Navigation

Navigation

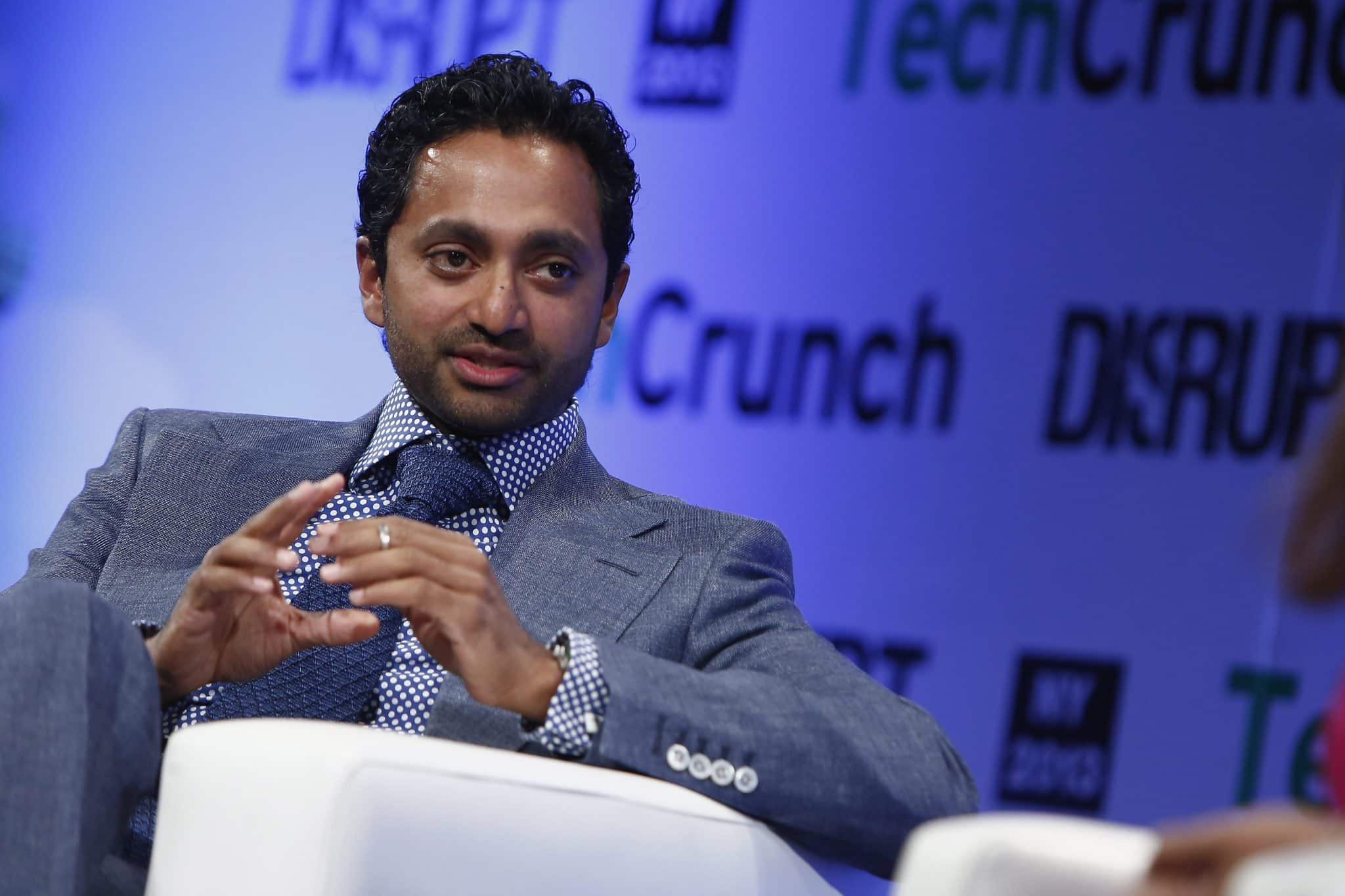

Did Venture Capitalists Screw Up Bitcoin?

|

|

Of the over $1 billion venture capitalists have invested in blockchain businesses, that funding has focused primarily on bitcoin, since for years that seemed like the only option. But with the arrival of Ethereum, and a surge of alternate coins and tokens such as Zcash into the market, the landscape is looking very different from what those investors signed up for.

Significant investment in bitcoin startups began in 2013, the year the value of the currency crossed the $1,000 mark before suddenly plummeting. With some wariness, investors returned and put $299 million into bitcoin companies in 2014 and $474 million in 2015.

Mostly, venture funding in this period went toward bitcoin wallet and exchange startups in geographically diverse areas. These companies focused on creating on-ramps and off-ramps for using the currency in jurisdictions where such trades are legally compliant, integrating with banking systems in those locations for more efficient payment pipes.

A lot of capital has gone into the infrastructure for bitcoin to exist. In the venture world, this is typically used as an argument for bitcoin’s staying power as the premier cryptocurrency. But on the blockchain, this traditional business logic doesn’t stand up to scrutiny.

Instead, the infrastructure built for bitcoin can increasingly be co-opted for use by new tokens. These new tokens don’t necessarily add any value for the venture capitalists who originally invested in bitcoin. To illustrate what is happening: Imagine if a railroad company in the 1800’s spent millions laying tracks, only to see a second (and third, and fourth) railroad come along and use the finished tracks for free, to ship more cargo in faster and safer cars.

Bridging technology implemented on Ethereum, such as BTC Relay, are like adding a track between the first railroad and the second railroad. With ZCash as the third railroad, Project Alchemy adds a track between it and the second railroad.

This co-opting of bitcoin is already happening; that the exchange infrastructure exists at all for Zcash is proof. Zcash operates on tracks that were laid with venture capital aimed years ago for bitcoin, since it’s much easier to add Zcash to an existing exchange than a new one. The same is more deeply true of ERC 20 tokens, which are even more trivial to add than Zcash.

As far as Ethereum is concerned, the adoption of the ERC token standard #20 made it easier for the rails built for bitcoin to be leveraged by other coins. This token standard for ethereum tokens dramatically lowers the cost of switching between tokens, or the unit cost of adding a new token to an exchange.

With the ERC 20 in place, it’s a very real possibility that the bitcoin infrastructure will be co-opted quickly, wherever a token has enough desirable properties and a sufficiently high market cap. This is already happening with Ethereum-based tokens such as SingularDTV.

ERC 20 tokens benefit from a substantial second-mover advantage as compared to bitcoin. However, there are several reasons bitcoin, though imaginably not as the dominant cryptocurrency, will stay relevant. Unlike ether, which is far newer, bitcoin has had since 2008 to build up mindshare, a market cap of $10 billion, and a reputation for relative stability.

That being said, bitcoin startups are smartly rebranding themselves as “blockchain”. This can make it difficult for investors to figure out whether they are gilding the tracks of bitcoin, or investing in applications of the technology that makes it work. Investors would be well served to educate themselves on these nuances, and understand the rapid pace of development in this field.

Originally published on Medium

[…] may argue that Bitcoin as a store of value may even be better than some of the national currencies, especially in […]

[…] may argue that Bitcoin as a store of value may even be better than some of the national currencies, especially in […]

[…] may argue that Bitcoin as a store of value may even be better than some of the national currencies, especially in […]

[…] may argue that Bitcoin as a store of value may even be better than some of the national currencies, especially in […]

[…] may argue that Bitcoin as a store of value may even be better than some of the national currencies, especially in […]

[…] may argue that Bitcoin as a store of value may even be better than some of the national currencies, especially in […]

Yeah, I think they really rushed into Bitcoin when it was too early for that scale of capital

Yeah, I think they really rushed into Bitcoin when it was too early for that scale of capital

Yeah, I think they really rushed into Bitcoin when it was too early for that scale of capital