|

|

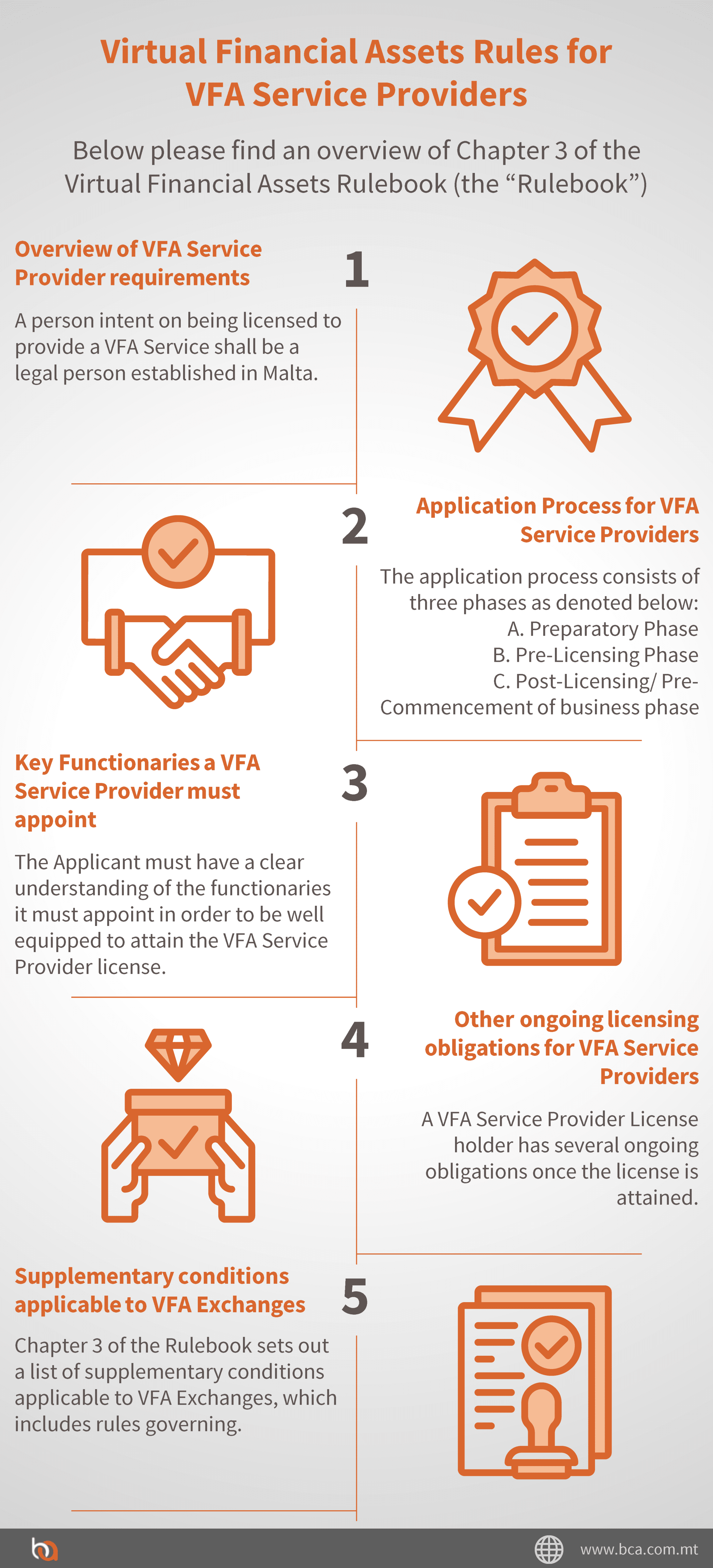

Below please find an overview of Chapter 3 of Malta Virtual Financial Assets Rulebook (the “Rulebook”): Virtual Financial Assets Rules for VFA Service Provider , published by the Malta Financial Services Authority (the“MFSA”) on the 25th of February 2019.

- Reception and Transmission of Orders

- Execution of orders on behalf of other persons

- Dealing on own account (trading against proprietary capital)

- Portfolio Management

- Custodian or Nominee Services

- Investment Advice

- Placing of virtual financial assets

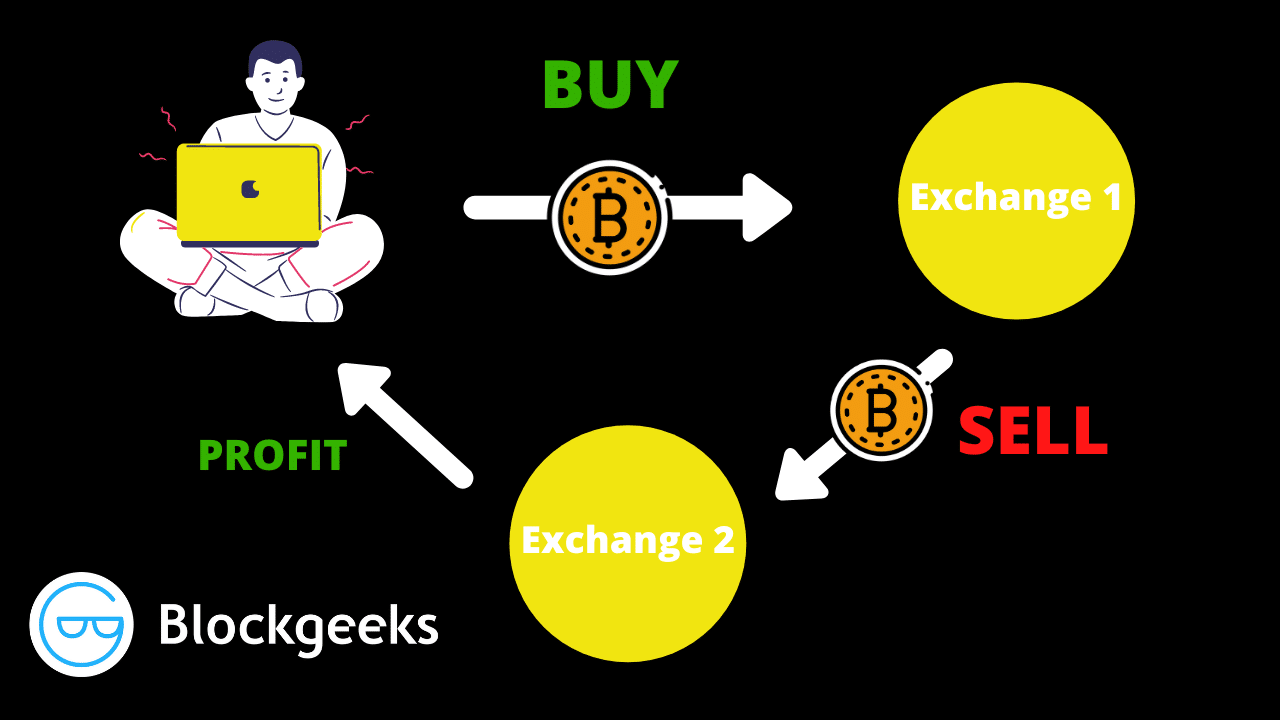

- The operation of a VFA Exchange

- Engage a registered VFA Agent or engage a company intending on applying for registration as a VFA Agent in accordance with Article 14 of the Act, provided that such person has at least three proposed Designated Persons who have successfully completed a course approved by the Authority;

- Provide evidence to the Authority that it has successfully passed a fitness and properness assessment, conducted by the service provider specified in point (i); and

- Provide evidence to the Authority that it has appropriate systems in place to satisfy the AML/CFT requirements applicable to VFA Service

Providers

Overview of VFA Service Provider requirements

- Integrity: The Authority must be reasonably assured that the Applicant is of good repute and intends to act honestly and in a trustworthy manner

- Competence: The Applicant must provide reasonable assurance that both collectively and individually, they possess an acceptable level of knowledge, professional experience, and expertise. Such may be brought to the fore in terms of qualifications, skill, and capacity to commit time to carry out functions within the Applicant’s proposed structure.

- Solvency: The initial capital requirements applicable to Class 4 VFA Service Providers is 730,000 Euro. The Applicant shall maintain such amount as a permanent minimum capital and shall demonstrate that it is financially sound and liquid.

Application Process for VFA Service Providers

Preparatory Phase

- the proposed structure identifying persons intent on holding key positions;

- a list of VFA Services for which licensing is being sought; and

- a legal opinion that activity doesn’t fall within traditional financial services legislation.

Pre-Licensing Phase

Post-Licensing/ Pre-Commencement of business phase

Key Functionaries a VFA Service Provider must appoint

-

VFA Agent:

-

Board of Administration

- overall responsibility for the Applicant and for the implementation of objectives, strategy and governance;- integrity of accounting and financial reporting and operational controls and compliance; overseeing disclosure mechanisms are in place;

- overseeing senior management etc.

-

Risk Manager

- Access the Board;

- Implement policies and procedures;

- Provide senior management with reports and advice;

- Develop the Applicant’s risk strategy and participate in risk decisions;

- Communicate with Board independent from Management.

-

Compliance Officer

- Monitor and assess adequacy and effectiveness of policies and procedures put in place;

- Implementation of the compliance monitoring plan;

- Advise and assist the individuals carrying out the VFA Services to comply with the Applicant’s regulatory obligations;

- Have the necessary authority, resources, expertise and access to all relevant information. The role of the Compliance Officer may only be outsourced to the VFA Agent appointed by the legal entity licensed, or applying to be licensed, as a VFA ServiceProvider.

-

Money Laundering and Reporting Officer (MLRO)

- fully understands the extent of responsibilities attached to the role;

- has a senior role within the company applying for the VFA Service Provider License;

- is well-versed with the provisions of Part I of the Implementing Procedures and sector-specific Implementing Procedures of the FIAU.

-

Auditor

Other ongoing licensing obligations for VFA Service Providers

- Notifying the MFSA There are several instances where the Applicant, at this stage License Holder, must notify the MFSA in writing for approval of certain actions. Such include:

- Change of address and/ any changes to contact details;

- Any proposed acquisitions or disposals of Units which fall within the disclosure provisions of the Act;

- Any proposed material change to its business at least one (1) month before the change is to take effect;

- Any evidence of fraud or dishonesty by a member of the Licence Holder’s staff;

- Any evidence of hacking, fraud or other serious malpractice suffered by the Licence Holder;

- Any decision to make a material claim on its professional indemnity insurance or on any other insurance policy held in relation to its business; Any actual or intended legal proceedings of a material nature by or against the Licence Holder;

- Any material changes in the information supplied to the MFSA;

- Any other material information concerning the Licence Holder, its business or its staff in Malta or abroad;

- Any breach of the Rules, the Act or regulations issued thereunder, as soon as the Licence Holder becomes aware of the breach; and

- Any decisions to make an application to a Regulator abroad to undertake any form of activity outside Malta.

Insurance

- Legal liability in consequence of any negligent act, error or omission in the conduct of business or any person employed;

- Legal defence costs which may arise in consequence of any negligent act, error or omission in the conduct of business;

- Covering the whole territory of the EU;

- Dishonest, fraudulent, criminal or malicious act, error or omission;

- Libel slander and defamation;

- Loss of and damage to documents and records belonging to the Applicant which are in the case, custody or control of the Applicant or for which the Applicant is responsible; and

- Liability arising from any breach of a provision of the Act, Regulation or Rulebook.

Yearly Compliance Certificate

Financial Instrument Test

Clients’ Assets

Supplementary conditions applicable to VFA Exchanges

- Listing Criteria;

- Custody;

- Settlement;

- Order matching;

- Pre-trade and post-trade transparency;

- Synchronisation of business clocks;

- System resilience;

- Bye laws;

- Disciplinary actions; Reporting of suspicious transactions;

- Suspension and removal from trading;

- Client record keeping;

- Inability to discharge functions; and Compliance certificate

![Canadian Bitcoin Exchange Comparison [Most updated Guide]](https://blockgeeks.com/wp-content/uploads/2020/10/image3.png)

Great Read.

Thanks

Small Malta is making huge waves in crypto ocean!

Thanks Nelly! Still the case, Malta Blockchain Summit last week was a big hit 🙂