Navigation

Navigation

Ethereum DeFi Projects Saw Nearly 1,000% In Growth Over the Last Year

|

|

Despite the recent volatility in the crypto-asset markets, data shows that Ethereum-based decentralized finance (DeFi) — deemed one of the blockchain’s “killer” applications — is anything but shrinking.

Here’s the breakdown.

Ethereum DeFi Ecosystem Is Growing at a Rapid Clip

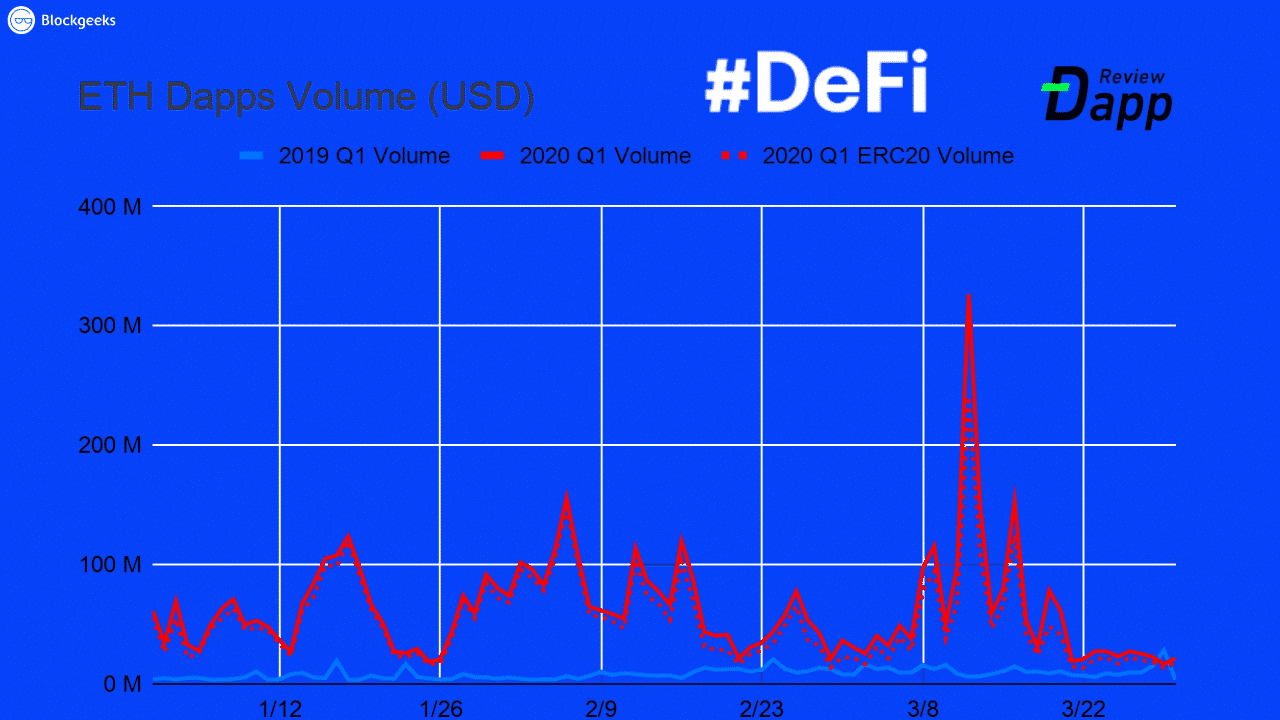

In a report published April 9th, blockchain analytics site DappReview revealed that transaction volume across DeFi projects has increased by nearly 800% when comparing Q1 2020’s metrics to that of Q1 2019.

Much of this growth was attributed to projects like Maker and Compound — which offer decentralized loans and stablecoin solutions — and derivatives providers like Synthetix and Augur. In fact, these applications, deemed “finance” dapps, saw a jaw-dropping year-over-year increase of 1,743% in Q1 2020.

Notably, the report also indicated that total dapp volume across the 13 leading blockchains (Ethereum, Tron, EOS, Icon, Waves, and more) grew by 82.2% when comparing the last quarter to Q1 of 2019, boding well for the broader industry.

The strong growth in usage of DeFi contracts has been reflected in the amount of locked value in Ethereum-based finance smart contracts.

Per recent data sourced from DeFi Pulse, there is approximately $734 million worth of locked value in DeFi applications, which is made up of 2,700,000 ETH and a swath of ERC-20 tokens and non-fungible tokens.

To give some context to these figures, the locked value figure was at a mere $650 million at the start of the year, at $322 million at the start of 2019, and $70 million at the start of 2018, prior to the Cambrian explosion in Ethereum’s dapps. View the growth below.

DeFi Launches to Boost Adoption

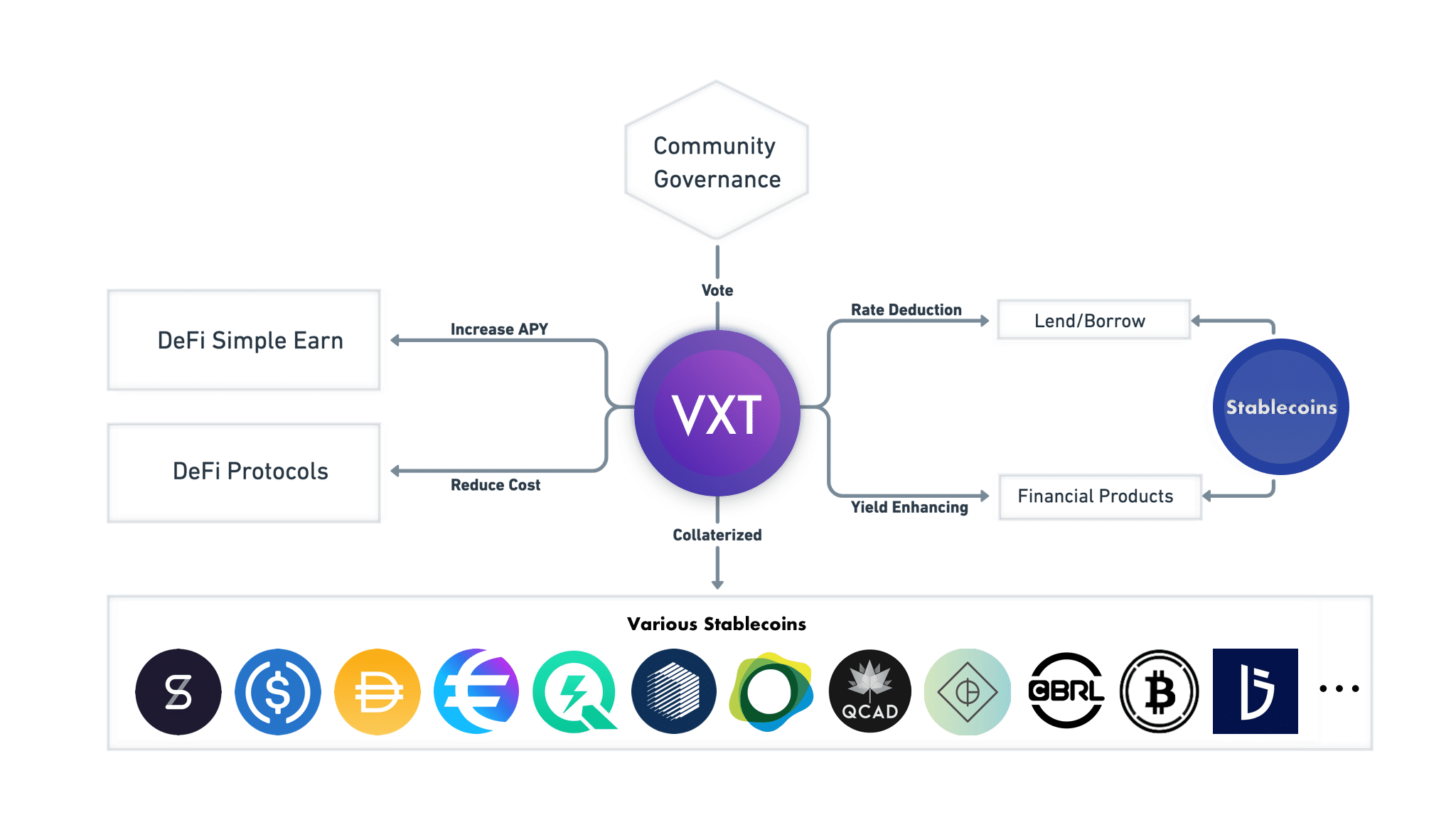

Decentralized finance is expected to grow even more as more products, which appeal to the needs of crypto-consumers, are launched.

As reported by BlockGeeks previously, crypto upstart Thesis and other partners are soon to release tBTC — a project that will act as a decentralized representation of Bitcoin on the Ethereum blockchain.

Steven Becker, president of MakerDAO, explained to Bloomberg in a recent interview this very thought, remarking that the joining of Bitcoin and Ethereum will allow DeFi to swell in size:

“tBTC is brilliant because ultimately it links two major concepts together. [Bitcoin and Ethereum working together] is how all these networks are going to come together to create the on-chain economy.”

Indeed, with tBTC and other projects like it, decentralized exchanges and other DeFi applications — especially lending protocols and second-layer scaling solutions — can leverage Bitcoin’s liquidity and “hard money” status, thereby increasing their functionality and popularity.

There are also projects such as Opyn, which is an Ethereum-based insurance protocol aimed at targeting users fearing unnecessary default risks when taking decentralized loans.

Not Ready to Go Mainstream Just Yet

Despite these factors, some fear that DeFi is not yet ready to go mainstream.

During March 12th’s flash crash — which saw Bitcoin, Ethereum, and the rest of the crypto market crater by 50% in a 24-hour time span — the DeFi ecosystem went into disarray. Namely, Ethereum application Maker, which issues loans, saw a $4+ million deficit as a result of an oracle glitch, a slowdown in the blockchain, and rapidly-moving prices.

And while the health of the DeFi ecosystem has started to recover since the carnage, the effects on the psyche of investors, especially DeFi users, have been lasting.

Tushar Jain, a partner at crypto and blockchain-centric investment fund Multicoin Capital, expressed his fears in an extended Twitter thread, writing:

“The entire DeFi ecosystem almost died today. Several large market participants went bust. […] If we just all need to accept that crypto can drop by 60%+ in a day that *severely* limits the usefulness of this tech.”

The entire DeFi ecosystem almost died today. Several large market participants went bust.

Many traders literally could not get money to the exchanges fast enough to trade due to blockchain congestion & the extreme volatility was then made worse.

— Tushar Jain (@TusharJain_) March 13, 2020

Jon Jordan of DAppRadar echoed this in an interview with me, saying:

“I don’t think anyone thinks the current generation of DeFi is ready to be deployed to the mainstream. In total, there are probably less than 10,000 people using DeFi protocols — just compare that to Binance.”