Contents

|

|

This guide will cover what Aave Protocol is, how it works, and why you should consider using it for your crypto needs.

•Aave Protocol is a decentralised platform for the provision of crypto loans.

• Aave Protocol requires users to deposit cryptocurrency in order to borrow it, so the platform does not operate without collateral.

• Aave provides its users with a native token known as AAVE, which can be staked in order to earn interest.

• Borrowers with Aave run the risk of having their collateral liquidated if the value of that collateral falls too far.

Contents

Getting Started with Aave Protocol

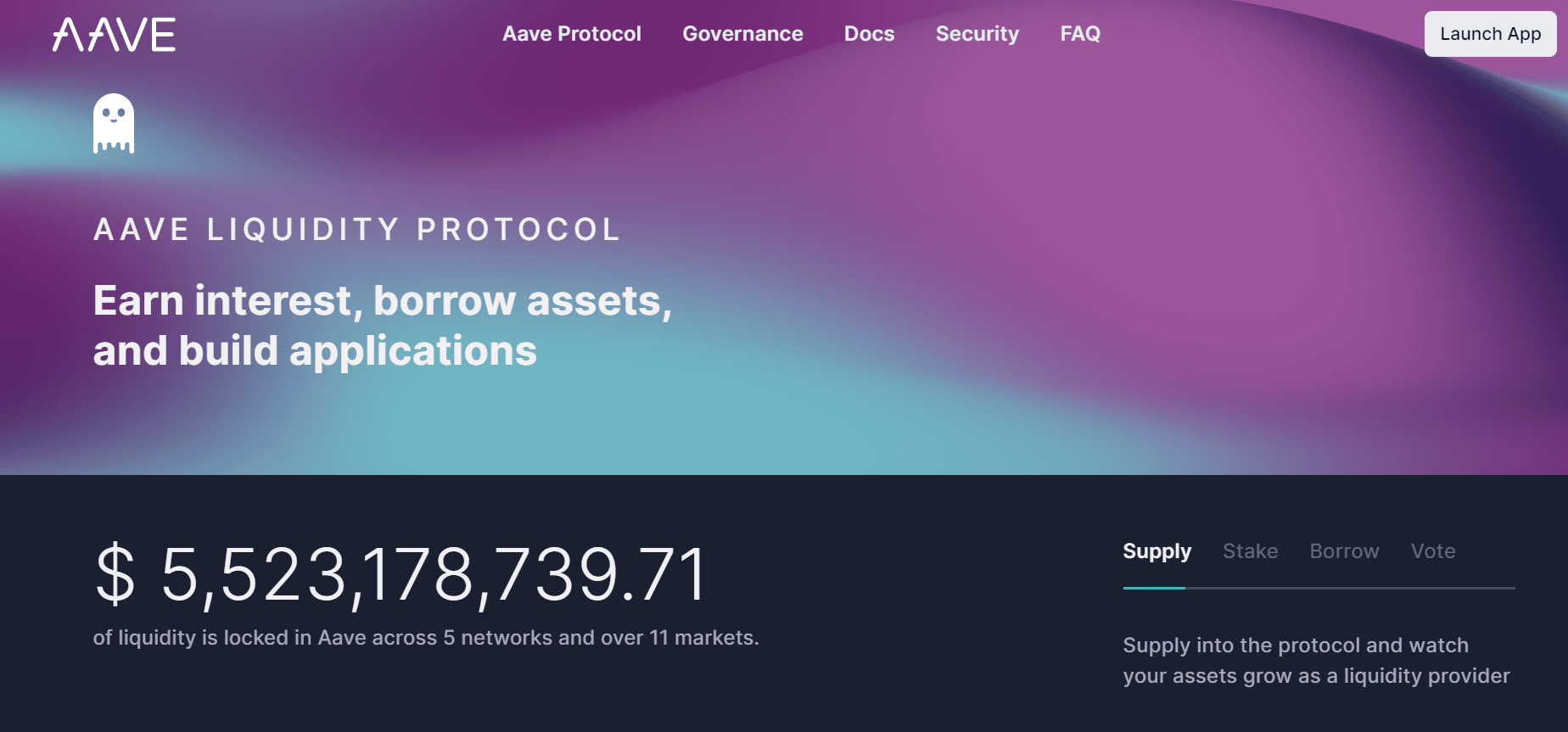

Aave is a decentralized finance (DeFi) protocol that allows users to earn interest on their crypto deposits and take out loans using cryptocurrency as collateral. It is one of the most popular DeFi protocols and has seen significant growth since its launch in 2017.

What Is Aave Protocol?

Aave is an open source, fully decentralized money market protocol built on top of the Ethereum blockchain. It was created to provide users with innovative financial services such as borrowing and lending of cryptocurrencies. The platform offers a variety of features including flexible lending options, low interest rates, high transparency through audited smart contracts, and a decentralized governance model.

How Does Aave Work?

Aave’s protocol works in three distinct stages:

- Depositing cryptocurrency

- Borrowing crypto loans,

- Staking the AAVE token.

To deposit cryptocurrency into Aave’s pool of assets, users can either use their wallets directly or exchange fiat currency for cryptocurrencies like ETH or DAI through the platform’s integrated wallet partners. Once the user has deposited funds into the pool, they can begin to borrow against it at whatever rate they choose. Borrowers are able to set their own interest rate (the “borrowing rate”) which determines how much they must pay back over time to maintain their loan. Additionally, users may also opt to stake their AAVE tokens in order to earn rewards from the network’s liquidity pools. Finally, all transactions made within the platform are secured by smart contracts which provide a high level of transparency and trustworthiness for all users involved in each transaction.

Features & Benefits of Using Aave

One of the main benefits of using Aave is its easy-to-use interface and platform design which makes it simple for both novice and experienced investors alike to access its various features without any prior technical knowledge or experience. Additionally, Aave offers access to flexible lending options at low interest rates which can be customized according to individual risk tolerance levels or desired results. Finally, transactions on this platform are highly transparent thanks to its audited smart contracts system and decentralized governance model which ensures fair play by all parties involved in each transaction.

Why You Should Choose Aave For Your Crypto Needs

Aave offers a unique borrowing and lending service built on the Ethereum blockchain. It provides users with access to fast, low-cost loans secured by cryptocurrency assets. Aave also gives users the ability to mint stablecoins, earn interest on deposits, and thrive in a permissionless environment. Innovative features such as flash loans allow users to borrow without collateral, while multi-collateral loan products provide additional control benefits and more simultaneously.

Native Staking

The lending platform Aave allows its users to unlock the potential of their crypto holdings and increase their capital through a wide variety of innovative financial solutions. One of the many ways that users can take advantage of this system is through staking AAVE, Aave’s native token. By staking AAVE in an easy and secure manner, users are able to gain access to an array of interest-bearing products tailored to their desired yields. Additionally, by tokenizing assets associated with debt contracts and creating stablecoins pegged to traditional banks or currencies, Aave ensures that its users are able to make perfect use of their tokens.

Aave Protocol Staking Risks

Like all smart contract-based platforms, the Aave protocol is at risk of failure due to bugs or attacks. In addition, market movements or third party app dependencies may also result in shortfall. Aave identifies several risk factors that could cause such an event:

- Smart contract risk: Risk of a bug, design flaw or potential attack surfaces on the smart contract layer.

- Liquidation risk: Risk of failure of an asset that is being used as collateral on Aave; risk of liquidators not capturing liquidation opportunities in a timely manner, or low market liquidity of the principal asset to be repaid.

- Oracle failure risk: Risk of the Oracle system not properly updating the prices in case of extreme market downturn and network congestion; risk of the Oracle system not properly submitting prices, causing improper liquidations.

In the unlikely event that one of these eventualities takes place, the protocol’s users will essentially be “bailed out” by AAVE stakers.

Examples of Aave Protocol Bad debt

https://twitter.com/The3D_/status/1595122276055539718?ref_src=twsrc%5Etfw%7Ctwcamp%5Etweetembed%7Ctwterm%5E1595122277854904325%7Ctwgr%5E8d3b58552b41315b4a73b6baf9f4b398619b47e0%7Ctwcon%5Es2_&ref_url=https%3A%2F%2Fblockworks.co%2Fnews%2Faave-curve-bad-debt

How Many Aave (AAVE) Coins Are in Circulation?

Out of the max supply of 16 million AAVE tokens, around 12.5 million coins are in circulation. The system uses most of the revenue generated through fees to buy back AAVE in circulation which is then destroyed in the burning process, regulating the supply of Aave and contributing to the liquidity of the protocol.

The number of AAVE in the circulating supply multiplied by the current Aave price in the market equals the market cap of the token. The market cap defines the market rank for AAVE and its market dominance compared with other cryptos in the market.

Conclusion

Aave provides a wide range of features that make it an attractive option for anyone looking to get started with DeFi or simply wanting access to more flexible lending options than traditional banking institutions offer. With its easy-to-use interface, high transparency levels through smart contracts auditing process ,and decentralized governance model; there’s no doubt that Aave is one of the more exciting defi protocols to look out for.