CNNMoney came up with the fear and greed index to gauge the performance of stocks on a daily, weekly, monthly, and yearly basis. This index is based on the two most primary emotions that investors feel – fear and greed. This is how it works:

- Greed drives the price of the stock up as investors start accumulating them.

- Fear drives the price of the stock down due to massive sell-off.

Excessive greed can bloat the price of the stock up to the extent where it is overpriced. Similarly, unbridled fear can plummet the price down to the undervalued zone. The crypto market, quite like the stock market, is extremely emotional as well. When the market goes up, a lot of investors enter the market due to FOMO (Fear of missing out). However, when the market goes down, these same people act irrationally and dump all of their cryptos. The Bitcoin fear and greed index can help us measure and mitigate these emotional overreactions and judge market sentiment.

What does Bitcoin’s fear and greed index look like?

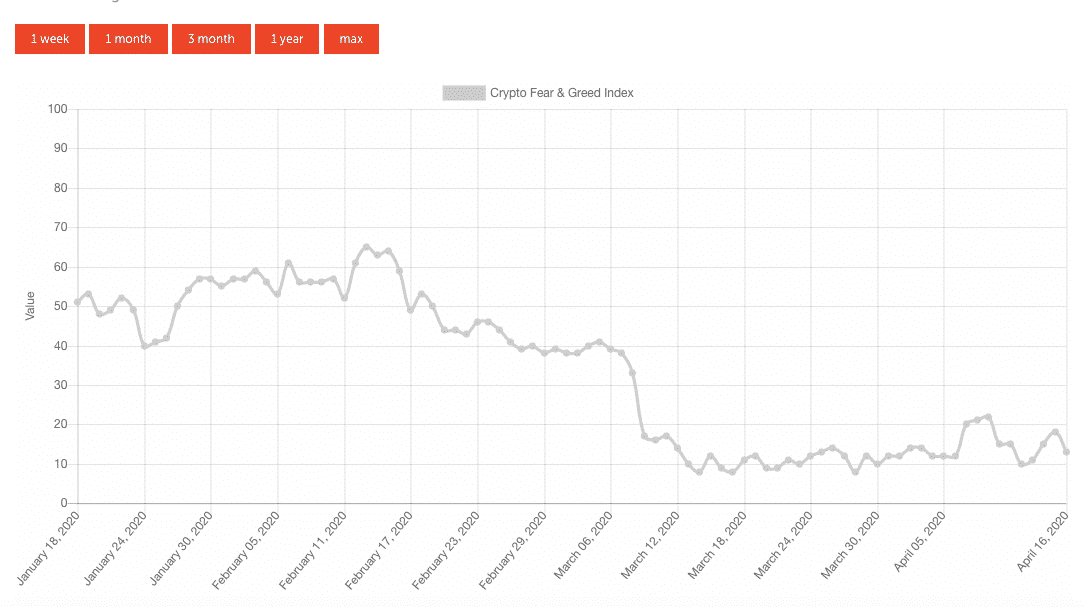

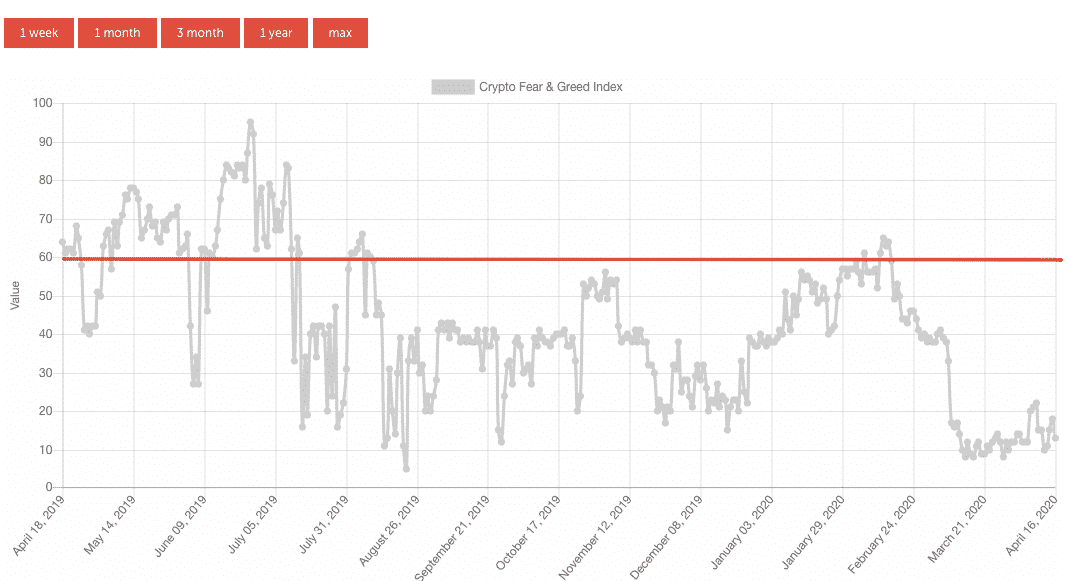

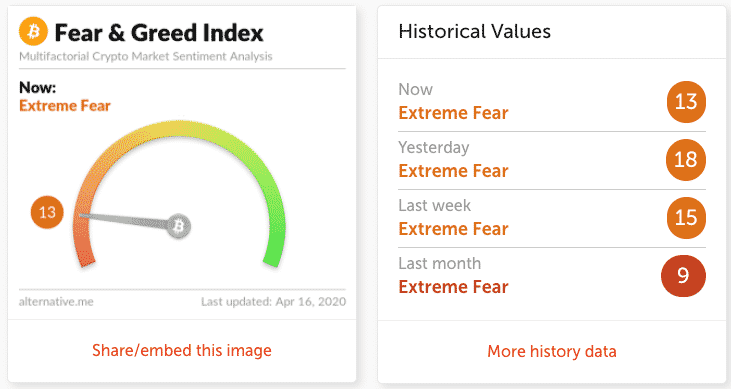

Alternative.me has the most well-known and respected Bitcoin fear and greed index. This is what the 3-month index looks like:

- When the index drops below 20 it indicates extreme fear.

- When the index rises above 60, it indicates extreme greed.

As per the 3-month chart, Bitcoin’s index has been deep inside the extreme fear territory, aka <20, since March 6, 2020. Now, let’s corroborate this with Bitcoin’s price action.

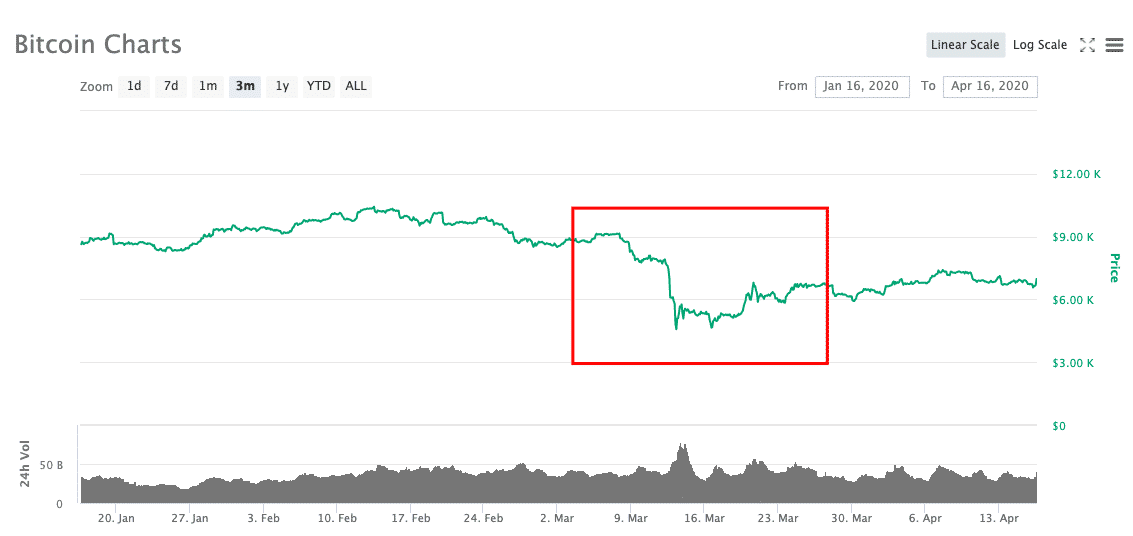

As you can see, in the same time period, BTC/USD fell from $9,087 on March 5 to $4,650 on March 16. Now, let’s see the fear and greed index over the last year.

Anything above the red line is in the extreme greed zone. Now, let’s look at the price action mid-June to mid-July, when the index was deep in the extreme greed zone.

As can be seen, this period of extreme investor greed also saw Bitcoin reach as much as $13,000 in valuation before experiencing a bearish correction. As such, the fear and greed index can be a pretty helpful metric to understand if the current price of Bitcoin is far above or below what it’s actually worth.

How is this index measured?

CNN Money examines seven different factors to calculate how much fear or greed is in the market. These factors are –

- Stock Price Momentum: S&P 500 index versus its 125-day moving average (MA)

- Stock Price Strength: The number of stocks hitting 52-week highs vs those hitting 52-week lows on the NYSE.

- Stock Price Breadth: Analyzing trading volumes in rising stocks against declining stocks.

- Put and Call Options: Do put options lag behind call options (greed) or surpass them (fear).

- Junk Bond Demand: Gauging the market appetite for junk bonds.

- Market Volatility: The Chicago Board Options Exchange Volatility Index (VIX) based on the 50-day Moving Average.

- Safe Haven Demand: The difference in returns for stocks versus treasuries

Each of these indicators is measured on a scale of 0-100. Following that, an equal-weighted average of each of them is computed, which gives us the fear and greed index. Taking inspiration from this, Alternative.me created their crypto fear and greed index via six data sources. Before we look into these sources, there are two more points that you must keep in mind:

- Each data point is valued the same as the day before.

- The measurements are for the Bitcoin index only.

Now, let’s look at the six datasets and how much they contribute to the Bitcoin’s index.

- Volatility (25%): An unusual rise in volatility is indicative of extreme fear. The current volatility and max. drawdowns of bitcoin are compared with the corresponding average values of the last 30 days and 90 days.

- Market Momentum/Volume (25%): A ratio of the market momentum and current volume compared with the last 30 and 90-day average values. Consistently high-volumes corresponds to a greedy market.

- Social Media (15%): A Twitter sentiment analysis that collects posts on various hashtags for the coin to see how fast and how many interactions it receives in specific time frames. An unusually high Twitter presence is a sign of a greedy market.

- Surveys (15%): Alternative.me conducts a large number of polls on various platforms and ask people how they see the market. They receive an average of 2000-3000 votes per poll.

- Dominance (10%): A sudden rise in specific keywords can give you an indication of the current crypto market sentiment. Eg. An increase in search volume for “Bitcoin scam” is a visible indicator of fear.

- Trends (10%): Google Trends data for various Bitcoin-related search queries. A sudden rise in specific keywords can give you an indication of the current crypto market sentiment. Eg. A rise in search volume for “Bitcoin scam” is an obvious indicator of extreme fear.

Current Situation

As of writing, the market is going through a period of extreme fear. Bitcoin’s price is massively undervalued right now, as per the index and presents a buying opportunity.

Criticism of the Fear and Greed Index

Many skeptics believe that the fear and greed index is not a credible investment research tool. According to them, buy-and-hold is a far better method of investing and tools like the fear and greed index encourage investors to make snapshot buy-and-sell decisions that give less favorable returns in the long term.

Conclusion

Please keep in mind that we are not investment advisors, which is why we are not going to recommend any tools to you. However, what we will say is that the fear and greed index is an interesting tool that you may look into. At the end of the day, you will need to do your own research before investing.