Contents

|

|

What Is Cryptocurrency: 21st-Century Unicorn – Or The Money Of The Future?

TL;DR:

- Cryptocurrency is an internet-based medium of exchange which uses cryptographical functions to conduct financial transactions. Cryptocurrencies leverage blockchain technology to gain decentralization, transparency, and immutability.

- The most important feature of a cryptocurrency is that it is not controlled by any central authority: the decentralized nature of the blockchain makes cryptocurrencies theoretically immune to the old ways of government control and interference.

- Cryptocurrencies can be sent directly between two parties via the use of private and public keys. These transfers can be done with minimal processing fees, allowing users to avoid the steep fees charged by traditional financial institutions.

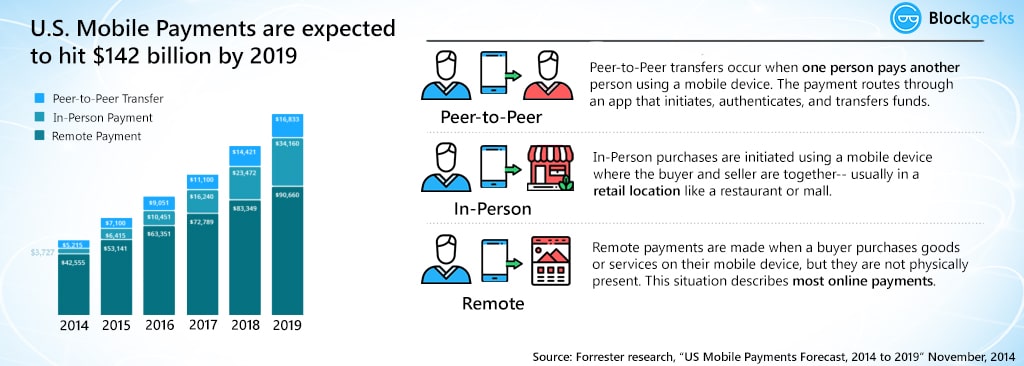

Today cryptocurrencies (Buy Crypto) have become a global phenomenon known to most people. In this guide, we are going to tell you all that you need to know about cryptocurrencies and the sheer that they can bring into the global economic system.

Nowadays, you‘ll have a hard time finding a major bank, a big accounting firm, a prominent software company or a government that did not research cryptocurrencies, publish a paper about it or start a so-called blockchain-project.

But beyond the noise and the press releases the overwhelming majority of people – even bankers, consultants, scientists, and developers – have very limited knowledge about cryptocurrencies. They often fail to even understand the basic concepts.

So let‘s walk through the whole story. What are cryptocurrencies?

Contents

Understanding Cryptocurrency Basics 101

- Where did cryptocurrency originate?

- Why should you learn about cryptocurrency?

- And what do you need to know about cryptocurrency?

How cryptocurrency works?

Few people know, but cryptocurrencies emerged as a side product of another invention. Satoshi Nakamoto, the unknown inventor of Bitcoin, the first and still most important cryptocurrency, never intended to invent a currency.

In his announcement of Bitcoin in late 2008, Satoshi said he developed “A Peer-to-Peer Electronic Cash System.“

His goal was to invent something; many people failed to create before digital cash.

Announcing the first release of Bitcoin, a new electronic cash system that uses a peer-to-peer network to prevent double-spending. It’s completely decentralized with no server or central authority. – Satoshi Nakamoto, 09 January 2009, announcing Bitcoin on SourceForge.

The single most important part of Satoshi‘s invention was that he found a way to build a decentralized digital cash system. In the nineties, there have been many attempts to create digital money, but they all failed.

… after more than a decade of failed Trusted Third Party based systems (Digicash, etc), they see it as a lost cause. I hope they can make the distinction, that this is the first time I know of that we’re trying a non-trust based system. – Satoshi Nakamoto in an E-Mail to Dustin Trammell

After seeing all the centralized attempts fail, Satoshi tried to build a digital cash system without a central entity. Like a Peer-to-Peer network for file sharing.

This decision became the birth of cryptocurrency. They are the missing piece Satoshi found to realize digital cash. The reason why is a bit technical and complex, but if you get it, you‘ll know more about cryptocurrencies than most people do. So, let‘s try to make it as easy as possible:

To realize digital cash you need a payment network with accounts, balances, and transaction. That‘s easy to understand. One major problem every payment network has to solve is to prevent the so-called double spending: to prevent that one entity spends the same amount twice. Usually, this is done by a central server who keeps record about the balances.

In a decentralized network , you don‘t have this server. So you need every single entity of the network to do this job. Every peer in the network needs to have a list with all transactions to check if future transactions are valid or an attempt to double spend.

But how can these entities keep a consensus about these records?

If the peers of the network disagree about only one single, minor balance, everything is broken. They need an absolute consensus. Usually, you take, again, a central authority to declare the correct state of balances. But how can you achieve consensus without a central authority?

Nobody did know until Satoshi emerged out of nowhere. In fact, nobody believed it was even possible.

Satoshi proved it was. His major innovation was to achieve consensus without a central authority. Cryptocurrencies are a part of this solution – the part that made the solution thrilling, fascinating and helped it to roll over the world.

What is cryptocurrency?

If you take away all the noise around cryptocurrencies and reduce it to a simple definition, you find it to be just limited entries in a database no one can change without fulfilling specific conditions. This may seem ordinary, but, believe it or not: this is exactly how you can define a currency.

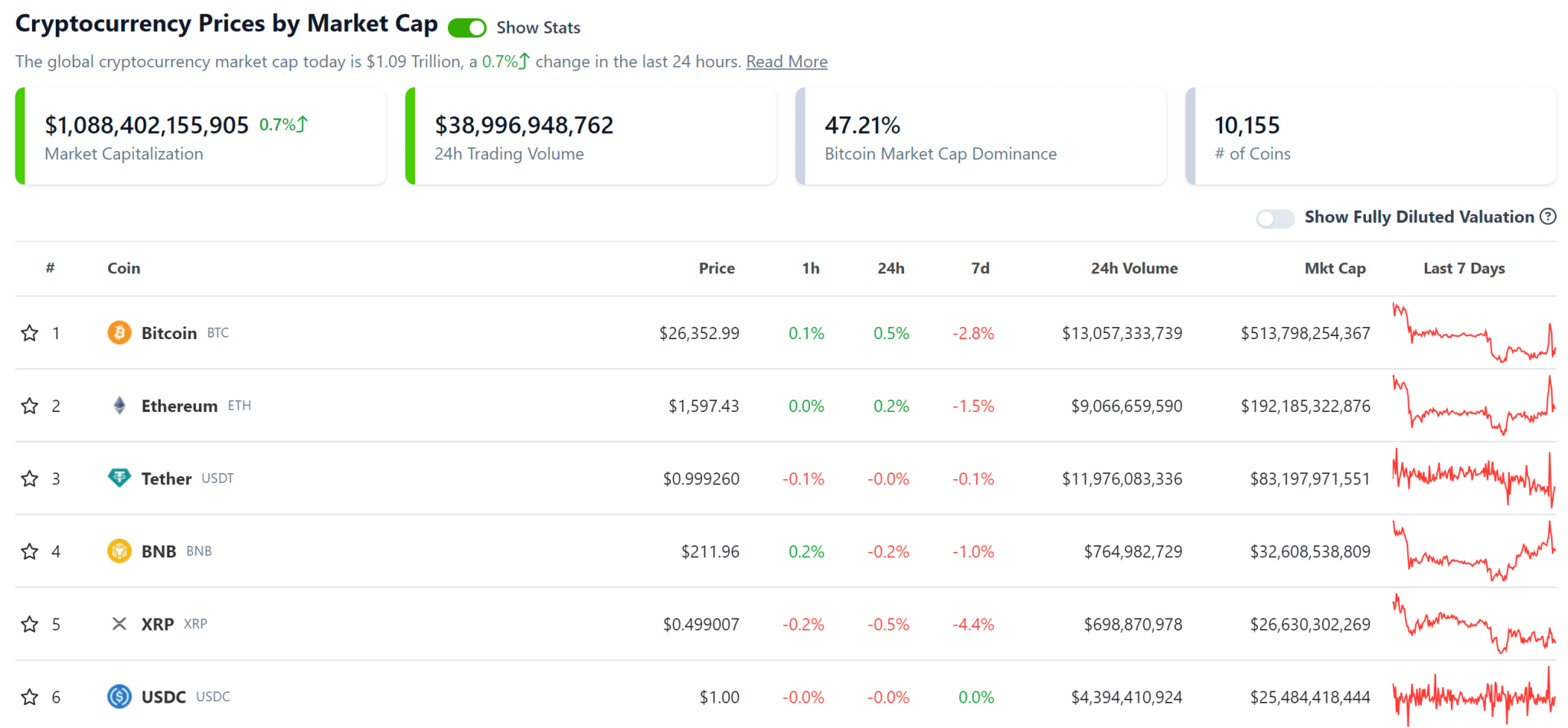

Examples of Cryptocurrencies

-

Bitcoin is the first and most valuable cryptocurrency.

-

Ethereum is commonly used to carry out financial transactions more complex than those supported by Bitcoin.

-

Cardano is a competitor to Ethereum led by one of its co-founders.

-

Litecoin is an adaptation of Bitcoin intended to make payments easier.

-

Solana is another competitor to Ethereum that emphasizes speed and cost-effectiveness.

-

Dogecoin began as a joke but has grown to be among the most valuable cryptocurrencies.

-

Shiba Inu is another dog-themed token with more complex mechanics.

-

Stablecoins, including Tether and USDC, are a class of cryptocurrencies whose values are designed to stay stable relative to real-world assets such as the dollar.

Take the money on your bank account: What is it more than entries in a database that can only be changed under specific conditions? You can even take physical coins and notes: What are they else than limited entries in a public physical database that can only be changed if you match the condition than you physically own the coins and notes? Money is all about a verified entry in some kind of database of accounts, balances, and transactions.

So, to give a proper definition – Cryptocurrency is an internet-based medium of exchange which uses cryptographical functions to conduct financial transactions. Cryptocurrencies leverage blockchain technology to gain decentralization, transparency, and immutability.

How miners create coins and confirm transactions

Let‘s have a look at the mechanism ruling the databases of cryptocurrencies. A cryptocurrency like Bitcoin consists of a network of peers. Every peer has a record of the complete history of all transactions and thus of the balance of every account.

A transaction is a file that says, “Bob gives X Bitcoin to Alice“ and is signed by Bob‘s private key. It‘s basic public key cryptography, nothing special at all. After signed, a transaction is broadcasted in the network, sent from one peer to every other peer. This is basic p2p-technology.

Blockchain and Cryptocurrency

The transaction is known almost immediately by the whole network. But only after a specific amount of time it gets confirmed.

Confirmation is a critical concept in cryptocurrencies. You could say that cryptocurrencies are all about confirmation.

As long as a transaction is unconfirmed, it is pending and can be forged. When a transaction is confirmed, it is set in stone. It is no longer forgeable, it can‘t be reversed, it is part of an immutable record of historical transactions: of the so-called blockchain.

Only miners can confirm transactions. This is their job in a cryptocurrency-network. They take transactions, stamp them as legit and spread them in the network. After a transaction is confirmed by a miner, every node has to add it to its database. It has become part of the blockchain.

For this job, the miners get rewarded with a token of the cryptocurrency, for example with Bitcoins. Since the miner‘s activity is the single most important part of the cryptocurrency-system we should stay for a moment and take a deeper look at it.

What is cryptocurrency mining?

Principally everybody can be a miner. Since a decentralized network has no authority to delegate this task, a cryptocurrency needs some kind of mechanism to prevent one ruling party from abusing it. Imagine someone creates thousands of peers and spreads forged transactions. The system would break immediately.

So, Satoshi set the rule that the miners need to invest some work of their computers to qualify for this task. In fact, they have to find a hash – a product of a cryptographic function – that connects the new block with its predecessor. This is called the Proof-of-Work. In Bitcoin, it is based on the SHA 256 Hash algorithm.

Image Credit: https://privacycanada.net

You don‘t need to understand the details about SHA 256. It‘s only important you know that it can be the basis of a cryptologic puzzle the miners compete to solve. After finding a solution, a miner can build a block and add it to the blockchain. As an incentive, he has the right to add a so-called coinbase transaction that gives him a specific number of Bitcoins. This is the only way to create valid Bitcoins.

Bitcoins can only be created if miners solve a cryptographic puzzle. Since the difficulty of this puzzle increases the amount of computer power the whole miner’s invest, there is only a specific amount of cryptocurrency token that can be created in a given amount of time. This is part of the consensus no peer in the network can break.

Revolutionary Properties

If you really think about it, Bitcoin, as a decentralized network of peers that keep a consensus about accounts and balances, is more a currency than the numbers you see in your bank account. What are these numbers more than entries in a database – a database which can be changed by people you don‘t see and by rules you don‘t know?

– Erik Voorhees, cryptocurrency entrepreneur

Basically, cryptocurrencies are entries about token in decentralized consensus-databases. They are called CRYPTOcurrencies because the consensus-keeping process is secured by strong cryptography. Cryptocurrencies are built on cryptography. They are not secured by people or by trust, but by math. It is more probable that an asteroid falls on your house than that a bitcoin address is compromised.

Describing the properties of cryptocurrencies we need to separate between transactional and monetary properties. While most cryptocurrencies share a common set of properties, they are not carved in stone.

Understanding cryptocurrency properties

1) Irreversible: After confirmation, a transaction can‘t be reversed. By nobody. And nobody means nobody. Not you, not your bank, not the president of the United States, not Satoshi, not your miner. Nobody. If you send money, you send it. Period. No one can help you, if you sent your funds to a scammer or if a hacker stole them from your computer. There is no safety net.

2) Pseudonymous: Neither transactions nor accounts are connected to real-world identities. You receive Bitcoins on so-called addresses, which are randomly seeming chains of around 30 characters. While it is usually possible to analyze the transaction flow, it is not necessarily possible to connect the real-world identity of users with those addresses.

3) Fast and global: Transactions are propagated nearly instantly in the network and are confirmed in a couple of minutes. Since they happen in a global network of computers they are completely indifferent of your physical location. It doesn‘t matter if I send Bitcoin to my neighbor or to someone on the other side of the world.

4) Secure: Cryptocurrency funds are locked in a public key cryptography system. Only the owner of the private key can send cryptocurrency. Strong cryptography and the magic of big numbers make it impossible to break this scheme. A Bitcoin address is more secure than Fort Knox.

5) Permissionless: You don‘t have to ask anybody to use cryptocurrency. It‘s just a software that everybody can download for free. After you installed it, you can receive and send Bitcoins or other cryptocurrencies. No one can prevent you. There is no gatekeeper.

What is Cryptocurrency: Monetary properties

1) Controlled supply: Most cryptocurrencies limit the supply of the tokens. In Bitcoin, the supply decreases in time and will reach its final number sometime around the year 2140. All cryptocurrencies control the supply of the token by a schedule written in the code. This means the monetary supply of a cryptocurrency in every given moment in the future can roughly be calculated today. There is no surprise.

2) No debt but bearer: The Fiat-money on your bank account is created by debt, and the numbers, you see on your ledger represent nothing but debts. It‘s a system of IOU. Cryptocurrencies don‘t represent debts, they just represent themselves.

To understand the revolutionary impact of cryptocurrencies you need to consider both properties. Bitcoin as a permissionless, irreversible, and pseudonymous means of payment is an attack on the control of banks and governments over the monetary transactions of their citizens. You can‘t hinder someone to use Bitcoin, you can‘t prohibit someone to accept a payment, you can‘t undo a transaction.

As money with a limited, controlled supply that is not changeable by a government, a bank or any other central institution, cryptocurrencies attack the scope of the monetary policy. They take away the control central banks take on inflation or deflation by manipulating the monetary supply.

“While it’s still fairly new and unstable relative to the gold standard, cryptocurrency is definitely gaining traction and will most certainly have more normalized uses in the next few years. Right now, in particular, it’s increasing in popularity with the post-election market uncertainty. The key will be in making it easy for large-scale adoption (as with anything involving crypto) including developing safeguards and protections for buyers/investors. I expect that within two years, we’ll be in a place where people can shove their money under the virtual mattress through cryptocurrency, and they’ll know that wherever they go, that money will be there.” – Sarah Granger, Author, and Speaker.

Understanding cryptocurrency: Dawn of a new economy

Mostly due to its revolutionary properties cryptocurrencies have become a success their inventor, Satoshi Nakamoto, didn‘t dare to dream of it. While every other attempt to create a digital cash system didn‘t attract a critical mass of users, Bitcoin had something that provoked enthusiasm and fascination. Sometimes it feels more like religion than technology.

Cryptocurrencies are digital gold. Sound money that is secure from political influence. Money promises to preserve and increase its value over time. Cryptocurrencies are also a fast and comfortable means of payment with a worldwide scope, and they are private and anonymous enough to serve as a means of payment for black markets and any other outlawed economic activity.

But while cryptocurrencies are more used for payment, its use as a means of speculation and a store of value dwarfs the payment aspects. Cryptocurrencies gave birth to an incredibly dynamic, fast-growing market for investors and speculators. Exchanges like Okcoin, Poloniex or shapeshift enable the trade of hundreds of cryptocurrencies. Their daily trade volume exceeds that of major European stock exchanges.

At the same time, the praxis of Initial Coin Distribution (ICO), mostly facilitated by Ethereum‘s smart contracts, gave life to incredibly successful crowdfunding projects, in which often an idea is enough to collect millions of dollars. In the case of “The DAO,” it has been more than 150 million dollars.

In this rich ecosystem of coins and token, you experience extreme volatility. It‘s common that a coin gains 10 percent a day – sometimes 100 percent – just to lose the same the next day. If you are lucky, your coin‘s value grows up to 1000 percent in one or two weeks.

Cryptocurrency list

While Bitcoin remains by far the most famous cryptocurrency and most other cryptocurrencies have zero non-speculative impact, investors and users should keep an eye on several cryptocurrencies. Here we present the most popular cryptocurrencies of today.

Bitcoin

The one and only, the first and most famous cryptocurrency. Bitcoin serves as a digital gold standard in the whole cryptocurrency-industry, is used as a global means of payment and is the de-facto currency of cyber-crime like darknet markets or ransomware. After seven years in existence, Bitcoin‘s price has increased from zero to more than 650 Dollar, and its transaction volume reached more than 200.000 daily transactions.

There is not much more to say – Bitcoin is here to stay.

The brainchild of young crypto-genius Vitalik Buterin has ascended to the second place in the hierarchy of cryptocurrencies. Other than Bitcoin its blockchain does not only validate a set of accounts and balances but of so-called states. This means that ethereum can not only process transactions but complex contracts and programs.

This flexibility makes Ethereum the perfect instrument for blockchain -application. But it comes at a cost. After the Hack of the DAO – an Ethereum based smart contract – the developers decided to do a hard fork without consensus, which resulted in the emerge of Ethereum Classic. Besides this, there are several clones of Ethereum, and Ethereum itself is a host of several Tokens like DigixDAO and Augur. This makes ethereum more a family of cryptocurrencies than a single currency.

Ripple

While Ripple has a native cryptocurrency – XRP – it is more about a network to process IOUs than the cryptocurrency itself. XRP, the currency, doesn‘t serve as a medium to store and exchange value, but more as a token to protect the network against spam.

Ripple, unlike Bitcoin and ethereum, has no mining since all the coins are already pre-mined. Ripple has found immense value in the financial space as a lot of banks have joined the Ripple network.

Litecoin

Litecoin was one of the first cryptocurrencies after Bitcoin and tagged as the silver to the digital gold bitcoin. Faster than bitcoin, with a larger amount of token and a new mining algorithm, Litecoin was a real innovation, perfectly tailored to be the smaller brother of bitcoin. “It facilitated the emerge of several other cryptocurrencies which used its codebase but made it, even more, lighter“. Examples are Dogecoin or Feathercoin.

While Litecoin failed to find a real use case and lost its second place after bitcoin, it is still actively developed and traded and is hoarded as a backup if Bitcoin fails.

Monero

Monero is the most prominent example of the CryptoNight algorithm. This algorithm was invented to add the privacy features Bitcoin is missing. If you use Bitcoin, every transaction is documented in the blockchain and the trail of transactions can be followed. With the introduction of a concept called ring-signatures, the CryptoNight algorithm was able to cut through that trail.

The first implementation of CryptoNight, Bytecoin, was heavily premined and thus rejected by the community. Monero was the first non-premined clone of bytecoin and raised a lot of awareness. There are several other incarnations of cryptonote with their own little improvements, but none of it did ever achieve the same popularity as Monero.

Monero‘s popularity peaked in summer 2016 when some darknet markets decided to accept it as a currency. This resulted in a steady increase in the price, while the actual usage of Monero seems to remain disappointingly small.

Cosmos

The Cosmos blockchain was developed to facilitate communication between distributed ledgers without relying on a centralized server. The Cosmos white paper was published in 2016, and the network was soon regarded as the Internet of blockchains by its founders who wanted to create an interoperable platform of open-source blockchains that could streamline transactions between them.

Solona

Solana is a blockchain platform designed to host decentralized, scalable applications. Founded in 2017, it is an open-source project currently run by Solana Foundation based in Geneva, while the blockchain was built by San Francisco-based Solana Labs.

Besides those, there are hundreds of cryptocurrencies of several families. Most of them are nothing more than attempts to reach investors and quickly make money, but a lot of them promise playgrounds to test innovations in cryptocurrency-technology.

The Evolution of Cryptocurrencies

Your standard cryptocurrency has evolved significantly over time. One of the most significant crypto implementations happens to be stablecoins, aka cryptocurrencies that use special cryptography to remain price stable. There are three kinds of stablecoins in the market:

- Fiat-backed.

- Crypto-backed.

- Algorithm-based (seignorage).

If you wish to learn more about stablecoins then do check out our guide on the same. While there is no need to get into the details, let’s see why these have exploded in popularity in recent times.

- The best of both worlds: One of the most attractive features of stablecoins is the fact that it provides you with the best of both worlds, fiat, and crypto. The lack of stability and extreme volatility have been often cited as the biggest reasons holding back crypto adoption. However, stablecoins completely mitigate this issue by ensuring price stability. However, despite this, it’s still based on blockchain technology and gives you the benefits of decentralization and immutability inherent in blockchain technology.

- DApps: Decentralized Finance (DeFi) has been touted as the future of finance and one of the biggest drivers of blockchain adoption. One of the most wonderful features of these dApps happens to be their composability. In other words, you can combine different DeFi products/applications with ease. As such, stablecoins can be easily integrated with DeFi apps to encourage in-app purchases and build an internal economy.

- Faster remittance: Stablecoins allow you to conduct cross-border payments and remittances at a much faster rate.

Going Mainstream with Central Bank Digital Currency (CBDC)

Central Bank Digital Currencies or CBDCs are a practical implementation of stablecoins that can push cryptocurrency into the mainstream market. The idea is to have a digital form of fiat money that can be used as legal tender, generated by the country’s central bank.

What are the advantages of CBDC?

- The cost of making cash can be very high for countries living on secluded islands. CBDCs can help mitigate these costs.

- Traditional financial systems often deal with loads of intermediaries involved that shoot up the costs and fees involved.

- CBDC could be a brilliant method for banking the unbanked. According to the World Bank, around 80% of people in Indonesia, the Philippines, and Vietnam, and 30% in Malaysia and Thailand, are unbanked. In Myanmar, only 23% of people have a legit bank account. CBDC can help create an inclusive financial system.

- CBDC can make the global payment system a lot more resilient. Currently, the payment system is concentrated in the hands of a few large companies. Using a DLT-based coin can have a very positive effect here.

- According to IMF, a properly executed CBDC can counter new digital currencies. Privately-issued digital currencies can be a regulatory nightmare. A domestically-issued CBDC which is, denominated in the domestic unit of account, would help counter this problem.

- One of the biggest problems with cryptocurrencies is its price volatility. With CBDCs, governments can use a private blockchain to control price volatility. While this will compromise on decentralization, it can help increase the widespread usage of blockchain technology.

- Speaking of widespread usage of blockchain technology, utilizing CBDCs can help banks experiment more with Distributed Ledger Technology (DLT). Some central banks are considering the option of providing CBDC only to institutional market participants in order to develop DLT-based asset markets.

- CBDCs can increase the economy’s response to changes in the policy rate. For example, during a period of prolonged crisis, CBDCs can theoretically be used to charge negative interest rates.

- CBDCs can help encourage competition and innovation in the financial sector. New entrants can build on the tech to enter the payments space and provide their own solutions. It will also reduce the need for most smaller banks and non-banks to run their payments through the larger banks.

- As electronic and digital payments take over from physical cash, the central banks will look to replace physical cash with its electronic equivalent, i.e., CBDC. Doing this will increase the proceeds from creating money, aka, seigniorage, earned by the bank.

Examples of CBDC

- China and Digital Yuan.

- Bank of Thailand’s and Project Inthanon.

- The Marshall Islands and Marshallese sovereign (SOV).

Cryptocurrency Regulations

The perception of cryptocurrencies has changed pretty wildly over the last half a decade. What started as a “scam” has become a legitimate and well-respect asset class. Regulators from all over the world are now figuring out the best way to oversee this space. While several countries have straight-up banned crypto, some, like El Salvador, have gone so far as to adopt BTC as legal tender.

The way people view crypto regulations is definitely interesting. Some are against regulations since they feel it goes against the cypherpunk ethos of the original crypto vision. The other half believes proper regulations are the next logical step for mainstream adoption.

Lately, the US White House and the SEC have been extra strict with their crypto sanctions. Here is a little overview of what’s going on:

- Tornado cash, a popular crypto mixer, got sanctioned by the US Treasury. Tornado Cash is a popular hub for hackers and money launderers.

- The US government is looking to effectively regulate stablecoins moving forward.

- Ripple and SEC are locked up in a multiple-year-long legal battle regarding the XRP token.

- The SEC has also started investigating Yuga Labs – the creator of Bore Ape Yacht Club NFTs. If NFTs are deemed unregistered securities, then it will change how NFT companies are perceived in the US.

What is Cryptocurrency: Conclusion

The market of cryptocurrencies is fast and wild. Nearly every day new cryptocurrencies emerge, old die, early adopters get wealthy and investors lose money. Every cryptocurrency comes with a promise, mostly a big story to turn the world around. Few survive the first months, and most are pumped and dumped by speculators and live on as zombie coins until the last bagholder loses hope ever to see a return on his investment.

– Cody Littlewood, and I’m the founder and CEO of Codelitt

Markets are dirty. But this doesn‘t change the fact that cryptocurrencies are here to stay – and here to change the world. This is already happening. People all over the world buy Bitcoin to protect themselves against the devaluation of their national currency. Mostly in Asia, a vivid market for Bitcoin remittance has emerged, and the Bitcoin using darknets of cybercrime are flourishing. More and more companies discover the power of Smart Contracts or token on Ethereum, the first real-world application of blockchain technologies emerge.

The revolution is already happening. Institutional investors start to buy cryptocurrencies. Banks and governments realize that this invention has the potential to draw their control away. Cryptocurrencies change the world. Step by step. You can either stand beside and observe – or you can become part of history in the making.

Frequently Asked Questions

What are the advantages of investing in cryptocurrency?

Investing in cryptocurrency offers potential high returns, diversification from traditional assets, and a decentralized system. However, risks include volatility and security concerns.

How does mining cryptocurrency work?

Mining involves validating transactions on the blockchain using powerful computers to solve complex mathematical puzzles. Miners compete to confirm transactions and receive rewards in the form of new coins.

Is storing cryptocurrencies safe?

Secure storage methods like hardware wallets or cold storage offer enhanced protection against hacking or theft compared to online exchanges. Always back up your private keys securely.

What is the legal status of cryptocurrencies globally?

Cryptocurrency regulations vary by country; some recognize it as legal tender while others impose restrictions or bans. Stay informed about laws in your region regarding taxation and trading practices.

Why is blockchain technology important for cryptocurrencies?

Blockchain ensures transparent, secure, and immutable transaction records without needing intermediaries like banks. It enables peer-to-peer transactions globally with reduced fees and increased efficiency.

![The Best Cryptocurrency Exchanges: [Most Comprehensive Guide List]](https://blockgeeks.com/wp-content/uploads/2017/04/exchanges.jpg)

![What is Bitcoin? [The Most Comprehensive Step-by-Step Guide]](https://blockgeeks.com/wp-content/uploads/2016/12/whatisbit.jpg)

![What is Ethereum? [The Most Updated Step-by-Step-Guide!]](https://blockgeeks.com/wp-content/uploads/2016/10/whatiseth.jpg)

Best legit bitcoin mining site HASHRAPID with 100% free mining plan. This site doesn’t charge any maintainacne fee for instant withdrawal .When ever you reach minimum (0.002 BTC) withdrawal you can withdraw. There are other plans which can pay (0.011 BTC) per day. You can earn 15% of your referrals deposit and most important this site always payouts. So if want to try free or paid plan(10× money return) sign up with this short adfree link: http://bit.ly/3744oph

Hello everyone, Bitcoin is currently my most favorite thing and i completely love the technology behind it out of which has spewed several other coins. I know its quite unclear for many how lucrative bitcoin is currently. i have earned thousands by following a less talked about approach which is trading. Trading is less affected by the speculative and unpredictable nature of cryptocurrency and with the right techniques and expertise, you can easily earn so much when others are actually making loses in an unstable market. There are several ways to make consistent profit but the safest and easiest from my personal experience would be using the guidance, signals and already proven trade strategies of a successful trader. Quite a few of them but my favorite would always remain Gareth Mike. I was able to easily triple my portfolio in just 3 weeks of trading with him. It would be only fair for me not to hide such a gem in the space. You can reach him via: garethmike010 . . gmail .com and ask him pretty much anything about trading and how he can help you become a better and more profitable trading of cryptocurrency. The best part of it all is his system is really easy to implement and i have learnt a lot already from him.?

Input robot.ml.ai.js.bot

Function cryptotrader.ml.ai.js.bot

End

Return

Great Article! Yes, undoubtedly I hope Cryptocurrencies would rule the future industry. Moreover, popular countries such as Singapore, the United States, the United Kingdom have already started adopting Cryptocurrencies as one of the payment modes. Soon this could also reflect in Asian Countries like India as well! You can refer more about cryptocurrencies here!

Thank you very much. Could we describe blockchain and its currencies as everyone will (in future) produce their own money.

For example, I am Onur. I produce my own money by producing my own software except from accepting bitcoin and purchasing with it.

Thanks for the great article!

I have been seeing so many good reviews about Mr Rose Parker here and other articles. How do. I get started??

Thank you for this. It’s such an educative article to newbies that want to participate in cryptocurrency projects! For instance when it’s someone’s first time at mintme.com , how do you expect that person to understand the created tokens and how to grow their value yet he has no idea about the whole cryptocurrency concept.

Wow, okay it really is an interesting project! thanks for refering it to me!

Does anyone fully understand the concept of utility tokens?

peculiar coin coming 8 days later.i follow it its looking interesting

This is extremely in depth but is worth reading a few times over. Unfortunately answering “What is Cryptocurrency?” is one of those questions that can’t be summed up to quickly if you really want to understand it.

We have been trying to do this for over a year with our Cryptocurrency Podcast, thecoinboys.com , and we are constantly learning every day. If you are reading this, good luck on your journey and The Blockgeeks are definitely doing a great job on educating others. You can’t go wrong here.

Thanks, Daniel!

delete

No discussion about cryptocurrencies is complete without a good mention about pump and dumps. How they work, whether or not to get involved, how to spot them.

A pump and dump is when an organised group of people, sometimes 200 or even 1000 strangers, arrange to buy a specific coin at exactly the same time. This drives the price of the coin up, and when their desired profit is reached, they sell and the price falls again. The coin isn’t advertised in advance, only the time at which it will be. Sounds great, but in a zero sum market anyone making a profit equals someone making a loss.

So I’ve been following pump and dump groups for upwards of a year now, with a view to working out whether or not they are profitable, or whether they are a sure fire way to lose money. To conclude, you can make money… if you know what you are doing, and if you are careful.

Please take my advice: if you join a pump and dump group, do your research. Join and then watch a while – see how things work out for a pump or two. Don’t jump in head first to begin with, Rome wasn’t built in a day. Preparation is everything.

The best group I have found by far is the Mega Pump Group, join their Discord group here -. In addition to the pumps you will also find good trade signals and crypto discussions.

Finally, while crypto-speculating can be incredibly exciting and rewarding, you can lose as well as win. Don’t speculate more than you can afford to lose. None of the above constitutes financial advice. Last words: good luck 🙂

Really i like iqfinex this platform make trade and business come easy … they have agood team support and system of airdrop one of the best …. really excellent platform and advanced

I like this article very much. it is really a helpful article i had ever scene.

This is one of the best site I have seen on internet. It really gives deep information about the topic.

You can learn a lot at World Crypto Con 2018 in Vegas on Halloween. Promo codes available – let me know.

this is a good artical keep it up

Thanks for writing this great article! It’s very informative, and you included some great points to the equally great article. Great read!

The cryptocurrencies are a solution to many of the obstacles that the traditional financial system currently has, sending money to different parts of the world is expensive, sometimes delayed and in some places it is not possible to do so. We are in a globalized era and cryptocurrencies help make financial transactions fast, secure and low cost. There are projects with a great vision, for example, the cryptocurrency Ultrapoint has the mission to become the first currency for global and practical use in all sectors of the economy. Then when a cryptocurrency achieves massive use, then its benefits will be fully understood.

Americ, your insights were very informative! A few months ago I didn’t even know what blockchain is, only heard about cryptocurrencies. My friend suggested me to start an investigation on crypto-mining, there was a boom of articles, but in most cases highly generic ones. Thus my friend found BitDegree publishing lots of good stuff about the crypto world, and especially the whole tutorials about mining that helped us to our Litecoin mining career step-by-step!

Thank you for the good article!

I would like to complement

The True History Of Bitcoin

https://cryptototem.com/the-history-of-bitcoin

… how it all began.

Really good article. You should block/delete the spam comments though.

0x412c8A0A2113035953357013b2975Fa9158D32Cc

Get me some Ether

Cryptocurrency Explained – Cryptocurrency is the ultimate digital currency that will gradually replace money as it is secure and unregulated by banks.

Thanks for the post that diagram really helps me to understand the process, what do you think It’s the best cryptocurrency for mining today? I want to start mining on my pc but there are a lot of new cryptocurrencies and I don’t want waste time and resources…

Thanks for sharing the info, keep up the good work going…. I really enjoyed exploring your site. good resource…

Good information, but poor grammar and sentence structure. This article could definitely use a strong proofreader.

Hey @brad-mills38

Can we trade using bitcoin(any other cryptocurrency) ? Is there any business/market which accept it as a valid mode of transaction ?

How does the flow of Cryptocurrency handled? How is the ratio between supply and demand balanced? I have read that there has been times when the security of crypto-network has been compromised. Is it really the future of Digital Money? Rather than a currency, it seems to be an investment scheme plan. I am not trying to be a critic here, just a lot of questions bubbling into the mind.

As I am always researching when educating myself I came across this article. I just have to say that finally someone explained it well! As we know it’s all about binary numbers and computer langauage and I was so intrigued on the hows!

Many people I find getting into this have really no clue! Again great article!

My questions will be, just to confirm all database/journals stays within the Blockchain correct? So we are actually backing up the private key we get from walllets/exchanges that we use to talk to/access the Blockchain correct?

Can one back up their private keys even tho their crypto currency is let’s say in an online wallet in what they call cold storage? It can there only be one key used at a time? So if I backup my wallet private key the wallet will be emptied and also the cold storage?

It’s very strange that nobody has details on backing up their currency aka keys to access Blockchain…

TY hope this makes sense. Please add a link if you have a blog on backing up or anything technical on the hows!

C+

Python

PHP

C++

MySQL

Backing up or anything technical 🙂

Eg….

Intriguing

Thank you for this guide. Hopefully there are no stupid questions here – but a quick clarification would be helpful. This and some of your other guides make reference to “requesting a transaction” at the very beginning of the process. What does that mean? Is is simply the request to purchase bitcoin in exchange for USD or whatever medium of exchange? Thank you in advance!

The “requesting a transaction” means you want to transfers some coins (let’s say bitcoin) to someone else. When you make the request the request is broadcasted to all the nodes. Then the nodes verify that (from all the history of transactions) you are not double spending your coins. When verified successfully the transaction is added in a block which is then mined by a miner. When the block is mined, your transaction is confirmed and the coins are transfered.

Dear friends!

We are happy to introduce our new Anybits.com project. It is a crypto-to-crypto exchange with 15 most popular cryptocurrencies available for trading.

You can log in using your Bitsane login and password.Â

Sincerely,Â

Bitsane Team

The article is very poorly written and has weak grammar. Kindly get it proofread by a native English speaker.

An amazing article. Gives a perfect picture of Cryptocurrency. Thank You !

Great infographics! Thanks for a cool article 🙂

Nice article. So actually you can turn this into a profit watch this video to learn more https://www.youtube.com/edit?o=U&video_id=lyAnlAbzjWY

I think Bitcoin is the future of currency.It’s just a start.

I trade it on bityep.com

Nice article, but you missed a couple of things that I read here; https://www.techgrapple.com/everything-you-should-know-about-crypto-currency/

Here’s a bunch of step by step tutorials for complete beginners on how to buy crypto coins: https://buyingcryptoguide.com

BITSANE.COM – new exchange of crypto-currencies

Bitsane presents the most technologically advanced platform in the industry to date.

Bitsane offers a minimalistic, user-friendly interface for maximum usability. Our platform provides super-fast execution of trade transactions for major currency pairs, such as Bitcoin, Bitcoin Cash, Litecoin, Ethereum, Dash, Iconomi, Ripple to traditional currencies USD and EUR. The number of trading instruments is constantly expanding. In addition to the aforementioned crypto currencies, deposits and withdrawals are available via SWIFT (in dollars) and SEPA (in Euros), OKPay and AdvCash payment systems.

With the hacks and security breaches encountered by many cryptocurrency platforms in recent years, we take the platform’s security very seriously. Our developers have created a state-of-the-art security which has network protection, network backup, a strong, modern infrastructure, cold storage and advanced monitoring.

These extra measures of security ensure that our customers’ funds and stored data are protected and secure at all times.

At any point of time, a qualified and experienced customer support service is at your disposal.

Not only do we provide web-based training and an exchange platform, we also enable access to mobile users. The platform can be accessed from any mobile device, allowing you to execute trades from anywhere in the world with the Internet connection.

We provide a strong investment platform, enabling users to participate in margin trading and margin lending while receiving automated trading assistance. Our developers are currently working on enhancing Bitsane’s investment features.

The platform is constantly evolving and we will be grateful for all thoughts, error messages, wishes and comments on the work of our exchange.

Sincerely,

Bitsane Team

For the first time, I have read through a whole article on CryptoEconomy and technlogy, and could understand some part of it. I will have to read it a few more times for sure, but such an article surely was missing from my Reading List.

Happy to hear that Nirmalya Sengupta

Yeah it does take a few reads to get your head around it.

Very thorough! I think I’ll post this to any friends who seriously want a deep dive into what exactly bitcoin and cryptocurrency is.

yeah, that’s what I thought too – excellent backgrounder

Indeed. It’s so important to at least learn the basics of cryptocurrency before investing your hard earned money. And I’d say this is the best beginners tutorial I’ve come across online.

Brad Mills Thanks for adding your input. Always appreciate it.

Pleas teach me in eazy way to participate crypto curruncy

The easiest way is to follow people who know what they’re talking about and essentially copy their picks. There’s some golden information you can find at: http://www.cryptocodexguide.com – Although it’s still worth learning the basic fundamentals here on blockgeeks.

How to buy bitcoin sir