Contents

|

|

This guide will help you learn a bit about the project, and then we will show you how you can get your hands on some of Ether tokens for trading Ethereum.

Learning how to buy and sell Ethereum can be very simple, provided you have the basics right. Being the second-largest coin by marketcap, Ethereum can be easily bought in exchanges around the world.

Contents

What is Ethereum?

Vitalik Buterin, a Russian-Canadian programming prodigy, was fascinated with the implications of the blockchain technology and Bitcoin. However, he felt that the blockchain had a lot more potential than just being a facilitator of payment protocols. He saw a world where developers from around the world could create applications on a global supercomputer based on the blockchain technology. The main thing to note about these applications is that a single, central corporation does not own them. This is why these applications are also called decentralized applications or “dApps.” This thinking was the primary motivation behind the creation of Ethereum.

Buterin then set out on his own and created his own project called “Ethereum.” In 2014, Ethereum’s crowd sale or ICO (initial coin offering) took place, which raised about $18 million in 42 days. The platform then went live on 30th July 2015.

Bitcoin vs Ethereum

So, before we get deeper into why you should trade Ethereum, let’s compare it with its biggest competitor – Bitcoin. Why should you take a chance on your hard-earned money and invest in Ethereum? Shouldn’t you just settle for the safe option and invest in Bitcoin?

Well, to understand why you should consider investing in Ethereum, you need to know the differences between the two. Bitcoin is a pure payment protocol. You can conduct transactions with Bitcoin or just buy and hold on to them as an investment. With Ethereum, you can do the same, but as we mentioned before, being a cryptocurrency is a tiny part of what Ethereum has to offer.

Ethereum aims to create a worldwide, decentralized supercomputer, which will consist of nodes from all over the globe. It will create a platform wherein developers can rent resources from the system and build their own decentralized applications or dApps. However, the truly fascinating thing to consider here is that each of these dApps can have an internal economy and tokenomics of its own.

So, not only will Ethereum have its own internal economy, it can theoretically sustain several microeconomies on top of its chain. This is where the real value proposition of Ethereum comes in. More than being “just a cryptocurrency,” it is the decentralized supercomputer of the future, which will rent out its resources to developers to create their own applications.

These dApps are based on blueprints called “smart contracts,” which are automated, self-executing agreements between parties. These smart contracts are coded by developers using a language called “solidity.” Each and every command in these contracts cost a certain amount of resource called “gas,” to execute. Before running a smart contract, the user will need to specify a gas limit before they submit it to Ethereum’s miners. If the gas limit isn’t enough to cover the contract, then it will revert back to its original state and the user must pay the gas fees to the miners.

These gas fees are paid in the native Ethereum currency called “Ether.”

TDLR

- Ethereum is the second-largest cryptocurrency by market cap, worth just under a quarter trillion dollars as of May 2022.

- Ethereum is optimized as a smart contract platform, which runs decentralized applications and tokens like ICOs or NFTs.

- Trading Ethereum’s native token, Ether (ETH), can be done online via a number of active exchanges.

- You can now also buy ETH through mainstream brokerage platforms like Robinhood or Paypal.

What is Ether?

A lot of people make the mistake of assuming that Ethereum is the name of the cryptocurrency. Ethereum is actually the name of the project. Its native currency is called “Ether.” Ether has multiple utilities inside and outside Ethereum’s ecosystem. Some of its most essential functions are:

- A mode of payment.

- A store of value.

- To reward the miners for their services.

- Staking (in the near future).

Along with this, there are several features that make ether trading both exciting and unique.

- Ether is not fiat: Like any public, decentralized cryptocurrency, Ether isn’t owned by a government or a consortium. As a result, there isn’t one single government or economy in control of the currency.

- Open 24/7: Unlike stock markets, the crypto market is open 24/7. The reason being stock markets are specific to the country they operate in and usually reflect the working hours of that country. Anyone can purchase ether on most of the exchanges. There are hundreds of exchanges around the world that operate 24/7.

- Volatility: Ether like most cryptocurrencies face rapid price fluctuations. A savvy trader can leverage this and earn easy money.

Trading Strategies for Ether

Trading strategies for Ether fall largely into two categories:

- Holding.

- Active trading.

#1 Holding

Holding or “hodling” as the community likes to call it is the simplest trading strategy used by investors since its the one that requires the least amount of effort. In stock-trading, holding is a long-term strategy. The idea is that the investor buys a certain amount of stocks in a strong and reputable company. They then hold on to those stocks as the company grows in valuation, making them rich in the process. In the crypto market, Bitcoin and Ethereum are the two market leaders in the space. A lot of early investors in the space have made acquired huge wealth over time.

Advantages

- Saves a large amount of time and energy. You just need to buy Ether and store them in a safe place.

- You don’t need to constantly keep track of news, information, price histories and other fundamental news to know whether the price is going to temporarily drop or not.

- Low portfolio maintenance.

- Since you don’t need to make frequent trades, the overall transaction fees you have to pay is low.

Disadvantages

- Long-term holders won’t be able to profit from short-term price fluctuations.

- Long-term holding can be really risky when it comes to cryptocurrencies. You will need to choose your coins with a lot of care and research. You don’t want to be “that guy who invested in Bitconnect.”

One of the most crucial aspects of holding is the eventual sale. In other words, when do you exit your position and pocket your profits? Should you sell all the coins at once, or should you sell them in chunks? This again depends on the coin and how much faith you have in its potential impact.

#2 Active trading

Active traders delve deep into the market and have more knowledge and experience about assets and price actions than long-term holders. They use technical and fundamental analysis to monitor the market’s performance continually.

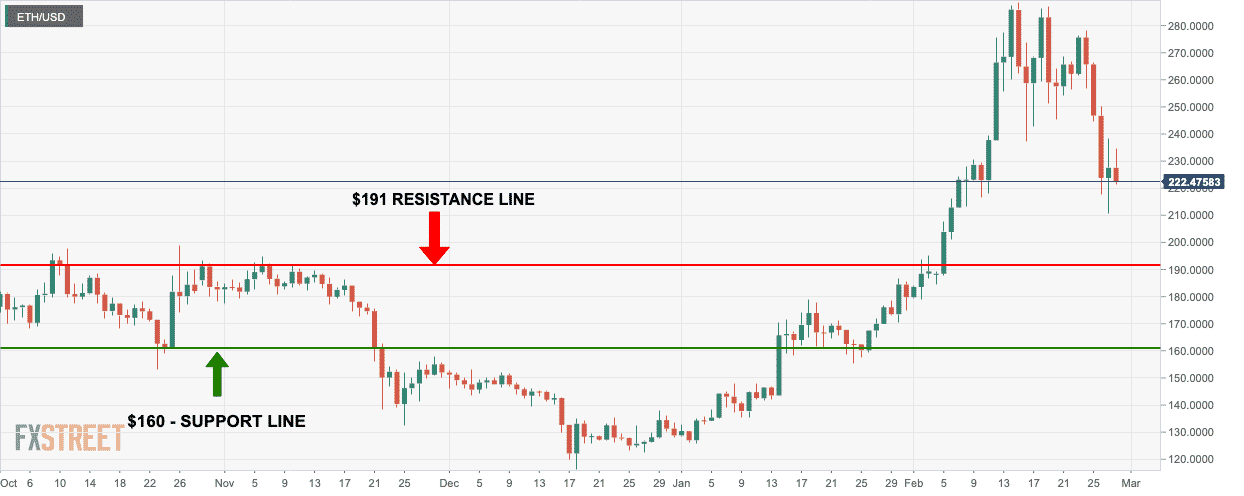

For these guys, the goal is to buy low and sell high. Consider the following diagram.

In the example given above, an educated, active trader would enter the market at the $160-level, and wait till the price went up to $191. Following that, they would exit the market and net a ~$30/ether profit. Of course, this a very simple example. If you want to know more about technical analysis and trading, then check out our guide here

Advantages

- Active trading will allow you to benefit significantly from the short-term price fluctuations.

- If you have the skills required to read the market correctly, then you will be able to identify short pumps in irrelevant coins and make your profits accordingly.

Disadvantages

- For some, this could be a full-time job and requires careful planning and strategy.

- Every time you sell your holdings, you may need to withdraw your holdings to your bank account. This could obviously take a long time and incur plenty of fees. This is why traders use stablecoins like Tether to hold their investments.

Ok, so how do I get started Trading Ethereum

So, you know how Ethereum works and how simple trading strategies look like, let’s look at how you can actually get your hands on some of these coins. Thankfully, Ethereum is a top-rated coin and is available in all the major exchanges. We are going to show you how you can get Ether on Kraken, one of the most popular and beginner-friendly exchanges in the world. However, before we do so, let’s talk a bit about P2P exchanges and especially LocalCryptos.

LocalCryptos

LocalCryptos is a peer-to-peer exchange that will allow you to directly buy and sell cryptocurrencies through the exchange. The most significant advantage here is that it is entirely decentralized, and honesty is maintained throughout the system via smart contracts. Local Cryptos has buyers and sellers around the world. The traders can trade between themselves by paying in cash or sending money via wire transfer or PayPal or SEPA or direct bank deposit or anything that the seller wants. Registration in the exchange only requires you to use your email ID. However, if you verify your identity, then you will be raising your trust between traders.

Despite being a very viable alternative, the fact remains that beginners may get scared by the P2P aspect of the exchange. They may want something more traditional and similar to stock exchanges. This is why Kraken is a great entry point for cryptocurrency investors.

Kraken

Kraken was founded by CEO Jesse Powell back in July 2011 and officially launched to the public in September 2013. While they are based out of San Francisco, USA, they still have one of the largest Euro-to-crypto markets in the world. Kraken is available to residents of the US, Canada, Japan, and various European nations. It also allows you to deal with multiple fiat currencies like the US Dollar, the Canadian Dollar, the Euro, the British Pound, and the Japanese Yen. Kraken does not currently accept deposits via credit cards, debit cards, PayPal, or similar services.

Alright, so what all cryptos are available for trade here?

Apart from Ethereum, they also provide Bitcoin, Monero (XMR), Dash (DASH), Litecoin (LTC), Ripple (XRP), Stellar/Lumens (XLM), Ethereum Classic (ETC), Augur REP tokens (REP), ICONOMI (ICN), Melon (MLN), Zcash (ZEC), Dogecoin (XDG), Tether (USDT), Gnosis (GNO), and EOS (EOS).

In 2014, Kraken became the number one exchange in the world when it comes to Euro trade volume. They also pioneered the first verifiable cryptographic proof of reserves audit system and was also listed on the Bloomberg Terminal within the same year.

Conclusion

Should You Trade or Hold ETH?

The trading mechanisms like spot and margin trading tend to focus on short-term fluctuations in the crypto market. But many investment strategies rely on buying cryptocurrencies when they are cheap, holding them for a long time, and selling them when they can be sold for a profit.

Short-term trading is always the riskier option. The crypto market is extremely volatile, with massive shifts happening over the short term. If you have good insight into what the market is going to do, you can make a lot of money on short-term trades. If you get it wrong, you can also lose a lot of money.

Holding tends to be the safer investment option. But this is only true if you think the cryptocurrency you are holding – Ethereum, in this case – will increase in value over the long term.

As a project, Ethereum is focused on building a decentralized computing machine. This attracts a much more diverse set of developers with a wider range of skills. Being more than just a payment network and allowing more computational operations on its decentralized network, Ethereum has attracted the attention of established corporations