Insider: Crypto Startup Circle Looking To Secure $250 Million

|

|

Taking a brief gander at the crypto market’s trading activity, it is more than apparent that the number of investors, along with capital allocated, have capitulated en-masse over the course of 2018. Some have even argued that Bitcoin has folded out of the mainstream consciousness, and could potentially be on its last legs.

Case in point, Chris Burniske, a partner at Placeholder Ventures, once explained that the days “cryptocurrency” and “blockchain” were plastered all over mainstream media, as CoinMarketCap sat open on the smartphones and laptops of millions the world over are long gone.

In fact, more likely than not, retail investors, including you and I, have removed CoinMarketCap from their bookmark list, purged the passkeys to their Coinbase and Binance accounts, and unfollowed crypto’s most eccentric commentators on Twitter.

But, the startups backing this budding ecosystem have continued to put their best foot forward. The odds may be against them, but they’re still trying their hardest to succeed.

The Elusive $250M Cheque

According to an exclusive report from business media resource The Information, which cited a person familiar with exclusive information, Circle is looking to get a nine-figure cheque for some of its equity and debt. Insiders told the outlet that the world-renowned cryptocurrency startup, backed by Wall Street powerhouse Goldman Sachs, is looking for $250 million in this latest round, which remains unannounced to the public audience. While this is unconfirmed hearsay, analysts claim that more likely than not, this deal is likely in the works. In an interview, technology entrepreneur Jeremy Allaire of the company noted that his company is seeking alternative capital raising structures.

Crypto Startup Circle Seeking $250 Million in New Funding https://t.co/dgmUT3EkbB via @theinformation

— Jon Victor (@jon_victor_) March 2, 2019

If Circle, which owns the popular, retail investor-centric Poloniex exchange, succeeds with this purported round, it would double the amount of venture funding it has received in its multi-year lifespan. For those out of the loop, the company, headed by Allaire, has already raised $246 million from investors like Goldman, Chinese heavyweight Baidu, IDG Capital, and Bitcoin mining giant Bitmain (the world’s foremost ASIC producer).

While the company was valued at $3 billion last year, just under half of competitor Coinbase’s $8 billion assessment, it is unclear how this nine-figure round is shaping up. Considering anecdotal evidence, it would be fair to assume that the company has seen its private valuation fall drastically. In fact, per a report from The Block, shares of the Massachusetts-headquartered company were being offered at $3.8 on a private equity site this January, down drastically from their valuation of $16.23 a share last year. A share price of $3.8 would imply the company is valued at $705 million in the eyes of investors.

What’s Going For Circle?

Although the collapse in the Bitcoin price may have all but the most dedicated investors and holders, some argue that there’s a lot going for the Boston-based company. Just eight weeks ago, Sean Neville and Jeremy Allaire released their 2018 breakdown, explaining how yesteryear treated Circle and how they intend to address 2019. Long story short, the numbers and business developments were fairly impressive. Here’s a brief breakdown.

- Poloniex added an array of popular digital assets, including EOS, Quantum, Basic Attention Token, Status, Kyber, LOOM, FOAM, MANA, Bancor, and USDC. This facet of Circle also delisted a number of projects, especially those that were in poor standing.

- Circle introduced Invest, which gave a seamless crypto investment experience for retail players. 30% of all purchases on the exchange are recurring, meaning that investors are looking to siphon money into this space for the long haul.

- Circle Trade, the startup’s over-the-counter desk, traded $24 billion in nominal volume over 2018, with most trade requests coming from institutional players. This volume was executed across 10,000 trades, by 600 counterparties, and across 36 different cryptocurrencies.

- The company launched US Dollar Coin (USDC) in partnership with Coinbase. USDC is rapidly proving itself to be a viable stablecoin.

Will The Crypto Startup Succeed?

That’s the question that remains on everyone’s mind. Will Circle be able to secure such a large sum of capital, especially with current market conditions in mind?

Some argue that the answer could be yes, here’s why.

Research completed by Diar, a crypto analytics publication, recently confirmed that while the lackluster (understatement) performance of the Bitcoin price has deterred all but the zaniest traders, venture groups and investor groups of similar caliber have kept their proverbial pedals to the metal.

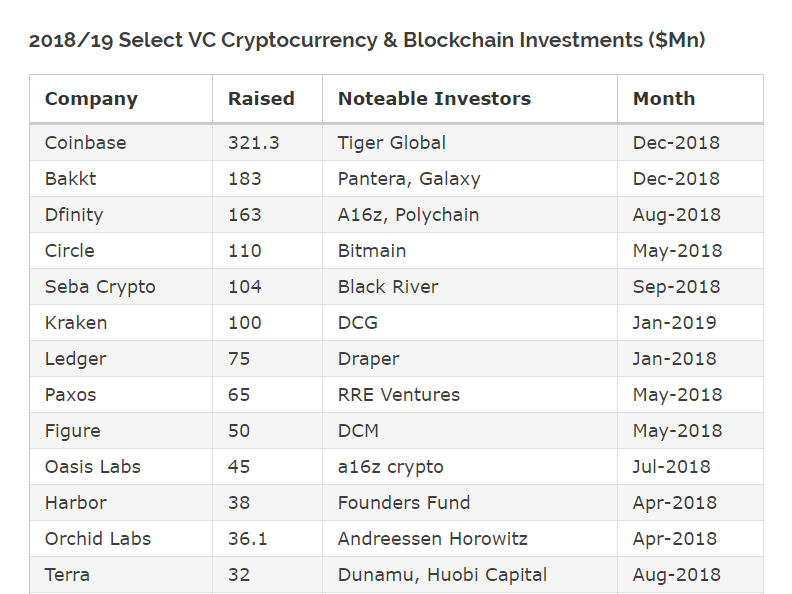

In the publication’s most recent newsletter edition, it was explained that while 2018 was a “bloodbath for cryptocurrencies,” what Diar deemed “blockchain-led” operations secured $1.6 billion in fiat investment over yesteryear.

Diar claims that since stakes in cryptocurrency startups became a viable investment vehicle, $5 billion has been siphoned into such opportunities — no small sum to say the least. Interestingly, the $1.6 billion the crypto war chest saw comes it way in 2018 primarily pertained to trading infrastructure, rather than blockchain projects in and of themselves.

Coinbase, Circle, Kraken, three notable American cryptocurrency service providers, raised $500 million collectively even “long after the bubble burst.” Bakkt and its competitors, in ErisX and SeedCX, have also secured hundreds of millions, as many, including Fundstrat Global Advisors, argue that proper regulated, institution-friendly, and multi-faceted fiat on-ramps and off-ramps is currently something curbing this space.

So, if Circle follows the trend it set last year, by flouting the unspoken rules of a bear market, there’s a chance it could secure $250 million, or at least a hefty portion of that sum.

Title Image Courtesy of Sharon Mccutcheon Via Unsplash