Contents

|

|

Unlike previous versions, Uniswap v3 offers a more efficient trading platform with virtual liquidity and options, allowing users to trade assets such as eth with ease while minimizing risk. The enhanced market-making structure of Uniswap V2 provides liquidity providers with greater control and flexibility over their positions, offering more options and assets compared to Uniswap V1. The team behind Uniswap v3 has optimized and improved the trading experience for users and providers by addressing the challenges faced in previous versions. Uniswap v3 offers a more seamless and efficient virtual liquidity platform for trading assets, such as ETH.

As interest in virtual liquidity and decentralized exchanges continues to grow, Uniswap v3, with its focus on eth assets, has emerged as a leading player in the market. Uniswap v2’s innovative approach and improved features have garnered attention and optimism within the cryptocurrency community, surpassing the popularity of Uniswap v1. The introduction of the v3 core has further enhanced its appeal, attracting more users and expanding its range of supported assets. To understand how Uniswap v3, the latest version of the platform, works and its role as a provider of decentralized exchange services for Ethereum (ETH), dive into our suggested reading below. This will give you a better understanding of the options and positions available on Uniswap v3.

Contents

Integration of smart contracts with Non-Fungible Tokens (NFTs) creates unique trading opportunities. These opportunities are made possible by the virtual liquidity provided by Uniswap v2 and Uniswap v1. – Introducing new features for ERC20 token trading, smart contracts, and virtual liquidity. – Introducing new features for ERC20 token trading, smart contracts, and virtual liquidity.

Uniswap v3, the upgraded version of the popular decentralized exchange protocol, introduces new features and improvements. With the release of Uniswap v3, users now have the option to enhance their trading positions with enhanced liquidity and efficiency. The integration of v2 and ETH provides a seamless experience for traders seeking optimal results. Integration of smart contracts with Non-Fungible Tokens (NFTs) creates unique trading opportunities. These opportunities are made possible by the virtual liquidity provided by Uniswap v2 and Uniswap v1. With the addition of the eth option, users now have more flexibility in their trading strategies. The new tick position feature allows for greater precision in setting price ranges. With the addition of the eth option, users now have more flexibility in their trading strategies. The new tick position feature allows for greater precision in setting price ranges.

Major upgrades and advancements introduced in Uniswap v3

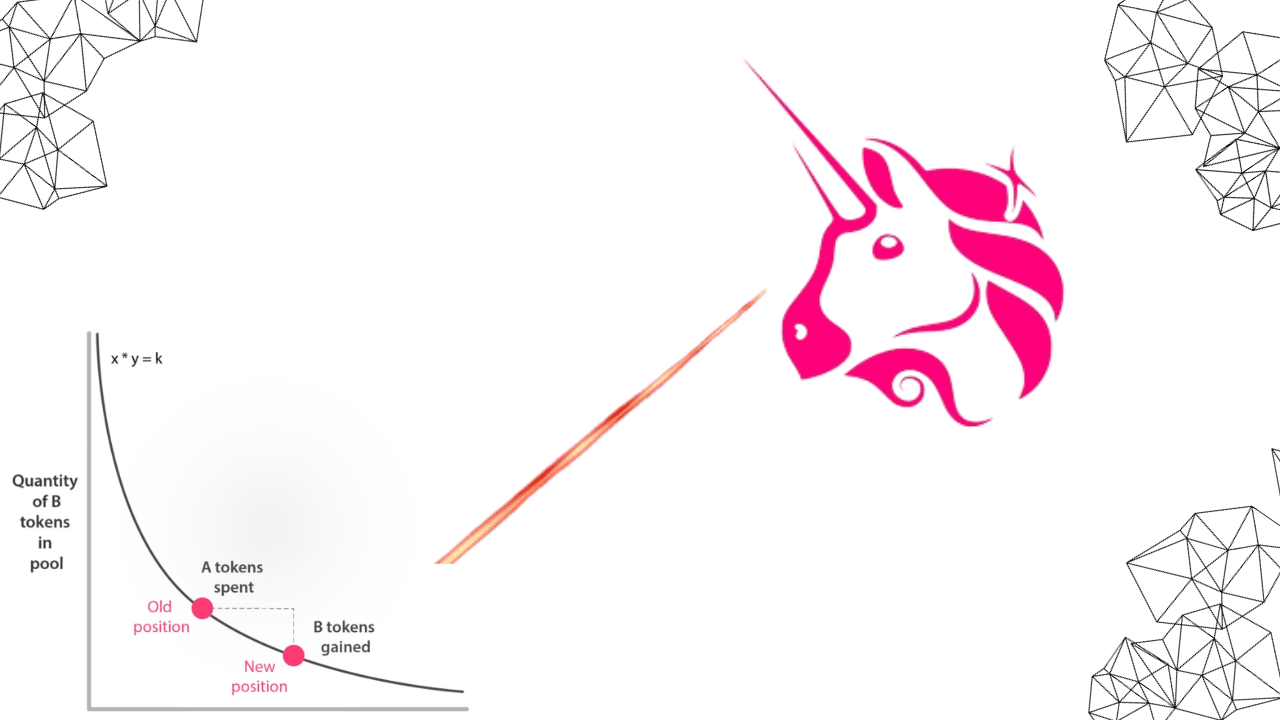

Integration of smart contracts with Non-Fungible Tokens (NFTs) creates unique trading opportunities. These opportunities are made possible by the virtual liquidity provided by Uniswap v2 and Uniswap v1. One of the upgrades is the addition of support for the Ethereum network’s native cryptocurrency, ETH. Another upgrade is the introduction of a new feature that allows users to adjust the position of their liquidity within a specified price tick. One of the upgrades is the addition of support for the Ethereum network’s native cryptocurrency, ETH. Another upgrade is the introduction of a new feature that allows users to adjust the position of their liquidity within a specified price tick. One of the key advancements in Uniswap v3 is the transition from the constant product formula used in previous versions to a concept called “concentrated liquidity.” This new approach allows liquidity providers (LPs) to concentrate their funds within specific price ranges, resulting in increased capital efficiency. This improved position and tick management system enhances the trading experience for users.

In Uniswap v3, LPs can create custom liquidity positions by specifying price ranges where they want to provide liquidity for tick intervals. This means that instead of providing liquidity across the entire price spectrum as was done in previous versions like uniswap v1, LPs can now focus their funds on areas where they believe there will be more trading activity or where they want to take advantage of potential arbitrage opportunities in uniswap v2. They can do this by adjusting their position on the tick scale. This concentrated approach enables Uniswap V2 LPs to maximize their returns while reducing their exposure to less active parts of the market by optimizing their position and tick.

Improved capital efficiency and enhanced user experience

By allowing LPs to concentrate their liquidity within specific price ranges, Uniswap v3 significantly improves capital efficiency by optimizing position and tick. This means that more trading volume can be supported with less overall capital locked into the protocol, making it easier to swap positions and tick trades. The ability for LPs to customize their positions and swap assets also provides them with greater control over their strategies, risk management, and tick sizes.

Integration of smart contracts with Non-Fungible Tokens (NFTs) creates unique trading opportunities. These opportunities are made possible by the virtual liquidity provided by Uniswap v2 and Uniswap v1. With Uniswap v3, users can now easily track their position and monitor every tick. With Uniswap v3, users can now easily track their position and monitor every tick. Traders benefit from improved pricing and higher capital efficiency, which reduces slippage when executing trades in the tick position.

Understanding Capital Efficiency in Uniswap V3

Integration of smart contracts with Non-Fungible Tokens (NFTs) creates unique trading opportunities. These opportunities are made possible by the virtual liquidity provided by Uniswap v2 and Uniswap v1. This concept helps improve the position of liquidity providers by ensuring their funds are used efficiently, resulting in higher returns. By implementing this concept, Uniswap v3 ensures that liquidity providers can tick all the boxes when it comes to maximizing their profits. This concept helps improve the position of liquidity providers by ensuring their funds are used efficiently, resulting in higher returns. By implementing this concept, Uniswap v3 ensures that liquidity providers can tick all the boxes when it comes to maximizing their profits.

Achieving Capital Efficiency through Concentrated Liquidity Pools

In Uniswap v3, liquidity providers have the ability to position and concentrate their funds within specific price ranges rather than providing liquidity across the entire trading range. This allows them to tick their positions more effectively. This allows them to allocate their capital more effectively and reduce potential losses caused by impermanent loss. By concentrating liquidity within a narrower price band, LPs can provide deeper liquidity at those specific prices where it is most needed.

Pros:

-

Concentrated liquidity pools enable LPs to achieve higher capital efficiency.

-

Reduces exposure to impermanent loss by focusing on specific price ranges.

-

Provides deeper liquidity at critical price points.

Cons:

-

Requires careful monitoring and rebalancing of positions as market conditions change.

-

May result in missed opportunities if prices move outside the concentrated range.

Optimizing Returns by Focusing on Specific Price Ranges

Uniswap v3 allows LPs to earn fees based on trading activity within their chosen price range. This means that they can optimize their returns by selecting a range where they anticipate high trading volume or volatility. By strategically choosing these ranges, LPs can capitalize on market movements and generate higher returns compared to providing liquidity across the entire trading spectrum.

Pros:

-

Enables LPs to focus on areas where they expect high trading volume or volatility.

-

Offers the potential for higher returns compared to traditional AMMs.

-

Allows LPs to tailor their strategies based on market conditions.

Cons:

Concentrated Liquidity: A Game-changer

Uniswap V3 introduces a groundbreaking concept called concentrated liquidity, which revolutionizes the way liquidity is provided in decentralized finance (DeFi). In traditional liquidity pools, such as those found in Uniswap V2, liquidity providers contribute their funds to a pool where they are spread across the entire price range. However, with Uniswap V3’s concentrated liquidity feature, liquidity providers have the ability to concentrate their funds within a customizable price range.

This new approach allows for more precise trading strategies and opens up a world of possibilities for liquidity providers. Instead of having their funds scattered across the entire price spectrum, they can now focus their capital on specific price ranges that they believe will yield the most profitable trades. This level of control and customization is a game-changer in the DeFi space.

Enabling Liquidity Providers in Decentralised Finance to Concentrate Their Funds Within a Customizable Price Range using smart contracts and the Uniswap V2 automated market maker.

With Uniswap V3’s concentrated liquidity feature, liquidity providers can create what are known as “liquidity positions.” These positions allow them to allocate their funds within a narrow price range rather than being spread out across the entire pool. By concentrating their funds in this way, liquidity providers can optimize their capital efficiency and potentially increase their profits.

For example, let’s say you’re a liquidity provider who believes that the price of a particular asset will stay within a specific range. Instead of providing liquidity across the entire price spectrum, you can now concentrate your funds within that desired range. This means that if trades occur within your specified range, you’ll earn higher fees compared to providing liquidity throughout the entire pool.

Benefits of Reducing Impermanent Loss and Increasing Potential Profits

One significant advantage of concentrated liquidity is its potential to reduce impermanent loss—a common concern for traditional market-making strategies.

Advanced Features of Uniswap v3

Uniswap v3 introduces several advanced features that enhance the functionality and flexibility of the decentralized exchange platform. Let’s take a closer look at these exciting new additions.

Customizable Fee Structures for LPs Based on Risk Appetite

One notable feature of Uniswap v3 is the ability for liquidity providers (LPs) to customize their fee structures based on their risk appetite. This means that LPs can choose to set different fees for different ranges of prices, allowing them to optimize their returns according to their individual preferences and market conditions.

For example, if an LP believes that a particular price range is more volatile and carries higher risks, they can set a higher fee for trades within that range. On the other hand, if they perceive another price range as less risky, they can opt for a lower fee structure. This customization empowers LPs to align their strategies with their risk tolerance and potentially maximize their profitability.

Integration of smart contracts with Non-Fungible Tokens (NFTs) creates unique trading opportunities. These opportunities are made possible by the virtual liquidity provided by Uniswap v2 and Uniswap v1.

Uniswap v3 also introduces integration with non-fungible tokens (NFTs), which opens up unique trading opportunities in the decentralized marketplace. NFTs are digital assets that represent ownership or proof of authenticity of a specific item or piece of content. By integrating NFTs into Uniswap v3, users can now trade these unique assets directly on the platform.

This integration enables users to engage in specialized markets where NFTs are traded, such as digital art collections or virtual real estate. It provides a seamless experience for those interested in exploring the growing world of NFT trading without having to navigate multiple platforms or exchanges.

Furthermore, by leveraging NFT integration, Uniswap v3 allows users to participate in liquidity provision specifically tailored to certain NFT pools.

Flash Swaps: Instant Transactions

Flash swaps are a revolutionary concept on the Uniswap platform that allows for instant transactions without requiring upfront token balances. This feature enables users to borrow tokens from the liquidity pool and execute trades within the same transaction, all in a single atomic operation. Let’s delve into how flash swaps work and their impact on the market.

Integration of smart contracts with Non-Fungible Tokens (NFTs) creates unique trading opportunities. These opportunities are made possible by the virtual liquidity provided by Uniswap v2 and Uniswap v1., which leverages virtual liquidity from liquidity pools on the Ethereum blockchain. Flash swaps allow users to instantly borrow any token from a liquidity pool and execute trades without needing to provide collateral. This innovative feature has revolutionized the way trading pairs are executed on Uniswap., which leverages virtual liquidity from liquidity pools on the Ethereum blockchain. Flash swaps allow users to instantly borrow any token from a liquidity pool and execute trades without needing to provide collateral. This innovative feature has revolutionized the way trading pairs are executed on Uniswap.

Flash swaps provide users with unprecedented flexibility by eliminating the need to hold tokens before executing a trade. With traditional swaps, users must have sufficient token balances to initiate a transaction. However, with flash swaps, users can borrow tokens from the liquidity pool temporarily, use them for trading purposes, and return them within the same transaction. This opens up exciting possibilities for traders and developers alike.

Enabling instant transactions without requiring upfront token balances

One of the key benefits of flash swaps is their ability to enable instant transactions without needing any upfront token balances. This means that traders can access a wide range of tokens and execute trades instantly, even if they don’t possess those tokens initially. By removing this barrier, flash swaps empower users to take advantage of arbitrage opportunities swiftly and efficiently.

Facilitating arbitrage opportunities and improving overall market efficiency

Flash swaps play a crucial role in facilitating arbitrage opportunities on Uniswap. Arbitrage is when traders exploit price differences between different markets or exchanges to make profits. By allowing users to borrow tokens for trading purposes within a single transaction, flash swaps enable traders to capitalize on price discrepancies across various platforms quickly.

This functionality also enhances market efficiency by reducing slippage and minimizing price impact during trades. Slippage refers to the difference between an expected trade execution price and the actual executed price due to market fluctuations or lack of liquidity. High slippage can eat into profits significantly.

ERC20-ERC20 Pools: Enhanced Flexibility

In addition to Flash Swaps, Uniswap v3 introduces ERC20-ERC20 pools, which offer enhanced flexibility in token pairing options. Unlike the traditional ETH-based pairs, these pools allow for trading between different ERC20 tokens directly on the Ethereum blockchain.

By expanding the trading possibilities beyond ETH, Uniswap v3 opens up new avenues for niche markets and specialized tokens. This means that users can now trade a wide range of ERC20 tokens against each other without having to go through the intermediate step of converting them into ETH first.

The introduction of multiple pools for ERC20-ERC20 pairs brings several advantages:

Increased Trading Flexibility

With ERC20-ERC20 pools, traders have more freedom to choose their preferred token combinations. They are no longer limited to trading against only ETH or stablecoins like USDT or DAI. Instead, they can explore various combinations and trade directly between different ERC20 tokens. This flexibility allows for greater customization and caters to specific market demands.

Enhanced Liquidity Provision

The availability of multiple pools also benefits liquidity providers (LPs). LPs can now allocate their funds across different pools based on their risk appetite and desired exposure. They can select pools with high potential returns or focus on specific tokens they believe will perform well. This increased control over liquidity allocation enables LPs to optimize their strategies and maximize their earnings.

Specialized Token Trading

ERC20-ERC20 pools open up opportunities for specialized token trading. Niche projects with unique utility tokens can now create dedicated liquidity pools that cater specifically to their token holders’ needs. This specialization fosters a more efficient market by providing direct access to these specialized tokens without relying on intermediaries or centralized exchanges.

Smart Contract Efficiency

Uniswap v3 leverages smart contracts to facilitate ERC20-ERC20 trades securely and efficiently.

Active Liquidity Management in Uniswap v3

In Uniswap v3, liquidity positions are actively managed using a strategy called time-weighted average prices (TWAP). This approach allows for dynamic rebalancing of liquidity to adapt to changing market conditions and optimize capital allocation based on real-time data.

Managing Liquidity Positions with TWAP

Uniswap v3 employs the concept of time-weighted average prices (TWAP) to manage liquidity positions effectively. This strategy involves calculating the average price of an asset over a specific time period, weighted by the volume traded during that period. By using TWAP, Uniswap v3 ensures that liquidity providers have exposure to a more accurate representation of the asset’s price during their participation in the pool.

With TWAP, liquidity providers can avoid potential losses caused by sudden price movements. Instead of relying solely on spot prices at the time of trade execution, TWAP considers a broader timeframe and takes into account fluctuations in price over that period. This approach provides a more stable and predictable environment for managing liquidity positions.

Dynamic Rebalancing for Market Adaptation

One key feature of Uniswap v3 is its ability to dynamically rebalance liquidity positions. This means that as market conditions change, the protocol automatically adjusts the allocation of funds within each pool to maintain optimal performance.

For example, if there is increased demand for one token in a particular pool, Uniswap v3 will allocate more funds towards that token to ensure sufficient liquidity. Conversely, if there is less demand for a token, funds will be reallocated accordingly. This dynamic rebalancing helps prevent slippage and maximizes trading efficiency.

Optimizing Capital Allocation with Real-Time Data

Uniswap v3 leverages real-time data to optimize capital allocation within each pool.

Non-Fungible Tokens (NFTs) and Uniswap v3

Integration of NFTs in Uniswap v3

Uniswap v3 has introduced an exciting feature by integrating non-fungible tokens (NFTs) into its platform. NFTs are unique digital assets that represent ownership or proof of authenticity for a particular item, artwork, or collectible. With this integration, users can now trade NFTs directly on the Uniswap decentralized exchange, providing a whole new level of trading experience.

Exploring the potential of NFT-based liquidity provision

By incorporating NFTs into Uniswap v3, the platform opens up new possibilities for liquidity provision. Liquidity providers can now utilize their NFT holdings to contribute to liquidity pools and earn fees from trades. This means that instead of only using traditional fungible tokens like Ethereum or stablecoins as liquidity, users can now use their valuable NFT assets to provide liquidity and participate in the ecosystem.

This integration brings several benefits to both liquidity providers and traders:

-

Enhanced trading experiences: The inclusion of NFTs allows for more diverse and unique trading opportunities. Traders can access a wide range of token pairs that include both fungible tokens and NFTs, enabling them to explore different markets and investment options.

-

Increased market depth: With the addition of NFT-based liquidity provision, Uniswap v3 expands its market depth by attracting users who hold valuable digital collectibles. This influx of liquidity enhances the overall trading experience by ensuring better price stability and reducing slippage.

-

Innovative investment strategies: The integration of NFTs enables users to devise innovative investment strategies by combining fungible tokens with unique digital assets. For example, investors can create token pairs that consist of a popular cryptocurrency paired with an exclusive digital artwork or limited edition collectible.

Flexible Fees for Customized Trading Experience

Uniswap v3 introduces a groundbreaking feature that empowers liquidity providers (LPs) with more control over their trading experience – customizable fee structures. With Uniswap v3, LPs have the flexibility to adjust fees based on factors such as risk tolerance and desired returns, tailoring their trading experience to suit their individual preferences.

Customizable Fee Structures for LPs

One of the key advantages of Uniswap v3 is the ability for LPs to customize their fee structures. In traditional automated market makers (AMMs), trading fees are typically set at a fixed rate for all trades. However, Uniswap v3 breaks away from this mold by allowing LPs to set different fees for different trading pairs or even specific price ranges within a trading pair.

This level of customization enables LPs to optimize their earnings based on various factors. For example, they can choose higher fees for high-risk trading pairs or specific price ranges that are expected to generate more profitable trades. Conversely, they can opt for lower fees in less volatile markets or when providing liquidity to less popular trading pairs.

Empowering LPs with Control Over Earnings

By giving LPs the ability to customize their fee structures, Uniswap v3 puts them in the driver’s seat of their earnings potential. This newfound control allows LPs to align their strategies with their risk appetite and desired returns.

Here’s how it works: when providing liquidity on Uniswap v3, LPs have the option to select between different fee tiers. Each tier corresponds to a specific range of prices within a given trading pair. By choosing different fee tiers, LPs can effectively target specific price ranges where they believe there will be higher demand and thus more profitable trades.

Advanced Oracles for Reliable Data Feeds

To ensure accurate and reliable data feeds, Uniswap v3 utilizes advanced oracles. These oracles play a crucial role in enhancing the security and trustworthiness of price information on the platform, minimizing the risk of manipulation or incorrect pricing.

Utilizing advanced oracles

Uniswap v3 relies on sophisticated oracles to obtain real-time and accurate data about asset prices. Oracles act as intermediaries between blockchain networks and external sources of information, such as centralized exchanges, APIs, and other trusted data providers. By leveraging these advanced oracles, Uniswap v3 ensures that it has access to reliable pricing information.

Enhancing security and trustworthiness

The use of advanced oracles significantly enhances the security and trustworthiness of price feeds on Uniswap v3. With accurate data from reputable sources, users can have confidence in the prices displayed on the platform when making trading decisions. This reduces the risk of being misled by manipulated or incorrect pricing information.

Minimizing manipulation risks

By utilizing advanced oracles for data feeds, Uniswap v3 minimizes the risk of price manipulation. Automated market makers (AMMs) like Uniswap rely heavily on accurate pricing information to execute trades effectively. Manipulation attempts could lead to significant losses for traders using AMMs. However, with reliable data feeds from trusted sources provided by advanced oracles, Uniswap v3 mitigates this risk.

Ensuring accuracy in pricing

The integration of advanced oracles into Uniswap v3 ensures that asset prices are accurately reflected within the platform’s liquidity pools. This accuracy is vital because it determines how trades are executed and impacts overall market efficiency. With precise pricing information obtained through advanced oracles, users can confidently engage in trading activities without concerns about unfair pricing practices.

Range Orders: Fine-tuning Liquidity Provisioning

Range orders are a key feature of Uniswap V3 that enables precise liquidity provisioning within specific price ranges. This functionality allows liquidity providers (LPs) to target specific market segments or optimize their exposure to certain assets. By introducing range orders, Uniswap V3 aims to improve efficiency by reducing unnecessary liquidity provision.

One of the main advantages of range orders is the ability for LPs to provide liquidity within narrow price ranges. Instead of offering liquidity across the entire price spectrum, LPs can now focus on specific price ranges that align with their trading strategies or risk preferences. This granular control over liquidity provision allows LPs to tailor their positions and maximize their potential returns.

To understand how range orders work, let’s imagine a scenario where an LP wants to provide liquidity for a particular token within a specified price range. In traditional automated market makers (AMMs), LPs typically offer liquidity across the entire price curve. However, with Uniswap V3’s range orders, LPs can set specific boundaries or tick spacings for their desired price range.

By setting these parameters, LPs can effectively limit their exposure to price movements outside of the specified range. For instance, if an LP wants to provide liquidity for a token between $100 and $150, they can set these values as the upper and lower bounds of their range order. This way, any trades executed outside this defined range will not impact their position.

Range orders also introduce a new concept called “limit order-like” behavior in AMMs. With limit orders in traditional exchanges, traders specify the exact price at which they want to buy or sell an asset. Similarly, in Uniswap V3’s context, LPs can use range orders to create more nuanced positions within specific price ranges.

This fine-tuned approach to liquidity provisioning offers several benefits:

-

**

License Protection and Prevention of Copycats

Uniswap v3 takes several measures to protect its license and prevent unauthorized copying. These steps are crucial for safeguarding intellectual property rights and maintaining the uniqueness of the platform.

Legal Frameworks and Licensing Agreements

To protect its license, Uniswap v3 relies on legal frameworks and licensing agreements. By establishing these legal structures, they ensure that their technology remains protected from unauthorized use or replication. This approach allows Uniswap v3 to maintain control over their platform’s development and usage.

Discouraging Copycats

Uniswap v3 actively discourages copycats from replicating their success without proper authorization. They employ various strategies to deter others from imitating their platform:

-

Innovation: Uniswap v3 continually strives to innovate and introduce new features that set it apart from competitors. By constantly pushing boundaries, they make it difficult for copycats to replicate the full functionality and unique offerings of the platform.

-

Community Engagement: Uniswap v3 fosters a strong community around its platform by encouraging active participation, collaboration, and knowledge sharing. This sense of community creates a barrier for potential copycats as it becomes challenging to replicate the same level of engagement and support.

-

Network Effects: Uniswap v3 benefits from network effects, where the value of the platform increases as more users join. This creates a significant advantage over copycat platforms because users are more likely to choose an established platform with a larger user base.

-

Brand Recognition: Uniswap v3 has built a strong brand presence in the decentralized finance (DeFi) space. Their reputation as a reliable and innovative platform makes it difficult for copycats to gain traction or attract users who trust in Uniswap’s established brand.

Integration of smart contracts with Non-Fungible Tokens (NFTs) creates unique trading opportunities. These opportunities are made possible by the virtual liquidity provided by Uniswap v2 and Uniswap v1. with Ethereum trading fees in v1 and v2. with Ethereum trading fees in v1 and v2.

Integration of smart contracts with Non-Fungible Tokens (NFTs) creates unique trading opportunities. These opportunities are made possible by the virtual liquidity provided by Uniswap v2 and Uniswap v1. include trading fees, ethereum, v1, and assets. include trading fees, ethereum, v1, and assets.

There are certain potential risks that liquidity providers (LPs) should be aware of. One significant risk is impermanent loss. Impermanent loss occurs when the price of the tokens in a liquidity pool changes, resulting in LPs losing value compared to simply holding the tokens. This can happen when one token’s price increases or decreases significantly relative to the other token in the pair.

Another risk is slippage. Slippage refers to the difference between the expected price of a trade and the actual executed price due to market volatility or insufficient liquidity in the pool. High slippage can lead to LPs receiving fewer tokens than expected when they withdraw their funds from a pool.

Challenges faced by LPs in managing concentrated positions effectively

In Uniswap v3, LPs have the option to provide liquidity within specific price ranges known as “concentrated positions.” While this feature allows for more efficient use of capital, it also presents challenges for LPs. Managing concentrated positions effectively requires constant monitoring and adjustment.

One challenge is maintaining proper balance within a concentrated position. If the price of one token moves outside of the chosen range, it can result in an imbalance that needs to be addressed promptly. Failure to do so may lead to increased impermanent loss or missed trading opportunities.

Managing multiple concentrated positions across different pools can become complex and time-consuming. LPs need to carefully consider their risk exposure and diversify their investments accordingly.

“Conclusion”

Congratulations! You’ve now gained a comprehensive understanding of how Uniswap v3 works and the exciting features it brings to the world of decentralized finance. By evolving from its previous versions, Uniswap v3 has revolutionized capital efficiency and introduced game-changing elements like concentrated liquidity.

As you delve deeper into the advanced features of Uniswap v3, such as flash swaps for instant transactions and ERC20-ERC20 pools for enhanced flexibility, you’ll realize the immense power this protocol offers. With active liquidity management, range orders for fine-tuning provision, and advanced oracles providing reliable data feeds, Uniswap v3 empowers you to take control of your trading experience like never before.

However, it’s important to note that participating in Uniswap v3 as a liquidity provider comes with risks and challenges. It requires careful consideration of license protection and prevention of copycats, as well as an understanding of potential vulnerabilities. With proper research and risk management strategies in place, you can navigate these challenges successfully.

Now that you’re equipped with knowledge about Uniswap v3’s inner workings and its potential benefits, why not take the next step? Dive into this exciting decentralized ecosystem, explore the possibilities it offers, and unleash your creativity in shaping the future of finance.

So what are you waiting for? Join the Uniswap v3 community today and embark on a journey towards financial empowerment!

FAQs

How does Uniswap V3 work?

Uniswap V3 is an advanced decentralized exchange protocol built on the Ethereum blockchain. It introduces several innovative features to enhance liquidity provision and trading efficiency.

What are the key features of Uniswap V3?

Uniswap V3 introduces concentrated liquidity, allowing liquidity providers (LPs) to concentrate their funds within specific price ranges. This feature enables LPs to provide more targeted liquidity, reducing capital inefficiencies.

How can I become a liquidity provider on Uniswap V3 and earn rewards in assets by providing liquidity to a specific pair of tokens through the v2 protocol?

To become a liquidity provider on Uniswap V3, you need to deposit an equal value of two different tokens into a specific pool. By doing so, you contribute to the liquidity available for trading on the platform and earn fees in return.

How do fees work in Uniswap V3?

In Uniswap V3, fees are collected from traders and distributed proportionally among liquidity providers based on their share of the pool. The fee structure can be customized by LPs within certain limits set by the protocol.

Is it safe to use Uniswap V3?

Uniswap V3 is designed with security in mind, but like any other decentralized application, there are risks involved. It’s important to exercise caution when using DeFi protocols and conduct thorough research before participating.

Can I trade any token on Uniswap V3?

Yes, you can trade a wide range of ERC-20 tokens on Uniswap V3 as long as there is sufficient liquidity available in the respective pools. However, always ensure that you verify the token’s legitimacy before engaging in any trades.

How can I get started with Uniswap V3?

To get started with Uniswap V3, visit their official website or access it through compatible wallets or dApps.