Contents

|

|

Welcome to the world of Chainflip, where decentralized finance meets cross-chain interoperability. Experience the power of trading volume and protocol rewards while enjoying seamless supply across different chains in just a matter of days. If you’ve been searching for a seamless way to swap assets across different blockchains, look no further. With our native flip tokens, you can easily trade assets with high trading volume. Try it out now and experience the convenience of Nov’s blockchain integration. Chainflip is here to revolutionize the way we transact and exchange cryptocurrencies by increasing trading volume and protocol rewards while also ensuring a steady supply.

In today’s rapidly evolving blockchain landscape, the need for interoperability has become increasingly evident. The trading volume and supply of tokens continue to increase, making it essential to have the ability to flip tokens seamlessly between different platforms. With various blockchains operating independently, users face challenges. This is where Chainflip steps in, offering a solution that allows users to effortlessly increase and bridge the gap between different chains.

By leveraging cutting-edge technology and protocols, Chainflip enables secure and efficient cross-chain swaps that increase the speed and decrease the fees to a minimum. Whether you’re an avid DeFi enthusiast or simply looking to explore new opportunities in the crypto space, Chainflip opens up a world of possibilities.

Join us as we delve into the inner workings of Chainflip and discover how this innovative platform is reshaping the future of decentralized finance.

Contents

Overview of Chainflip’s Features

Chainflip offers a range of impressive features that make it stand out in the world of decentralized finance. Let’s dive into some of its key offerings.

Fast and Secure Swaps

One of the standout features of Chainflip is its ability to facilitate fast and secure swaps between different blockchain networks. With Chainflip, you can seamlessly exchange assets across multiple chains without worrying about security risks or delays. This means you can quickly flip tokens and take advantage of opportunities in various markets without any hassle.

Cross-Chain Liquidity

Chainflip also provides cross-chain liquidity, allowing users to access liquidity pools from different blockchains. This opens up a whole new world of possibilities for traders and investors, as they can flip and tap into a wide range of assets and markets that were previously inaccessible. Whether you’re looking to diversify your portfolio or explore new investment opportunities, Chainflip’s cross-chain liquidity feature has got you covered.

User-Friendly Interface

Navigating through complex decentralized finance platforms can be overwhelming for many users. However, with the flip of a switch, users can easily access and understand these platforms. However, Chainflip aims to simplify the user experience with its intuitive interface. Even if you’re new to the world of DeFi, you’ll find it easy to navigate through the platform and execute transactions seamlessly. Whether you want to buy, sell, or flip assets, our platform has a user-friendly interface that makes it simple for beginners. The user-friendly interface ensures that everyone can effortlessly participate in decentralized finance activities, including flipping assets, regardless of their technical expertise.

Low Fees and Gas Optimization

High fees and gas costs have been a major pain point for many users in the DeFi space, causing them to flip. But with Chainflip, you can enjoy low fees and optimized gas usage when conducting transactions on the platform. This not only saves you money but also enhances overall efficiency by reducing unnecessary expenses. Additionally, it allows you to flip your budget and resources effectively.

Decentralized Governance

Decentralization is at the core of Chainflip’s philosophy, which is why it incorporates decentralized governance into its platform. Through community-driven decision-making processes, users have a say in shaping the future direction of Chainflip. This ensures that the platform flip evolves in a way that aligns with the needs and preferences of its users.

Robust Security Measures

Security is a top priority for Chainflip, and it employs robust measures to protect user funds and data. The platform utilizes advanced encryption protocols, multi-signature wallets, and smart contract audits to ensure that your assets are safe at all times. Whether you want to buy, sell, or flip your assets, our platform has you covered. By prioritizing security, Chainflip provides users with peace of mind when engaging in decentralized finance activities.

Chainflip’s Market Overview and All-Time High

Chainflip, a decentralized cross-chain asset bridge protocol, has gained significant traction in the market. Let’s take a closer look at the flip market overview and explore its all-time high.

Growing Popularity and Adoption

Chainflip has been making waves in the crypto community due to its unique features and potential for bridging assets across different blockchain networks. With an increasing number of users embracing decentralized finance (DeFi) solutions, Chainflip offers a seamless way to transfer assets between various chains.

The popularity of the flip protocol can be attributed to its ability to address one of the key challenges in the crypto space: interoperability. By enabling users to move their assets from one blockchain network to another without relying on centralized exchanges, Chainflip opens up new opportunities for investors and traders.

Cross-Chain Asset Bridge Protocol

At its core, Chainflip acts as a bridge between different blockchains, allowing users to transfer their assets securely and efficiently. This flip cross-chain functionality is crucial for expanding the reach of flip cryptocurrencies and flip tokens beyond their native networks.

By leveraging smart contracts and atomic swaps, Chainflip ensures that transactions are executed trustlessly and without intermediaries. This eliminates the need for third-party custodianship while maintaining the security of user funds throughout the flip process.

All-Time High Performance

Since its launch, Chainflip has experienced remarkable growth in terms of both adoption and value appreciation. The native token of the protocol has experienced significant price surges, flipping to an all-time high (ATH) and demonstrating investor confidence in its potential.

Potential Benefits for Users

Investing in Chainflip presents several potential benefits for individuals looking to diversify their cryptocurrency portfolios or capitalize on emerging trends. By participating in the Chainflip ecosystem, investors can potentially benefit from:

-

Increased liquidity: As more assets are bridged across chains using Chainflip, liquidity pools expand, creating new opportunities for traders and investors.

-

Exposure to emerging projects: Chainflip’s cross-chain capabilities allow users to access tokens and projects that may not be available on their native networks, providing exposure to promising ventures.

-

Potential for yield farming: With its interoperability features, Chainflip facilitates participation in various yield farming strategies across different blockchain networks, potentially increasing returns.

Chainflip to USD: Chart Analysis and Pricing Advantages

Chainflip, a decentralized exchange protocol, offers numerous advantages. Let’s delve into the key points that make Chainflip stand out in terms of its chart analysis capabilities and pricing advantages.

Real-Time Chart Analysis

Chainflip provides real-time chart analysis, allowing users to monitor price movements and trends accurately. This flip feature is crucial for traders who rely on technical analysis to make informed decisions. By offering up-to-date charts, Chainflip ensures that users have access to the most recent data, enabling them to identify potential buying or selling opportunities more effectively.

Historical Price Data

In addition to real-time chart analysis, Chainflip also provides historical price data. This allows users to analyze past market performance and identify patterns or trends that could help predict future price movements. By having access to this information, traders can make more informed decisions based on historical data and increase their chances of making profitable trades.

Advanced Charting Tools

Chainflip offers a range of advanced charting tools that enhance the trading experience. These tools include various technical indicators such as moving averages, oscillators, and trend lines. Traders can utilize these tools to gain deeper insights into market conditions and better understand price dynamics. The availability of advanced charting tools on Chainflip empowers traders with the necessary resources to conduct thorough analyses and make well-informed trading decisions.

Competitive Pricing

One of the significant advantages of using Chainflip is its competitive pricing structure. The platform strives to offer fair and transparent pricing for all transactions conducted on its decentralized exchange. By ensuring competitive pricing, Chainflip aims to attract more users while providing them with cost-effective trading options compared to traditional centralized exchanges.

Low Fees

Chainflip boasts low fees for trading activities on its platform. This fee structure benefits traders by minimizing transaction costs associated with buying or selling assets through the exchange. With lower fees, users can maximize their potential profits and reduce the impact of trading expenses on their overall returns.

No Middlemen

Chainflip’s decentralized nature eliminates the need for intermediaries or middlemen in transactions. This removes additional costs associated with traditional financial systems and ensures that traders can engage in peer-to-peer trading without unnecessary fees or delays. By cutting out middlemen, Chainflip enables direct and efficient trading between users, enhancing the overall user experience.

Security Measures and Capital Efficiency in Chainflip

Security Measures

Chainflip takes security seriously to protect your assets. They employ robust security measures to ensure that your funds are safe throughout the swapping process. One of the key security features is their implementation of multi-signature wallets. This means that multiple private keys are required to authorize any transaction, adding an extra layer of protection against unauthorized access.

Chainflip also utilizes smart contracts on the Ethereum blockchain, which are designed to execute transactions automatically once certain conditions are met. These smart contracts help eliminate any potential for human error or fraud during the swapping process.

To further enhance security, Chainflip conducts regular audits and assessments of their platform’s codebase. This ensures that any vulnerabilities or weaknesses are identified and addressed promptly. By prioritizing security at every level, Chainflip aims to provide users with a secure and reliable swapping experience.

Capital Efficiency

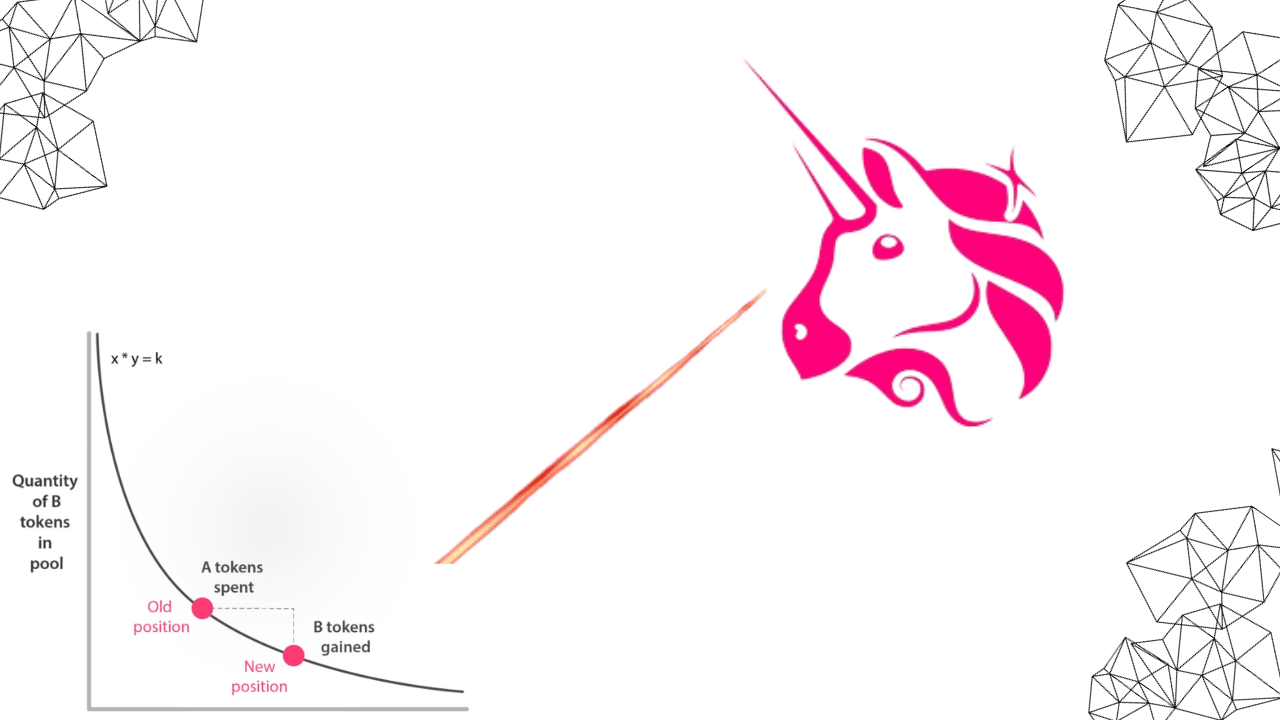

Chainflip offers capital efficiency through its innovative cross-chain liquidity protocol. Unlike traditional decentralized exchanges (DEXs) that rely on individual liquidity pools for each trading pair, Chainflip pools liquidity across multiple chains. This enables users to swap assets seamlessly between different blockchains without the need for intermediaries.

By pooling liquidity from various chains, Chainflip maximizes capital efficiency by reducing slippage and increasing trading volumes. This means that users can trade larger amounts of assets without experiencing significant price impact or loss due to insufficient liquidity.

Moreover, Chainflip’s capital efficiency extends beyond just swapping assets. It also allows users to earn passive income through yield farming opportunities provided by their platform. By utilizing idle assets in liquidity pools, users can earn additional rewards in the form of trading fees or governance tokens.

Earning Fees and Rewards with Chainflip

Chainflip not only provides security measures and capital efficiency but also offers the opportunity to earn fees and rewards. Let’s explore how you can benefit from participating in the Chainflip ecosystem.

Staking and Liquidity Provision

One way to earn fees and rewards is through staking your CHAIN tokens. By staking your tokens, you contribute to the security and stability of the Chainflip network. In return for your contribution, you receive a portion of the transaction fees generated on the platform. This incentivizes users to hold their tokens rather than sell them, as they can earn passive income by simply staking.

Chainflip encourages liquidity provision by offering rewards for providing liquidity to their decentralized exchanges (DEXs). By supplying liquidity to trading pairs on these DEXs, you help ensure smooth trading operations while earning rewards in return. The more liquidity you provide, the higher your potential earnings.

Yield Farming

Another way to maximize your earnings with Chainflip is through yield farming. Yield farming involves locking up your crypto assets in smart contracts or protocols to earn additional rewards. With Chainflip’s yield farming program, users can stake their CHAIN tokens into designated pools and earn additional tokens as rewards.

These reward tokens may have value within the Chainflip ecosystem or even beyond it. Users can then choose whether to sell these reward tokens or continue holding them for potential future gains.

Governance Participation

Chainflip believes in decentralization and community involvement. As a token holder, you have the power to participate in governance decisions that shape the future of the platform. By actively voting on proposals such as protocol upgrades or changes, you have a say in how Chainflip evolves.

Participating in governance not only allows you to influence decisions but also presents an opportunity for additional rewards. Some platforms offer incentives for active participation in governance processes, rewarding token holders who actively engage with voting and discussions.

Referral Program

Chainflip also offers a referral program, allowing users to earn additional rewards by inviting others to join the platform. By sharing your unique referral link with friends, family, or even on social media, you can earn a percentage of the fees generated by those who sign up through your link. This provides an opportunity for passive income as more users join and transact on Chainflip.

Chainflip’s Community Engagement and Market Sentiment

Chainflip, a decentralized exchange protocol, has not only revolutionized the way users earn fees and rewards but has also actively engaged with its community to gauge market sentiment. This engagement is crucial in understanding the needs and preferences of its users, ensuring that Chainflip continues to provide a seamless trading experience.

Active Community Participation

Chainflip places immense value on its community members, encouraging active participation through various channels. The project maintains an active presence on social media platforms such as Twitter, Telegram, and Discord, where users can interact directly with the team and fellow community members. These channels serve as hubs for discussions, updates, and announcements related to the platform.

By fostering a vibrant community ecosystem, Chainflip benefits from valuable feedback from its users. This direct line of communication allows the project to address concerns promptly and implement improvements based on user suggestions. Moreover, it creates a sense of inclusivity and ownership among community members who feel heard and valued.

Community Governance

In addition to soliciting feedback from its community, Chainflip embraces decentralized governance principles by involving token holders in decision-making processes. Through voting mechanisms implemented within the protocol, users have the power to influence important decisions such as platform upgrades or changes in fee structures.

This democratic approach ensures that Chainflip remains aligned with the interests of its user base while avoiding centralized control or manipulation. By giving every participant a voice in shaping the future of the platform, Chainflip fosters trust and transparency within its ecosystem.

Market Sentiment Analysis

Understanding market sentiment is crucial for any trading platform’s success. To this end, Chainflip employs various tools and techniques to analyze market trends and sentiment indicators. By monitoring social media platforms, news sources, and other relevant channels for mentions of Chainflip or related keywords, they gain insights into how investors perceive their platform.

Chainflip leverages data analytics techniques to track trading volumes across different assets and identify patterns that may indicate market sentiment. This information helps the team make informed decisions regarding liquidity provision, asset listings, and other strategic moves.

By staying attuned to market sentiment, Chainflip can adapt its offerings to align with user expectations and capitalize on emerging trends. This proactive approach ensures that users have access to the assets they desire while maintaining a competitive edge in the rapidly evolving decentralized exchange landscape.

The Impact of Chainflip’s Listing on KuCoin

Increased Trading Volume and Liquidity

Chainflip’s listing on KuCoin has had a significant impact on the trading volume and liquidity of the platform. With its introduction, more traders have flocked to KuCoin to take advantage of the new investment opportunities presented by Chainflip. As a result, the trading volume on KuCoin has experienced a substantial surge, leading to increased liquidity in the market.

This surge in trading volume and liquidity is beneficial for both existing and new traders. Existing traders can enjoy improved market stability as there are more participants actively buying and selling Chainflip tokens. Increased liquidity means that traders can easily enter or exit positions without causing drastic price fluctuations.

Enhanced Market Visibility and Credibility

Being listed on a reputable exchange like KuCoin brings Chainflip enhanced market visibility and credibility. KuCoin is known for its rigorous listing process, which includes thorough due diligence on projects before they are listed. Therefore, when Chainflip successfully passed this evaluation process and got listed on KuCoin, it gained instant recognition as a legitimate project with potential.

The listing also opens up new avenues for exposure to a wider audience of crypto enthusiasts who actively follow platforms like KuCoin for investment opportunities. This increased visibility not only helps attract potential investors but also boosts confidence among existing holders of Chainflip tokens.

Expansion of Community Reach

Chainflip’s listing on KuCoin allows it to tap into an extensive community reach that is already present within the exchange’s ecosystem. By gaining access to this established user base, Chainflip can engage with a broader audience interested in decentralized finance (DeFi) projects.

Moreover, being part of the KuCoin community enables Chainflip to leverage various marketing channels provided by the exchange itself. These channels include social media promotions, newsletters, and educational resources that help raise awareness about Chainflip’s unique features and benefits.

Potential Price Appreciation

Listing on KuCoin has the potential to drive price appreciation for Chainflip tokens. As more traders and investors become aware of Chainflip’s listing and its promising technology, demand for the tokens may increase, leading to a potential surge in their value.

Furthermore, being listed on a reputable exchange like KuCoin can attract institutional investors who often rely on established platforms for their investment decisions. The entry of institutional investors into the market can result in increased buying pressure, driving up the price of Chainflip tokens.

Analyzing Chainflip’s Recent Price Movements

Recent Surge in Price

Chainflip, the decentralized exchange platform, has experienced a significant surge in its price recently. This sudden increase has caught the attention of investors and cryptocurrency enthusiasts alike.

The price of Chainflip’s native token has been on an upward trajectory, reaching new highs in a short span of time. This surge can be attributed to several factors that have contributed to the increased demand for Chainflip.

Growing Popularity and Adoption

One key factor behind Chainflip’s recent price movements is its growing popularity and adoption within the crypto community. As more users recognize the potential and benefits of decentralized exchanges, they are turning to platforms like Chainflip for their trading needs.

Chainflip offers unique features such as cross-chain swaps and liquidity mining incentives, which have attracted a large user base. The increasing number of users utilizing the platform has created a higher demand for Chainflip tokens, driving up its price.

Market Sentiment and Investor Confidence

Another crucial aspect influencing Chainflip’s price movements is market sentiment and investor confidence. Positive news surrounding the project, such as partnerships with established blockchain projects or endorsements from influential individuals within the industry, can significantly impact investor sentiment.

When investors perceive a project as promising and trustworthy, they are more likely to invest in its native token, leading to an increase in demand and subsequently driving up the token’s price. Positive market sentiment towards Chainflip has played a vital role in its recent surge.

Supply and Demand Dynamics

Supply and demand dynamics play a fundamental role in determining asset prices, including cryptocurrencies. In the case of Chainflip, limited token supply combined with increasing demand has created a situation where buyers outnumber sellers.

With fewer tokens available for purchase on exchanges coupled with rising interest from investors wanting to acquire Chainflip tokens, there is upward pressure on prices due to increased competition among buyers. This dynamic contributes to the recent surge observed in Chainflip’s price.

Market Volatility and Speculation

It is important to note that the cryptocurrency market is known for its volatility and speculative nature. Price movements can be influenced by a wide range of factors, including market trends, news events, and even social media discussions.

The recent surge in Chainflip’s price may also be attributed, at least partially, to speculation and trading activity within the crypto community. Traders seeking short-term gains or attempting to capitalize on market trends may contribute to price fluctuations.

Purchasing Chainflip Cryptocurrency: Platforms and Process

To purchase Chainflip cryptocurrency, you’ll need to find the right platform and follow a straightforward process. Let’s dive into the details!

Popular Platforms for Buying Chainflip

There are several platforms available that support this cryptocurrency. Some of the popular ones include:

-

Binance: Binance is one of the largest and most well-known cryptocurrency exchanges globally. It offers a user-friendly interface and supports a wide range of cryptocurrencies, including Chainflip.

-

Coinbase: Coinbase is another widely used platform that allows users to buy, sell, and store various cryptocurrencies securely. Chainflip may be available on Coinbase depending on its listing.

-

KuCoin: KuCoin is a reliable exchange that provides access to numerous cryptocurrencies, including Chainflip. It offers advanced trading features for experienced traders and has a simple user interface for beginners.

-

Uniswap: Uniswap is a decentralized exchange (DEX) built on the Ethereum blockchain. It enables users to trade tokens directly from their wallets without relying on intermediaries or centralized platforms.

The Process of Buying Chainflip

Once you’ve chosen a suitable platform, you can follow these general steps to purchase Chainflip:

-

Create an account: Sign up for an account on your chosen platform by providing the required information and completing any necessary verification processes.

-

Deposit funds: After creating your account, deposit funds into your wallet or trading account using supported payment methods such as bank transfers or credit/debit cards.

-

Find CHAIN token: Search for “CHAIN” or “Chainflip” on the platform’s trading page to locate the correct cryptocurrency pairings.

-

Place an order: Decide whether you want to place a market order (buy at current market price) or limit order (set your desired price). Enter the amount of Chainflip you want to purchase and review the order details.

-

Confirm and complete: Once you’re satisfied with the order details, confirm your purchase. The platform will execute the trade, and your purchased Chainflip tokens will be credited to your wallet or trading account.

Tips for Buying Chainflip

When purchasing Chainflip or any other cryptocurrency, it’s essential to keep a few tips in mind:

-

Research: Before investing in any cryptocurrency, conduct thorough research about its technology, team, market trends, and potential risks. This will help you make informed decisions.

-

Security: Choose reputable platforms that prioritize security measures such as two-factor authentication (2FA) and cold storage for funds.

Conclusion

So there you have it, a comprehensive exploration of Chainflip and its various aspects. We’ve covered everything from its features and market overview to security measures and community engagement. By analyzing Chainflip’s recent price movements and discussing the process of purchasing its cryptocurrency, we’ve gained valuable insights into this platform.

Now that you have a solid understanding of Chainflip, it’s time to take action. Consider exploring further, diving deeper into the world of decentralized exchanges, or even becoming a participant in the Chainflip community. The opportunities are endless, and with Chainflip’s innovative approach to cross-chain trading, you may just find yourself at the forefront of a game-changing revolution in the crypto space.

So go ahead, seize the moment, and embark on your own journey with Chainflip. The future awaits!

FAQs

What is Chainflip?

Chainflip is a decentralized cross-chain bridge that allows users to swap tokens between different blockchain networks. It enables seamless interoperability and facilitates the transfer of assets across various blockchains.

How does Chainflip ensure security?

Chainflip incorporates robust security measures such as multi-signature wallets, smart contract audits, and strict protocol governance. These measures are designed to protect user funds and ensure the integrity of token swaps on the platform.

Which blockchain networks does Chainflip support?

Currently, Chainflip supports popular blockchain networks like Ethereum, Binance Smart Chain, and Avalanche. However, the platform aims to expand its compatibility with more chains in the future to provide users with increased flexibility.

What fees are associated with using Chainflip?

Chainflip charges transaction fees for token swaps on its platform. These fees depend on factors such as network congestion and gas prices. Users can check the current fee structure on the Chainflip website or through supported wallet interfaces.

How can I use Chainflip?

To utilize Chainflip, you need to connect your compatible wallet to the platform, select the tokens you want to swap, specify the desired destination chain, approve the transaction, and confirm the swap. The process is intuitive and user-friendly for seamless cross-chain asset transfers.