Navigation

Navigation

Blockchain vs Fiat: A Confrontation of Ages

|

|

Disclaimer: The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of Blockgeeks

A fresh look at the difference between monetary systems and convergence possibilities

Image by Jean–Léon Gérôme

Alex Kontegna (December 2016)

It’s been almost a decade, and we are still trying to explain why blockchain money is any better than fiat or “money as usual.” Sadly, this topic has already become a huge bore. The basic premises of decentralized banking, deflationary currency, libertarian economics, and the theoretical fraud-resistance of blockchains has mostly fallen on deaf ears.

To be sure, there is a real battle raging between two different approaches to monetary control—between old and new power structures. And, where these two meet, overlap, mix, and compete is where the real action is! To be a fly on the wall during the board meetings of financial institutions or to hear the pitch of some upstart “blockchain financial technologist” to these giants of financial clout would be equally entertaining as exhilarating. Lacking access, though, we do not get to see the essence of the backroom deals between the fiat bigwigs and the new blood of crypto startups.

What are they are up to?

What’s going on inside those consortia which try to implement “private” blockchain architecture for banks? Why did Goldman Sachs, Banco Santander, and others flee from R3CEV? Did they discover such a bright engineering insight that it must not be shared? What do they really think about what is likely to be the futility of hand-reared blockchains? There are no definite answers from behind the wall, just “expert” speculations.

But, there are places where one can observe the contact between fiat and blockchain in real time. Those are the startups that offer “assets-over-blockchain” services. Some of them are actively promoting themselves trying to pull banks and even central banks into their orbit. Technically, the essence of such service is primitive. Blockchain-based tokens have a nominal next-to-zero face value on the native network. What gives them value is the inclusion of metadata that records someone’s promise of something in the physical world. We have had some engagement with two of such startups. One does the transport of a meta-coin on top of Bitcoin, another uses more natural Solidity tools to do the same on Ethereum.

Here’s some new interesting contradictions and misunderstandings we have learned there. That really added to our perception of the fiat-blockchain difference, and we would like to share that with you.

Ordinary Miracles

Dealing with something familiar, one is hardly expected to change her basic understanding of the matter. Fiat money as they are today can not be perceived correctly at the conventional level of thinking; there’s no “intuitive” mind gate there. Fiat is not simple. It cannot be described without care in the use of the terms. Once we clearly define the concepts and start using them in a formally correct way, it turns out that fiat is an unnatural and pathological thing. However, it is important to realize that the only way of thinking about money that currently exists in the banking reality is terms of fiat.

Entrepreneurs who move towards fiat-associated services from a blockchain/bitcoin background base their thought pattern on experience with Bitcoin and Ethereum. They perform a very clear and correct technological thinking about payments. But at the same time, highly inappropriate thinking.

Blockchainers address a bank with something like this: “Here are your tokens, they are like cash “traveling” from point A to point B and further to point C in a reliable, convenient and extremely inexpensive way. Glue some value to these tokens by backing the promise with some reserves or your reputable name. Then, Profit!”

Why do they always miss?

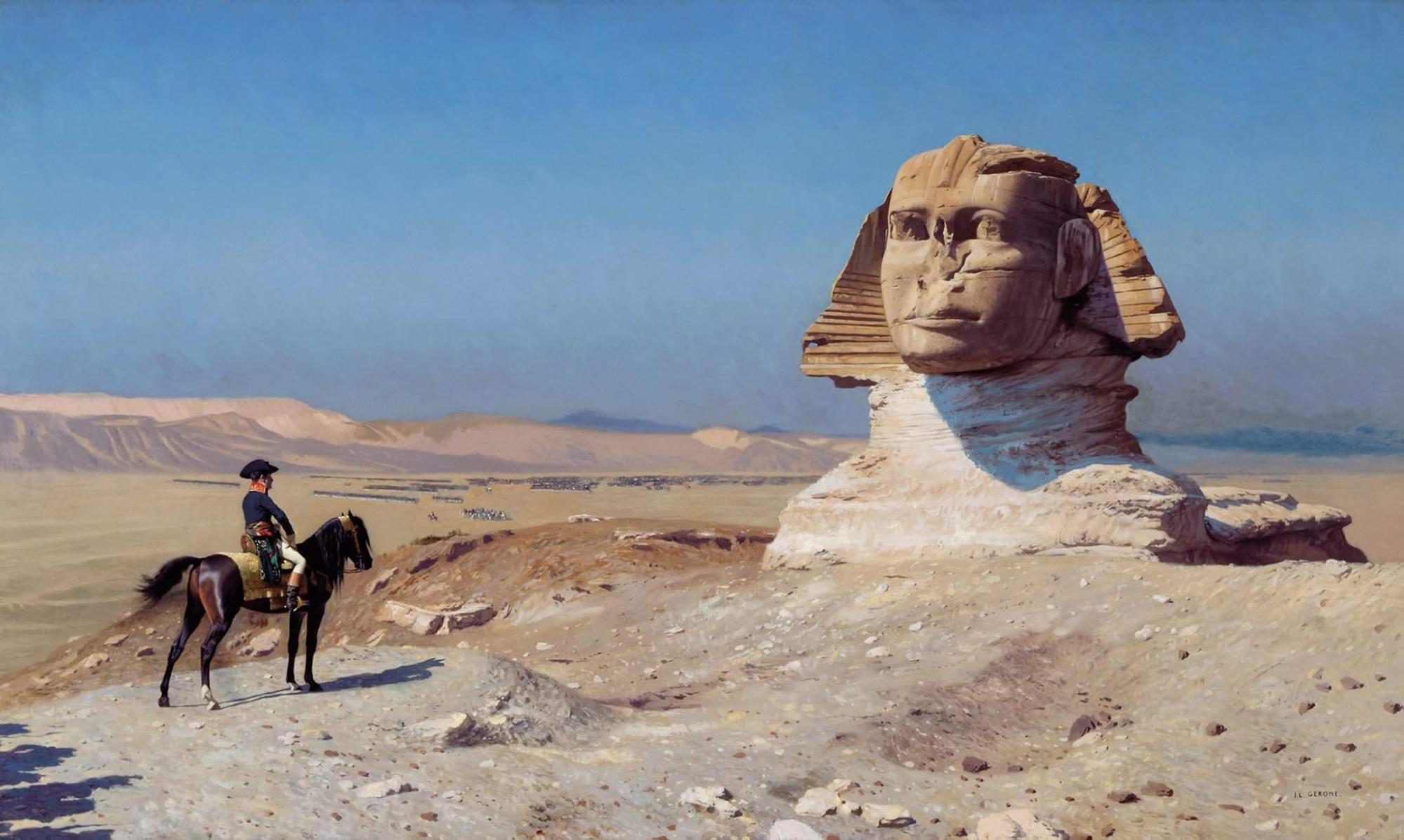

Here is why: the diagram above shows the single quantum (the minimum existing element) of money. Perhaps we should note that we consider a quantum in payments context, so we don’t talk of some abstract static investment penny. The rest should be self-explanatory: there are at least five participants, located on at least three levels. If you think in bitcoiner terms, each “coin” dies on the settlement level with a clone being sent to the payee.

So, what’s the main point? There is no transfer from A to B at all ever! The only exception is paper cash. But the key words here are “THE only exception.” It is impossible to make “new cash” or “crypto cash.” Inside a banking brain, “just like cash” has no meaning. Payments could be different. There could be hundreds of variations of the above scheme, and they are, with infinite complications but with no simplifications ever. It is impossible to “cash” if it’s not actually cash.

Here’s another important thing. Not only there is no such thing as a direct transmission from payer A to payee B, but also, there is no money in existence to consider unless the full set of participants is in place and watching. No observers, no money. That’s really a time to recall Schrodinger and his cat! This phenomenon is not even seriously considered in the blockchain community. Also, we should mention some weak echoes of that in the rhetoric of the “trust-less-ness” (the absence of a need for authority who is trusted by all parties to the deal). We now see that the phenomenon occurs on a much deeper fundamental level.

Last but not least: at each stage, a live system of communication and the format of the messages (clearing) are present. They also constitute the money being an integral part of its quantum. One can’t just replace or tune any component. When we talk [fiat] money, it is not the law that follows but the technology, always being behind the law. The inalienability of the communication system entails the aspect of size. In fiat, different sizes of payments mean different networks. Those networks have substantial fundamental differences not only in accessibility of institutions participating but also in many purely technological senses. In the United States, for example, there are many levels of intermediary bodies and networks, such as Fedwire Funds Service, Clearing House Interbank Payments System, the Automated Clearing House, and others. Systems of the different levels are not directly compatible.

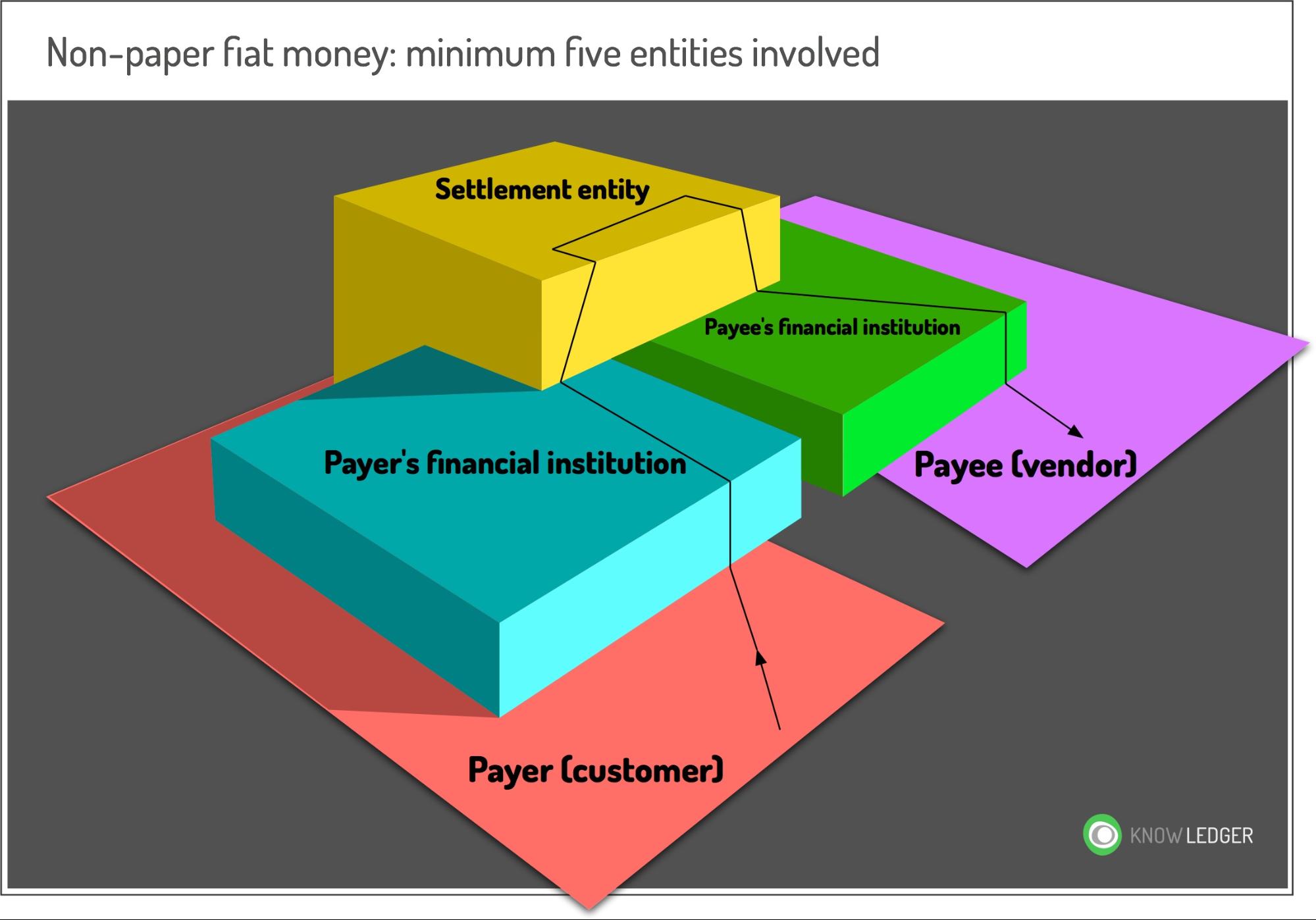

It turns out that big money, smaller money, and small money—are all different things of different nature. Making it even less natural, even within the same category, different countries host both incompatible and structurally different system of fundamentally different accessibility class. The table below shows the distribution of participants of various payment networks with an average number of the operations they perform. The difference amounts to hundred folds. From a blockchainer’s point of view, it’s an absurdity and inconvenience. Should a technologist prepare a framework for mice in one country, bringing it elsewhere to only find stegosaurus and no mice?

Source: Michael Tompkins, Bank of Canada, data from Committee on Payments and Market Infrastructures (CPMI), Statistics on Payment, Clearing and Settlement Systems in CPMI Countries, BIS, September 2015.

How miserable would an entrepreneur selling “assets-over-blockchain” to a bank appear as he starts his “pitch” with “p2p transfer of independently existing tokens”. A five words phrase containing three non-existent phenomena. Adding a psychological error to the terminology, one expresses the puzzlement of bankers lacking enthusiasm. Apparently, this is due to an incomplete understanding of the new technology, he thinks. No, it isn’t. The fact is that the above described inner fiat meanings are embedded and imprinted into bankers’ native thinking. A banker hears the story, comprehends an extremely broken—up to the illegibility of the message—language but still, no clear explanation comes to his mind.

How else should we explain to ourselves that the maximum success of fiat-over-blockchain projects over these years are the marginal examples of Barbados dollars and Crypto-bahts?

No Fools Around Here

Let’s try to get back to the big banks’ private party and knock on the back door with our own understanding of their reasoning, with the retranslated vision they have their mind trapped within a banker’s brain.

Bankers are not idiots. They crave something like the blockchain, its directness, and naturalness. Most of them are ordinary technicians and businessmen, not clearing the political consequences of fiat’s displacement. They should see perfectly that when it gets to money engineering, blockchain really is how it should be arranged. Less caring whether it is bitcoin or Corda. IBM and its division, Institute for Business Value, has recently conducted a study which revealed that in only one year about 15% of banks will be ready for field tests of blockchain technologies. 15%! Going live and commercial! A stunning 65% of respondents have expressed the same willingness but on a three-year horizon. IBM itself, by the way, can’t be blamed for stupidity and ignorance either: it is participating in building the Hyperledger and promoting a cloud-blockchain hybrid, Bluemix.

I have already written that banks are crypto-enthusiasts’ allies, not foes. But they too, just can’t change the rules and laws quickly. Moreover, at certain high levels, they will be rejected and asked to leave.

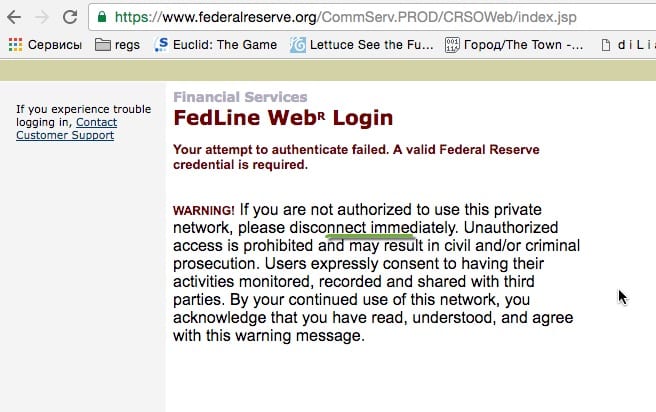

An extremely angry off-entrance pivoting on the site of the Holy of holies of our materialistic world.

To summarize, selecting from blockchain-driven fiat supporters and bankers not immune to blockchain ideas we would jump on the bank train. The former are really bad yet. Unfortunately, banks are soon to hit the limits and prohibitions too. Technological obstacles will join the legal ones and the block will become fundamental. One way or another, but the climax is approaching quickly. Not sure if Chandler Guo is right but he believes that every country that prints its own money is literally controlled by five or so families, who essentially compete for the opportunity to print. This opportunity they once in awhile hand to each other has recently started to change hands with accelerating frequency.

uw madison help with dissertation https://helpon-doctoral-dissertations.net/

what is a phd dissertation https://dissertations-writing.org/

dissertation citation chicago https://mydissertationwritinghelp.com/

ucla dissertation filing https://help-with-dissertations.com/

online dissertation help united kingdom https://dissertationwriting-service.com/

capstone vs dissertation https://buydissertationhelp.com/

free las vegas slots https://slotmachinegameinfo.com/

igt video slots free play https://www-slotmachines.com/

wow equipment slots https://411slotmachine.com/

better off ed slots https://download-slot-machines.com/

sun

interactive slots https://slotmachinesforum.net/

skill slots app smt4a https://slotmachinesworld.com/

scorchy slots guide https://pennyslotmachines.org/

free slots cleopatra https://candylandslotmachine.com/

scatter slots by murka https://freeonlneslotmachine.com/

armor slots https://2-free-slots.com/

gay teen dating sites https://speedgaydate.com/

free chat with men – live gay cams, free gay webcams at chaturbate https://gay-buddies.com/

gay dating app for over 50 https://gaypridee.com/

2madeira

Fundamentally, in this new (emerging) paradigm of human existence, structures/systems that lack integrity/well-being will be unsupported/incompatible and will gradually (perhaps uncomfortably) go extinct. This is the great shift of the ages we are in.

Fundamentally, in this new (emerging) paradigm of human existence, structures/systems that lack integrity/well-being will be unsupported/incompatible and will gradually (perhaps uncomfortably) go extinct. This is the great shift of the ages we are in.

Fundamentally, in this new (emerging) paradigm of human existence, structures/systems that lack integrity/well-being will be unsupported/incompatible and will gradually (perhaps uncomfortably) go extinct. This is the great shift of the ages we are in.

Although it’s nice to be indirectly mentioned in the article I have to respectfully disagree with Alex on a few points.

What we offer with our CryptoCash is simply a new rails to move money from A to B and yes, P2P, just like bitcoin or ether. Like other forms of payments, EFT uses ACH to move, wire transfers use SWIFT to move, and banknotes use armored trucks to move. There is no difference between CryptoCash and money order, except that one is issued on blockchain and another is on paper.

True, in conventional financial system indeed “there is no transfer from A to B at all ever” but in the blockchain world there is no other way to transfer value other than directly from A to B.

I never pitch this to a banker for a one simple reason: They.Don’t.Need.It.

And why would they? Everything is just fine in the banking world. They are making money without blockchain.

Who needs it? Those who can’t use banks or want to compete with them. 2.5M of un(der)banked folks, MSBs, and telecoms. We tested Cryptocash and it works! People see this is super easy way to move money internationally outside the banking system, and it creates business to the money exchangers. Our one small article about 100 migrants sending money home got us attention from the bunch of money industry players.

We are at the infant stage of this. And why nobody else is doing it ? Because it’s Too.Damn.Hard.

*I got my popcorn ready. Waiting for rebuttals 🙂

kontegna Thoughts 🙂 ???

Although it’s nice to be indirectly mentioned in the article I have to respectfully disagree with Alex on a few points.

What we offer with our CryptoCash is simply a new rails to move money from A to B and yes, P2P, just like bitcoin or ether. Like other forms of payments, EFT uses ACH to move, wire transfers use SWIFT to move, and banknotes use armored trucks to move. There is no difference between CryptoCash and money order, except that one is issued on blockchain and another is on paper.

True, in conventional financial system indeed “there is no transfer from A to B at all ever” but in the blockchain world there is no other way to transfer value other than directly from A to B.

I never pitch this to a banker for a one simple reason: They.Don’t.Need.It.

And why would they? Everything is just fine in the banking world. They are making money without blockchain.

Who needs it? Those who can’t use banks or want to compete with them. 2.5M of un(der)banked folks, MSBs, and telecoms. We tested Cryptocash and it works! People see this is super easy way to move money internationally outside the banking system, and it creates business to the money exchangers. Our one small article about 100 migrants sending money home got us attention from the bunch of money industry players.

We are at the infant stage of this. And why nobody else is doing it ? Because it’s Too.Damn.Hard.

*I got my popcorn ready. Waiting for rebuttals 🙂

kontegna Thoughts 🙂 ???

Although it’s nice to be indirectly mentioned in the article I have to respectfully disagree with Alex on a few points.

What we offer with our CryptoCash is simply a new rails to move money from A to B and yes, P2P, just like bitcoin or ether. Like other forms of payments, EFT uses ACH to move, wire transfers use SWIFT to move, and banknotes use armored trucks to move. There is no difference between CryptoCash and money order, except that one is issued on blockchain and another is on paper.

True, in conventional financial system indeed “there is no transfer from A to B at all ever” but in the blockchain world there is no other way to transfer value other than directly from A to B.

I never pitch this to a banker for a one simple reason: They.Don’t.Need.It.

And why would they? Everything is just fine in the banking world. They are making money without blockchain.

Who needs it? Those who can’t use banks or want to compete with them. 2.5M of un(der)banked folks, MSBs, and telecoms. We tested Cryptocash and it works! People see this is super easy way to move money internationally outside the banking system, and it creates business to the money exchangers. Our one small article about 100 migrants sending money home got us attention from the bunch of money industry players.

We are at the infant stage of this. And why nobody else is doing it ? Because it’s Too.Damn.Hard.

*I got my popcorn ready. Waiting for rebuttals 🙂

kontegna Thoughts 🙂 ???

Alex,

I c the blockchain (TAU chain) as best means to fund ‘sate of the art’ transport/infrastructure ($blns required). The infrastructure owned/operated by its chain funders/contributors. Funders of the chain can contribute fiat currency, Bitcoin. gold/silver/palladium backed crypto-currencies, etc. A company manages the chain to construct the ‘sate of the art’ infrastructure (e.g. ET3); the owners of he blockchain receive revenue (e.g. fiat, cryoto, metals, etc) through services provided via ‘sate of the art’ infrastructure. ET3 infrastructure can transport 94% of all goods (e.g. LNG, freight, food, sewage, garbage, people, etc); 400/4000mph local/int’l; all automated (the Physical Internet, Physcial World Wide Web).

http://www.ET3.NL

My question is this:

How much money do you think is needed to launch a website, adopting TAUs block-chain software?

Alex,

I c the blockchain (TAU chain) as best means to fund ‘sate of the art’ transport/infrastructure ($blns required). The infrastructure owned/operated by its chain funders/contributors. Funders of the chain can contribute fiat currency, Bitcoin. gold/silver/palladium backed crypto-currencies, etc. A company manages the chain to construct the ‘sate of the art’ infrastructure (e.g. ET3); the owners of he blockchain receive revenue (e.g. fiat, cryoto, metals, etc) through services provided via ‘sate of the art’ infrastructure. ET3 infrastructure can transport 94% of all goods (e.g. LNG, freight, food, sewage, garbage, people, etc); 400/4000mph local/int’l; all automated (the Physical Internet, Physcial World Wide Web).

http://www.ET3.NL

My question is this:

How much money do you think is needed to launch a website, adopting TAUs block-chain software?

Alex,

I c the blockchain (TAU chain) as best means to fund ‘sate of the art’ transport/infrastructure ($blns required). The infrastructure owned/operated by its chain funders/contributors. Funders of the chain can contribute fiat currency, Bitcoin. gold/silver/palladium backed crypto-currencies, etc. A company manages the chain to construct the ‘sate of the art’ infrastructure (e.g. ET3); the owners of he blockchain receive revenue (e.g. fiat, cryoto, metals, etc) through services provided via ‘sate of the art’ infrastructure. ET3 infrastructure can transport 94% of all goods (e.g. LNG, freight, food, sewage, garbage, people, etc); 400/4000mph local/int’l; all automated (the Physical Internet, Physcial World Wide Web).

http://www.ET3.NL

My question is this:

How much money do you think is needed to launch a website, adopting TAUs block-chain software?

Great article! We are definitely gearing up for a big confrontation.

kontegna – what do you think about Senegal’s attempt to introduce blockchain-based currency?

People of Senegal have mobiles now without having home telephones before that. Similarly, they might jump directly from the “unbanked” stage to the blockchain-based national monetary system.

I Will bet on it!

Sounds about right – not just with banking but leap-frogging all kinds of legacy systems i.e. energy, education, healthcare etc and going straight into a ones that have integrity form the get go. I expect Africa to be a leader in many ways over the next 5 decades, having very little to unlearn relative to western society.

Great article! We are definitely gearing up for a big confrontation.

kontegna – what do you think about Senegal’s attempt to introduce blockchain-based currency?

People of Senegal have mobiles now without having home telephones before that. Similarly, they might jump directly from the “unbanked” stage to the blockchain-based national monetary system.

I Will bet on it!

Sounds about right – not just with banking but leap-frogging all kinds of legacy systems i.e. energy, education, healthcare etc and going straight into a ones that have integrity form the get go. I expect Africa to be a leader in many ways over the next 5 decades, having very little to unlearn relative to western society.

Great article! We are definitely gearing up for a big confrontation.

kontegna – what do you think about Senegal’s attempt to introduce blockchain-based currency?

People of Senegal have mobiles now without having home telephones before that. Similarly, they might jump directly from the “unbanked” stage to the blockchain-based national monetary system.

I Will bet on it!

Sounds about right – not just with banking but leap-frogging all kinds of legacy systems i.e. energy, education, healthcare etc and going straight into a ones that have integrity form the get go. I expect Africa to be a leader in many ways over the next 5 decades, having very little to unlearn relative to western society.