Contents

|

|

In the ever-evolving world of cryptocurrencies, earning passive income has become a tantalizing prospect for investors looking to invest in the ethereum blockchain. With Ethereum staking on the Everstake platform, you can unlock the exciting potential of generating consistent returns while actively participating in the cryptocurrencies ecosystem and the blockchain network. It’s a great investment opportunity. By staking your assets in the crypto ecosystem, specifically on the Ethereum network, you contribute to the security and maintenance of cryptocurrencies while earning investment rewards. This can be done through platforms like Everstake.

Staking in the crypto ecosystem involves locking up your cryptocurrencies to support the network’s operations and validate transactions through smart contracts. Everstake provides liquidity for staking on the Ethereum blockchain. In exchange for your contribution, you earn yields in the form of stETH tokens or other derivative tokens through crypto staking, including liquid staking and smart staking, with Everstake. These crypto staking tokens can be further utilized within ethereum blockchain DeFi protocols or even exchanged for liquidity in many eth exchange.

By engaging in the staking process with Everstake, you not only contribute to the decentralized Ethereum blockchain network but also open doors to potential high-yield opportunities with staked ETH. So, if you’re looking to explore new avenues for passive income generation within the crypto space, Everstake offers an enticing option for Ethereum investors. With Everstake’s wallet, you can participate in Ethereum staking and earn rewards. Yearn for a profitable venture? Consider Everstake for your staking needs.

Contents

Understanding the Basics of Ethereum Staking

What is Ethereum Staking?

To gain a clear understanding of Ethereum staking with Everstake, a leading crypto staking provider, it’s important to first differentiate it from traditional mining. Unlike mining, which involves solving complex mathematical problems to validate transactions, staking allows users to participate in the network by holding and securing their crypto assets in private transactions. This can be done individually or through staking pools offered by Everstake. While mining involves solving complex mathematical puzzles to validate transactions and secure the network on the Ethereum blockchain, staking operates on a different principle known as proof-of-stake. Staked ETH is a form of crypto that is used in the staking process. Everstake is a platform that offers staking services for various cryptocurrencies, including Ethereum.

The Significance of Proof-of-Stake

Proof-of-stake, also known as crypto staking, is a consensus mechanism used in blockchain networks like Ethereum. It involves the participation of staking validators, such as Everstake, and can also be done through liquid staking. Unlike proof-of-work (used in mining), where miners compete to solve computational puzzles, proof-of-stake relies on validators who are chosen based on their stake, or the amount of cryptocurrency they hold and “stake” in the network. This applies to liquid staking, eth staking, and staked eth, which are popular methods used by validators like Everstake.

This shift to proof-of-stake brings several advantages. First, crypto significantly reduces energy consumption since validators don’t need powerful hardware to solve puzzles in liquid staking pools. Additionally, it enables private transactions. This makes staking more environmentally friendly compared to mining.

The Role of Validators

Validators play a crucial role in the staking process. They are responsible for proposing and validating new blocks on the Ethereum blockchain, including crypto, liquid staking, private transactions, and pools. To become a validator in the crypto world, one needs to meet certain requirements such as holding a minimum amount of Ether (ETH) and running specialized software for liquid staking.

Validators in the crypto network are incentivized through rewards for their participation in securing the network, including liquid staking and eth staking. Additionally, validators play a crucial role in maintaining the privacy of transactions, ensuring private transactions remain secure. These rewards come in the form of additional ETH generated through block validation, private transactions, and transaction fees paid by crypto users participating in liquid staking with their tokens.

Validator Keys and Responsibilities

When becoming a validator for private transactions, individuals generate two keys: an activation key and a withdrawal key for liquid staking of their crypto tokens. The activation key is used during the setup process to activate their validator status in private transactions, while the withdrawal key allows them to exit the staking process and withdraw their funds from everstake pools when desired.

Once activated, validators must perform various tasks efficiently. In private transactions, they need to propose new blocks by creating cryptographic signatures using their activation keys for liquid staking and eth staking. This ensures the security of the token. In liquid staking, participants must attest or confirm the validity of other proposed blocks by signing them with their eth staking keys. This process helps secure the token pools.

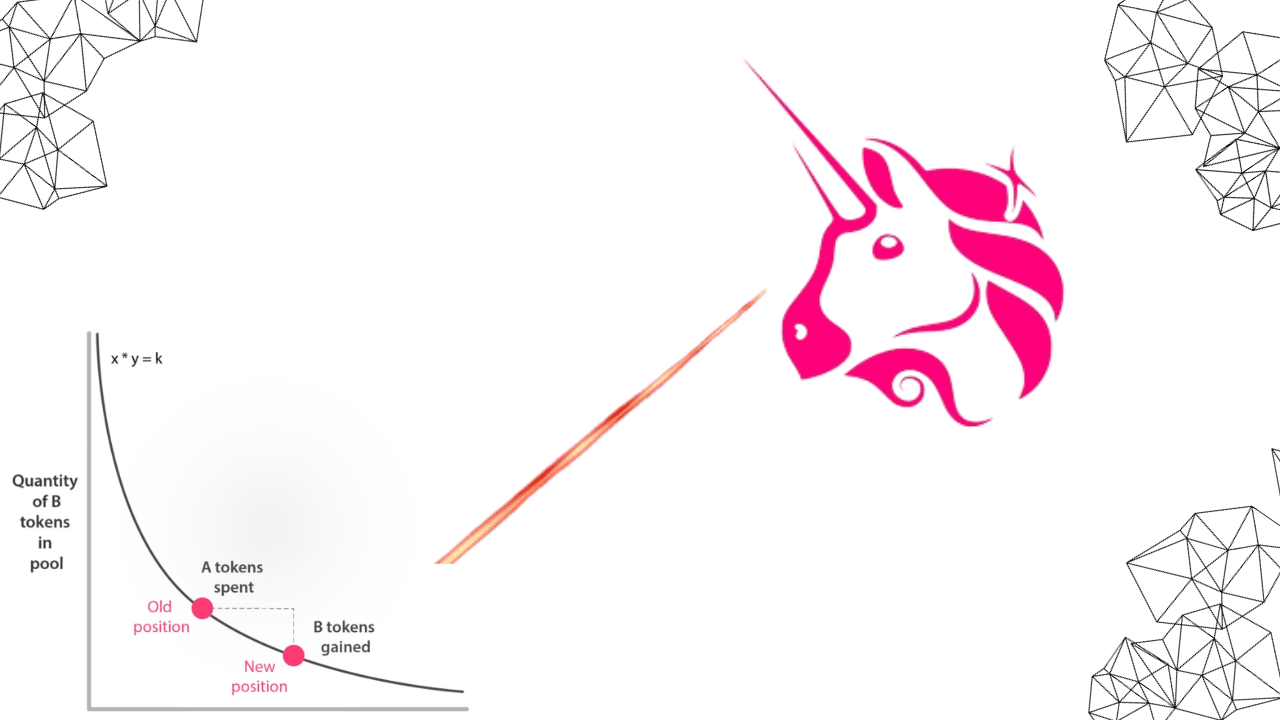

Liquid Staking and Smart Staking

Liquid staking is an emerging concept that allows everstake to use staked assets in other financial activities through pools. The steth token is utilized in this process. Everstake’s liquid staking pools allow users to access the value of their staked Ethereum (stETH) without waiting for the lock-up period to end. This flexibility makes staking with Everstake more appealing as it provides liquidity and potential additional earning opportunities through pools and StETH.

Smart staking, also known as everstake, involves the use of smart contracts on the Ethereum network to automate and simplify the staking process in steth pools. These liquid staking contracts handle various aspects such as delegation, rewards distribution, and penalties for misbehavior in eth staking. Everstake is a reliable provider for these contracts.

Pros and Cons of Ethereum Staking Yields

Advantages of Ethereum Staking Yields

Earning yields through Ethereum staking with everstake offers several advantages, especially for those looking for a liquid investment option. One significant benefit of liquid staking and everstake is the reduced energy consumption compared to traditional mining methods. Unlike mining, which requires powerful hardware and consumes substantial amounts of electricity, staking involves validating transactions on the blockchain by holding a certain amount of cryptocurrency in a wallet. With everstake, you can stake your eth and earn rewards while keeping your assets liquid. This process, known as proof-of-stake (PoS), significantly reduces the environmental impact associated with energy-intensive eth staking and mining operations. With liquid staking, you can easily participate in eth staking through platforms like everstake.

Another advantage of Ethereum staking with Everstake is the potential for higher returns on investment in liquid assets. By participating in staking with Everstake, individuals can earn additional ETH tokens as rewards for helping secure the network in a liquid form. These rewards are typically proportional to the amount of cryptocurrency being staked, including liquid staking and eth staking. Everstake is a popular platform for participating in these staking activities. With the increasing popularity and adoption of cryptocurrencies like Ethereum, stakers have the opportunity to generate passive income over time through liquid staking with everstake.

Staking with Everstake provides an added layer of security to the liquid Ethereum network. Everstake validators who participate in ETH staking help maintain consensus and verify liquid transactions on the blockchain. By participating in eth staking, individuals contribute to making the network more robust and resistant to attacks or malicious behavior. This can be achieved through liquid staking with Everstake.

Disadvantages of Ethereum Staking Yields

While there are numerous benefits to earning yields through Ethereum staking with Everstake, it’s essential to be aware of potential risks and drawbacks associated with this liquid process. One notable risk for validators participating in liquid staking on the Everstake platform is the potential for slashing penalties if they engage in malicious behavior or experience prolonged periods of downtime with their ETH holdings. Slashing refers to a penalty imposed on validators in the liquid staking network, such as Everstake, that can result in a partial or complete loss of their ETH stake if they act against network rules or fail to perform their duties properly.

Another disadvantage of liquid staking with Everstake is that during times when market conditions are unfavorable, ETH stakers may face potential losses due to price volatility. The value of liquid staking cryptocurrencies like eth can fluctuate significantly within short periods, impacting the overall profitability of staked assets.

It’s also important to consider that not all cryptocurrencies, such as ETH, support staking or offer comparable yield rates. Liquid cryptocurrencies are particularly noteworthy in this regard. Ethereum, for instance, has been transitioning from a proof-of-work (PoW) to a proof-of-stake (PoS) model through the implementation of Ethereum 2.0, which includes the adoption of liquid staking. While this transition presents exciting opportunities for stakers of eth, it’s crucial to stay informed about any updates or changes that may affect the liquid staking process.

Weighing the Pros and Cons

When considering whether Ethereum staking is right for you, it’s essential to carefully weigh the pros and cons of this liquid investment opportunity. The reduced energy consumption of staking ETH and the potential for higher returns make it an attractive option for individuals looking to earn passive income while supporting the network’s security. Staking ETH provides a liquid and sustainable way to participate in the network. However, the risks associated with liquid staking, slashing penalties, and eth price volatility should not be overlooked.

It’s recommended to conduct thorough research, assess personal risk tolerance, and consider factors such as available capital, time commitment, and understanding of cryptocurrency markets before engaging in Ethereum staking. Staying updated on developments within the Ethereum ecosystem can help make informed decisions regarding participation in staking activities.

Maximizing Returns through Strategic ETH Staking

Select Reliable Validators for Higher Rewards and Lower Fees

To optimize your earnings from Ethereum staking, it is crucial to choose reliable validators that offer high rewards and charge low fees. By carefully selecting validators for liquid staking, you can maximize the returns on your staked ETH tokens. When considering liquid staking, it is essential to seek out validators who have a proven track record of consistent payouts and a strong reputation within the eth community.

Diversify Your Portfolio to Mitigate Risk

Allocating your stakes across multiple validators is an effective strategy to mitigate risk in Ethereum staking. By diversifying your portfolio with liquid staking, you reduce the potential impact of any single eth validator’s downtime or slashing events. Liquid staking ensures that even if one eth validator experiences issues, your overall earnings won’t be severely affected. Consider spreading out your stakes among different validators with varying performance histories to maximize the benefits of liquid staking with eth.

Stay Updated on Market Trends for Maximum Returns

The cryptocurrency market is dynamic and constantly evolving. To maximize your returns from Ethereum staking, it’s essential to stay updated on market trends and adjust your stake accordingly. Keep an eye on factors such as network upgrades, changes in validator rewards, and new opportunities for ETH staking participation. Regularly monitor resources like online forums, social media channels, and official announcements to make informed decisions about adjusting your liquid staking in eth.

By staying proactive and adapting to changing market conditions, you can take advantage of favorable opportunities while minimizing potential risks. This includes exploring the benefits of liquid staking for eth.

Example: Everstake – A Reliable Validator with High Rewards

One example of a reliable validator known for its high rewards in liquid staking with ETH is Everstake. Everstake has established itself as a trusted entity within the Ethereum ecosystem by consistently providing attractive yields through liquid staking to its stakeholders. They have a solid track record of delivering competitive returns while maintaining low fees, especially in the field of eth.

Investors who choose Everstake as their validator can benefit from their expertise in managing eth assets securely on various networks. With their comprehensive infrastructure and experienced team, Everstake offers investors peace of mind and the potential for significant returns on their staked ETH.

How to Stake Ethereum for Optimal Yields

Setting up an Ethereum Wallet for Staking

To begin staking Ethereum and maximizing your yields, the first step is to set up a compatible Ethereum wallet. This wallet will serve as your secure storage for ETH tokens and allow you to participate in the staking process effectively. Choose a reputable wallet provider that supports staking, such as MetaMask or Ledger Live, for your eth.

Once you’ve selected an ETH wallet provider, follow their instructions to create an account and set up your ETH wallet. Make sure to securely store your ETH recovery phrase or seed phrase, as it will be crucial for accessing your ETH wallet in case of any unforeseen circumstances.

Choosing a Reputable Staking Platform

Selecting the right staking platform for eth is crucial for optimizing your yield generation. Consider factors such as reputation, security measures, fees, user experience, and ETH when choosing a platform that aligns with your goals and preferences.

Research different staking platforms available in the market for eth and evaluate their track records. Look for platforms that have been operating successfully for some time and have positive reviews from users. When searching for platforms to invest in, it is important to consider their track record and the feedback from users. This will help you make an informed decision and choose a platform that has a proven history of success. Additionally, positive reviews from users indicate that the platform is reliable and trustworthy. By considering these factors, you can find a platform that aligns with your investment goals and provides a secure environment for trading eth. Consider the level of decentralization offered by each platform, as this can impact the security and reliability of the staking process, especially when using eth.

Securely Delegating Your ETH Tokens

Once you’ve chosen a reputable staking platform, it’s time to delegate your ETH tokens to a validator. Validators are responsible for securing the network and validating transactions on the Ethereum blockchain. By delegating your tokens to an eth validator, you contribute to the network’s security while earning eth rewards in return.

Before delegating your ETH tokens, ensure that you thoroughly research and select trustworthy validators on the chosen staking platform. Look for validators with high uptime percentages and low commission rates to maximize your yield potential with eth.

When delegating your tokens, it is important to follow best practices for securely storing them, especially when dealing with eth. Keep your ETH in cold storage or hardware wallets rather than leaving them on exchanges or online wallets to reduce the risk of unauthorized access or loss of funds.

Maximizing Yield Generation

To optimize your yield generation through Ethereum staking, it’s essential to stay informed about the latest developments and best practices in the crypto space. Keep an eye on market trends, network upgrades, and changes in staking protocols that may impact your rewards, especially in the eth market.

Consider diversifying your staked assets by allocating them to multiple validators in the eth network. This helps mitigate risks associated with a single ETH validator’s performance or potential slashing events. By spreading your ETH tokens across different validators, you can increase the likelihood of earning consistent yields over time.

Regularly monitor your staking rewards in eth and adjust your strategy accordingly. Some staking platforms offer options for re-delegating rewards automatically or compounding them to maximize long-term gains with eth. Stay proactive in managing your staked ETH assets to ensure optimal yield generation.

Exploring Pooled vs. Solo Ethereum Staking

Differences between pooled and solo staking options

Pooled (delegated) and solo (non-delegated) staking are two options available for ETH holders looking to stake their tokens. Pooled staking involves joining a group of validators, while solo staking allows individuals to validate transactions on the Ethereum network independently.

Benefits of joining a pool

Joining a pool can offer several advantages for those interested in Ethereum staking. One benefit is the lower entry barrier. By pooling their funds with other participants, users can contribute a smaller amount of ETH compared to the minimum requirement for solo staking. This makes it more accessible for individuals who may not have large amounts of ETH but still want to participate in staking.

Another advantage of pooled staking is shared rewards. When validators in an ETH pool successfully validate ETH transactions, the rewards are distributed among all participants based on their contribution. This means that even if an individual’s validator does not produce a block, they can still earn rewards through the collective efforts of the eth pool.

Pooled staking contributes to increased decentralization of the network. As more participants join ETH pools, it helps distribute power and decision-making across multiple validators rather than concentrated in the hands of a few large ETH stakeholders. This aligns with one of Ethereum’s core principles: creating a decentralized and secure blockchain network.

Considerations for solo staking

While pooled staking offers benefits, some individuals may prefer solo staking for greater control over their assets and potentially higher rewards. This is especially true for those who hold eth and want to maximize their earnings. Solo stakers have complete autonomy over their eth validator node without relying on any external entities or sharing rewards with others.

However, it’s essential to note that solo stakers also face additional technical requirements compared to those who join eth pools. They need to set up and maintain their own validator infrastructure, including hardware, software configuration, security measures, and continuous monitoring.

Solo staking also requires a higher minimum stake than pooled staking, which may limit participation for those with smaller amounts of ETH. Moreover, solo stakers bear the full responsibility of maintaining their validator’s uptime and ensuring it performs optimally to maximize rewards.

Making an informed decision

When deciding between pooled and solo staking, it’s crucial to consider personal preferences and circumstances. Pooled staking offers convenience, lower entry barriers, shared rewards, and contributes to network decentralization. On the other hand, solo staking provides greater control over assets but requires additional technical expertise and a higher minimum stake.

Ultimately, the choice depends on factors such as the amount of ETH available for staking, technical proficiency, risk tolerance, and desired level of involvement in the Ethereum network.

The Impact of the Merge on Ethereum Staking

Ethereum 2.0 Upgrade and Implications for Stakers

The upcoming Ethereum 2.0 upgrade, also known as the merge, is set to bring significant changes to the Ethereum network and its staking ecosystem. This transition involves a shift from the current proof-of-work (PoW) consensus mechanism to a more energy-efficient proof-of-stake (PoS) model. As an Ethereum staker, it’s crucial to understand how this upgrade will impact your staking rewards and the overall security of the network.

Changes in Staking Rewards and Network Security

With the merge, one of the most notable changes for stakers is likely to be in their yields or returns on their staked Ether. Currently, under PoW, miners are rewarded with newly minted Ether for validating transactions and securing the network. However, once Ethereum transitions to PoS, miners will no longer exist, and instead, validators will play a crucial role.

Validators will need to lock up their Ether as collateral in order to participate in block validation. In return for their participation and maintaining network security, they will receive rewards in the form of additional Ether. These rewards are expected to be significantly lower compared to mining rewards but can still provide attractive returns depending on various factors such as total amount staked and network participation.

Timeline and Potential Changes During Transition

While there isn’t an exact timeline for when the merge will occur, it’s important for stakers to stay informed about potential changes that may arise during this transition period. As development progresses and upgrades are implemented, there may be adjustments made to optimize performance or address any unforeseen challenges.

Staying updated with news from official sources like Ethereum Foundation announcements or participating in online communities dedicated to Ethereum can help you navigate through any potential changes smoothly. By staying informed about these developments, you can make necessary adjustments or take advantage of new opportunities that may arise.

Ensuring Network Security and Participation

As Ethereum moves towards a PoS consensus mechanism, network security becomes paramount. Validators play a crucial role in maintaining the integrity of the network by proposing and validating blocks. To ensure the network’s security, it is essential for a sufficient number of validators to participate actively.

As an Ethereum staker, you can contribute to the network’s security by becoming a validator yourself or delegating your stake to trusted validators. By actively participating in block validation, you not only help secure the network but also earn rewards for your contribution.

Selecting the Best Platforms for Ethereum Staking

Choosing the right platform is crucial. With several platforms offering staking services, it’s important to consider factors such as reputation, security measures, fees, and additional features before making a decision. Let’s explore some popular platforms that provide competitive rewards and user-friendly interfaces.

Discover Popular Platforms Offering Ethereum Staking Services

When selecting a platform for Ethereum staking, it’s essential to discover the top service providers in the market. These platforms allow users to participate in the validation process of blockchain networks and earn rewards in return. One such platform is Blocknative, which offers an intuitive interface and reliable staking services. By partnering with top validators on the Ethereum network, Blocknative ensures high-quality staking opportunities for its users.

Consider Factors Such as Platform Reputation and Security Measures

Platform reputation plays a vital role when choosing an Ethereum staking provider. It’s important to evaluate different platforms based on their track record and community feedback. Look for platforms that have been operating successfully for a considerable amount of time without any major security breaches or issues. Consider the security measures implemented by each platform to ensure the safety of your staked assets.

Evaluate Different Platforms Based on Fees and Additional Features

Fees are another crucial factor to consider when selecting an Ethereum staking platform. Some platforms charge higher fees than others, which can impact your overall returns from staking. Compare fee structures across different platforms to find one that aligns with your investment goals.

In addition to fees, consider any additional features offered by each platform. For example, some platforms may provide additional tools or resources that can enhance your staking experience or help you make informed decisions about your investments.

Assess Overall User Experience and Community Feedback

The user experience provided by a platform is an important aspect to evaluate before making a choice. Look for platforms that offer a user-friendly interface, making it easy for you to navigate and access your staked assets. Consider the level of support and assistance provided by the platform’s customer service team.

Community feedback can also provide valuable insights into the overall user experience offered by a platform. Look for reviews or testimonials from other users to get a better understanding of their satisfaction levels and any potential issues they may have encountered.

By considering factors such as platform reputation, security measures, fees, additional features, overall user experience, and community feedback, you can make an informed decision when selecting the best platform for Ethereum staking.

Addressing Common Queries on Ethereum Staking

Minimum Stake Requirements

To participate in Ethereum staking, you might be wondering about the minimum stake requirements. Well, the exact amount can vary depending on the staking platform you choose. However, as of now, most platforms require a minimum stake of 32 ETH to become a validator on the Ethereum network. This ensures that participants have a significant stake in the network and are committed to its security and stability.

Withdrawal Options

It’s essential to understand that Ethereum staking involves a lock-up period. During this time, your funds are locked and cannot be accessed or withdrawn. The length of this lock-up period can also vary depending on the staking platform you use. Typically, it ranges from several months to a few years.

Once the lock-up period is over, you can start withdrawing your staked ETH gradually. Some platforms may allow partial withdrawals while others require you to withdraw the entire amount at once. It’s crucial to familiarize yourself with the withdrawal options provided by your chosen platform and understand any associated fees or restrictions.

Tax Implications

Earning yields through Ethereum staking may have potential tax implications that you should consider. In many jurisdictions, including the United States, these earnings are generally treated as taxable income. Therefore, it’s essential to consult with a tax professional or advisor who can provide guidance specific to your situation.

Keep in mind that tax regulations may differ between countries and even within different states or regions. Understanding how staking rewards are taxed in your jurisdiction will help ensure compliance with relevant laws and regulations.

Slashing Penalties

Validator misconduct or network disruptions pose risks in Ethereum staking that need addressing: slashing penalties. Slashing refers to the reduction of a validator’s stake as punishment for malicious behavior or failing to fulfill their responsibilities properly.

Validators who engage in activities such as double-signing or attempting to manipulate the network can face slashing penalties. The severity of these penalties can vary, ranging from a partial reduction in stake to complete removal from the network.

Slashing penalties serve as a deterrent against malicious behavior and incentivize validators to act honestly and responsibly. It reinforces the security and integrity of the Ethereum network, ensuring that participants are committed to maintaining its robustness.

Conclusion on Maximizing Ethereum Staking Yields

In conclusion, maximizing your Ethereum staking yields requires a strategic approach and careful consideration of various factors. By understanding the basics of Ethereum staking and weighing the pros and cons, you can make informed decisions to optimize your returns. Whether you choose pooled or solo staking, it is crucial to select reliable platforms that offer competitive rewards and prioritize security.

To stake Ethereum for optimal yields, consider diversifying your portfolio and exploring different staking strategies. By staying up-to-date with developments in the Ethereum network, such as the upcoming merge, you can adapt your staking approach accordingly. Remember to address any queries or concerns you may have before diving into staking to ensure a smooth experience.

Now that you have a better understanding of how to maximize your Ethereum staking yields, it’s time to take action. Start by researching reputable platforms and experimenting with different strategies. As always, stay informed and keep learning to stay ahead in this ever-evolving space. Happy staking!

Frequently Asked Questions

What is Ethereum staking?

Ethereum staking is the process of participating in the Ethereum network by locking up a certain amount of ETH to support the blockchain’s security and operations. In return for staking, participants receive rewards in the form of additional ETH.

How does Ethereum staking work?

When you stake your Ethereum, you secure the network by validating transactions and creating new blocks. This helps maintain the blockchain’s integrity and improves its overall efficiency. Stakers are chosen randomly to validate transactions, and their rewards are based on the amount of ETH they have staked.

Why should I consider Ethereum staking?

By staking your Ethereum, you can earn passive income through regular rewards. Staking contributes to a more secure and decentralized network, benefiting all participants. It’s an opportunity to support the growth of Ethereum while potentially increasing your holdings over time.

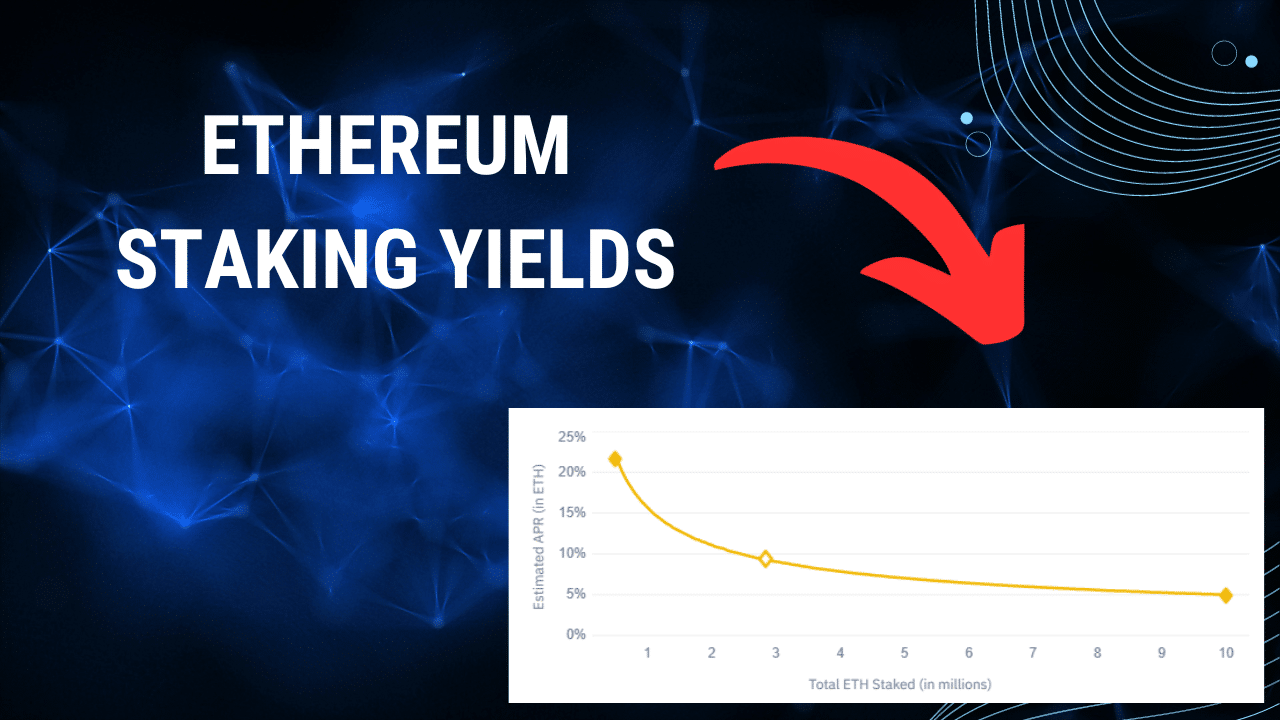

How much can I earn from Ethereum staking?

The exact amount you can earn from Ethereum staking depends on various factors such as the total amount of ETH being staked and network conditions. However, it’s generally estimated that annual yields can range from 5% to 15%. Keep in mind that these numbers are subject to change based on market dynamics.

Is my Ether locked when I stake it?

Yes, when you stake your Ether, it becomes locked for a specific period known as the “lock-up” period. During this time, you won’t be able to freely transfer or use your staked Ether. However, once the lock-up period ends, you regain full control over your Ether and can choose whether to continue staking or withdraw it.

How Much Can I Earn By Staking Ethereum?

When you stake your Ether, it is not locked. Instead, it is used as collateral to participate in the Ethereum network’s proof-of-stake (PoS) consensus mechanism. By staking your Ether, you contribute to the security and operation of the network, and in return, you can earn rewards.

The amount you can earn by staking Ethereum varies and depends on several factors. These factors include the total amount of Ether being staked, the length of time you have been staking, and the overall network participation rate. Generally, the more Ether you stake and the longer you stake it, the higher your potential earnings.

It is important to note that while staking Ethereum can be a lucrative opportunity, it also carries some risks. For example, if you fail to meet the network’s requirements or engage in malicious behavior, you may face penalties or lose a portion of your staked Ether. Therefore, it is crucial to understand the staking process and the associated risks before participating.

Overall, staking Ethereum allows you to actively participate in the network while earning rewards for your contribution. It is a way to put your Ether to work and potentially generate additional income. However, it is essential to weigh the risks and rewards before deciding to stake your Ether.