Navigation

Navigation

How Not To Be Scammed By An ICO

…Application coin sales (often called “initial coin offerings” or ICOs) are a new form of crowdfunding and some can have as much legal merit as a Kickstarter or Indiegogo campaign…

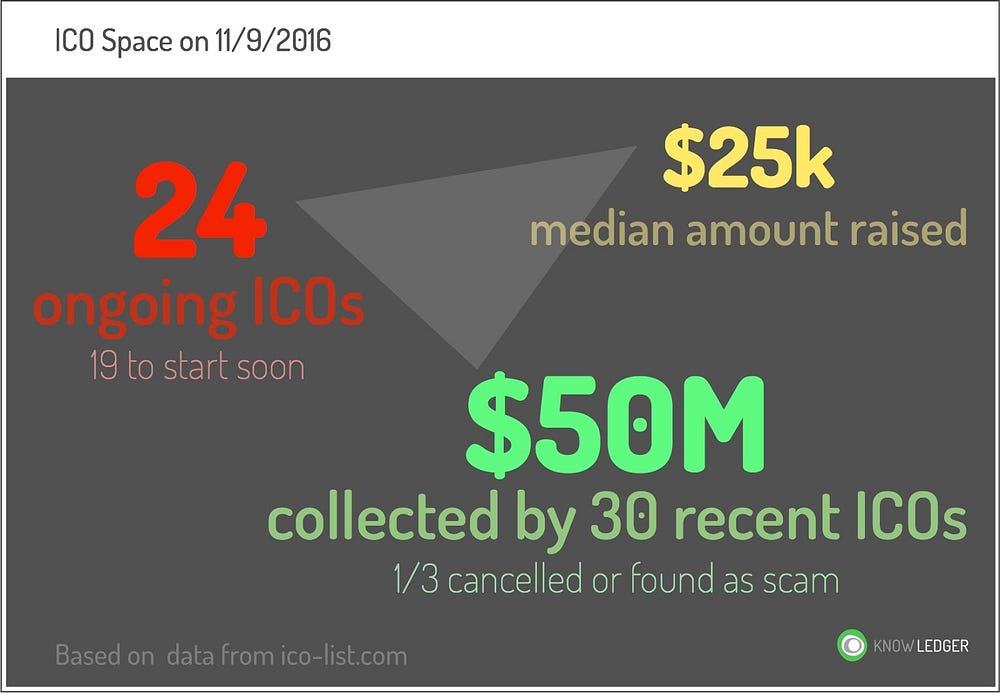

The Initial Coin Offering phenomenon has started to play a significant role in the crypto-startup world. Lately, more and more experts are looking to decentralized crowd-funding methods with interest.

But, the absence of legal guidelines in the operation of these ICOs has resulted in more than a few scams. This is hardly abnormal for an entirely new, unregulated field; but, would-be investors, nonetheless, find it difficult to discern potential opportunities from grab-the-money-and-run schemes.

If you look at lists of recent Initial Coin Offering campaigns it is really hard to come up with any sort of reasonable filter. There’s so much to be obviously skeptical of in this space that wealthier and experienced investors won’t even consider it — with good reason.

As with any investment, nothing in the Initial Coin Offering space can be predicted or proved with absolute certainty. Analysis of the team, style and quality of management, and even some basic managerial accounting data is not available in most case. Still, most ICO trackers try to combine lists of presumably relevant parameters such as: who holds the collected money (in many cases investors do not even know!), what kind of social network activity a given project can boast, and other seemingly disparate data.

Does this mean ICOs are all bad? Of course not. Knowledger prefers to apply some patience, best-practices and investment experience to avoid throwing the baby out with the bathwater..

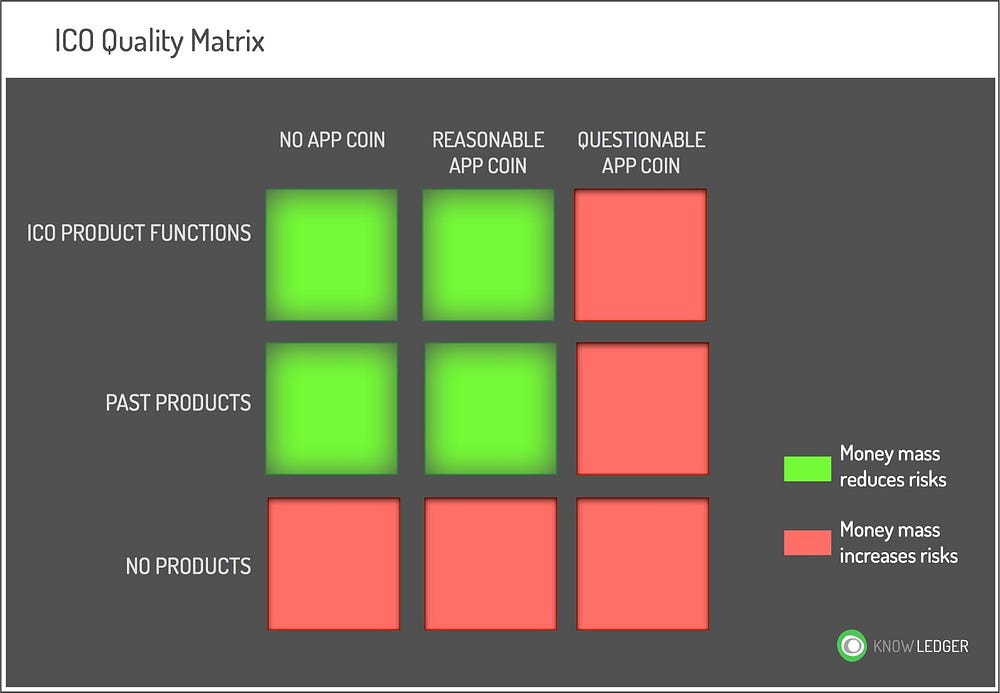

We think we have a working solution to help make an informed assessment of a given product in this domain. Despite the fact that most of the important parameters are not measurable, we found a simple and transparent matrix by which to judge a given ICO:

Product Dimension

Some people like to build parallels between ICOs and the IPOs of the modern technological era. But, this analogy is incongruent — the problem being that the great majority of projects behind ICOs can not present a functioning product or service. In older and less tumultuous times, one could probably make a good enough judgment by reputations of individual team members:

e.g.

“It’s not Tesla, but Elon is doing a new app…”

Such an approach doesn’t work in crypto-oriented startups because even if the product in question is projecting future success based on past achievements of one or more team members it will likely be a within different legal, work, and management structure as the previous product with no guarantees.

Another important thought to be aware of is that the amount of money raised by an ICO in no way directly translates to a corresponding quality of product. Marketing budgets, clever branding, great intro videos, SEO-wizards…all of these things can help attract attention, bring funds, and inflate perceptions.

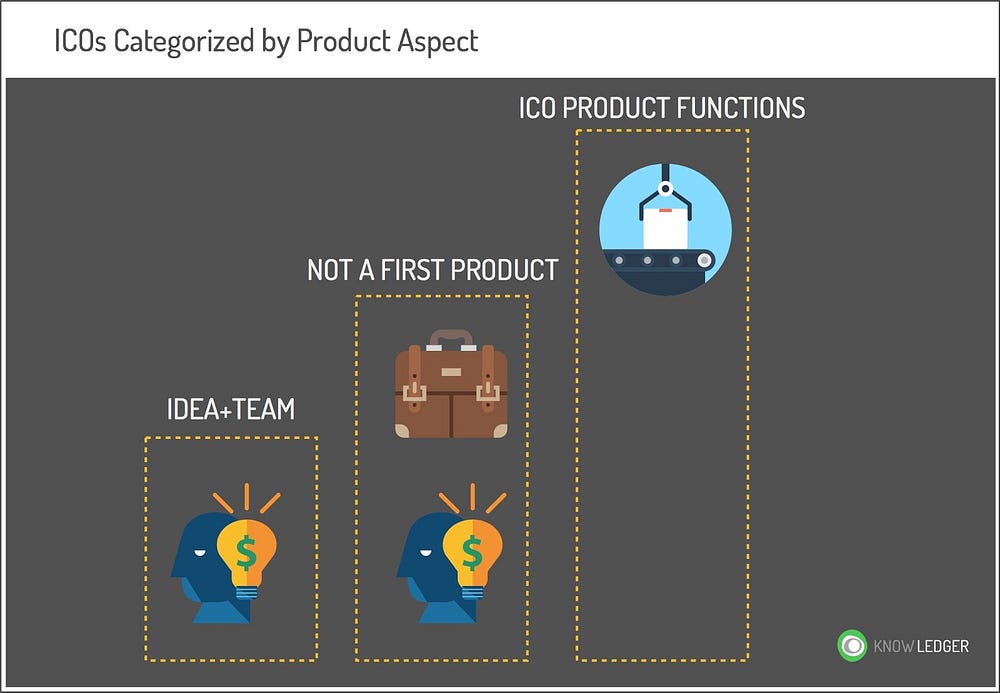

With this in mind, we have ranked ICO projects into three tiers:

- Lowest tier. No product. These projects lack anything users can touch or test. The company (or just a team if there’s no legal entity) presents only the project pitch and promise. Most of such projects — if not all — have GitHub accounts with some code; but, you would need a few full-time analysts to do even surface-level due diligence. Example: Waves Platform.Despite accumulating nearly twenty million USD during the ICO there’s still no such thing as Waves Platform

- Middle tier. Second/third/etc product. Example: Iconomi. The ICO result was also impressive: over ten million USD raised. Neither the Iconomi fund — the face product for the ICO — nor any clear full-scale technical description exists. Founders do not try to hide, though. They have Cashila — a great and well accepted product that has been around for a couple of years making many bitcoiners’ lives easier. The existence and usefulness of the team’s previous product seems to be enough of a promise for Iconomi investors.

- Highest tier. Functioning product. Rarely, does a project fall into this category by offering a usable iteration of their product during the ICO. Example: Ethereum.

Coin Dimension

The middle and most important word in the ICO acronym is “coin”. We’ve written about how difficult it might be for a project to “coinify” itself. Sales of “coins” didn’t become the new type of crowdfunding overnight. The first appcoins were merely trying to repeat the success of bitcoin and were mostly clones of it in technical sense. Later deviations became greater, alternative coins got transformed from cryptocurrency to “application coins” and this is where things got really mixed up.

The basic borderlines, however, remained where they were from the very beginning. Thus, projects can further be judged through a second set of criteria and fall into these three categories:

- Lowest category. A senseless app coin claim made. Examples are numerous, unfortunately. It is very hard to explain why KimDotCom’s project is okay with bitcoins while Steemit, Incent, Chronobank and dozens others are not. These coins have very little chance of success due to a) being fundamentally superfluous and b) trying to survive under strong speculative pressure.

- Middle category. There is an app coin and it is really needed, it is part of product’s essence. Example: Mass Network. This kind of project is very rare. They are generally less attractive compared to straight-forward DAOs (distributed autonomous organization) because it is extremely difficult to keep your inner currency, the blood of your product’s organism, in the needed temperature range under the pressure of free markets filled with short term traders (and hackers too).

- Highest category. No appcoin claim. Projects in this category do not try to create an “inner currency” proving this way or another that normal money (or even BTC) are not good enough for them. Such projects are basically incorporated companies or stable teams transforming their organization into a formalized form of a DAO with voting, petitions, and budgeting put on safe, distributed rails. This case is the closest to “normal” IPO when companies just change their form of ownership via a general public offering for individual ownership of equities. Example: Iconomi.

Mapping the ICO Space

Our map divides the space into a nine-slot matrix with positive and negative spaces determined at various intersections. An interesting application of this map is measuring the risk parameter of your portfolio if you own a bunch of coins. There’s a simple set of rules we suggest:

- Comparing two assets both in the negative territory: the greater the amount of money already collected by a project in the negative territory the greater your risk associated with owning its coins; negative-territory projects — lacking solid grounds in the first place — become even less stable when they grow larger.

- Follow the contrary rule when comparing two assets that are both in the positive territory: the greater the amount collected by a project in the positive territory the lower your risk associated with owning its coins.

- And, it goes without saying, one should avoid investing in ICOs with negative characteristics at all. Of course, sometimes there are factors that prevail, such as large “early-bird” bonuses making speculative investment more worthwhile.

need help with my dissertation https://helpon-doctoral-dissertations.net/

dissertation memes https://dissertations-writing.org/

dissertation completion pathway https://mydissertationwritinghelp.com/

online dissertation help hu berlin https://help-with-dissertations.com/

dissertation titles https://dissertationwriting-service.com/

buy dissertation writing services https://buydissertationhelp.com/

slots machine https://slotmachinegameinfo.com/

play free casino slots https://www-slotmachines.com/

free slots just for fun https://411slotmachine.com/

free slots/penny https://download-slot-machines.com/

sun

liberty slots casino https://slot-machine-sale.com/

real vegas slots https://slotmachinesforum.net/

wonder woman slots https://slotmachinesworld.com/

casino slots free games https://pennyslotmachines.org/

wms slots https://candylandslotmachine.com/

mobile deluxe slots https://freeonlneslotmachine.com/

triple seven slots free https://2-free-slots.com/

adam for adam gay online dating hookups https://speedgaydate.com/

free boys gay chat https://gay-buddies.com/

gay sissie chat https://gaytgpost.com/

dating a bipilar gay guy https://gaypridee.com/

gay sissie chat https://bjsgaychatroom.info/

2elevate

How does one start a white page and launch an ico?

How does one start a white page and launch an ico?

How does one start a white page and launch an ico?

[…] US regulators are starting to crack down on previously unregulated cryptocurrency activities. Take initial coin offerings (ICOs) for example. Despite their popularity, many ICOs are for new cryptocurrencies with speculative business models, and have been widely criticized as scams. […]

[…] US regulators are starting to crack down on previously unregulated cryptocurrency activities. Take initial coin offerings (ICOs) for example. Despite their popularity, many ICOs are for new cryptocurrencies with speculative business models, and have been widely criticized as scams. […]

[…] US regulators are starting to crack down on previously unregulated cryptocurrency activities. Take initial coin offerings (ICOs) for example. Despite their popularity, many ICOs are for new cryptocurrencies with speculative business models, and have been widely criticized as scams. […]

[…] US regulators are starting to crack down on previously unregulated cryptocurrency activities. Take initial coin offerings (ICOs) for example. Despite their popularity, many ICOs are for new cryptocurrencies with speculative business models, and have been widely criticized as scams. […]

[…] US regulators are starting to crack down on previously unregulated cryptocurrency activities. Take initial coin offerings (ICOs) for example. Despite their popularity, many ICOs are for new cryptocurrencies with speculative business models, and have been widely criticized as scams. […]

[…] US regulators are starting to crack down on previously unregulated cryptocurrency activities. Take initial coin offerings (ICOs) for example. Despite their popularity, many ICOs are for new cryptocurrencies with speculative business models, and have been widely criticized as scams. […]

[…] US regulators are starting to crack down on previously unregulated cryptocurrency activities. Take initial coin offerings (ICOs) for example. Despite their popularity, many ICOs are for new cryptocurrencies with speculative business models, and have been widely criticized as scams. […]

[…] US regulators are starting to crack down on previously unregulated cryptocurrency activities. Take initial coin offerings (ICOs) for example. Despite their popularity, many ICOs are for new cryptocurrencies with speculative business models, and have been widely criticized as scams. […]

[…] US regulators are starting to crack down on previously unregulated cryptocurrency activities. Take initial coin offerings (ICOs) for example. Despite their popularity, many ICOs are for new cryptocurrencies with speculative business models, and have been widely criticized as scams. […]

Very useful criteria to assist a relative newcomer to the cryptocurrency space to discern what is a genuinely promising opportunity and what is not.

Very useful criteria to assist a relative newcomer to the cryptocurrency space to discern what is a genuinely promising opportunity and what is not.

Very useful criteria to assist a relative newcomer to the cryptocurrency space to discern what is a genuinely promising opportunity and what is not.

[…] мы столкнулись с новым явлением, так называемым ICOs (Первичным размещением криптовалюты), по аналогии с IPO (Первичным размещением акций). С […]

[…] мы столкнулись с новым явлением, так называемым ICOs (Первичным размещением криптовалюты), по аналогии с IPO (Первичным размещением акций). С […]

[…] мы ÑтолкнулиÑÑŒ Ñ Ð½Ð¾Ð²Ñ‹Ð¼ Ñвлением, так называемым ICOs (Первичным размещением криптовалюты), по аналогии Ñ IPO (Первичным размещением акций). С […]

[…] мы столкнулись с новым явлением, так называемым ICOs (Первичным размещением криптовалюты), по аналогии с IPO (Первичным размещением акций). С […]

[…] мы столкнулись с новым явлением, так называемым ICOs (Первичным размещением криптовалюты), по аналогии с IPO (Первичным размещением акций). С […]

[…] мы ÑтолкнулиÑÑŒ Ñ Ð½Ð¾Ð²Ñ‹Ð¼ Ñвлением, так называемым ICOs (Первичным размещением криптовалюты), по аналогии Ñ IPO (Первичным размещением акций). С […]

Wow, you just earned my follow! Thank you!

Wow, you just earned my follow! Thank you!

Wow, you just earned my follow! Thank you!

[…] and how the various stakeholders are incentivized in an era of blockchain and tokenization. The new ICO’s (Initial Coin Offerings) that are fueling projects like Ethereum may be the latest iteration of corporate […]

[…] and how the various stakeholders are incentivized in an era of blockchain and tokenization. The new ICO’s (Initial Coin Offerings) that are fueling projects like Ethereum may be the latest iteration of corporate […]