Contents

|

|

Cryptocurrencies are seeing a massive surge in popularity. While they used to attract a very niche audience just a few years ago, today, everyone and their grandmother wants to learn how to invest. You probably can’t avoid seeing a news article about the latest Bitcoin price or stumbling upon investment advice on social media.

And the growth is not even close to being over. The global cryptocurrency market was valued at 332 million US dollars in 2017, has risen to 3.67 billion in 2020, and is projected to reach 394.60 billion by 2028 (Grandviewresearch.com).

So what does this all mean? Should you get involved? How do you get started investing in cryptocurrencies?

If you’re looking to get a better understanding of what cryptocurrencies are, how they work, and how to invest in cryptocurrency, then this guide to trading cryptocurrency is for you. Read on to find out how it works, what your options are, and the best and safest way to invest in digital currency.

While the decision to invest in cryptocurrency is ultimately up to you, it is our hope that you’ll walk away from this guide feeling more educated, empowered, and confident that you have everything you need to start investing.

Contents

What is Cryptocurrency?

Cryptocurrency is a broad term for digital assets with transactions that are verified and records maintained by a decentralized blockchain system using cryptography, rather than by a centralized authority like a Visa credit card or a bank. Bitcoin is the most popular cryptocurrency today as a currency that functions as a store of value. One study from 2019 estimates ~100 million people currently hold Bitcoin.

Unlike traditional money, or ‘fiat’, which is printed and backed by a centralized government, cryptocurrency has no physical form, and exists digitally on a blockchain as tokens.

Crypto is not yet a widely accepted form of money, but it gaining recognition as a real-world unit of account by some early adopters. Mark Cuban, owner of NBA franchise The Dallas Mavericks announced that the Mavs now accept the cryptocurrency Dogecoin for online tickets and merchandise purchases. And some centralized payment providers like PayPal now accept Bitcoin and other cryptocurrencies as forms of payment.

Just like stocks and bonds, cryptocurrencies can increase and decrease in value, depending on their demand in the market. This is why many people are interested in speculating on and investing in cryptocurrencies.

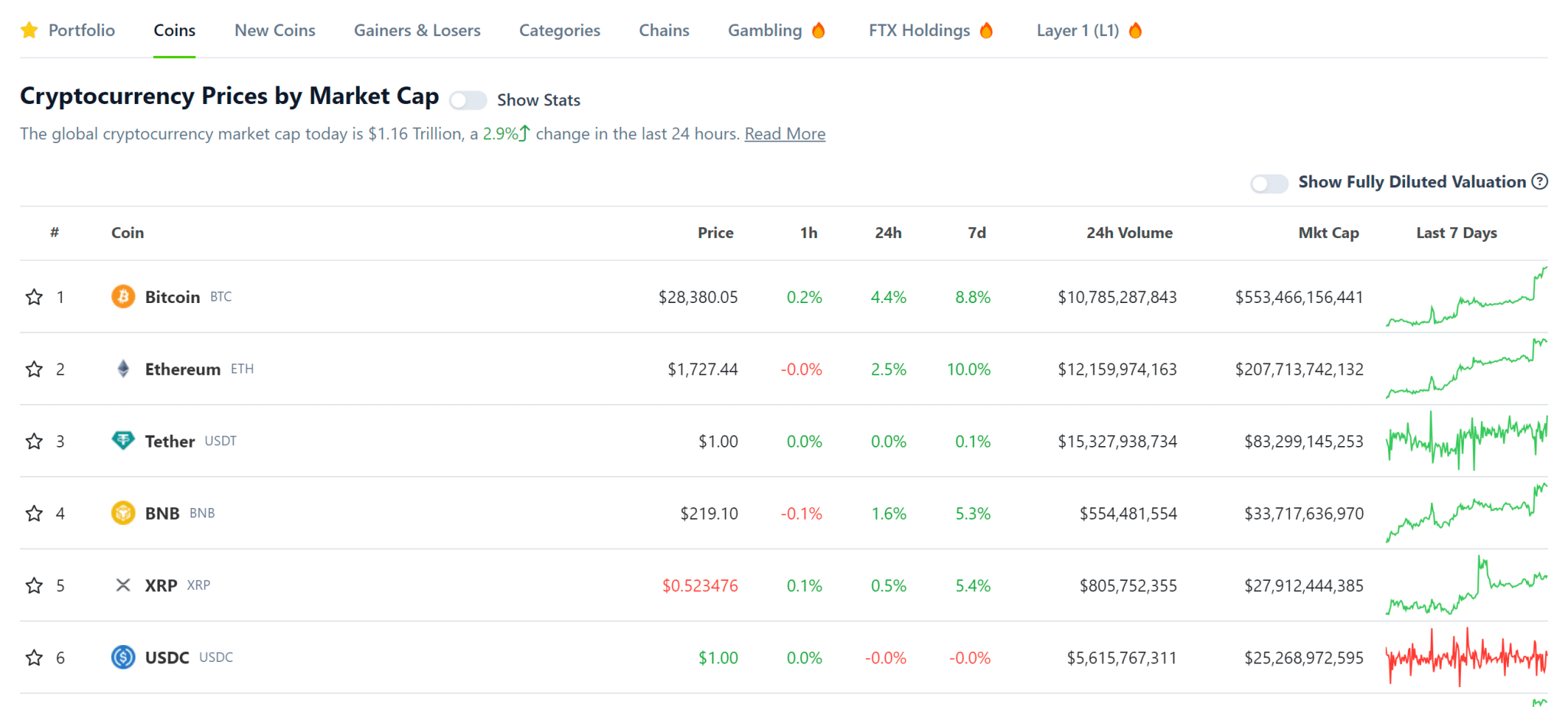

Top 10 cryptocurrencies by USD market cap

As of September 2023:

- Bitcoin

- Ethereum

- Tether

- XRP

- BNB

- USDC (US Dollar Coin)

- Dogecoin

- Cardano

- Solana

- TRON

What Makes Cryptocurrencies Different From Fiat Money?

Fiat money — money like the American (USD) or Canadian (CAD) dollar — is issued by the government, meaning there’s a central authority that controls its value, interest rates, and supply (how much is in circulation). Many view this degree of government involvement in the mechanics of the free market as manipulation and as an archaic (and futile) attempt to manage a vast and complex economic system. A noble intention at best, a catalyst of hyperinflation that makes wealth building very difficult for the average person, at worst.

Cryptocurrencies, on the other hand, are decentralized — all transactions are done peer-to-peer or through smart contracts and there’s no authority overseeing them. Many people consider this a massive advantage over traditional money, because it gives them full control of their assets.

How Do Cryptocurrencies Work?

When a new cryptocurrency transaction occurs, it gets added to a digital ledger of all other transactions on a decentralized network of computers called the blockchain. Computers or ‘nodes’ of blockchain can have varying degrees of centralization and decentralization, and can be spread all across the world. Before a new transaction can be added to the blockchain, these nodes check the new data to be added or ‘block’, against each other’s records to verify it.

This makes the blockchain incredibly secure and virtually impossible to hack. If someone wanted to fake a transaction, they’d essentially need to hack 51% of the nodes in a network, which would be incredibly time consuming and expensive to ever be worth it.

Investing in Cryptocurrency

Before we dive into how to invest in cryptocurrency, it’s important to understand that there are good reasons to get involved, and there are poor ones. Remember that for every person who made an overnight fortune trading Bitcoin, there is someone who lost their entire life’s savings, so if you’re not willing or able to tolerate high-risk and extremely volatile investments with potential for high rewards and losses, then cryptocurrency investing may not be for you.

However, if you’re genuinely curious about the possibility of cryptocurrencies forever changing the way we deal with finances, and are willing to learn and able to manage the risk, then read on.

Good Reasons to Invest in Cryptocurrency

- You believe that cryptocurrencies are the way of the future and will likely replace the traditional fiat money — if this happens, you want to be educated, prepared, and experienced.

- You support the social vision behind cryptocurrencies — that currency should be decentralized and under full control of the people who use it.

- You understand and appreciate how blockchain technology works — you value the peer-to-peer aspect of transactions, their security, and confidentiality.

Tips to Know Before Investing in Cryptocurrency

Here are a couple of important things you should know before investing in cryptocurrency.

- Capital Gains Tax: For tax purposes, cryptocurrency is considered an asset, like a stock or property. When you sell crypto and make a profit, you’ll have to pay capital gains tax on what you earned. Keep this in mind when you’re budgeting for the year and planning for taxes.

- Short-Term Investing: Because cryptocurrency is a volatile asset, many investors would consider it to be a short-term investment rather than a long-term one. It’s possible that in the future, cryptocurrency may become a stable investment and that long-term holdings will yield significant profit. But that’s a big “if.”Since cryptocurrency values have been decreasing, you might have a better chance of making a profit by timing the market. That’s incredibly risky, but crypto is high-risk. If you want your money to appreciate over a long period, you’re better off investing in long-term bonds, index funds, or IRAs.

Is Cryptocurrency a Good Investment?

The cryptocurrency markets are far more volatile than the stock markets. With less liquidity, and more speculation than traditional financial markets, the value of any given cryptocurrency can rise and fall by 30% or more in a day. Not only that, crypto markets are open for trades 24/7, 365 days a year. There are no evenings or weekends off like the NASDAQ or LSE

If you’ve been hearing about cryptocurrencies a lot these days, you may feel like it’s a good opportunity to make a quick profit. But if you’re just jumping on the bandwagon and take no steps to educate yourself about how the technology and the market work, you risk losing money.

Let’s take a look at Bitcoin, for example — the first and by far most dominant cryptoasset.

Early investors in Bitcoin have made millions of dollars in profits. In the span of just one year, Bitcoin’s price went from $7,000 USD in April 2020 to over $60,000 USD in April 2021! Now imagine what kinds of profits went into the pockets of people who bought Bitcoin back in 2013, when it was a mere $100 USD.

Though that sounds very exciting, it certainly is not the whole picture. Take a look at the entire graph, showing Bitcoin’s fluctuations in price between October 2013 and the end of May 2021. It’s not a straight upward climb.

Bitcoin’s price went from $18,000 in December 2017 to $3,000 in December 2018. And here’s an even quicker drop: if you were one of the people who got excited by all the growth Bitcoin experienced in early 2021, you would’ve seen it drop from $64,000 in April to $35,000 just one month later in May 2021.

The point here is this: cryptocurrency prices can be extremely volatile and impossible to predict in the short term. All it takes is an announcement from a large company or a tweet from Elon Musk, and the currency’s value can skyrocket or plummet in a matter of hours.

That’s why you should only ever risk as much money as you can afford. Like Wence Casares, CEO of Xapo, sums it up in an AMA on bitcoin.com:

“I always tell them [my family] that the second most stupid thing they could do right now is to own a number of bitcoins they cannot afford to lose and the most stupid thing they could do would be to not own any.”

Before investing in cryptocurrencies, it’s absolutely imperative that you educate yourself so you can be equipped to make the right decision at the right time. Or as they say: DYOR – do your own research!

What Cryptocurrency Should You Invest In?

First, Blockgeeks does not give financial advice, and second, never asks anyone else what to do with your money, least of all Google! Always educate yourself, understand the risks, the all possible outcomes, and don’t make any investments if you are not 100% comfortable with your decision.

That said, Bitcoin remains the undisputed king of cryptocurrencies — it’s been around the longest and has the largest market capitalization of over 674 billion USD (as of May 2021). Market capitalization is the total value of all tokens available, or the price of each token multiplied by the number of tokens in circulation.

However, there are other cryptocurrencies to choose from, such as Ethereum, Cardano, Litecoin, and thousands of others. They all differ in price, availability, demand, transaction speed and fees, and the technology that supports them.

The website Coingecko lists over 5,000 options in order of decreasing market capitalization. Here are the top 10 and their performance as of May 2021.

It doesn’t matter what the price of a given cryptocurrency is, you can always buy a fraction of a token. For example, if 1 Bitcoin costs $35,000 USD, you can always buy 0.0001 Bitcoin for the equivalent of $350 USD.

When researching tokens to invest in, you can take a look at CoinMarketCap to get a snapshot of the top performers, but your research should not stop there. In fact, that’s where the real work begins.

Read on to find out how to invest in cryptocurrency properly, and evaluate whether a cryptocurrency is worth investing in and how to avoid getting yourself into risky or fraudulent situations.

1. Read the Project’s Whitepaper

When you’ve found a cryptocurrency you like, the first thing you need to do is read the whitepaper.

“A white paper is an authoritative report or guide that informs readers concisely about a complex issue and presents the issuing body’s philosophy on the matter. It is meant to help readers understand an issue, solve a problem, or make a decision.” (Wikipedia)

Reading the whitepaper will give you two tremendous benefits:

- You, as a potential investor, will learn everything you need to know about the cryptocurrency and the value that it’s bringing into the ecosystem.

- A poorly written whitepaper is often a sign that the project is not worth investing in. If the team behind the cryptocurrency can’t adequately explain the true utility of their token, then it’s probably not worth supporting.

2. Think About the Value that the Project is Bringing In

Check to see whether the project is bringing in any practical utility into the ecosystem. The perfect example of this is Ethereum. There is a reason why it took off so fast — for the first time, developers around the world had a platform that they could use to build their own dapps – or decentralized applications – on a blockchain.

Along with that, keep in mind the issues that the crypto world is desperately looking to solve — privacy, scalability, and interoperability. A good way to go about your investment is to find the projects that are specifically working on solving these problems.

As of 2021, the players trying to solve these same problems and roll them all into their platform, or “Layer 1” network include:

- Matic

- Binance Smart Chain

- Fantom

- Polkadot

- Solana

3. Evaluate the Project’s Tokenomics

How do you make sure that you’d be getting good quality tokens?

William Mougayar outlines a great framework for evaluating a token based on three principles:

- Role

- Purpose

- Features

Each token role has its own purpose, as outlined below:

- Right: the token holder gets a certain amount of rights within the ecosystem, such as the right to vote.

- Value exchange: the token helps buyers and sellers trade value within the ecosystem.

- Toll: the token acts as a toll gateway in order for the holder to use certain functionalities of the system.

- Function: the token enables the holder to enrich the user experience inside the confines of the environment.

- Currency: the token stores value that can be used to conduct transactions both inside and outside the ecosystem.

- Earnings: the token provides an equitable distribution of profits or other related financial benefits among investors.

The following table provides examples of criteria to assess when evaluating a token:

So, how does this all help with evaluating token utility?

If you want to maximize the amount of utility that a token provides, then it needs to check off more than one of these roles. The more roles it serves, the more utility and value your token brings into the ecosystem. If the token’s role cannot be clearly explained, or if the token doesn’t serve at least two roles, then it has little to no utility and your best bet would be to consider another option.

Now, why shouldn’t you take a chance on tokens with no utility?

In order to answer that, we need to understand the concept of token velocity. Token velocity is an indication of how much people respect the value of that particular token. If people hold on to a token, then it has low velocity. On the other hand, if people quickly sell the token for another currency or fiat money, then that token has high velocity.

If you were to define token velocity in strictly mathematical terms, then it would look like this:

Token Velocity = Total Transactional Volume / Average Network Value

If we were to flip the formula then:

Now, that leads to two conclusions:

- Higher token velocity means lower average network value

- Higher transactional volume means higher token velocity

Ideally, you’ll want to invest in a project with tokens that have lots of utility, giving people a reason to hold on to them. This lowers the token’s velocity, in turn increasing the average network value.

4. Look Out For Obvious Signs of Scam

Good coins have a transparent technical vision, an active development team, and a lively, enthusiastic community. Bad coins are not transparent, promote fuzzy technical advantages without explaining how to reach them, and have a community that is mostly focused on getting rich quickly. Perhaps the worst kind of cryptocurrencies are MLM coins like the now infamous scam Bitconnect.

We will talk more about Bitconnect in a bit. For now, here are some of the more obvious signs of scam.

-

The Team

It really goes without saying that the success of a project is directly related to the credibility of the team. Let’s put it like this: if you are investing your money into a company, wouldn’t you want to know that the company is in good hands and that your money is going to be appreciated considerably?

One of the most successful new projects of the current 2020-2021 market cycle is Uniswap. Although created in 2018 by ex-Siemens engineer Hayden Adams, Uniswap saw incredible success later on in 2020-2021. In March of 2021, it was generating fees of approximately $2-3 million dollars daily for liquidity providers who create a market for buying and selling on the platform.

Now, compare that to this team:

Yes…your eyes are not deceiving you, that’s Ryan Gosling’s photo on the team page.

Of course, most of the time, bad investment advice won’t be this easy to detect. But there are steps you can take to thoroughly research the project’s team and ensure their credibility.

First, search for the names of the team members on Google. More often than not, they’ll have a LinkedIn profile. Learn as much as you can about each team member and ask yourself the following questions:

- Have they been involved in any successful ICO venture before?

- Have they been involved in a reputable company?

- Have they been recommended or endorsed by credible people?

Next, search for the team members’ photos on Google. This will help you identify whether or not you’re being “catfished”. You may discover that the photo depicts another person entirely, a celebrity, or a stock photography model. You may also come across the same photo on a number of similar projects — another clear sign of a mass scam.

-

Pyramid Scheme Resemblance

According to Wikipedia, “A pyramid scheme is a business model that recruits members via a promise of payments or services for enrolling others into the scheme, rather than supplying investments or sale of products or services. As recruiting multiplies, it becomes quickly impossible, and most members are unable to profit; as such, pyramid schemes are unsustainable and often illegal.”

An ICO that promises “guaranteed returns” on their investment is a scam. Any crypto investor worth their salt will tell you that there are no guarantees in the crypto currency world.

One of the most egregious examples of this is Bitconnect. Let’s take a look at their website and promises.

If you see anything like this on a website, don’t bother taking any of their bounties. Simple as that.

You don’t want to end up with tokens like these:

-

Inactive Code Repository

An active GitHub repository is a good indicator that serious development has been going on in the project. Here’s a good example of an active GitHub repository — with 1,014 commits, their developers are definitely giving their all to the project.

How to Buy Cryptocurrency On A (CeFi) Centralized Exchange

- Find a centralized exchange that accepts your local fiat currency (ie. US: Coinbase, Kraken, CA: Newton, Bitbuy)

- Create an account on that exchange and upload your proof of identity as requested

- Wait a few days for your identity is verified according to KYC and AML regulations

- Send fiat from your bank via direct deposit, e-transfer, SWIFT money transfer or credit card (options vary by exchange) to the exchange

- Buy crypto (availability varies by exchange)

The exchange serves as one of the most critical functions in the crypto ecosystem. It basically acts as a portal between the fiat world and the crypto world — the “on-ramp” if you will. Centralized exchanges help you buy Cryptocurrencies in exchange for fiat money (US or Canadian dollars, British pounds, etc). Coinbase is a perfect example of this kind of exchange. Coinbase lets you exchange your fiat for crypto with its easy to use app.

If you’re wondering why you have to go through the lengthy and arduous process of signups and verifications to purchase crypto, the answer lies in the various Know Your Customer (KYC) and Anti-Money Laundering (AML) laws that centralized exchanges are legally obligated to comply. Some exchanges avoid this process by simply not allowing you to deposit your fiat dollars into the exchange, and limit transactions to be between crypto-to-crypto, as opposed to the fiat-to-crypto that requires AML laws to be observed by the exchange.

How to Buy Cryptocurrency On A (DeFi) Decentralized Exchange

- First create an account on a centralized exchange (see above)

- Create a hot wallet (ie. Metamask, TrustWallet) by adding as an extension to your browser (Chrome, Firefox)

- Be sure to physically write down your secret passphrase on paper and keep it safe!

- Transfer crypto from the wallet on your centralized exchange to your hot wallet

- Evaluate and choose a blockchain ecosystem you want to use (ie. Ethereum, Polygon, Binance Smart Chain)

- Find a decentralized exchange (DEX) that has the liquidity and assets you want on the ecosystem you want

- Buy crypto!

The question, what type of exchange to use depends on a number of factors. What is your risk tolerance? What are your investment goals and timelines? What is your investment or trading strategy? How important is security, privacy, or decentralization to you?

There are a lot of variables and trade-offs to consider, and no one-size fits all answer. One thing is for certain: crypto investing can be risky – so do your own research, and do not make investments without strong conviction.

If you want to learn more about how to safely invest in CeFi and DeFi exchanges, our Crypto Investment School course has a comprehensive curriculum taught by crypto investors who’ve got real-world experience.

Buying Bitcoin…Without Owning BTC

While some years ago it was a very challenging process to buy cryptocurrencies, today there are a range of options, some easier, some more difficult – each with different degrees of exposure to Bitcoin as an asset.

Buying Bitcoin on any CeFi exchanges discussed above is obviously the most direct way, but if the risk is beyond your tolerance, there are other ways to get exposure to cryptoassets with less direct exposure.

Today you can now get indirect exposure to bitcoin by investing in publicly traded cryptoassets like Greyscale Investments, a large digital currency asset manager with approximately $46B assets under management (AUM).

The first crypto ETFs are also starting to become available with Galaxy Bitcoin and Ethereum ETFs and Purpose Bitcoin ETFs in the Canadian market.

You can buy shares of stock (via Robinhood, or you local stock broker) of publicly traded companies that have significant exposure to bitcoin on their balance sheet like Tesla (TSLA), Square (SQR), and notably Microstrategy (MSTR), which as of June 2021 has 91,326 bitcoins on it’s balance sheet, which it bought for $2.21 billion, or an average $24,214 per bitcoin.

Finally, you can choose to invest in publicly traded bitcoin mining companies like Riot and Hive. These companies generate profit by mining and issuing new Bitcoin to the blockchain.

Is There A Good Time To Buy?

There is no general rule when to buy cryptocurrencies. Usually it is not a good idea to buy in at the peak of a bubble, and usually, it is also not a good idea to buy it when prices are crashing. Never catch a falling knife, as the trader’s wisdom says. The best time might be when the price is stable at a relatively low level.

The art of cryptocurrency trading is a vast topic in and of itself, and determining precisely when a crypto is in a bubble and when it has reached a local bottom after falling is not an exact science. What is easy to say in retrospect is a hard question to answer in the present. Sometimes a coin starts to rise, and after it passes a key line of historical resistance, and many believe it to be at the peak of a bubble, the real rally just begins.

For example, many people did not buy Bitcoin at $1,000 or Ether at $100, because it seemed to be overpriced. But years later these prices now appear to be an incredible bargain that will never again appear to the market.

This is definitely not financial advice, but some general guidelines to help you decide when to make an investment include:

- Don’t compare crypto bubbles with traditional bubbles in traditional finance. A ten percent price increase or decrease in crypto can easily be daily volatility. 100 percent up can be a bubble, but often it is just the start of it. 1,000 percent might be a bubble usually, but there is no guarantee that it pops.

- Don’t buy-in, just because there was a dip. There might be another, take some time to observe the changing conditions.

- Don’t buy-in, because you fear that the price will explode tomorrow. Get yourself informed, and buy in when you feel a strong conviction in your entry point.

- Don’t succumb to reactive selling or ‘paper hands’. Selling too early undermines your plan, and can sabotage your ROI. Hold. Diamond Hands. The monetary revolution has just started.

How To Store Cryptocurrencies?

Alright, so you bought your cryptocurrencies, where exactly should you store them?

Centralized exchanges are much more reliable, secure, and (importantly) insured today than they were a few short years ago. Most retail investors are more than comfortable trusting a centralized crypto currency exchange like Binance or Coinbase with custody of their holdings. And since mass adoption of crypto is still just beginning, this is the easiest and most straight forward option

If you are more risk averse, and less trusting of centralized methods of custody, there are a variety of crypto wallet options available with an array of features and trade offs.

Hot Wallets vs Cold Wallets

Let’s understand the basic distinction between the two with a real-world example. Hot storage is like the wallets that you carry around in your pocket. The Cold storage is basically somewhat akin to your savings bank account. Keep this distinction in mind as we move forward. Basically, if you want to use your digital currency frequently then you must use hot storage. On the other hand, if you want to store your money for a long time then you must use cold storage.

Hot Wallet/Storage

Hot storage, in simple terms, is when you keep your cryptocurrency in a device that is directly connected to the internet. This connection is what makes a device “hot”.

You should think of exchange wallets, desktop clients, and mobile wallets (any wallet that exists on a device that will ever connect to the internet) as a hot wallet. It’s easy to access funds on a hot wallet, and if you live somewhere that accepts cryptos for micropayments, there’s nothing wrong with using one for day-to-day spending. Think of it like fiat (government-issued) currency. You might walk around with a portion of your wealth in a wallet for convenience but the majority you keep secured away. Your hot wallet should behave in the same way as a real-world wallet. You use it to carry a small amount of cash for ease of access. That is all.

While transacting with hot wallets is very simple, there is a huge drawback when it comes to them. They are easily hackable. The whole crypto-space has been gaining a lot of value recently and where there’s value, crime is never far behind. Recent ransomware attacks and previous compromises of large exchanges should be sufficient beacons to newcomers.

Even though you’ll not be storing a great deal of value on your hot wallet, it’s vital that you follow the backup steps within the restoration section of your wallet to avoid losing funds through human error. With your private key, and seed phrase intact, you should be able to restore any wallet painlessly enough.

Pros of Hot Storage

- Quick to access funds.

- A wide number of options, and support for different devices.

- User-friendly UIs make sending and receiving simple.

Cons of Hot Storage

- Exposed to cybercrime. Sophisticated hackers, ransomware, and other malicious actors are a constant threat.

- Damaging the device could destroy the wallet. Without carefully backing up private keys, and seed words you could permanently lose your cryptocurrency investment.

- You could still lose/damage/have stolen the restoration details.

Now let’s explore the different kinds of hot storage wallets that you can use.

- Online Wallets aka Cloud Wallet

- Mobile Wallets

- Desktop Wallets

- Multisig Wallets

Cold Wallets/Storage

When you keep your digital currency in a device that is completely offline it’s called cold storage. For those seeking the most secure form of storage, cold wallets are the way to go. These are best suited to long term holders, who don’t require access to their coins for months, or years at a time.

They aren’t without their own set of risks but if you follow the instructions correctly, and take every precaution possible, these are greatly minimized. Given the amount of attention that cryptocurrency has been receiving over the last few years, it has unfortunately piqued the interest of attackers. In light of that, it’s a far more secure option to use cold storage as a means of storing your money.

San Francisco based bitcoin wallet and exchange service CoinBase holds up 97% of its coin reserves in hardware and paper wallets. What are hardware and paper wallets? You will get to know about it in a minute. For now, let’s check out the pros and cons of cold storage:

Pros of Cold Storage:

- A great place to hold large amounts of coin for a long period of time.

- It provides a safety net against hackers and people with malicious intent since it is completely offline.

Cons of Cold Storage

- It is still susceptible to external damage, theft and general human carelessness.

- It is not ideal for quick and daily transactions.

- Setting it up can be a little intimidating for beginners.

Now that we have seen both the pros and cons let’s take a look some cold storage wallets that you can use to store your coins

Hardware wallets

Hardware wallets are physical devices where you can store your cryptocurrency. They come in a few forms but the most common is the USB stick style typified by the Nano Ledger series. Although many swear by them, hardware wallets are still prone to compromise. Firstly, you’re trusting that the company who made your wallet hasn’t logged all the private keys with a plan to raid wallets in the future. This applies to those bought from the company themselves, but particularly if a hardware wallet has been acquired second hand. Under no circumstances should anyone ever use a pre-owned hardware wallet.

Although loss or damage can spell disaster for the unprepared, hardware wallets can be restored. Therefore, it’s just as important to back up your hardware wallet, as it is your online hot wallets. You should keep restoration details in a safe place that only you, and anyone you plan to leave the money to know about. Remember, your restoration details open the wallet. Think very carefully about who (if anyone) you share them with. It’s also vitally important that you transfer all coins to a new wallet, should something unfortunate happen between you and anyone else who knows your private keys (spouse, etc.)

Here are some hardware wallets that you can use:

- Ledger Nano X

- Trezor

- Keepkey.

Paper Wallets for Safety

Without a doubt, the safest way to store any cryptocurrency is by using a paper wallet

What Is a Paper Wallet?

To keep it very simple, paper wallets are an offline cold storage method of saving cryptocurrency. It includes printing out your public and private keys in a piece of paper which you then store and save in a secure place. The keys are printed in the form of QR codes which you can scan in the future for all your transactions. The reason why it is so safe is that it gives complete control to you, the user. You do not need to worry about the well-being of a piece of hardware, nor do you have to worry about hackers or any piece of malware. You just need to take care of a piece of paper.

Do You Need a Paper Wallet?

The answer to this question will largely depend on your circumstances. If you plan to spend the summer day cryptocurrency trading a few coins, perhaps you don’t. Alternatively, if you’re in for the long haul, and don’t intend to touch any portion of your stash, then a paper wallet is the most secure option available to you. The paper wallets that you can use are as follows:

- For Bitcoin, Litecoin, Dogecoin etc. you can use Wallet Generator.

- For Ethereum and ERC20 tokens you can use My Ethereum Wallet.

Do I Need to Do Crypto taxes?

Disclaimer: We are no tax bureau nor tax consultants. If you have issues with taxes, and if large sums are at stake, you better ask your local tax consultant.

Right now there are only a few tax consultants who know how to deal with cryptocurrencies. But it can be safely assumed that the number is growing quickly and that cryptocurrencies will soon be a standard issue for tax experts like securities, shares, ETFs and real estates are.

All we can provide here is an overview of the typical issues with cryptocurrencies and taxes.

No Free Lunch

Nothing is for certain, except death and taxes, and crypto is no exception. If you earn money by investing in cryptocurrencies, you likely have to pay taxes.

Cryptocurrency investment tax returns are dependant on your regional and national tax regulations.

Nearly every country of the world exempts cryptocurrencies from VAT. Like with every financial product you don’t need to pay VAT when selling Bitcoin. There have been some ideas of tax authorities in Poland, Estonia, Germany, Australia, and Sweden to demand VAT on crypto sales, but after the European Court over turned this important decision, VAT for Bitcoin seems to disappeared.

Another piece of good news is that in some jurisdictions you have to pay nearly no taxes. Amazingly Germany, a country usually known for very high tax rates, has become a tax haven for cryptocurrencies. Like the USA and many other countries, Germany considers Bitcoin not a financial product, but a property. This means that if you earn money by trading it, you don’t pay a flat tax for financial income – which is 25 percent, for example for bank account interest – but you have to tax the profit of buying and selling cryptocurrencies like income.

It’s more as you sold your house than a security.

You bought 10 Bitcoins for 1,000 Euro and sold them for 2,000? Your taxable income increased by 10,000 Euro.

You bought one bitcoin for 100 Euro and ordered a 10-Euro-pizza when the price was 1,000 Euro? Your income increased by 9 Euro. In most cases, the tax rate for this is higher than for financial gains.

However, there is a loophole. If you hold your coins for more than 1 year, you don’t need to pay taxes at all when you sell it. This rule was added to dis-incentivize day trading of other properties and stabilize prices by incentivizing holders. For cryptocurrencies it made Germany, and also the Netherlands, which apply the same rules, to tax havens. Some countries might have similar rules. In doubt, your tax advisor can help you out.

One problem the one year rule poses is that you need to prove that you hold the crypto for this timeframe. Usually, exchanges can help you with prints of your trade history. Also, you can use the public blockchain as proof of storage. In most cryptocurrencies, it is transparent when coins are received and spent by a particular address. But not in all. For example, Monero uses Ring Signatures and Confidential Transactions, which are great tools to maintain anonymity. But the downside is that they make it more or less impossible to prove that you hold coins for more than one year. Maybe you take this into account when selecting coins for your portfolio.

Conclusion: How To Invest in Cryptocurrency

If you use a good exchange and keep track of your trades, taxing Bitcoin is possible, but also complicated. You need to calculate every single profit, not just from cryptocurrency trading, but also from using Bitcoins to pay for things.

But that’s just the beginning. Things become really a complicated nightmare if it comes to Altcoins. For the tax authorities, an Altcoin counts like Bitcoin. In most countries, this means it is not a financial product, but a property. If you buy it with Bitcoin and sell it for Bitcoin, you have to tax the difference, but not in Bitcoin, but in Dollar or your national paper money. This means, you not only need to keep track of all your Altcoin trades, but you also need to take into account the price of Bitcoin when buying and selling.

Obviously, this makes things extremely complicated. You can have a bad trade, resulting in getting less Bitcoin back than you invested, but being still, in theory, accountable to taxes, when the price of Bitcoin did soar between your trades. So you lost money in cryptocurrency trading but have to pay taxes for it.

At this moment you should accept the fact that cryptocurrencies are something new and that you are no expert in dealing with your financial authorities. Go for a tax consultant, educate her or him about cryptocurrencies and look forward to talking with confused financial authority officials.

If you’re reading this guide, you’re still early, enjoy investing in cryptocurrencies and trade safe!

![The Best Cryptocurrency Exchanges: [Most Comprehensive Guide List]](https://blockgeeks.com/wp-content/uploads/2017/04/exchanges.jpg)

Thanks for the article Ameer. Cryptocurrencies will rule the world of future payment methods without any doubts. Moreover, popular brands have made cryptocurrencies as an optional mode of payment. Hence, this is always a good time to invest in cryptocurrencies and generate a huge amount of profits for the business. You can check more about this here!

great detailed article thanks..

Great Read!

Build your passive income daily with the second largest cryptocurrency mining and investment pool. Buy hashpower to start mining Bitcoin and three other altcoins daily. You can sign up on bitrearer com to get started now. Thank me later

How current is this information? e.g. Bitstamp was hacked in 2015.

Why is this not mentioned?

RIGHT TIME TO INVEST IN BEST CRYPTO OR BEST COINÂ : RIGHT TIME TO INVEST IN BEST CRYPTO?Â

Buy Ethereum token like Ethereum cash, Ethereum gold, Ethereum blue, ieth, Ripple, Coss,monetha, kick, life, Bitcoin silver, Bitcoin red, FUN coin, These all token go higher and higher..,,, …. Some Mining Token very old since 2014 which jumped to sky in 2018 which are Florin coin, Quark, Quantum, Pink coin, Megacoin, Prime coin, dont waste any other fraud people .

The guide is full of useful information.

However, while I understand the authors’ desire to cover their backside, I think there should be more emphasis on anonymity. Here is why;

One of the major strengths of Bitcoin has been that it is (was) decentralized. It is a peer to peer currency not issued and manipulated by any government (or so it’s supposed to be). The author’s are devoting a reasonable space and effort to Taxation. That tells me that they are anticipating regulation and obviously taxation of all crypto-currencies. This is really bad news, for any would be investor out there. We will end up with the complete control of the block-chain transactions by governments, a sort of crypto stock market that will head in a totally different direction from from the current one.

Of course the Germans could not recognize Bitcoin as currency because doing so would’ve legitimized over the counter transactions in Bitcoin and challenged the status quo of the Euro.

I’m a firm believer in a world where everyone’s rights and obligations are the same (not wealth because wealth is created at individual level and it’s personal) and government(s) play a minimal role.

Please let the masses now how to protect their newly found golden goose from corrupt, and oppressive governments.