Contents

|

|

Aura Finance is a protocol that was built on top of the Balancer system in order to provide maximum incentives to Balancer liquidity providers and BAL stakers (into veBAL).

• A seamless onboarding process to veBAL is provided by Aura for BAL staking participants through the creation of a tokenized wrapper token known as auraBAL.

• Within the ecosystem, the AURA token serves as a tool for governance and for incentivizing participants.

Contents

What is Aura Finance

Aura Finance is a protocol that was built on top of the Balancer system in order to provide maximum incentives to Balancer liquidity providers and BAL stakers (into veBAL). This was accomplished through the social aggregation of BAL deposits and Aura’s native token.

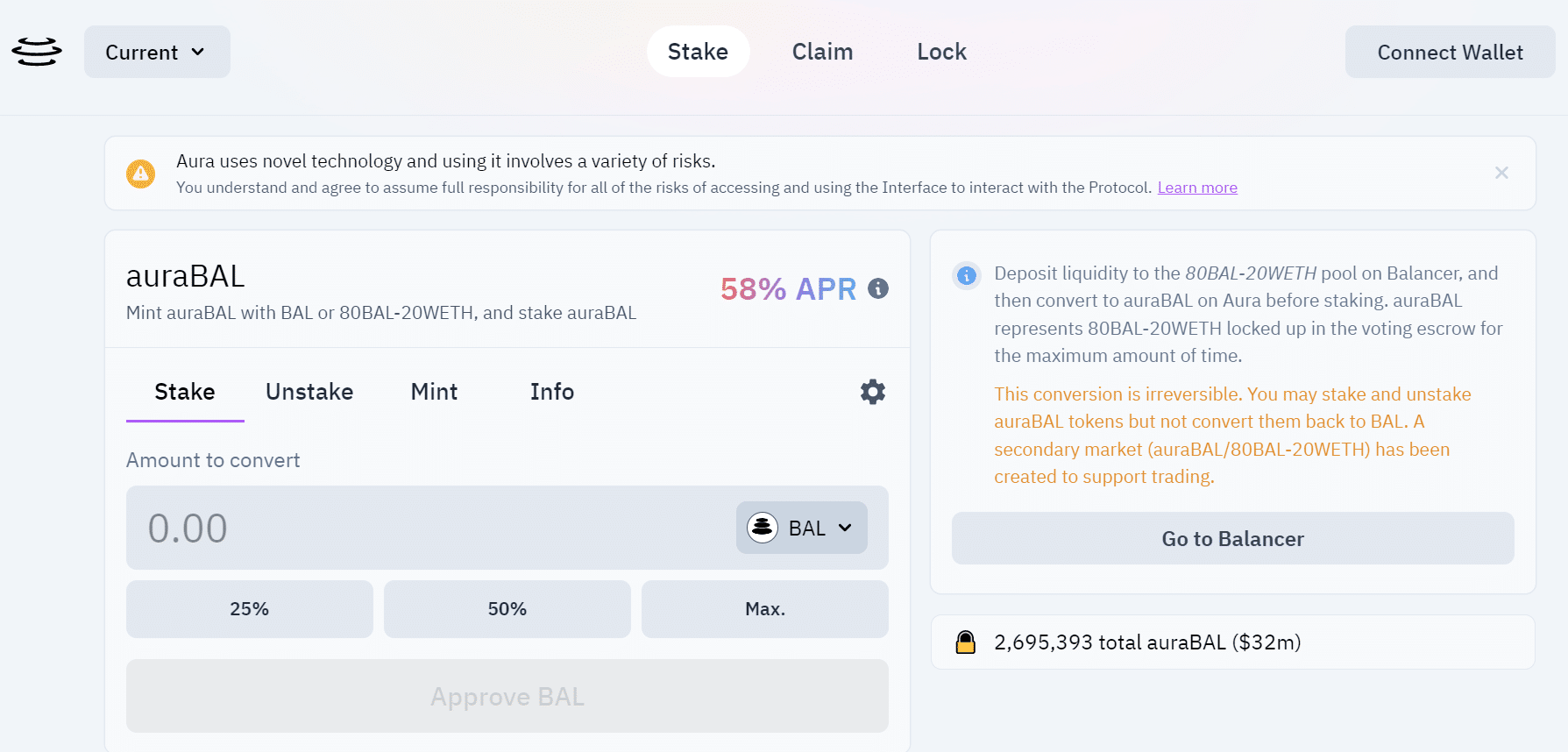

A seamless onboarding process to veBAL is provided by Aura for BAL staking participants through the creation of a tokenized wrapper token known as auraBAL. This token represents the 80/20 BPT that has been locked up for the maximum time in VotingEscrow (read more about what this means). You can stake this to receive existing rewards (BAL and bbaUSD) from Balancer, in addition to a share of any BAL earned by Aura (for more information regarding the fees, see the related article), and additional AURA. This minting process cannot be undone; however, users are able to convert their auraBAL holdings back into BAL through a liquidity pool that offers incentives.

Aura makes the process of depositing into the Balancer gauge system much simpler for providers of liquidity by providing a streamlined onboarding procedure for any and all Balancer gauge deposits. Aura enables depositors to achieve a high boost through the protocol-owned veBAL while simultaneously accruing additional AURA rewards for their participation.

Within the ecosystem, the AURA token serves as a tool for governance and for incentivizing participants. Locked AURA tokens will be able to vote both on internal proposals and using the voting power that is owned by the protocol itself when it comes to veBAL voting. These tokens will also have governance rights within the system.

In 2022, Aura has managed to:

✅ reach $400m+ TVL

✅ become a Top 20 DeFi protocol on Ethereum

✅ develop 4+ Protocol ecosystem integrations

✅ establish 22%+ in veBAL voting share— Aura (@AuraFinance) December 31, 2022

Aura Finance For Liquidity providers

What exactly are BPTs?

When assets are deposited into a liquidity pool, the participant is rewarded with Balancer Pool Tokens, also known as BPTs.

Balancer Gauges

These BPTs have the potential to win BAL rewards if they are staked in Balancer Gauges. The amount of the depositor’s veBAL balance determines the “boost” that they receive, which can range from 1.5x to 2.5x (). Users are typically required to lock up BAL in the Balancer VotingEscrow before they can obtain a veBAL balance. Exactly here is where Aura comes into play…

Aura for Balancer LPs

Aura enables its users to continue receiving their trading fees, but now at a higher APY thanks to the fact that veBAL is owned by the Aura protocol. At the same time, Aura Limited Partners will be eligible to receive rewards in the form of protocol native AURA tokens.

Aura gives users the ability to maximize the return on their BPT investments while also giving them exposure to the governance token of a protocol that carries the economic weight of substantial veBAL.

AURA governance tokens, which are used to direct the voting power of the veBAL in AURAbal, are minted alongside BAL earned and paid to LPs and other ecosystem users, thereby creating additional incentives. In AURAbal, the veBAL is a digital asset that represents a stake in the AURAbal ecosystem.

For $BAL stakers

auraBAL is tokenised veBAL

Aura enables users to deposit their here and receive auraBAL, rather than the non-transferable veBAL that is normally received. Tokenized auraBAL is provided to the user at a rate of 1:1 for veBAL, and it is tradable on the Balancer finance platform.

This BPT is then placed in Voting Escrow by the Aura protocol for the maximum amount of time allowed, where it will allow the Aura system to benefit from its voting power by increasing rewards and voting for gauges. This BPT will remain in Voting Escrow until the Aura protocol releases it.

auraBAL Staking auraBAL can be staked into the platform to receive normal Balancer admin fees, which one would get for normally holding their veBAL, in both BAL and bb-a-USD; additionally, users who stake auraBAL will receive BAL from Aura’s performance fee, in addition to the platform’s native token, AURA.

auraBAL Liquidity Pools

Users also have the option of contributing to the auraBAL/[80/20 BAL/ETH BPT] Balancer pool rather than staking auraBAL. This option is available to users.

The auraBAL BPT token can then be staked on Aura Finance by users in order to receive a separate pool of AURA rewards for providing liquidity to other users so that they can enter and exit the ecosystem using the auraBAL token.

Aura Finance Vote Locking

The Aura protocol’s governance will be made easier by the use of locked AURA. Those who lock their AURA and delegate their voting (self-delegation is allowed) prior to the beginning of the epoch that follows will be able to take part in all of the decisions that are made concerning the formation of the protocol. Locks can be worn for a total of 16 weeks.

Locked AURA balances are mapped to system-owned veBAL and also provide voting power for the governance of the Balancer.

Among these are the development of it as well as the distribution of the protocol’s accumulated veBAL. Because of this, users who want to exert some level of control over the distribution of rewards will need to lock their accounts. The economic power that this carries has previously been demonstrated by other protocols…

AuraBAL will be given out as a reward straightaway for aura lockers.

On the Aura frontend, the Aura can be locked if necessary.

Delegation

It is possible to appoint a different location as the recipient of your voting power. If you are not an active governor of the network or if you want to make use of protocols provided by third parties, this may be useful to you.

The delegation of voting power to Aura

After you have locked Aura, you have until the beginning of the next epoch to delegate control of your vlAURA either to yourself, a third party, or to Aura itself.

Click the “Self Delegate” option if you want to delegate tasks to yourself. To delegate authority to a third party, go to “Delegate to a specific address,” type in the address, and then click “Delegate.” Simply select the “Delegate to Aura” option to give authority to Aura.

The total amount of vlAURA that is being delegated will be displayed under “Delegating” once it has been delegated, and your voting weight will be displayed under “Vote weight.”

The delegation of voting power to the Balancer

- The delegation of votes for the Balancer is handled independently from the delegation of votes for the Aura. On the Gnosis Delegate Registry, the balancer.eth space is where you’ll find the definition for this delegation.

- You do not need to first self-delegate in order to vote on the Balancer; this is not the case with the Aura delegation. You have the option of delegating to Aura or to another reliable third party.

- After locking Aura, you can view your Balancer voting power and set a delegate by selecting the “Balancer” tab on the of the Aura frontend, or by using. Alternatively, you can use.

Governance

Aura is a protocol that is governed by the community and is decentralised. Token holders have the ability to direct all actions that are carried out through.

How does it work

Aura has made preparations for full-scale chain governance by incorporating vote delegation into the Vote Locked Aura contract. Having said that, until such time as the Aura voter base becomes more mature, a more secure method will be used to carry out the decisions made by governance.

The snapshot and multisigs page from Phase 1 will be used for all of the aspects (1-4) listed in the previous paragraph. In order for community members to take part in snapshot voting, they are required to lock their AURA and delegate it. It is acceptable to delegate tasks to oneself. The multisig that is chosen to carry out the results of the snapshot proposals can be one of two. It will be necessary for these entities and individual signers to carry out transactions in a way that is consistent with the results of snapshot votes.

Aura is committed to transitioning this mechanism on-chain when it is appropriate in the coming months via the likes of Governor bravo, provided that it is technically feasible and doesn’t require compromising on security. This transition will take place when appropriate.

“Internal governance proposals (such as setting fee rates),” which can be moved on chain with the implementation of GovernorBravo as soon as the vote distribution is sufficiently mature, can be moved on chain.

This “Aura treasury” business could proceed with either or some kind of on-chain treasury management

Solution.

“Balancer Gauge voting” is something that can be accomplished with the help of custom smart contracts. This solution could be implemented on a less expensive L2 and then forwarded if necessary, taking into account the weekly increase in gas costs associated with voting for gauges.

Security

The protection of smart contracts is one of the most important concerns for those working on Aura Finance. To ensure that the protocol can be used without risk, every precaution that can reasonably be taken must be taken. The following is a list of some of the factors that we believe contribute to the security of systems that use smart contracts.

Audits

- Audit 1 – Peckshield (4-18th Apr 2022)

- Audit 2 – Code4rena (11-25th May 2022)

A competition with a prize pool of one hundred fifty thousand dollars and a duration of two weeks was held to invite people who were familiar with the Aura system or who were simply interested in finding bugs to come and help improve its level of safety before its launch.