Contents

|

|

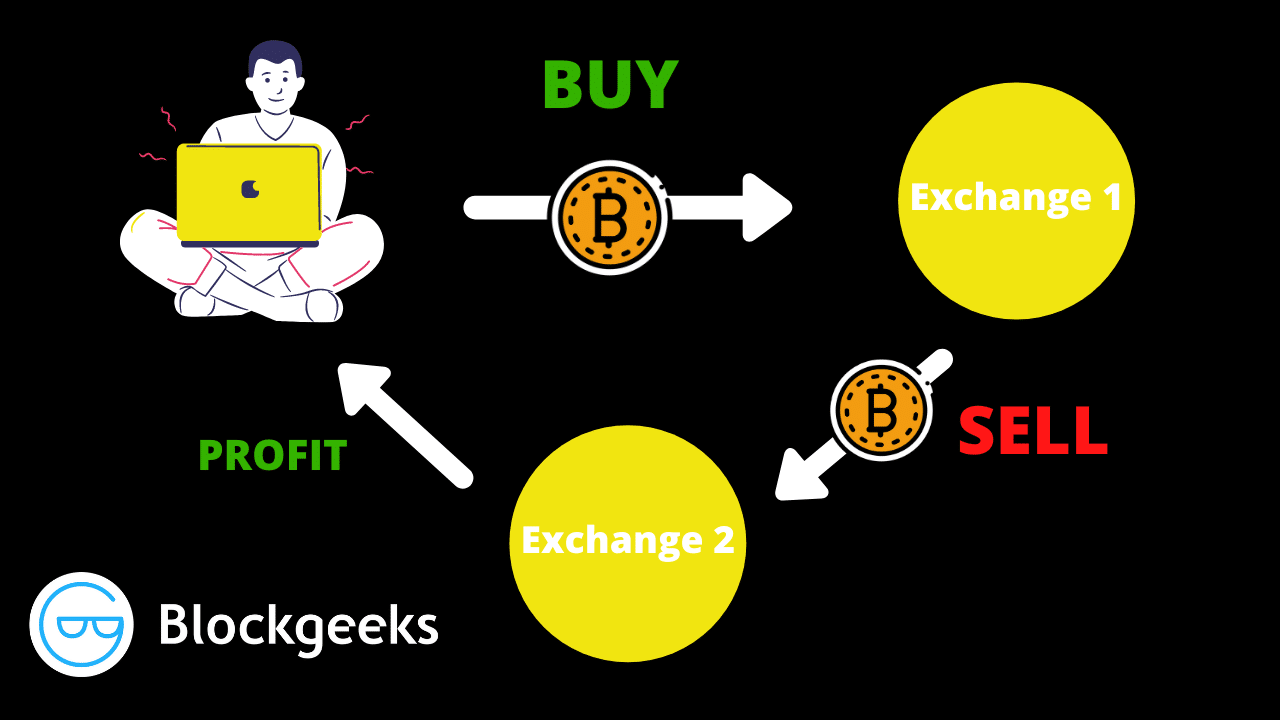

Crypto arbitrage opportunities exist where there is a price difference between two or more exchanges.

Arbitrage is the process of buying and selling some assets which usually happens simultaneously. It involves finding and trading assets that cost different in different markets. With arbitrage, you can benefit from a price difference between two or more markets, by purchasing an asset in one market and selling it in another to profit off the price difference.

Contents

The Beginner’s Guide to Crypto Arbitrage

Ever wondered why the price of bitcoin differs from exchange to exchange?

The primary goal of crypto arbitrage is to generate profit. There are hundreds of exchange platforms with a large price distribution, which creates room for price differences due to imbalances in supply and demand. Given the fact that price discovery is done separately for each exchange, you have large exchanges with liquidity driving the price and then small ones following them.

There are two main types of crypto arbitrage:

- Simple Arbitrage

- Triangular Arbitrage

In the context of cryptocurrency arbitrage, both simple arbitrage and triangular arbitrage are common and similar to some extent. Both methods require high-speed networks, low latency, and they both have almost zero-level risk.

How crypto arbitrage works

For simple crypto arbitrage opportunities, make sure that you have registered for accounts on two exchange platforms: For example, exchange – 1 (Binance) and exchange – 2 (Kraken).

Both exchanges have a common pair of assets – Ripple (XRP) against Bitcoin (BTC).

Each exchange has its order book. At the top of the order book is usually the highest bid price, which is the highest price that the trader is willing to pay to buy an XRP. Besides, we have the lowest ask price, which is the price to which the trader is looking to sell their XRP.

However, the bid and ask prices in one exchange should not be equal to the bid and ask prices in the second exchange.

The difference in bid and ask prices in two exchanges is due to the cryptocurrency market being illiquid. As a result, we frequently observe different prices in different exchanges, especially the imbalance in cryptocurrency prices between South Korean exchanges and foreign exchanges.

This inefficiency is no less than a blessing in disguise which creates a crypto arbitrage opportunity.

In the first exchange, for instance, when purchasing some Ripple at a market price, we will pay the lowest ask price. As opposite to this when we sell the same Ripple in the second exchange, we have to sell it to someone with the highest bid price.

In this example, the price of Ripple on the second exchange is increasing while the price of Ripple in the first exchange remains the same. What matters is that the highest bid price in the second exchange is higher than the lowest ask price in the first exchange.

This price difference between the two exchanges creates the opportunity to arbitrage a cryptocurrency.

All you need do is buy Ripple in the first exchange where you want to pay the lowest ask price. Then, you need to transfer these Ripple to the second exchange where you want to sell them at the highest bid price.

The difference between the highest bid price in one exchange and the lowest ask price in the second exchange is your profit, at least theoretically. In reality, this difference will further come down after deducting trading and withdrawal fees.

Crypto triangular arbitrage

Triangular arbitrage involves trading between three two pairs of assets. For example, you have purchased 1 BTC on a major exchange platform and convert it to foreign currency via an exchange serving a local market. Then, you convert the local currency to US dollars for hundreds of dollars worth of profit. Fiat triangular arbitrage opportunity is often limited to trade between exchanges that target local markers.

In crypto triangular arbitrage, you can benefit from the price difference between 3 pairs of coins. The trade is possible only when the ratios between coins have different USD prices.

Opportunities of crypto arbitrage

- Listing on large exchanges pump the value of a coin

- Smaller exchanges have demand and supply imbalances

Disadvantages of crypto arbitrage

- Withdrawal limit or KYC restrictions can pose exchange issues

- Execution risk due to volatility

- Low liquidity

- Transfer risks

- Transaction fees

- Taxes

Things to consider in arbitrage

Even though Crypto arbitrage limits your exposure, you can carefully set your trades and minimize fees by choosing exchanges and processes carefully. Make sure to pay attention to crypto space for arbitrage opportunities.

Transactions speeds play a huge role in the success of crypto arbitrage. When possible, transfer with faster coins, by choosing ETH (Ether) over BTC (Bitcoin). Always use trusted exchanges and make use of different exchanges for coins and strategies for good results.

Arbitrage opportunities are extremely time-sensitive as they usually last for only less than a minute. Due to these time restrictions, it is very difficult for human traders to seize these opportunities and perform arbitrage.

You also need to consider the wait time for the approval on the withdrawal of funds following email, Google Authenticator’s 2FA passcode, so on and so forth. Sometimes, these factors result in the loss of an arbitrage opportunity.

To eliminate all these difficulties, crypto arbitrage is usually performed by trading bots.

Crypto arbitrage bots

When it comes to using crypto arbitrage opportunities to your benefit, the emotional rush from watching the crypto markets daily may not be the most efficient way or productive to trade. This is exactly where crypto trading bots can come in handy.

Bots can help traders grow profits, minimize risk, and limit losses across multiple exchanges. They also allow traders to receive passive income from fully-automated trades regularly. Several platforms support algorithmic trading, but below are some of our favorites bots that work.

Some of the free crypto trading bots are Blackbird Bitcoin Arbitrage, Catalyst Enigma, ZenBot, etc. Even though different crypto trading bots serve different purposes, their primary objective is to make use of arbitrage opportunities by finding price gaps between the exchanges and taking advantage of those imbalances.

Some of the paid crypto trading bots include Shrimpy, Hassbot, 3Commas, and Cryptohopper.’

Is crypto arbitrage worth your time and effort?

Sure, taking advantage of a price difference between two exchanges sounds like an idea worth exploring, especially if you are looking for some hands-on experience with buying and selling crypto. Besides, investing time, money, and effort in crypto should be never done without proper research.

Is crypto arbitrage still profitable?

If your objective is to profit off the price difference, you need to have plenty of experience buying and selling crypto in the marketplace. Your experience multiples the potential of finding success in crypto arbitrage. Always ask yourself this question: Is the effort of completing a transaction will be worth my time?

It is also imperative that you consider the legal, technical, and financial issues that may crop up. To sum up, earning profits through crypto arbitrage may not be possible without trading bots. That said, we also recommend you to do some research and see for yourself if crypto arbitrage actually helps you achieve your financial goals.

![Canadian Bitcoin Exchange Comparison [Most updated Guide]](https://blockgeeks.com/wp-content/uploads/2020/10/image3.png)