Contents

|

|

Security Token offerings, or blockchain-based investment contracts, emerged in 2017 out of the need for a more compliant, regulated approach to digital assets. After all, 2017 was “the year of the ICO,” with largely unregulated capital raises overtaking angel and seed venture capital.

Contents

Legal Problems With ICOs

This shocked regulators like the SEC and put them into overdrive, regularly going after potentially fraudulent offerings and actors from Alex Tapscott to DJ Khaled and Floyd Mayweather. The SEC even went after companies outside the US, such as Kik (which is based in Canada).

The industry clearly has seen the benefits of a blockchain-based capital raise, which enables anyone, anywhere in the world to invest any amount, no matter how small. By removing intermediaries, many projects skipped KYC/AML altogether, opening investment to quite simply anyone with money. From 2017 to the end of 2018, ICOs raised over $20 billion. STOs, or Security Token Offerings, paled in comparison from 2017 to 2018.

STOs Are Replacing ICOs and IEOs

2017 saw just 5 STOs, and BlockState reports that just around a billion dollars has been raised so far (as of early 2020). However, the tides are changing as ICOs are being replaced by STOs. STOs raised around $450 million of that figure is 2019, while ICOs raised just $370 million in the same year. As a matter of fact, it’s predicted that ICOs will virtually disappear in 2020, while STOs will continue to grow.

As the saying goes, “follow the money,” and since companies are turning to STOs over ICOs, it’s clear that security tokens are winning out, at least in the blockchain space.

STOs Will Replace IPOs

What’s even more interesting is that STOs are a completely viable option for capital raising outside of the blockchain space entirely. For instance, IPOs, or Initial Public Offerings, cost over $4.2 million to conduct, on top of 4-7% fees, according to PwC. ChainPlus estimates the cost of doing an STO at around $100,000.

At this point, many would argue that IPOs are for raising far greater sums than STOs are capable of, but the reality is that, due to the globally accessible nature of STOs, there’s virtually no limit to the amount you can raise (with the caveat that there can be jurisdictional legal limits). As an example, tZERO raised around $134 million, greater than the median deal size of a US IPO at around $100 million.

When you’re raising $100 million, spending over $4 million just on fees is a serious hit to the margin. This isn’t even to mention things like the cost of KYC, which is around $616 per customer, according to Refinitiv. Being able to digitally record and verify an investor’s identity via the blockchain can drastically reduce KYC costs.

Compliance is a major concern, as around $26 billion in KYC/AML non-compliance fines have been given out in the last decade, according to a FENERGO report. Security Tokens can create an easier compliance solution, baking compliance requirements into the token itself.

Security Tokens Can Be A Better Compliance Solution

To go into more detail, let’s compare the most common token protocol used for an ICO, ERC-20, with that of tokens used for STOs. ERC-20 is a protocol that defines just a few basic functions:

- Token name (e.g. ETH)

- Token decimal number (e.g. 18)

- Transferring tokens

- Inquiring the balance of tokens at a certain address

- Total supply of tokens

You’ll notice that, in these functions, you don’t have things like the ability to restrict transfers, ban investors from certain jurisdictions, implement a lock-up period, or prevent transferring to a minor or someone on a watch list.

These tokens are missing a lot of what’s needed for a compliant securities offering. You don’t want to accidentally sell securities to a minor or to someone in a jurisdiction you’re not regulated in, for instance, but you can’t control that with an ERC-20 token.

You can, however, control those sorts of actions with a security token, which enables you to program compliance into the token itself.

Security Tokens can enable everything from administrator transfer functions to forced transfers, and a whole lot more:

- Code / Reference Link

- Get number of holders function

- Granularity

- Token sender hook

- Token receiver hook

- Data parameter in transfer functions

- Get the administrator address

- Transfer administrator function

- Transfer administrator event

- Get metadata of an address

- Static checks

- Dynamic checks

The list could go on and on, because security tokens are programmatically highly complex. There are many potential standards to use, with perhaps the most well-known one being ERC-1400. One potential downside is the sheer complexity of the protocol, as you’ll have to find the blockchain talent who can handle it without introducing security vulnerabilities.

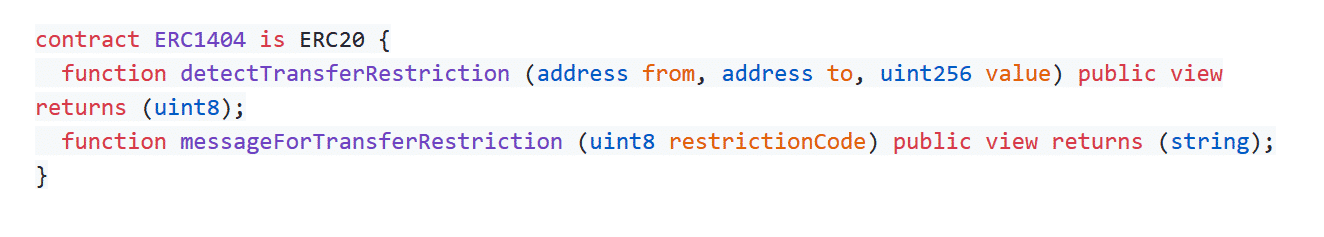

A much simpler version is presented with ERC-1404, aptly named the “Simple Restricted Token Standard,” which adds just two basic functions to the ERC-20 standard:

These functions let you enforce some of the previously mentioned transfer restrictions, for instance relating to an investor’s age or jurisdiction. Since there are literally hundreds of thousands of ERC-20 smart contracts out there and over 1,000 Ethereum developers, it’s relatively easy to find talent that can handle the ERC-20 protocol (not to say that it’ll be cheap).

From there, it’s a straightforward process to understanding the added ERC-1404 functions, and creating your very own security token.

The Future of Compliance

Security tokens will likely fundamentally revolutionize compliance, as security tokens can represent any financial asset, whether it’s equity, debt, or a real asset, and as such, they can improve compliance for any asset.

Currently, it seems that no security token project has forfeited the use of an additional KYC/AML party for compliance. It’s always “better safe than sorry” when it comes to securities regulations, but it’s possible that one day, all KYC/AML measures will be baked into digitized assets themselves, negating the need for an additional party.

Higher Liquidity

One of the most touted benefits of security tokens is increased liquidity. After all, the blockchain doesn’t just operate during trading hours like the NYSE or NASDAQ. Instead, security tokens can be traded 24/7/365. Further, they’re not geographically limited, so an investor in any market can buy and sell them at any time.

Low liquidity becomes a major problem in private secondary markets, especially for physical, expensive assets like collectibles and certain commodities like gold. This makes these assets especially ripe for tokenization.

That being said, security tokens promise higher liquidity in the future, not today. Currently, there’s a severe lack of secondary market infrastructure for security tokens, and the infrastructure that’s out there doesn’t have enough buyers and sellers to create sufficient volume for superior liquidity over traditional markets.

However, if you believe in security tokens, meaning that you believe better technologies win out in the end, then buyers and sellers will naturally fill these markets over time, building up a liquidity premium for security tokens.

Indeed, traditional exchanges faced these same challenges in the beginning. The London Stock Exchange, for instance, can trace its history back more than 300 years. Surely, investors expected low liquidity hundreds of years ago, with a negligible amount of investors and volume compared to today.

Slowly but surely, traditional markets saw a growth in traction and volume, bringing liquidity with it. Today, the London Stock Exchange market cap is over $26 billion, which is significantly smaller than exchanges like NYSE. In any case, the security token market has a long way to go, but higher liquidity will come alongside more issuers, investors, and regulatory approval.

The Future of the Security Token Market

As discussed, the security token market is still in its nascency. There’s no consensus on what protocols to use or legal consensus on how to regulate security tokens. Further, most blockchain developers haven’t worked with security tokens, nor have many legal teams. There’s simply not a lot of expertise or cohesion, so we can’t expect the same exponential growth as in the ICO space, especially given the relative complexity of security tokens.

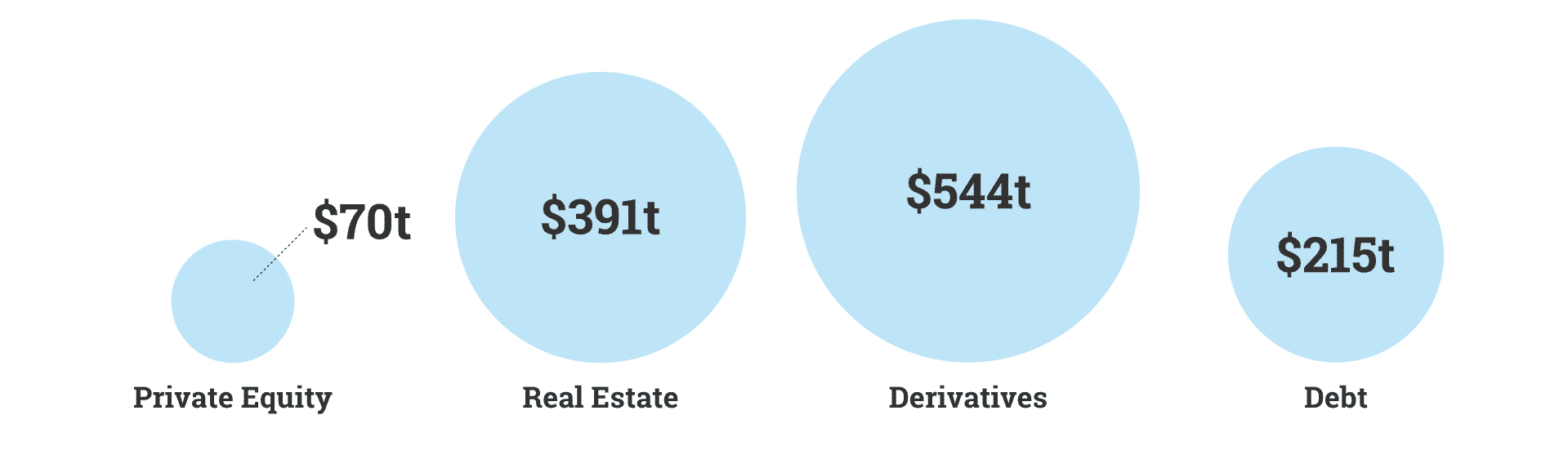

That being said, the potential market for security tokens is enormous. To put it simply: The potential market of Security Tokens is the market of securities.

This global market encompasses practically any asset you can think of, whether it’s collectibles like watches and supercars, commodities like diamonds and gold, other alternatives like real estate, or traditional assets like stocks.

In fact, each of these assets is currently being tokenized, or already available for sale. You can buy tokens to get fractionalized ownership of supercars with CurioInvest, or invest in gold with Aurus tokens, or invest in tokenized real estate with realT (disclaimer: The author does not endorse these projects, this is for informational purposes only).

Again, the industry is just getting started, but things are moving in the right direction for mass adoption.

Security Token Regulations

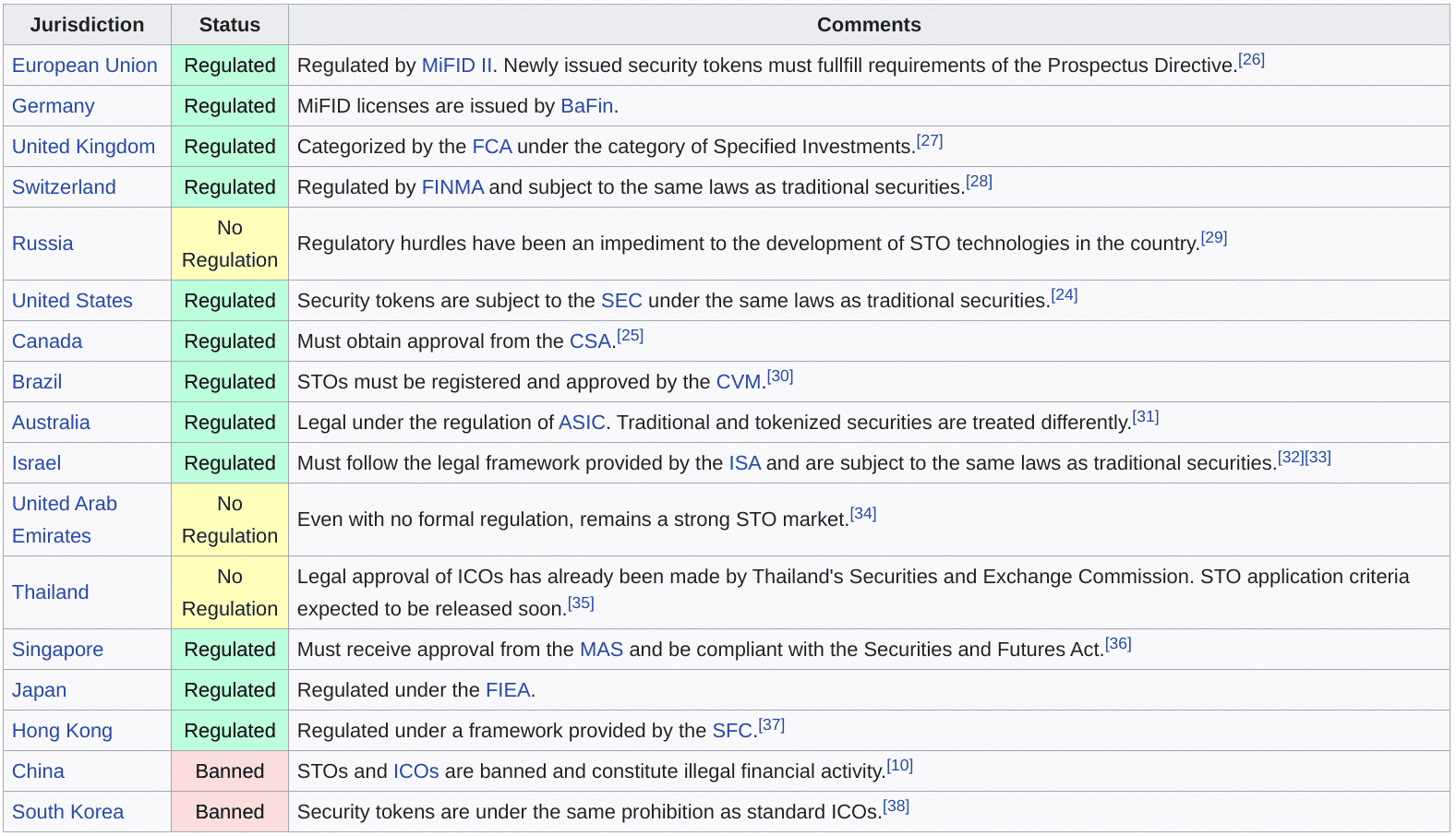

Regulators around the world are warming up to Security Tokens, in marked contrast to utility tokens and their associated ICOs. Wikipedia currently offers the most in-depth take on global security token regulations:

As you can see, only two jurisdictions have flat-out banned security tokens. China comes as no surprise, and it’s more than likely that South Korean regulators will learn to distinguish between ICOs and STOs, and thereafter alter their hastily-made regulations.

The world’s biggest financial markets from the US to the EU to the UAE have all reacted positively towards security tokens. As regulators are increasing their knowledge of the space, more jurisdictions are sure to follow suit.

Why It Won’t Happen Overnight

The future of the security token industry is looking bright. Projects are shifting from ICOs and IEOs towards STOs, and regulators are warming up alongside them. However, there are many hurdles ahead to overcome.

For starters, there are a couple of distinct areas where the industry is experiencing confusion, such as security token protocols and securities regulations. As mentioned, ERC-20 tokens are incapable of handling the needed complexities for regulatory compliance. However, if you Google “erc20 security token” or “erc-20 security token”, you’ll find hundreds of articles, posts, and company pages claiming that a certain token is a security token, while using the ERC-20 protocol.

These are fundamentally incompatible. It is legally possible, depending on the jurisdiction, to be classified as a “security token” while using ERC-20, but this token does not realize the benefits of security tokens, which are mainly in increasing operational and compliance efficiency of securities.

So-called “ERC-20 security tokens” are subject to the same operational shortfalls of utility tokens, such as the inability to restrict transfer events, and are ill-suited for digitizing securities.

Another area of confusion, which goes hand-in-hand with the protocol misconceptions, is regulations. Many issuers fail to realize that US securities regulators like the SEC have a global reach and that if your security token sale is available to US investors, you are subject to US securities regulations, regardless of where you’re based.

This makes using the right protocol even more important, as the right protocol, such as ERC-1404, will let you bake-in measures such as restricting US investors if you’re not regulated in the US.

Conclusion: Security Token Offerings

Ultimately, real security tokens, using security token protocols, are the only proper way to represent securities on the blockchain. Securities are far more efficient on the blockchain, whether it’s in terms of issuing, transferring, or compliance, than off-chain and in a traditional paper-based system. Logically, securities will, therefore, shift, slowly but surely, to security tokens.

When security token protocols were first being proposed, just in the last couple years, it was thought that it would take many years before blockchain-based securities could become a reality. Even today, there are many naysayers, so it’s important to simply stay informed, and focus on the progress in the industry, rather than the hype or “anti-hype.”

how?