Contents

|

|

GMX Protocol is a decentralized perpetual trading platform on Arbitrum. In this post, we’ll explore what GMX is, review the GMX vs GLP tokens, and show you how to use this exchange.

The vast majority of trading in the crypto ecosystem is done via centralized cryptocurrency exchanges. There are several reasons for this, such as a simple and intuitive user experience, powerful features for traders to track their trades in line with their goals, and several built-in security features that protect funds from potential risks and bad actors. But isn’t using a centralized exchange or agency against the very ethos of decentralization, as highlighted by Satoshi Nakamoto in the Bitcoin whitepaper?

However, the advent of DeFi (Decentralized Finance) and decentralized exchanges changed this scenario. DeFi and decentralized exchanges gained mainstream exposure in 2020 during what many call the “Summer of DeFi,” allowing users to maintain custody of their funds. However, these exchanges are plagued with a plethora of problems, such as low liquidity and poor user experience. This is where GMX comes into the picture, looking to address these issues through a unique multi-asset liquidity model and an interesting take on the traditional AMM model.

Contents

What Is GMX Protocol?

Launched in 2021, GMX is a decentralized spot and perpetual exchange enabling users to trade popular cryptocurrencies such as Bitcoin and Ethereum directly from their crypto wallets. GMX went live on Arbitrum in September 2021 and then launched on Avalanche at the beginning of 2022. Unlike decentralized spot exchanges, GMX allows users to do spot swaps and trade perpetual futures with up to 50x leverage while allowing users to have custody of assets in their cryptocurrency wallet.

With low swap fees, zero-price impact trades, and limit orders, GMX is looking to provide its users with a better and more efficient trading experience. Trading on the platform is supported via a multi-asset pool, which allows liquidity providers to earn fees in the form of GLP tokens. The platform utilizes Chainlink Oracles, aggregating price feeds from high-volume exchanges. Because GMX is a decentralized exchange, it does not feature an order book, nor is there a central authority handling funds. Instead, it utilizes its multi-asset pool and liquidity providers. But how do they work?

How Does GMX Protocol Work?

Now that we’ve gone through the “what,” let’s understand the “how.” GMX facilitates trading through a multi-asset liquidity pool called GLP. The multi-asset pool consists of 50-55% stablecoins, 25% ETH, 20% BTC, and around 5-10% other altcoins, such as Chainlink and Uniswap. Liquidity providers add liquidity when they mint GMX Liquidity Provider Tokens (GLP), in exchange for which they receive 70% of fees generated on the blockchain. Unlike other liquidity pools, GLP does not suffer from impermanent loss.

Another feature of GMX is its use of price oracles such as Chainlink to empower trades and act as a hedge against any liquidation risk. Using Chainlink Oracles allows the protocol to get accurate price data for assets in the pool, allowing it to pinpoint when liquidations could occur and protect user positions. Any user can supply liquidity, earning fees in return. Users can also trade perpetual swaps and spots using the assets provided. Additionally, the GLP pool also acts as a counterparty for traders because the GLP token holders provide liquidity used for leverage trading.

Users can mint the GLP token by using any of the index assets and burn the token to redeem any index asset. However, unlike the GMX token, the GLP token is non-transferable and can be automatically staked. Furthermore, GLP’s reward, price, and index composition differ on Avalanche and Arbitrum.

https://twitter.com/GMX_IO/status/1608100629380988928

The GMX Token And GLP

The GMX token is the protocol’s utility and governance token, allowing holders to vote on critical decisions and proposals that shape GMX’s future direction. Token holders can also stake their tokens and earn three types of rewards.

- The first reward stakers are eligible for is 30% of all generated protocol fees distributed to all GMX token stakers. These fees are collected from leverage trading, market making, and swap fees and are paid out in ETH or AVAX.

- Stakers can also earn escrowed GMX (esGMX) tokens, which can be staked to earn further rewards or vested. If a token holder vests these tokens, they are converted back to GMX tokens over 12 months. esGMX tokens act as a form of locked staking, preventing holders from selling their tokens immediately and staving off inflation.

- GMX stakers can also earn something called Multiplier Points that help boost yield and reward long-term users, helping further decentralized ownership on the platform.

The total supply of the GMX token is capped at 13.25 million, with 8,395,950 GMX in circulation. Out of this, 7,042,003 GMX are staked.

On the other hand, GLP is the liquidity token for GMX, providing liquidity to traders on the platform. These tokens can be purchased using any other liquidity pool assets, such as USDC, WETH, DAI, WBTC, etc. The GLP token cannot be traded and can be utilized to redeem the assets locked during the minting process. The minted GLP tokens are also eligible for staking rewards (25% on Avalanche and 31% on Arbitrum).

How To Use GMX?

The GMX exchange offers a viable alternative to traditional exchanges, allowing users to trade and earn by providing liquidity for market making. Trading requires no registration process or account, with users requiring only their wallets. Users can start a leveraged trade by setting their preference to “long” or “short.” Users can also access low-fee spot swaps, allowing them to swap between assets in the GLP pool. All open trades appear under the “positions” tab, and opening or closing a leveraged trade costs 0.1% of the position size.

Users can also stake their GMX tokens, earning a yield with boosted and compounded rewards.

In Closing

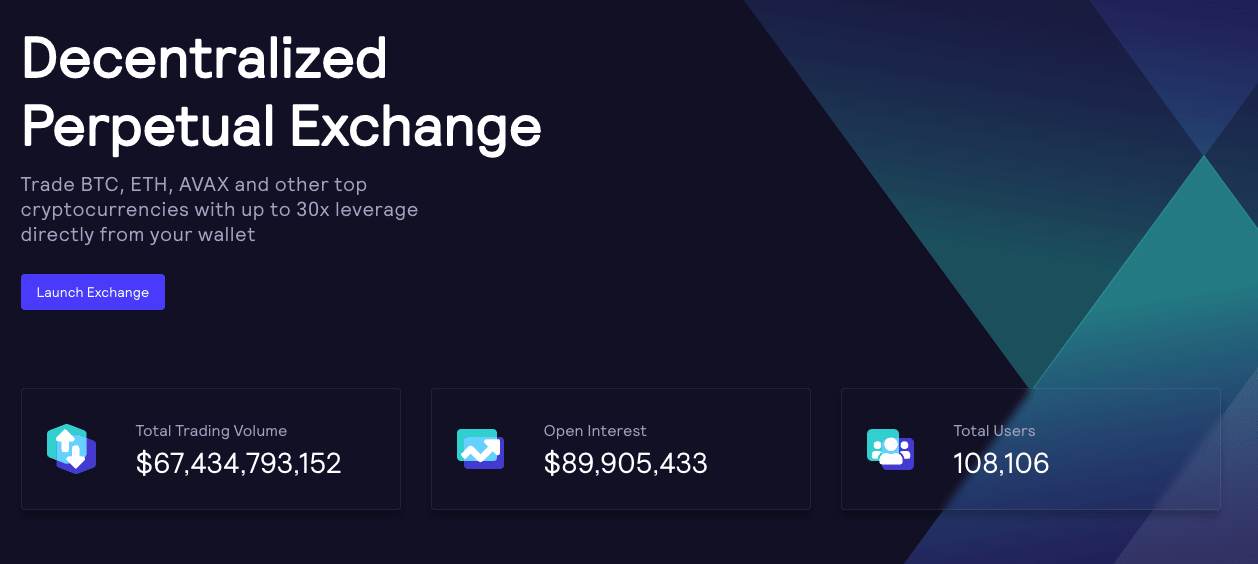

Currently, GMX Protocol has nearly 200,000 users and over $92 billion in total trading volume, and the protocol is fast making a name for itself. The protocol allows anyone with access to a crypto wallet to avail of its decentralized exchange services. With the protocol’s roadmap planned by its own GMX DAO, GMX is looking to become the most complete and user-friendly DEX for on-chain leverage trading.