potential and is likely to experience significant growth in the coming years. With more businesses and individuals looking to use the blockchain for a variety of purposes, Ethereum is well-positioned to become one of the leading cryptocurrencies in the world..

And with the launch of Consensus Layer, experts believe that Ethereum may become the next big thing, increasing its value and market cap significantly, giving you insane ROI numbers.

It’s vital to remember that cryptocurrency markets are extremely volatile, making it tough to forecast a coin’s price in a few hours, and virtually impossible to give long-term predictions. As such, analysts and algorithm-based forecasters can and do make wrong predictions.

This goes for investing in all asset classes and not just cryptocurrencies – conduct your own research and pay attention to the most recent market trends, news, technical and fundamental analysis, as well as professional opinion before putting down your investment. And never put more money into a trade than you are willing to lose.

Ask any crypto expert and they’ll say invest only 1% to 5% of your portfolio into cryptos!

_________

Disclaimer: This article is provided for general informational purposes only and does not constitute financial, investment, tax, legal or accounting advice nor does it constitute an offer or solicitation to buy or sell any cryptocurrencies referred to.