Contents

|

|

Contents

Introduction

A new regime for French Digital Asset Service Providers is being introduced in France which will regulate entities offering services related to digital assets which are not financial securities or currencies, thus financial instruments are excluded from this regime. Similarly, the Maltese Virtual Financial Assets Act (VFAA) regulates Virtual Financial Assets (VFAs) which are defined as any form of digital medium recordation that is used as a digital medium of exchange, unit of account, or store of value and that is not electronic money, a financial instrument or a virtual token. While the Malta Financial Services Authority (MFSA) is the competent authority that regulates VFA service providers, the French equivalent is the Autorité des Marchés Financiers (AMF). In this article, we compare the regulations of french virtual financial assets and Maltese Virtual financial assets.

Categorization of Service Providers

Services are divided into 5 categories:

- Store digital assets or private cryptographic keys on behalf of third parties.

- Buy or sell digital assets against legal currencies.

- Exchange digital assets against other digital assets.

- Manage a trading platform for digital assets.

- Various services such as portfolio management of digital assets on behalf of third parties, advice to subscribers on digital assets and underwriting of digital assets.

The first two categories must be registered while obtaining a license for the rest of the categories is optional. On the other hand, the VFA Act stipulates that all VFA service providers must obtain a license from the MFSA.

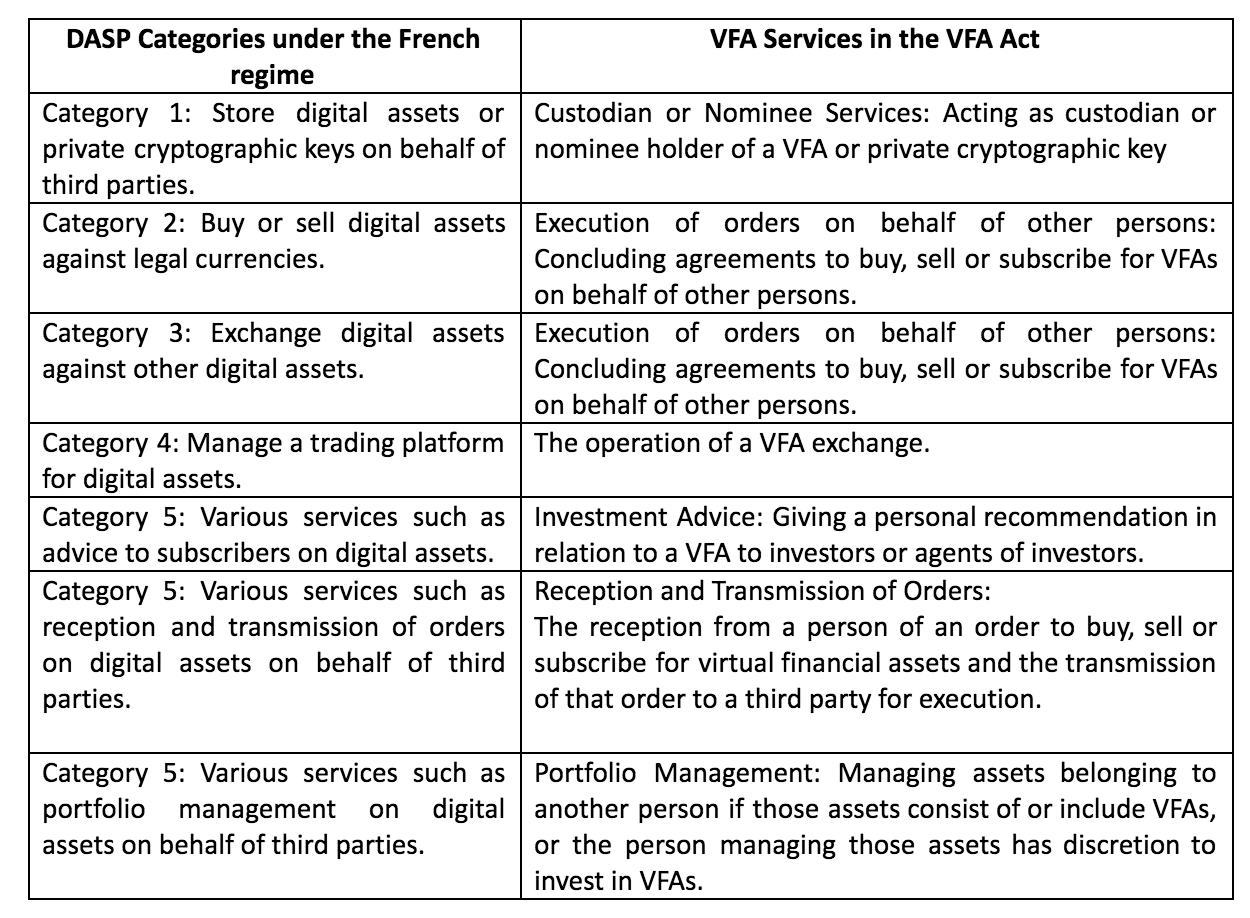

The categorization of services under the French regime is similar to the categorization of VFA services provided in the Second Schedule to the VFA Act. The table below outlines the DASP categories under the French regime, and the comparable VFA service stipulated in the VFA Act.

The distinction is drawn between Category 2 and 3, wherein exchanging digital assets against fiat currencies under Category 2 requires mandatory registration, whilst exchanging digital assets against other digital assets under Category 3 does not require registration, is not reflected in Maltese law. The Maltese legislator adopted a different approach whereby all services require mandatory registration.

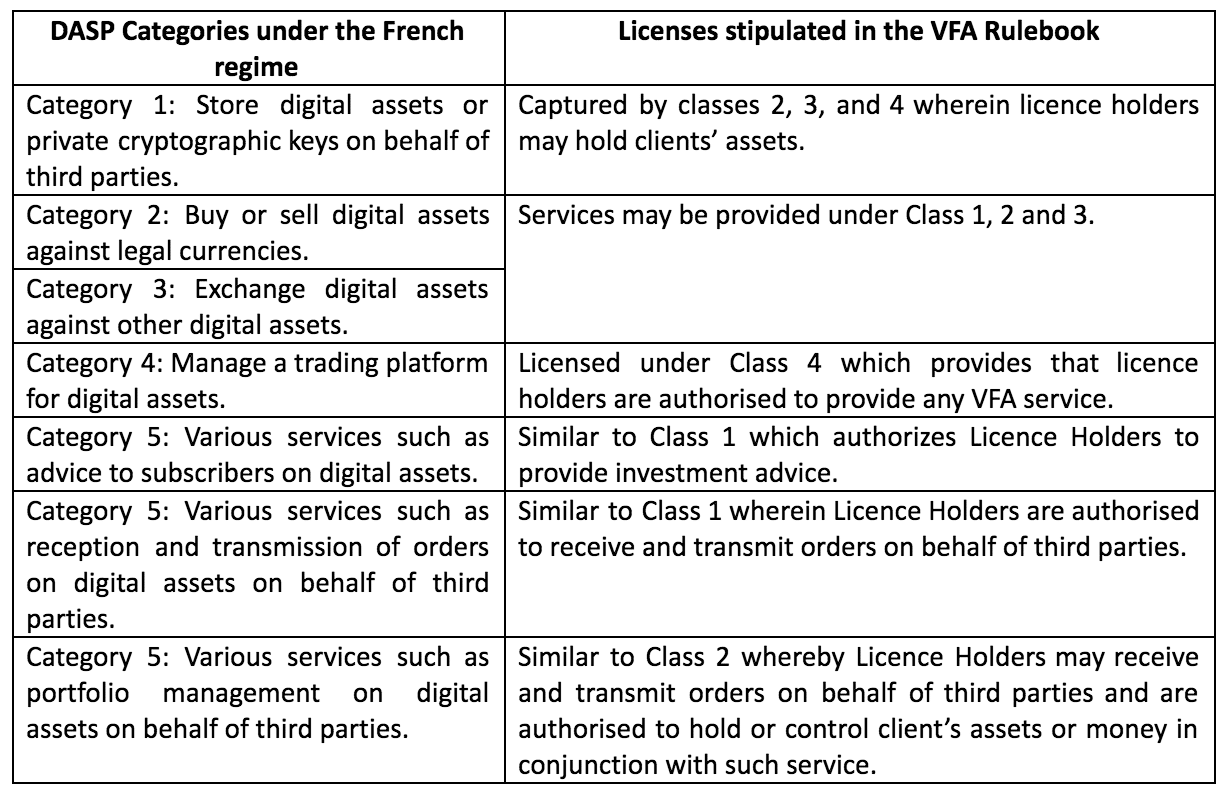

The 4 classes of VFA services licenses envisaged under Chapter 3 of the Virtual Financial Assets Rulebook issued by the MFSA, can also be contrasted to the French Digital Asset Service Providers Categories under the French regime.

Brokerage

Dealings that do not occur on an exchange take place over-the-counter (OTC), typically through brokers. Classes 1, 2 and 3 as stipulated in the VFA Rulebook may be applicable to OTC trading as they occur off-exchange. Class 3 envisages a broker-dealer service since a Licence Holder is authorized to deal on its own account and acts as the counterparty. Similarly, Category 4 of the French framework envisages a broker-dealer service as the manager of the trading platform can engage his own capital.

Furthermore, a brokerage service is also envisaged under Categories 2 and 3 of the French framework which, under the Maltese framework, consists of executing orders on behalf of third parties. Furthermore, reception and transmission of orders and portfolio management provided under Category 5 of the French regime is another brokerage service which is also envisaged under Maltese law.

Licensing Requirements

With regards to services under Categories 1 and 2 which are subject to mandatory registration, the AMF must verify that senior managers and shareholders are of good repute and competence through obtaining documents such as identification, a Curriculum Vitae and a statement that they are not the subject of a criminal conviction or a prohibition to engage in an activity. The AMF must also verify that the French Digital Asset Service Providers has AML/FT procedures in place. French Digital Asset Service Providers which apply for an optional license must provide the AMF with documents such as identification, proof of competence and good repute of senior managers and shareholders and financial information. Similarly, applicants seeking to obtain a license under the VFA Act must undergo the fitness and properness test. The assessment is applicable to qualifying shareholders, beneficial owners, directors, senior managers, the MLRO and compliance officers. The test is based on integrity, solvency, and competence. In contrast to the French regime, Chapter 3 of the VFA rulebook stipulates initial capital requirements for each class of VFA Service Providers.

Obligations

The French regime stipulates various obligations that all licensed French Digital Asset Service Providers must fulfill, some of which are similar to the obligations which Service Providers licensed under the VFA Act are required to fulfill. The French regime provides that French Digital Asset Service Providers must have adequate security and internal control system, and a secure computer system. The VFA Rulebook stipulates that Service Providers must have risk management policies and procedures in place, and a risk management function that implements such policy. License Holders must also ensure that IT infrastructures ensure privacy and confidentiality, and security of stored data.

Both frameworks require management of conflicts of interest, with the MFSA Rulebook expressly requiring conflict of interest policy to be in place. The French regime also requires communication of clear and accurate information to the client, with whom there must be a written agreement. Likewise, the VFA Rulebook requires execution policies to provide the best possible results for clients who must be provided with adequate information on such policy.

The French regime also stipulates specific obligations applicable to each category of services. For example, French Digital Asset Service Providers providing services under the first category must set out a safekeeping policy and ensure that digital assets kept on behalf of clients are returned without delay. The VFA Rulebook stipulates that where a license holder is authorized to hold or control clients’ assets the Licence Holder must hold such assets in segregated accounts, among other obligations.

Under categories 2 and 3, French Digital Asset Service Providers must, namely, set out a non-discriminatory commercial policy, publish a firm price of the digital assets or the pricing method applicable to the digital assets, and publish the volumes and prices of the transactions completed. Under category 4, both frameworks set out specific obligations when managing a trading platform for digital assets or VFAs. Under the French regime, French Digital Asset Service Providers must set out functioning rules, ensure fair competition, and publish the details of the orders and transactions completed on the platform. The VFA Rulebook sets out similar obligations to ensure pre-trade and post-trade transparency. Pre-trade obligations include publishing current bid and offer prices, while post-trade obligations include publishing the price, volume and time of the transactions. License Holders must also issue clear and transparent bye-laws, similar to the functioning rules required under the French framework.

Non-Compliance

In the event of non-compliance, the AMF may hand down sanctions and withdraw licenses. The AMF may also publish a “blacklist” of French Digital Asset Service Providers that do not comply with the regulations and may block websites offering fraudulent services in digital assets. The MFSA is similarly empowered to sanction Licence Holders, which powers include the right to impose administrative penalties without recourse to a court of law up to €150,000.

Conclusion

The regime being introduced by France is similar to the Maltese framework, indicating a pattern in the regulation of digital assets across different jurisdictions. The main distinction between the two regimes is that under the French regime obtaining a license for the provision of certain services is optional. This optional nature provides a degree of flexibility on the one hand and security of the financial market on the other, however, it could potentially pose certain risks. For example, reception and transmission of orders and portfolio management are equivalent to traditional brokerage services. When these services are unregulated, investors risk financial loss without the option of compensation.

Government regulations will change the virtual Financial Services providers roll in the field for years to come.

It is inevitable; and for those who think that decentralised exchanges will escape regulation, there have been various instances where they were proven wrong. Ultimately, only decentralised exchanges in the purest sense of the word i.e. with no centralised function over which there is a responsible person, will escape regulatory clutches.

So will crypto currencies rule the future markets?

Potentially. It is worth noting that futures of cryptocurrencies that are also settled in cryptocurrencies present a very interesting scenario, regulatory-wise.

Thank you so much Blockgeeks for the updates! It seems that the governments are working hard to provide the regulations on the crypto-asset transactions and related services. If this trend continue, what do you think of the impact of these regulations? Are they gonna boost blockchain awareness on citizens and democratize blockchain/cryptocurrency usage? Thank you so much!

I would definitely say that they would help raise awareness as well as end-user protection. Ultimately, keep in mind that most of these exchanges are financial service providers and therefore should be regulated in a similar (but not the same) fashion.