Contents

|

|

Back in July 2019, Stacks, then called Blockstack, got the whole crypto world talking when they held the first-ever SEC-qualified token offering in US history. Stacks is an open-source, developer-friendly network for building decentralized apps and smart contracts. As of now, there are more than 400 tapps already on the network.

Stacks got its start at the Princeton Computer Science Department in 2013 as an effort to build a better internet. Muneeb Ali and Ryan Shea participated in the Y-Combinator accelerator program in 2014. They recruited other Princeton computer scientists for initial R&D. Early investors include Union Square Ventures, Naval Ravikant, and SV Angel, among others.

Contents

Connecting to Bitcoin with the Stacks blockchain

Bitcoin may end up becoming one of the most significant inventions of the 21st century. While Bitcoin is primarily used as a payment protocol, many mistakenly believe that the premier cryptocurrency isn’t capable of doing much more. However, that’s simply not the case. Projects like Stacks are providing developers with the tools required to do just that.

Stacks 2.0, the new blockchain launching this week, is a layer-1 blockchain that connects to Bitcoin for security and enables decentralized apps and predictable smart contracts. To enable interoperability between the two chains, Stacks runs a novel consensus algorithm called Proof of Transfer (PoX). Via PoX, Stacks miners can use Bitcoin to mine newly minted Stacks tokens (STX). Stacks holders, then, can lock up their STX to support consensus and earn Bitcoin as a reward. This makes STX a unique crypto asset that is natively priced in BTC and allows for BTC earnings.

Initially, the network ran on the Stacks 1.0 blockchain, which offered functionality focused on giving developers decentralized app building tools like auth and storage. The Stacks 2.0 is a significant upgrade that replaces the previous technical design of Stacks 1.0 and enables new functionality, notably smart contracts, to go alongside the existing tools.

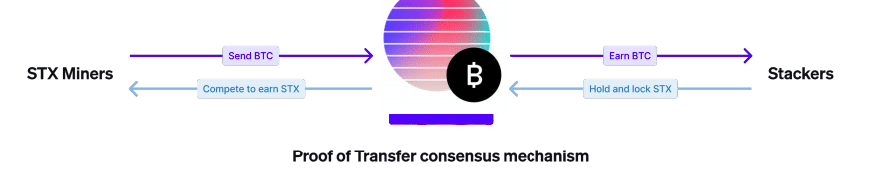

What is the PoX Consensus?

PoX is the first ever consensus mechanism that creates consensus between two blockchains – with Bitcoin as the base chain and Stacks as the connected chain. Here are some important points that you must keep in mind:

- The leader election happens on the Bitcoin blockchain. PoX reuses already minted Bitcoin as “proof of computation.” This way PoX can do their election without having to waste electricity like BTC PoW.

- As you may have already figured, there are two types of participants in the PoX consensus system – STX miners and Stacking participants.

What do the STX miners do?

- STX miners can view state on both the Bitcoin blockchain and the Stacks blockchain.

- STX miners bid for becoming the leader of the next round. The protocol selects the leader of a round using a verifiable random function (VRF).

- VRF randomly selects the leader of each round while giving more weight to higher BTC bids.

- The leader is responsible for adding new blocks to the Stacks blockchain and receiving the reward. STX miners get newly minted STX (coinbase rewards), transaction fees paid to them in STX, and smarty contract execution fees of each block also paid in STX.

What do the Stacking participants or ‘Stackers’ do??

- STX holders can participate in PoX and earn BTC awards by participating in a process called “Stacking.” More on this in a bit.

- Users can participate in Stacking by locking their STX for a reward cycle (lasts for approximately two weeks), run or support a full node, and send useful information on the network as STX transactions.

- Holders that actively participate in Stacking earn bitcoin rewards for that cycle.

- All the bitcoins used for miner bids are sent to a set of specific addresses corresponding to STX token holders that are actively participating in consensus. This makes sure that the BTC consumed in the mining process goes to STX holders as a reward instead of simply getting destroyed.

Since we brought up the topic of Stacking, here are some pointers that you should keep in mind.

- Stacking parameters: 2 reward addresses per block; reward cycle 2000 blocks (~2 weeks) for a total of 4000 reward slots.

- Stacking threshold: The minimum number of STX tokens required adjusts dynamically based on participation. This threshold is 0.025% of the participating amount of STX when participation is between 25% and 100% and when participation is below 25%, the threshold level is always 0.00625% of the liquid supply of STX.

Other info about Proof-of-Transfer

- The block reward will be 1000 STX/block for the first 4 years, 500 STX/block for the next 4, 250 STX/block for the next 4 and then 125 STX/block perpetually after that.

- The Stacks blockchain produces blocks at the same rate as the Bitcoin blockchain, which is around 10 mins.

- PoX also has a block reward maturity window to ensure finality. In other words, if a miner wins a block, they earn the coinbase reward after 100 blocks have elapsed.

Details about the Stacks (STX) cryptocurrency

As mentioned earlier, the STX cryptocurrency was distributed to the public via the first-ever SEC-qualified token offering in US history. Around 4,500 people/entities ended up participating in the token offering, including USV, Lux, DCG, Winklevoss Capital, Blockchain Capital, Foundation Capital, Hashkey, Fenbushi, and others.

PoX creates a native exchange pair between STX and BTC. This means that you can lock up STX and get earning in BTC. This is very different from other staking mechanisms wherein you receive yield in the same cryptocurrency. Due to this very reason, it could cause a significant amount of these STX tokens to be locked up and made illiquid by long-term holders. These holders will opt to perpetually lock these tokens away and receive BTC rewards in return. This supply crunch should ideally have a positive impact on STX’s long-term valuation.

Here are some points to note about STX:

- The primary purpose of STX is to be used as fuel to execute Blockstack’s smart contracts.

- Stacks are also used for other network functions like registering digital assets, paying for transaction fees, and to publish smart contracts on the blockchain.

- Stacks can be locked by STX holders to participate in consensus and earn Bitcoin rewards.

In the initial years, 1000 STX per new block are released as newly minted tokens (coinbase rewards). In addition to coinbase rewards, fees for contracts and transactions also determine how miners value a block. So, when the network usage goes up, the overall value of a block to the miner goes up significantly due to the higher contract and transaction fees.

STX Token Economics

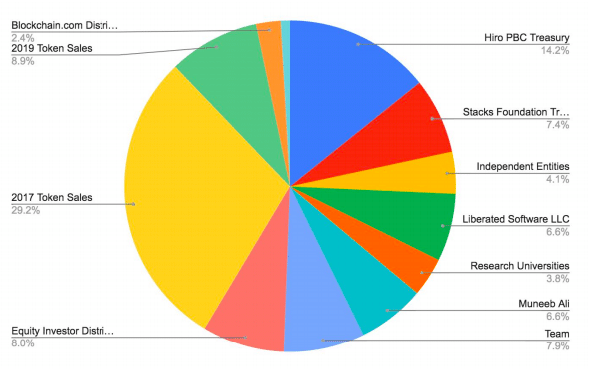

The figure above shows the breakdown of genesis block tokens.

The Stacks cryptocurrency has 1.32 billion (1,320 million) tokens that were distributed through various offerings in 2017 and 2019. The 2017 offering distributed STX at a $0.12 price, the 2019 Reg S offering at $0.25, and the 2019 SEC qualified offering at $0.30.

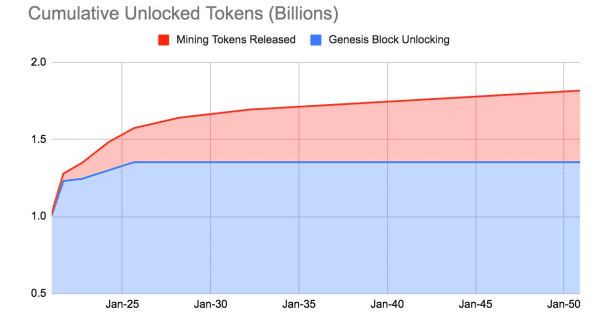

By year 2050, the STX supply will reach 1,818 million as per predefined mechanics. The chart below shows the increase in the total circulating supply of STX until 2050.

Clarity Smart Contracts on Stacks 2.0

Clarity is the language used to create smart contracts on the Stacks network. Clarity is a new programming language for smart contracts that optimizes for predictability and security. The language was developed by Princeton and MIT scientists at Hiro PBC and Algorand over the last two years.

Not only does Clarity allow developers to write logic around Bitcoin’s state directly, it also eliminates entire classes of common smart contract bugs. According to Clarity’s website, Clarity takes a “what you see is what you get” approach.

The behavior, cost, and performance of smart contracts are transparent both for developers and for automated verification and introduces post-conditions for added safety.

#1 Turing Incompleteness

A system is Turing complete if it is capable of performing any computation, given enough time and resources. Clarity is intentionally Turing incomplete since it avoids “Turing complexity” and makes the smart contracts more predictable and easy to read. Further, support for types and type checkers can eliminate whole classes of bugs like unintended casts, reentrancy bugs, and reads of uninitialized values.

So, why is this significant?

Well, to get a better understanding, let’s compare it with Solidity.

Solidity, aka the language used to code Ethereum smart contracts, is Turing complete, and hence a lot more dynamic and unpredictable than Clarity. While there are several advantages to this method, the main issue is that they can be pretty buggy. Smart contracts may be dealing with millions of dollars worth of transactions. They can’t afford to be buggy. Which is why, taking a more inflexible yet predictable approach may be the best way to go.

#2 Visibility into Bitcoin

Clarity smart contracts can offer Bitcoin’s state visibility, enabling contract logic to be triggered by pure Bitcoin transactions. These contracts have built-in SPV proofs for Bitcoin and make interacting with Bitcoin’s state simpler for developers. Plus, Clarity contracts fork in sync with the Bitcoin blockchain, ensuring that the contracts are always in sync with the underlying protocol.

#3 Lack of compilers

The Clarity contract source code is published and executed by blockchain nodes directly, removing the need for a compiler. This removes intermediaries from the system and minimizes the probability of buggy contracts. Compiler bugs can be pretty damaging in blockchains because while the source code itself may not have any errors, the eventual program reaching the blockchain could. These errors usually end up in contentious hard forks, which could have a damaging impact on the overall ecosystem.

Stacks Ecosystem Status

The Stacks ecosystem is a collection of independent entities, developers, and community members working to build a user-owned internet on Bitcoin. 2020 was a significant year for the company in its path towards decentralization. Several independent entities emerged in the Stacks ecosystem. These include:

- The non-profit Stacks Foundation.

- Freehold, a community-focused entity.

- Daemon Technologies, a mining and Asia markets focused entity.

- New Internet Labs (started in 2019)

- Secret Key Labs

In Fall 2020, Blockstack PBC released a legal memo summary that details the transition to a non-security status for the STX cryptocurrency in the US

Conclusion

Overall, Stacks is an entire ecosystem for decentralized applications that aim to bring the concept of blockchain to all aspects of the internet. Instead of relying on third-party intermediaries to access data, Stacks seeks to give users a direct connection to the data through blockchains and the tools to developers hoping to expand what’s possible when it comes to building on Bitcoin.

Through the Stacks 2.0the community hopes to revolutionize the internet by fixing some of its most dangerous issues – insecure connections, data breaches, tech monopolies, and lack of user ownership

Stacks 2.0 Mainnet Launch Event Is January 14: Here’s How To Participate

The Stacks 2.0 mainnet will launch on January 14, 2021, bringing with it the promise of a new era of innovation on Bitcoin and potentially a new chapter for the entire internet. . The Clarity smart contract language also goes live with Stacks 2.0 and all of a sudden, developers have a set of tools for building on Bitcoin many never thought they would.

We’re excited to see where innovation on Bitcoin can take Web 3.0, and what a world where users are anchored to a secure base-layer that assures ownership at every level looks like.

To register for the Stacks 2.0 mainnet launch event, be sure to check out the official website. To learn more, you can also read the Stacks 2.0 technical whitepaper.