Navigation

Navigation

How Bitcoin Payments Are Taking Over & Why You Should Care

In recent years, non-physical forms of payment have significantly grown in popularity to the extent that cashless payments have now overtaken the use of physical money in the UK.

One area of growth is the continued development and entry to market of cryptocurrencies. While Bitcoin is the most well-known, there are currently over 700 cryptocurrencies available to trade via online markets, making the options in the world of non-physical currency plentiful.

Total Processing are a payment gateway and merchant services provider. In this article, their Head of Operations, David Midgley, outlines what is driving this move to non-physical types of payment, focusing specifically on the advantages cryptocurrencies offer before highlighting the threats they could potentially face going forward.

When first released, cryptocurrencies were the preserve of online gamers as far as I was concerned. As they developed though, I took real notice and began to understand how revolutionary they could be. I wasn’t the only one either, as uptake has continued to increase to the point that there are now even Bitcoin ATM machines dotted across the globe.

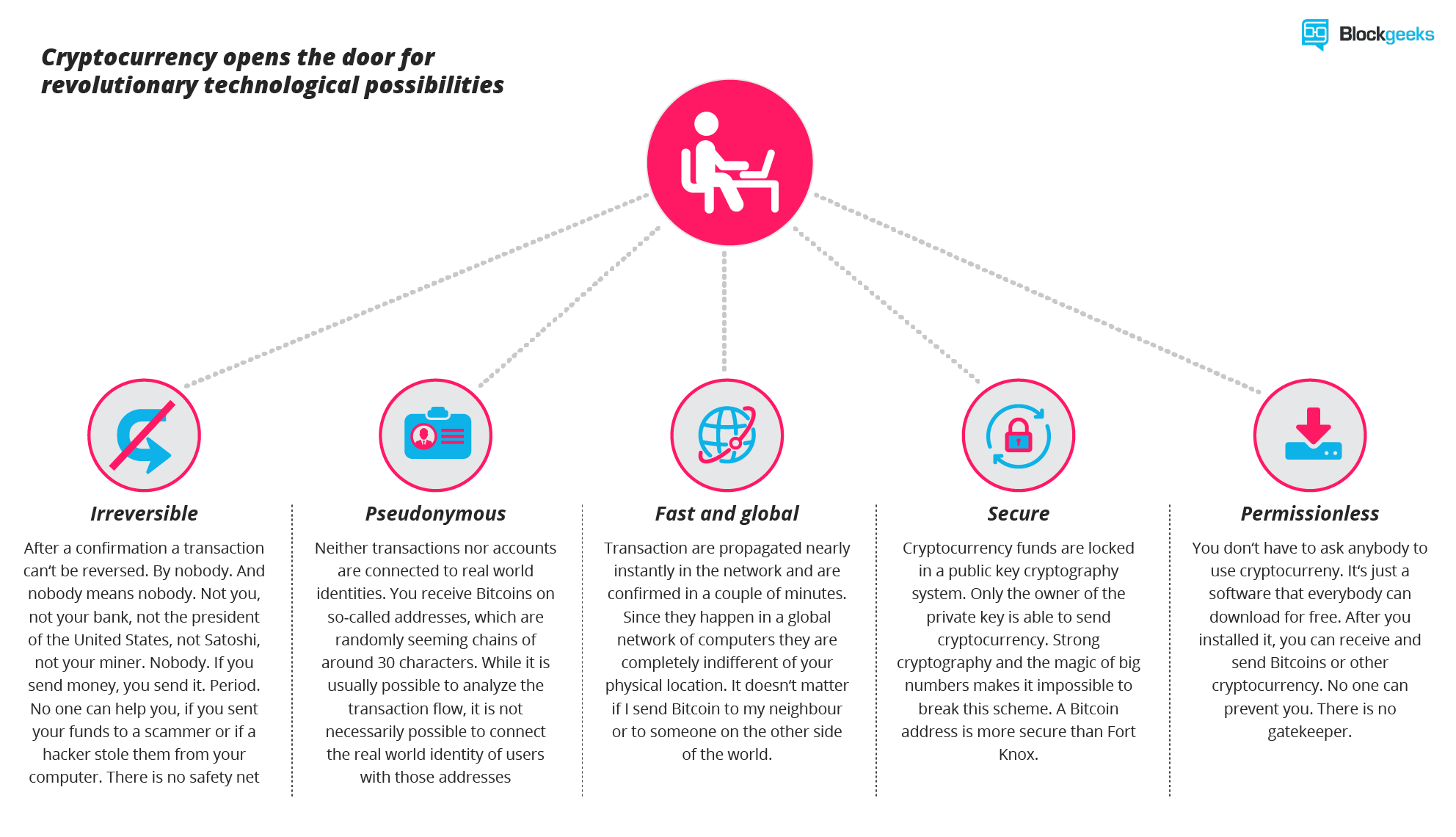

I am not surprised the use of cryptocurrencies is now widespread, as they offer a range of advantages and benefits over more traditional forms of currency.

Benefits of Cryptocurrency

Firstly, using cryptocurrency carries a number of security benefits; much like when you use your credit card to buy something online, cryptocurrencies require authentication in order to access them. Given many cryptocurrencies are decentralized, this means they are also less susceptible to online fraud. Finally, as it is a digital currency, it affords security from physical world-currency issues such as theft or loss.

Aside from the fact that it can’t be physically stolen, a cryptocurrency also has other advantages. For example, as the online security protecting it is so good, it theoretically can’t be lost or destroyed either. Unlike national currencies, cryptocurrencies are also borderless too. Therefore, they can be used to pay for goods from other countries without concern for issues such as currency fluctuation, transaction fees or commission.

A solid argument can also be made to say that cryptocurrencies are stronger, more robust and less susceptible to geopolitical and socio-economic effects than national currencies too. I say this as, in the majority of cases, cryptocurrencies aren’t directly linked to a nation or national economy. For example, while the value of a Bitcoin is shown in United States Dollar (USD) terms, it is not indexed against the USD, as other currencies are. Therefore, when Great Britain votes to leave The European Union, Bitcoin’s value against other currencies isn’t adversely affected as the British Pound was and continues to be, the value of a cryptocurrency doesn’t dip in response to Donald Trump’s election as President of the United States, as the USD did, and a cryptocurrency’s value doesn’t dip before bouncing back to a two-week high, as the Euro did continent-wide following the result of Italy’s constitutional referendum on Sunday.

However, that is not to say that a cryptocurrency couldn’t be adversely affected by geopolitical events. Cryptocurrencies have come under question as a potential source of terrorist financing, and I can see why. For example, ZCash is an open, permissionless system and requires zero-knowledge security. As noted previously, many cryptocurrencies are decentralized too. Therefore, the perception in some quarters that cryptocurrencies help to fund terrorist activities are going to persist, as the same guarantees of privacy and untraceable transitions that make them attractive to ordinary folk who simply value their privacy also makes them an ideal way for terrorists to move money around. This is why both The European Commission and the Australian government have announced they will be regulating cryptocurrencies as part of counter-terrorism measures. Therefore, it is possible other countries may follow suit. Seriously, I really wouldn’t be surprised if Donald Trump took to Twitter announcing he plans to ‘wage war’ on bitcoin.

When specifically considering Bitcoin payments, it should also be noted that it is now traded like a commodity. While I don’t see it falling significantly in value anytime soon, viable alternative cryptocurrencies have come to the fore in the last year or so. Therefore, as competitors gain traction in the market, it stands to reason bitcoin will at least lose some of its value as the demand for it lessens. As with any commodity, market forces still apply, and those who have invested heavily in bitcoin could make big losses.

Conclusion

bitcoin and other forms of payments have started to take over due to their added security benefits, their ability to be used across borders and robustness to world events. Even in the face of regulations by both Australia and The European Commission, bitcoin has continued to hold its value to the point it can be viewed as a viable investment opportunity as well as a secure and borderless currency. However, if the global superpowers of China, Russia or the USA begin to act, I would begin to worry about cryptocurrencies going forward. Given that much of this regulation has come about due to fears about terrorist financing, it would be advisable for cryptocurrency creators to be seen to find a way to prevent criminals from abusing their creations.

dissertation help derrida https://helpon-doctoral-dissertations.net/

best dissertation editing services https://dissertations-writing.org/

dissertation writing services mumbai https://mydissertationwritinghelp.com/

dissertation writing services near me https://help-with-dissertations.com/

defending a dissertation https://dissertationwriting-service.com/

dissertation title https://buydissertationhelp.com/

spooky slots 2015 https://slotmachinegameinfo.com/

free slots just for fun https://www-slotmachines.com/

ali baba slots game free https://411slotmachine.com/

brazilian beauty slots https://download-slot-machines.com/

free wms slots https://beat-slot-machines.com/

san manuel online slots https://slot-machine-sale.com/

vegas world slots free https://slotmachinesforum.net/

pop slots https://slotmachinesworld.com/

obama slots https://pennyslotmachines.org/

scatter slots https://freeonlneslotmachine.com/

free giants gold slots https://2-free-slots.com/

is plenty of fish a gay dating site? https://speedgaydate.com/

naked gay chat rooms https://gay-buddies.com/

gay video chat apps https://gaytgpost.com/

best website for senior gay dating https://gaypridee.com/

gay incest chat https://bjsgaychatroom.info/

2gratuit

[…] for years. But, even more importantly, the general public is paying more and more attention to bitcoin as a result. Validation, by the Lindy effect as well as the public’s’ increasing awareness […]

[…] for years. But, even more importantly, the general public is paying more and more attention to bitcoin as a result. Validation, by the Lindy effect as well as the public’s’ increasing awareness […]

[…] for years. But, even more importantly, the general public is paying more and more attention to bitcoin as a result. Validation, by the Lindy effect as well as the public’s’ increasing awareness […]

[…] of a global adoption of bitcoin we have an all-time high for the amount of transactions taking place on the bitcoin blockchain […]

[…] of a global adoption of bitcoin we have an all-time high for the amount of transactions taking place on the bitcoin blockchain […]

[…] of a global adoption of bitcoin we have an all-time high for the amount of transactions taking place on the bitcoin blockchain […]

Whatever technology is out there, it will be used by (many) regular people and (some) criminals. I dont think its on cryptocurrency creators more than on any other technology creators to try to mitigate criminal use. Also, what is criminal use is highly subjective – e.g. victimless crimes

Whatever technology is out there, it will be used by (many) regular people and (some) criminals. I dont think its on cryptocurrency creators more than on any other technology creators to try to mitigate criminal use. Also, what is criminal use is highly subjective – e.g. victimless crimes

Whatever technology is out there, it will be used by (many) regular people and (some) criminals. I dont think its on cryptocurrency creators more than on any other technology creators to try to mitigate criminal use. Also, what is criminal use is highly subjective – e.g. victimless crimes