Contents

|

|

Bitcoin is more popular than ever, here is how you purchase it.

Yale economist Aleh Tsyvinski did a study that concluded, for optimal effects, around 6% of every portfolio should be purely Bitcoin. The study also added that those who are incredibly skeptical must maintain at least 4% in BTC allocation. With Bitcoin becoming bigger than ever and receiving mainstream recognition, let’s understand how BTC has become an irreplaceable asset for any investment portfolio.

Contents

Why do traditionalists still underestimate Bitcoin?

Old school market analysts and investors often tend to underestimate Bitcoin and other cryptocurrencies for various reasons. Multi-billionaire Warren Buffet, the Oracle of Omaha himself, believes that Bitcoin is an elaborate Ponzi Scheme, as it doesn’t produce anything and shouldn’t have any value. On the other hand, since Apple and Tesla produce an actual product, they generate value.

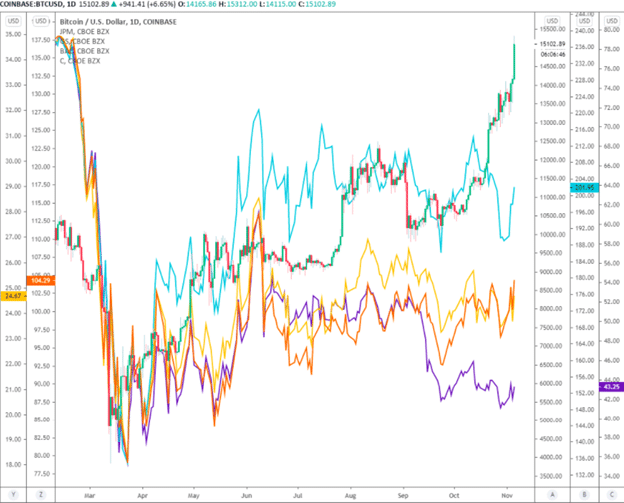

Despite these detractors, Bitcoin has had a positively heroic 2020. Checkout the following chart:

As you can see, there was a massive sell-off in mid-March induced by the COVID-19 pandemic. Since then, the price has gone up from $4,860 to $15,550. This rise can be attributed to the following:

● There has been a considerable increase in institutional demand.

● Investors have a lot of belief in BTC’s growth potential.

● Bitcoin has proven itself to be a viable hedge during the recent economic uncertainty.

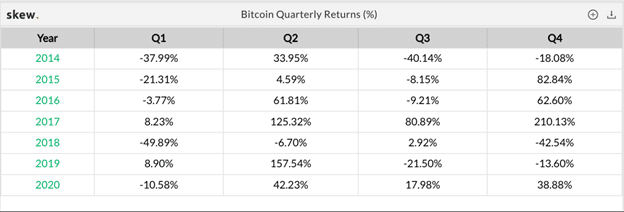

As shown in the chart below, most top U.S. banks posted record results in Q2, as the entire market roared back from the COVID-19-induced sell-off in mid-March, but significant threats to the stock market and global economy remain. At the same time, Bitcoin massively outperformed the financial sector, particularly in the fourth quarter.

As per the chart:

● JPMorgan rallied by 32.63% since reaching a low of March 23. In Q4, the bank rallied by over 8%.

● Goldman Sachs’s trading division recorded a revenue of $4.55 billion. The bank exceeded Wall Street expectations with ease, posting a 29% year-over-year increase.

While all this is definitely impressive, Bitcoin has still managed to handily outperform the stock market and global economy in the fourth quarter.

Institutional investors entering Bitcoin

As already mentioned, several institutions have started investing in Bitcoin. While the price hasn’t really lived up to the post-halving predictions, the premier cryptocurrency has still performed admirably, as we have seen above. Recently, Microstrategy made a massive splash by purchasing 21,454 BTC, establishing a significant footing in the Bitcoin world. Michael Saylor, Microstrategy’s CEO, justified this by stating that BTC is easily the “fastest horse” with the best odds performance-wise. Bitcoin futures contract in Bakkt has exceeded $200 million, while Grayscale’s Bitcoin trust has ballooned to nearly $7.6 billion.

As per a survey commissioned by crypto asset insurance company, Evertas, institutional investors plan to “significantly increase their stakes in Bitcoin ” andBitcoin” and other crypto assetscryptoassets. Evertas surveyed over 50 institutional investors that collectively manage over $78 billion in assets in the United States and the United Kingdom. This is what they found during their studies:

● 26% of participants believe that pension funds, insurers, family offices, and sovereign wealth funds will raise their stakes in cryptocurrency.

● 64% believe that hedge funds will be more actively engaged in crypto.

● 32% of respondents believe hedge funds will increase their crypto holdings drastically.

However, it’s still not all sunshine and rainbows. The participants in the survey mentioned above have also made the following negative observation:

● >50% are heavily concerned about the lack of insurance for digital assets.

● Some are also worried about the quality of custodial services, trading desks, reporting facilities, and the procedures of other companies working in the sector.

Bitcoin vs Gold: Is BTC a better investment than the OG asset?

JPMorgan analysts believe that Bitcoin is a viable alternative to gold. As per their study, Grayscale’s bitcoin trust saw a tremendous amount of inflows through October 2020, whereas gold exchange-traded funds (ETFs) saw “modest outflows” since mid-October. This proves that investors, who had previously purchased gold ETFs, have now moved on to Bitcoin.

People, in general, tend to always compare Bitcoin with gold because of one primary reason:. bBoth are considered “safe haven” assets. Basically, when the economy goes for a tumble, these assets are usually more resilient and tend to be good value stores. However, it should be noted that gold has been proven its worth for an infinitely larger period than Bitcoin ever has. Gold usage dates back to thousands of years, while the digital asset is barely over a decade old.

BTC, on the other hand, has two distinct advantages over gold:

● Bitcoin has a fixed market cap of 21 million. However, no one knows how much gold is out there in the world. There are talks of companies launching space missions to mine precious metals.

● It is very easy to fake and manipulate gold. Bitcoin —- on the other hand —- is a non-tamperable asset, thanks to blockchain technology.

Bitcoin’s future price action

To judge Bitcoin’s future price action, let’s look at what some of the experts have to say.

Max Keiser of the Keiser Report believes that BTC’s short-term target is around $100,000, while the long-term is around $400,000. Keiser is known in the community as a major BTC bull who usually makes pretty optimistic predictions.

Bloomberg Research believes that BTC will reach $12,000 in the short-term (which it has) and will reach $20,000, aka all-time-high levels, by the end of 2020.

Rich Dad, Poor Dad author, Robert Kiyosaki, is also well-known for his advocacy of BTC. The New York Times bestselling author believes that gold will reach $3,000/ounce, and Bitcoin to reach $75,000 within the next three years.

Plan B’s famous “Stock-to-Flow” Model has some hyper optimistic predictions for BTC. According to the model, Bitcoin should go as high as $288,000 over the next couple of years.

Adam Back, bitcoin developer and CEO at Blockstream, feels that the benchmark cryptocurrency is going to touch $300,000 over the next several years.

Alright, all this sounds pretty amazing, right? So, the next question to ask is: how to buy your first Bitcoin?

Purchasing your first Bitcoin

Founded by Yoni Assia, Ronen Assia, and David Ring, eToro is one of the world’s finest social trading and multi-asset brokerage companies. It was worth $800 million in 2018 and focuses on providing financial and copy trading services. If you are looking for an easy-to-use platform that can help you trade cryptocurrencies, then look no further. Along with the ease of use, eToro is exceptionally safe since top-tier financial authorities regulate its UK and Australian arms.

Leveraging eToro’s automated portfolios

One of the reasons why we highly recommend eToro is its automated portfolios, aka, CopyPortfolios. The CopyPortfolio acts like multiple traders that are working for you simultaneously. The minimum amount required to invest in CopyPortfolios is $5,000.

What is a CopyPortfolio?

Each person or market under a CopyPortfolio is counted as a single trade, and each trade opens up for you with the same proportional amount. Each CopyPortfolio automatically rebalances itself to enable your traders to diversify their portfolio while minimizing long-term risk optimally. This periodic rebalancing empowers the users to get the most out of different trading strategies. The weight of each within the CopyPortfolio is proportional to the size of its market cap.

Overall, there are three types of CopyPortfolios

● Top Trader CopyPortfolio: A trader-only portfolio, where each of the traders that are being copied as part of the portfolio are selected based on the CopyPortfolio’s strategy.

● Market CopyPortfolio: These portfolios are a combination of CFD stocks, commodities, or ETFs bundled together as per a predefined theme.

● Partner CopyPortfolio: EToro’s partners have built this portfolio —– Tipranks (a stock analyst software company), WeSave (a French robo-advisor), and Meitav Dash (a multi-billion dollar investment house).

The TIE – An example of how a eToro CopyPortfolio works

TheTIE-LongOnly CopyPortfolio is the result of a partnership between The TIE and eToro.

The TIE’s core offering is the most advanced data analytics platform in cryptocurrency, combining proprietary sentiment, market, fundamental, technical, and on-chain data. Its main aim is to bring trusted and transparent data and develop technology solutions for the next wave of cryptocurrency trading. Their crypto strategies were developed to harness the crowd’s knowledge (sentiment). They parse through 850,000,000 tweets every day using proprietary machine learning and natural language processing technology to derive sentiment on cryptocurrencies. (The Tie is only available to copy for US residents)

eToro and Delta

Another partnership that should put eToro in your radar is the one that it has done with crypto portfolio tracker app, Delta. The app supports more than 6,000 crypto assets from more than 180 exchanges and provides investors with a range of tools to track and analyze their crypto portfolios. By leveraging Delta, investors will be able to make better decisions regarding their crypto investments by providing tools such as portfolio tracking and pricing data.

Conclusion

While it’s just a little over a decade old, Bitcoin has proven itself to be revolutionary when it comes to being an investment asset. By using hardcoded cryptoeconomics, BTC has grown by leaps and bounds and has the solid fundamentals required to develop even more.

However, the technical aspects scared newbie investors before and prevented them from enjoying significant growth in their investment portfolio. Thankfully, exchanges like eToro not only reduce the barriers to entry by a considerable amount, but its CopyPortfolios allow you to enjoy sustained growth via diversification and rebalancing.

Sign up for eToro today and enjoy the benefits of one of the most significant inventions of the modern age.

The purchase of real/cryptoassets is an unregulated service and is not covered by any specific European or UK regulatory framework/protection. Your capital is at risk. eToro US LLC; investment are subject to market risk, including the loss of principal.

–––

Sponsored Post Disclaimer. Blockgeeks does not endorse any content or product on this page. While we aim at providing you all important information that we could obtain, readers should do their own research before taking any actions related to the company and carry full responsibility for their decisions, nor this article can be considered as an investment advice.