Contents

|

|

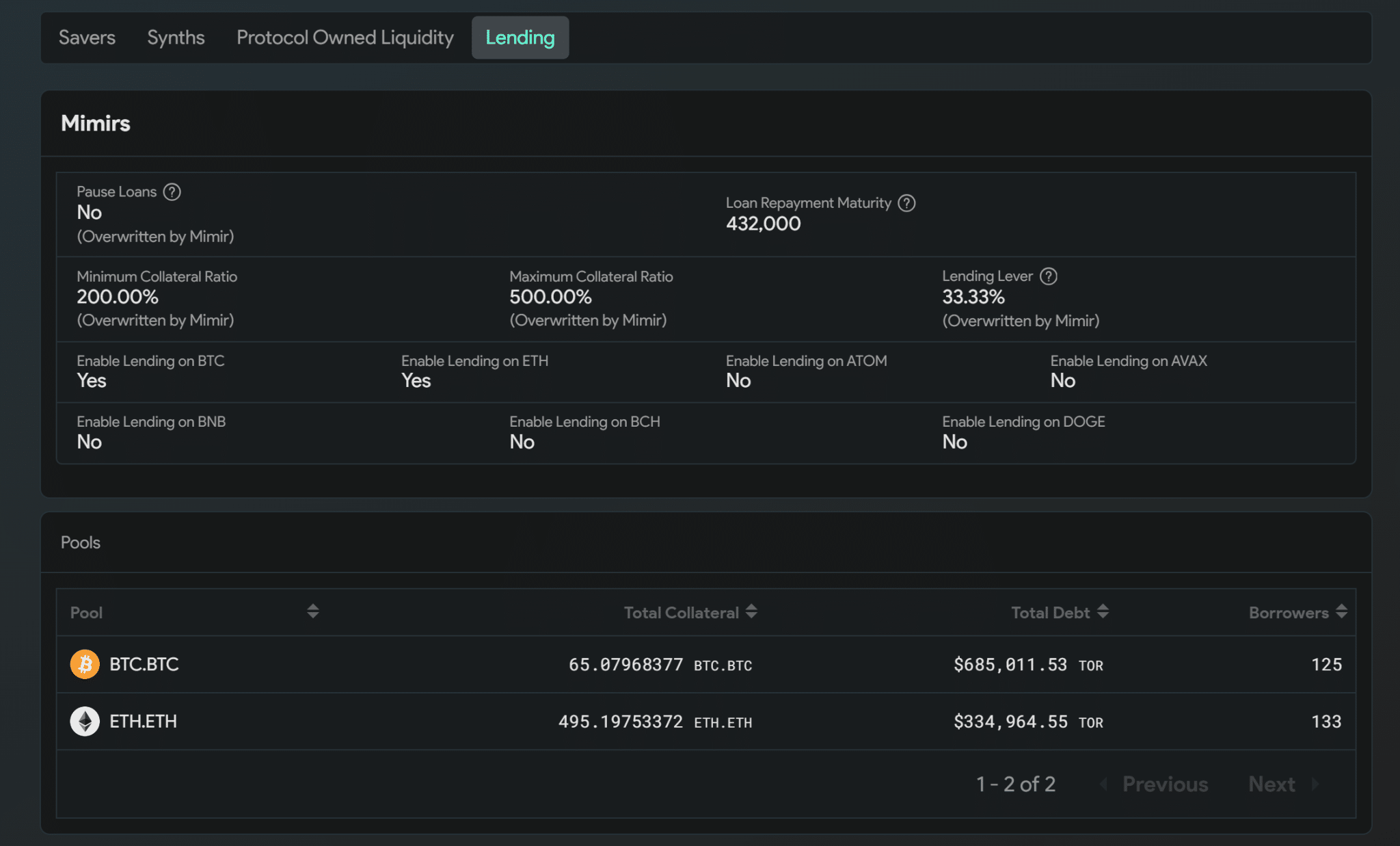

Thorchain lending is a decentralized lending protocol built on the Thorchain network that enables stablecoin minting and loan opening with eth. It offers an innovative way for individuals like yourself to earn passive income by minting and providing liquidity with your crypto assets. With a lending cap, you can maximize your equity while navigating the volatility of the market. Imagine being able to mint and lend out your cryptocurrencies, earning interest while maintaining full control over your funds. Whether it’s equity or debt, you can benefit from this opportunity without worrying about excessive fees.

What sets Thorchain lending apart is its commitment to security, transparency, equity, minting, debt, and fees. The protocol operates without intermediaries, allowing for peer-to-peer lending and minting of digital assets. Users can participate in the lending platform, with fees being charged for transactions.

Contents

Understanding Thorchain’s Innovative Solution

Thorchain is revolutionizing the debt lending space with its innovative rune solution that enables cross-chain interoperability for seamless lending. By leveraging a unique algorithm and decentralized liquidity pools, Thorchain eliminates the need for centralized exchanges, offering users a more accessible and efficient way to access debt and provide liquidity across multiple blockchain networks through a single interface. With Thorchain, users can easily manage their debt and rune transactions in one place.

Cross-Chain Interoperability for Seamless Lending

Thorchain’s primary goal is to bridge the gap between different blockchains, enabling them to communicate and interact with one another seamlessly. This is achieved through the use of the rune token, which facilitates cross-chain transactions and ensures secure communication between blockchains. Additionally, Thorchain’s innovative CR mechanism helps to reduce debt and maintain the stability of the network. Traditional lending platforms often face limitations. However, Thorchain’s protocol, CR, overcomes this challenge by facilitating efficient asset swapping between different chains using the Rune technology.

The rune protocol achieves cross-chain interoperability by utilizing a unique algorithm that ensures assets can be easily transferred from one chain to another without any complications or delays. This rune algorithm is designed to seamlessly enable the transfer of assets between chains. This means that users can lend or borrow assets on one blockchain network and seamlessly transfer them to another network using the rune without having to go through complex processes or intermediaries. The CR allows for easy cross-chain asset transfers.

Decentralized Liquidity Pools for Enhanced Accessibility

One of the key features of Thorchain’s solution is its reliance on decentralized liquidity pools, known as runes. The CR (conversion rate) of these runes plays a crucial role in facilitating seamless transactions within the Thorchain ecosystem. These rune pools are created by users who contribute their assets as collateral, allowing others to borrow against these pooled funds. This decentralized approach eliminates the need for traditional intermediaries such as banks or centralized exchanges, making it ideal for rune and cr enthusiasts.

By relying on decentralized liquidity pools, Thorchain enhances accessibility in the lending space with the use of runes. Users no longer have to rely on centralized platforms that may have restrictions or require extensive KYC procedures. With the introduction of the rune, users can bypass these limitations and enjoy a more decentralized and inclusive experience. Instead, users can directly participate in the rune network and access rune loans using their own rune assets as collateral.

Single Interface for Multiple Blockchain Networks

Another significant advantage of Thorchain is its ability to provide users with a single interface through which they can access loans and provide liquidity across multiple blockchain networks, including the rune network. This simplifies the rune process significantly since users do not have to navigate multiple platforms or understand the intricacies of each individual blockchain.

Through Thorchain’s interface, users can seamlessly interact with different blockchains, lending and borrowing assets as needed using the rune. This not only saves time but also reduces the complexity associated with cross-chain transactions, making it easier to perform rune transactions. Users can enjoy a streamlined experience while taking advantage of the opportunities presented by various blockchain networks, including the use of rune.

Enhanced Accessibility and Efficiency in Lending

Thorchain’s innovative rune solution enhances accessibility and efficiency in the lending space. By eliminating intermediaries and leveraging decentralized liquidity pools, users can directly participate in the lending process, giving them more control over their assets and the ability to leverage the power of rune. This democratizes lending, making it accessible to a wider range of individuals without sacrificing security or transparency. With the introduction of the rune, lending becomes more accessible and secure for everyone.

Moreover, Thorchain’s solution also offers enhanced efficiency by removing unnecessary steps and reducing transaction costs associated with traditional lending platforms. Users can quickly access loans or provide liquidity without having to wait for approvals or navigate complex procedures. This speed and efficiency make Thorchain an attractive option for borrowers and lenders alike.

Benefits and Features of Thorchain Lending Protocol

Thorchain’s lending protocol offers a range of benefits and features that make it an attractive option for users looking to borrow or lend funds. Let’s explore some of the key advantages this decentralized protocol brings to the table.

High Levels of Security

One of the standout features of Thorchain’s lending protocol is its decentralized nature, which ensures high levels of security for users. Unlike traditional financial institutions, where your funds are held and controlled by a central authority, Thorchain operates on a blockchain network. This means that transactions are verified and recorded by multiple nodes spread across the network, making it extremely difficult for any single entity to compromise the system.

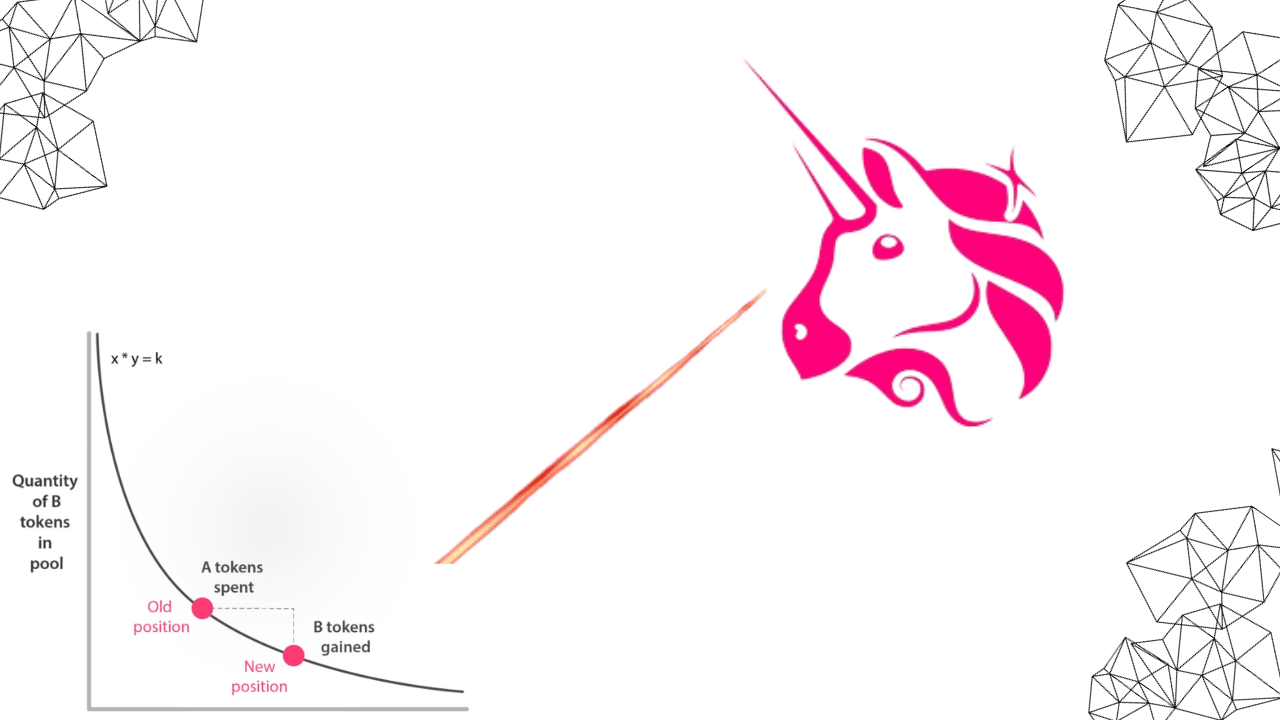

Automated Market-Making Algorithms for Liquidity

Liquidity is a critical factor in any lending protocol, and Thorchain ensures smooth operations through its automated market-making algorithms. These algorithms continuously adjust the supply and demand of assets within the platform, ensuring there is always sufficient liquidity available for borrowers and lenders. This means that users can easily enter or exit loan positions without experiencing delays or difficulties due to insufficient liquidity.

Trustworthy Transactions with Transparent Smart Contracts

Trust is crucialEspecially in the world of lending. Thorchain addresses this concern by implementing transparent smart contracts. These contracts are visible to all participants on the blockchain, ensuring transparency and eliminating any doubts about the terms and conditions of loan transactions. With transparent smart contracts, users can have confidence in their interactions within the lending protocol.

Competitive Interest Rates for Lenders

For those looking to earn passive income through lending, Thorchain’s protocol offers competitive interest rates that maximize potential earnings. By participating as a lender on Thorchain, individuals can allocate their funds to borrowers in exchange for interest payments. The decentralized nature of the platform ensures fair competition among lenders, resulting in attractive rates that can potentially outperform traditional savings accounts or other investment options.

Flexible Loan Terms and Low Transaction Fees for Borrowers

Borrowers also stand to benefit from Thorchain’s lending protocol. Unlike traditional financial institutions that often have rigid loan terms and high fees, Thorchain provides borrowers with flexibility and lower transaction costs. Users can customize their loan terms according to their specific needs while enjoying reduced fees compared to conventional lenders. This makes borrowing more accessible and affordable for individuals who may not have access to traditional banking services.

Open Loan Flow

-

The user sends in collateral (BTC.BTC -> RUNE, RUNE -> THOR.BTC)

-

THOR.BTC is held as collateral in the Lending module

-

Convert THOR.BTC value to TOR terms

-

Calculate debt in TOR based on CR and collateral TOR value

-

Mint TOR

-

TOR -> RUNE, RUNE -> L1 out (e.g. – ETH)

-

L1 -> RUNE (optional, user can also pay back with RUNE)

-

RUNE -> Mint TOR

-

Burn TOR (amount deducted from loan debt)

-

Burn Derived Asset (THOR.BTC) (amount is the same percentage of collateral as a percentage of loan debt paid) -> Mint RUNE

-

RUNE -> BTC.BTC (loan originator)

Participating in Lending on Thorchain: A Comprehensive Guide

To participate in lending on Thorchain, it’s essential to connect your wallet securely to the platform. By doing so, you can take advantage of the various opportunities available for lending and borrowing within the Thorchain ecosystem. Here’s a comprehensive guide to help you navigate through the process smoothly.

Connect Your Wallet Securely

Before diving into lending on Thorchain, it’s crucial to ensure that you have a secure connection between your wallet and the platform. This step is essential for safeguarding your funds and protecting your assets from potential security threats. By connecting your wallet securely, you can confidently engage in lending activities without worrying about unauthorized access or potential loss.

Choose Collateral from Supported Cryptocurrencies

Thorchain provides users with a wide range of supported cryptocurrencies that can be used as collateral when opening loans or providing liquidity. This feature offers flexibility and allows users to choose assets they are comfortable using as collateral. Whether it’s Bitcoin (BTC), Ethereum (ETH), or other popular cryptocurrencies, you’ll find options that suit your preferences.

Automated Matching Process

Once you’ve selected your desired collateral, loan requests are matched with available lenders through an automated process facilitated by smart contracts. This automated matching system ensures efficiency and transparency in pairing borrowers with lenders based on their specific requirements and available capital.

Earn Interest as a Lender

As a lender on Thorchain, you have the opportunity to earn interest based on the capital you provide for loans. The interest earned serves as compensation for providing liquidity within the network and contributes to the overall growth of the Thorchain community. By participating as a lender, you not only support borrowers but also benefit from passive income generated by your capital.

Borrow Funds Against Collateralized Assets

On the other hand, if you’re looking to borrow funds against your collateralized assets, Thorchain offers this option too. Borrowers can access funds by using their locked assets as collateral, allowing them to leverage their holdings without selling or liquidating their cryptocurrencies. This feature provides borrowers with financial flexibility while maintaining ownership of their digital assets.

Navigating the User-Friendly Interface

To participate in lending on Thorchain effectively, it’s crucial to navigate the user-friendly interface provided by the platform. The intuitive design and straightforward layout make it easy for users to explore different options, manage their lending activities, and monitor their loan status. Whether you’re a beginner or an experienced user, Thorchain’s interface ensures a seamless experience throughout your lending journey.

Embracing the Thorchain Community

Participating in lending on Thorchain goes beyond accessing financial opportunities; it also involves becoming part of a vibrant community. Engaging with fellow lenders, borrowers, and other members of the Thorchain ecosystem allows you to share insights, learn from others’ experiences, and contribute to the growth of the platform. By actively participating in discussions and staying connected with the community, you can maximize your lending experience on Thorchain.

Managing Loans: Opening, Repayment, and Loan Terms

Opening a loan on Thorchain is a straightforward process that allows users to access liquidity by leveraging their existing assets. By selecting the desired collateral and specifying the loan amount, borrowers can quickly initiate the lending process.

Loan Opening

To open a loan on Thorchain, borrowers begin by choosing the collateral they wish to use. This collateral serves as security for the lender in case of default. Once the collateral is selected, borrowers specify the loan amount they require. It’s important to note that there may be certain lending caps or limits imposed by lenders based on their risk appetite or available liquidity.

Loan Terms

Loan terms are crucial aspects of any lending agreement. These terms include interest rates and repayment periods, which are agreed upon by both borrowers and lenders before entering into a loan contract. The interest rate determines how much additional fee borrowers will pay on top of the principal amount borrowed over time.

Repayment periods can vary depending on the agreement between parties involved. Borrowers have flexibility in choosing whether they prefer to repay their loans in multiple installments or as a lump sum at the end of the loan term.

Repayment Options

Thorchain provides borrowers with various options for loan repayment. They can choose to make regular payments in installments until the entire loan is repaid or opt for a lump-sum payment at maturity.

Making regular installment payments allows borrowers to manage their cash flow more effectively while gradually reducing their debt liability. On the other hand, opting for a lump-sum payment at maturity requires careful financial planning but may suit those who anticipate having significant funds available at that time.

Consequences of Non-Repayment

Failure to repay loans within agreed-upon terms has consequences for both borrowers and lenders. When borrowers default on their loans, lenders have the right to liquidate collateral assets held as security to cover outstanding amounts owed.

Liquidation involves selling off these assets to recover the funds lent. It’s important for borrowers to be aware of the potential risk involved in defaulting on their loans, as it can lead to loss of collateral and damage to their creditworthiness.

Real-Time Loan Information

Thorchain provides users with real-time information about their loans, ensuring transparency and ease of tracking. Borrowers can access details such as remaining loan balances, repayment schedules, and any applicable fees or interest charges.

Having access to this information empowers borrowers to stay informed about their financial obligations and make timely repayments. It also allows them to plan their finances effectively by understanding the status of their outstanding loans.

Exploring the Design Goals of Thorchain Lending

Thorchain lending is a decentralized alternative to traditional banking systems, aiming to provide users with increased security, transparency, and trust. With its unique design architecture, this protocol enables seamless lending across different blockchain networks through cross-chain interoperability. By eliminating intermediaries, Thorchain lending reduces costs and enhances efficiency for borrowers and lenders alike.

Security

One of the primary design goals of Thorchain lending is to prioritize security. The protocol implements various measures to ensure that user funds are protected throughout the lending process. By utilizing smart contracts and cryptographic mechanisms, Thorchain maintains a high level of security while facilitating lending transactions.

Transparency and Trust

Transparency and trust are crucial aspects of any financial system, and Thorchain recognizes their significance. The protocol’s design promotes transparency by providing users with visibility into the lending process. Users can monitor their transactions on the blockchain, ensuring that they have full control over their assets at all times.

Cross-Chain Interoperability

Cross-chain interoperability is a key feature of Thorchain lending that sets it apart from traditional banking systems. This capability allows users to lend or borrow assets across different blockchain networks seamlessly. Whether you hold Ethereum (ETH), Bitcoin (BTC), or other cryptocurrencies, you can participate in the lending ecosystem without being limited by network constraints.

Cost Reduction and Efficiency Enhancement

By eliminating intermediaries such as banks or centralized platforms, Thorchain lending significantly reduces costs associated with borrowing or lending activities. Traditional financial institutions often charge high fees for loan origination or processing services. In contrast, the decentralized nature of Thorchain eliminates these unnecessary expenses, making borrowing and lending more affordable for users.

Furthermore, the removal of intermediaries also enhances efficiency within the lending ecosystem. Transactions can be executed directly between borrowers and lenders without any middlemen involved. This streamlined process not only saves time but also ensures that loans are processed quickly and efficiently.

Fair Market Conditions

Thorchain lending is designed to create fair market conditions for both borrowers and lenders. The protocol utilizes a unique mechanism called “depth” to ensure that loans are matched based on supply and demand. This means that borrowers can access loans at competitive interest rates, while lenders have the opportunity to earn attractive returns on their assets.

Thorchain lending incorporates stablecoins into its ecosystem, providing users with stability and predictability. Stablecoins are cryptocurrencies pegged to a specific value, usually a fiat currency like the US dollar. By minting stablecoins, Thorchain lending allows users to borrow or lend assets with minimal exposure to price volatility.

Protection Against Inflation: Thorchain’s Circuit Breaker System

Thorchain lending is designed to provide users with a secure and reliable platform for borrowing and lending assets. One of the key features that sets Thorchain apart is its circuit breaker system, which plays a crucial role in protecting against inflationary risks within the lending markets.

Circuit Breaker System

The circuit breaker system implemented by Thorchain serves as a safeguard against potential instability within the lending ecosystem. This mechanism acts as a protective measure by temporarily halting new loans in certain situations.

If excessive borrowing occurs or asset prices become highly volatile, the circuit breaker kicks in to prevent further lending activities. This proactive approach helps maintain overall security and prevents any detrimental effects on user funds.

Maintaining Stability

By implementing a circuit breaker system, Thorchain ensures that its network remains stable even during times of market turbulence. This protection mechanism is especially important for savers who rely on the platform to earn interest on their assets without worrying about sudden market fluctuations or systemic risks.

The circuit breaker acts as an additional layer of security for participants in Thorchain’s lending protocol. It provides peace of mind knowing that their funds are shielded from unexpected events, such as extreme price swings or excessive borrowing activity.

Preventing Inflationary Risks

Inflationary risks can pose significant challenges within lending markets. Excessive borrowing can lead to an imbalance between supply and demand, potentially devaluing assets and eroding trust in the system.

Thorchain’s circuit breaker system effectively mitigates these risks by temporarily pausing new loans when necessary. By doing so, it prevents overborrowing and helps maintain healthy pool depths across various asset pairs.

The Role of Block Science

Block Science, led by Barraford Tor, has played a vital role in developing Thorchain’s circuit breaker system. Their expertise and research have contributed to creating an effective mechanism that protects against inflationary risks.

The circuit breaker system takes into account various factors, including asset prices, borrowing activity, and overall market volatility. By monitoring these variables, the system can identify potential risks and take appropriate action to maintain stability.

Low Volatility and Rune Pools

Thorchain’s circuit breaker system is particularly effective in managing low volatility assets like Rune. The system ensures that pool depths are maintained at optimal levels by temporarily halting new loans if necessary.

This approach allows for a balanced lending ecosystem where borrowers have access to liquidity while preventing excessive borrowing that could lead to inflationary pressures.

Enhancing Security and User Confidence

The implementation of a circuit breaker system within Thorchain’s lending protocol significantly enhances security and instills confidence among users. Knowing that their funds are protected from sudden market fluctuations or systemic risks provides peace of mind for participants.

This protection mechanism aligns with Thorchain’s commitment to maintaining a robust and secure platform for borrowing and lending assets. It demonstrates their dedication to safeguarding user funds and ensuring the long-term sustainability of the network.

FAQs

How secure is Thorchain’s lending protocol?

Thorchain’s lending protocol is built on a robust blockchain infrastructure that prioritizes security. Through decentralized governance and cross-chain interoperability, Thorchain ensures that your assets are protected from potential vulnerabilities.

Can I earn passive income through Thorchain lending?

Absolutely! By participating in Thorchain’s lending protocol, you can earn interest on your deposited assets while maintaining full control over them. It’s an excellent way to generate passive income without relying on traditional banking systems.

Are there any fees associated with borrowing or lending on Thorchain?

Yes, there are fees involved when borrowing or lending on Thorchain. These fees ensure the sustainability and operation of the platform while providing incentives for liquidity providers. Make sure to familiarize yourself with these fees before engaging in any transactions.

How can I stay updated with the latest developments in Thorchain?

To stay informed about all things related to Thorchain, make sure to follow their official social media channels and join their community forums. These platforms provide regular updates about new features, partnerships, and developments within the ecosystem.

What happens if I encounter any issues or need assistance while using Thorchain?

If you encounter any issues or require assistance while using Thorchain, you can reach out to their dedicated support team. They are available to address your concerns and provide guidance throughout your Thorchain lending journey.