Contents

|

|

Thorchain vs Uniswap are both platforms that enable users to swap different coins directly without intermediaries. These platforms are popular for their ability to handle high trading volume and support various blockchains, including bitcoin. However, different blockchains, such as bitcoin, have distinct differences in terms of technology, liquidity, governance, and tokenomics. These differences make them unique from other coins and eliminate the need for centralized intermediaries. By understanding the nuances of bitcoin, coins, chart, and different blockchains, you can make informed decisions about which platform aligns with your investment goals and trading preferences.

In the following sections, we’ll delve into the features and functionalities of Thorchain and Uniswap, two different blockchains that are making waves in the world of decentralized finance. We’ll discuss the pros and cons of chain liquidity, highlight its unique selling points (USPs), analyze its token models, and explore how it contributes to the growing DeFi ecosystem. So buckle up as we embark on this journey to uncover the differences between Thorchain and Uniswap!

Contents

Unveiling THORChain vs Uniswap

What is THORChain?

THORChain is a decentralized liquidity network that enables cross-chain swaps between different cryptocurrencies. It aims to provide seamless interoperability and liquidity across various blockchain networks, allowing users to trade assets without relying on centralized exchanges. With THORChain, you can swap tokens directly from your wallet using the native cryptocurrency RUNE.

How does THORChain work?

THORChain operates through a system of liquidity pools, where users can deposit their assets to provide liquidity for trading. These pools are decentralized and non-custodial, ensuring that users have full control over their funds. When a user wants to make a trade, THORChain matches the order with available liquidity in the pool and executes the swap instantly.

One unique feature of THORChain is its ability to support cross-chain transactions. This means that you can trade assets from one blockchain network to another without any intermediaries or custodians. For example, you can swap Bitcoin for Ethereum directly on THORChain without needing to go through a centralized exchange.

Benefits of using THORChain

-

Decentralization: As a decentralized protocol, THORChain eliminates the need for intermediaries and central authorities in trading. This enhances security and reduces the risk of hacks or thefts associated with centralized exchanges.

-

Cross-chain compatibility: By supporting cross-chain transactions, THORChain opens up new possibilities for asset transfers between different blockchain networks. This promotes interoperability and expands the options available for traders.

-

Non-custodial: With THORChain, you retain full control over your funds throughout the trading process. You don’t need to trust a third party with your assets since all transactions occur directly between wallets.

-

Instant swaps: The use of liquidity pools allows for instant execution of trades on THORChain. There’s no need to wait for order matching or settlement, ensuring a seamless trading experience.

What is Uniswap?

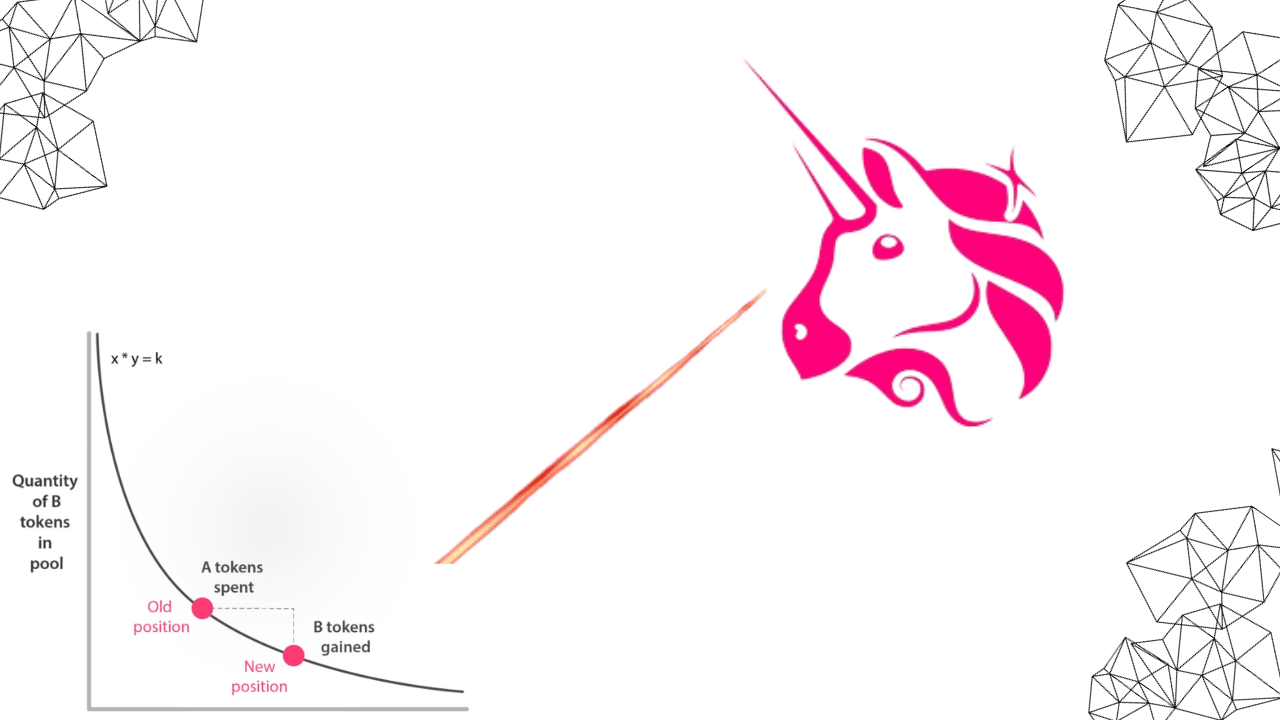

Uniswap is a decentralized exchange (DEX) built on the Ethereum blockchain. It operates using an automated market maker (AMM) model, which relies on liquidity pools and smart contracts to facilitate trading. Uniswap has gained significant popularity within the decentralized finance (DeFi) space due to its user-friendly interface and efficient trading mechanism.

How does Uniswap work?

Uniswap’s AMM model works by utilizing liquidity pools instead of traditional order books. Liquidity providers deposit their assets into these pools, which are then used to facilitate trades. When a user wants to make a trade, they interact with a smart contract that automatically calculates the price based on the pool’s available liquidity.

Foundational Differences

Liquidity Pools: The Heart of the Operation

THORChain and Uniswap differ in their approach to liquidity pools. THORChain utilizes a decentralized cross-chain liquidity protocol, allowing users to trade assets across different blockchains directly. On the other hand, Uniswap focuses on providing liquidity for ERC-20 tokens within the Ethereum ecosystem.

Cross-Chain Functionality vs. Ethereum-Centric Approach

While both platforms facilitate decentralized trading, THORChain stands out by offering cross-chain functionality. This means that users can swap assets from one blockchain to another without relying on centralized exchanges or intermediaries. In contrast, Uniswap operates exclusively within the Ethereum network.

Native Tokens: RUNE vs. UNI

THORChain has its native token called RUNE, which plays a vital role in securing and governing the network. Holders of RUNE have voting rights and can participate in staking to earn rewards. On the other hand, Uniswap introduced its governance token UNI as an incentive for liquidity providers and platform participants.

Impermanent Loss Mitigation: Slashing Mechanism vs. Fee Structure

Both THORChain and Uniswap address impermanent loss, but they employ different mechanisms. THORChain implements a slashing mechanism where nodes can be penalized for malicious behavior or downtime, reducing potential losses for liquidity providers. In contrast, Uniswap tackles impermanent loss by charging trading fees that are distributed to liquidity providers as compensation.

Network Security: Consensus Algorithms and Audits

THORChain employs a Byzantine Fault Tolerant (BFT) consensus algorithm called Tendermint, which ensures security and finality of transactions across chains. It undergoes regular audits to identify vulnerabilities and enhance overall network security. Uniswap operates on Ethereum‘s Proof-of-Stake (PoS) consensus algorithm with plans to transition to Ethereum 2.0, which aims to improve scalability and security.

Scalability: Native Cross-Chain Swaps vs. Layer 2 Solutions

THORChain’s cross-chain functionality allows for direct native swaps across different blockchains, providing scalability without relying on layer 2 solutions. Uniswap, being built on Ethereum, faces scalability challenges due to network congestion and high gas fees. However, the upcoming Ethereum 2.0 upgrade aims to address these issues and enhance scalability.

User Experience: Simplicity vs. Advanced Features

Uniswap offers a user-friendly interface with a simple design that caters to both beginners and experienced traders. It focuses on enabling easy access to decentralized trading within the Ethereum ecosystem.

Supported Platforms and Audience Reach

Supported Platforms

Thorchain and Uniswap are both decentralized exchange platforms that operate on different blockchain networks. Thorchain is built on the THORChain network, while Uniswap operates on the Ethereum blockchain.

Being built on different networks means that each platform has its own set of supported tokens and assets. Thorchain supports a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and many others. On the other hand, Uniswap primarily supports ERC-20 tokens that are native to the Ethereum network.

Audience Reach

Both Thorchain and Uniswap have their own user bases. However, due to its compatibility with multiple blockchains, Thorchain potentially has a broader reach as compared to Uniswap.

Thorchain’s ability to support cross-chain transactions allows users from various blockchain ecosystems to access its services. This inclusivity attracts users who hold different types of cryptocurrencies and prefer a seamless experience across multiple networks.

Uniswap, being an Ethereum-based platform, primarily caters to users within the Ethereum community. As one of the most popular decentralized exchanges in the cryptocurrency space, it has gained significant traction among Ethereum enthusiasts and developers.

In terms of user experience, both platforms offer intuitive interfaces that make trading accessible even for beginners. They provide liquidity pools where users can trade directly from their wallets without relying on centralized intermediaries.

However, it’s worth noting that since Thorchain is relatively newer compared to Uniswap, its user base may still be growing. As more projects integrate with Thorchain’s infrastructure and more users discover its benefits, its audience reach is likely to expand further.

Analyzing Trading Volume and Native Coins

In the world of decentralized finance (DeFi), two popular platforms that have gained significant attention are Thorchain and Uniswap. When comparing these platforms, it is essential to consider factors such as trading volume and native coins.

Trading Volume

Trading volume refers to the total number of assets traded on a platform within a given time period. It serves as an indicator of liquidity and activity on the platform. Both Thorchain and Uniswap have seen substantial trading volumes, but there are some differences worth noting.

Thorchain operates as a cross-chain liquidity protocol, allowing users to trade assets across different blockchain networks. Its unique design enables seamless interoperability between various cryptocurrencies, resulting in increased trading opportunities. While Thorchain’s trading volume may not be as high as some centralized exchanges, it has been steadily growing due to its expanding user base and increasing adoption.

On the other hand, Uniswap is one of the most prominent decentralized exchanges built on the Ethereum blockchain. It offers users access to a wide range of ERC-20 tokens for trading. As Ethereum continues to dominate the DeFi space, Uniswap benefits from its network effect, leading to higher trading volumes compared to other decentralized exchanges.

Native Coins

Native coins play a crucial role in both Thorchain and Uniswap ecosystems. They serve different purposes and provide various benefits to their respective platforms.

Thorchain’s native coin is called RUNE. It acts as a utility token within the Thorchain network, facilitating transactions and securing the network through staking mechanisms. By holding RUNE tokens, users can participate in governance decisions and earn rewards for providing liquidity.

Uniswap has its own native token known as UNI. UNI holders have voting rights in protocol governance decisions and can also earn fees generated by trades on Uniswap through staking their tokens. UNI tokens were distributed widely among early users of the platform, further enhancing its community-driven nature.

The presence of native coins in both platforms creates an ecosystem where users can actively participate and contribute to the growth and development of the protocols. These tokens also provide incentives for liquidity providers and users, fostering a vibrant and engaged community.

Fees and Speed Comparison

Fees

There are some notable differences. Thorchain operates on a network of validators who secure the network and process transactions. These validators charge a small fee for their services, which is typically lower than what you would find on traditional centralized exchanges. On the other hand, Uniswap charges a fixed 0.3% fee for every trade conducted on its platform.

While both platforms have fees associated with trading, it’s important to consider the overall cost when deciding which one to use. If you’re making frequent trades or dealing with large amounts of money, even slight differences in fees can add up over time. Therefore, it’s essential to evaluate your trading habits and determine which platform aligns better with your needs.

Speed

In terms of speed, Thorchain boasts impressive transaction times due to its cross-chain capabilities. With Thorchain, users can swap assets across different blockchains quickly and efficiently. This feature allows for seamless interoperability between various cryptocurrencies without relying on centralized intermediaries.

On the other hand, Uniswap operates on the Ethereum blockchain, which can sometimes experience congestion during periods of high demand. This congestion can lead to slower transaction times and higher gas fees. However, Uniswap has been working on solutions like layer-two scaling solutions to address these issues and improve transaction speeds.

When deciding between Thorchain and Uniswap based on speed, it’s crucial to consider your specific requirements. If you prioritize fast transactions across multiple chains, then Thorchain may be the better option for you. However, if you primarily deal with Ethereum-based tokens and are willing to wait for potential scalability improvements from Uniswap in the future, then it might still be a suitable choice.

Ecosystem Support and API Accessibility

To truly understand the differences between Thorchain and Uniswap, we need to delve into their ecosystem support and API accessibility. These factors play a crucial role in determining the overall functionality and usability of these platforms.

Ecosystem Support

Ecosystem support refers to the level of community involvement and development activity surrounding a particular platform. In this regard, both Thorchain and Uniswap have garnered significant attention from developers and users alike. However, there are some notable distinctions between the two.

Thorchain boasts a robust ecosystem that is continuously expanding. It has gained popularity among developers due to its cross-chain compatibility, which allows for seamless interoperability between different blockchain networks. This means that users can easily swap assets across various chains without any hassle.

On the other hand, Uniswap has established itself as one of the leading decentralized exchanges within the Ethereum ecosystem. Its user-friendly interface and extensive liquidity pools have attracted a large user base. However, it primarily operates within the Ethereum network, limiting its cross-chain capabilities compared to Thorchain.

API Accessibility

API accessibility plays a vital role in enabling developers to build applications on top of these platforms. It determines how easy it is for developers to integrate their projects with Thorchain or Uniswap.

Thorchain provides comprehensive API documentation that offers detailed instructions on how to interact with its network. This facilitates smooth integration for developers looking to leverage Thorchain’s features in their applications. The documentation includes information about endpoints, parameters, authentication methods, and response formats.

Uniswap also offers an API that enables developers to access its functionalities programmatically. While not as extensive as Thorchain’s documentation, it still provides essential endpoints for interacting with liquidity pools and executing trades on the exchange.

However, it’s important to note that while both platforms offer APIs for integration purposes, they may have different levels of complexity depending on individual requirements. Developers should consider factors such as data retrieval, transaction execution, and error handling when choosing between Thorchain and Uniswap.

Reviews, Ratings, and Community Trust

Positive reviews and high ratings

One of the key factors to consider when comparing Thorchain and Uniswap is the reviews and ratings from users. Both platforms have garnered positive feedback from their respective communities. Users appreciate Thorchain for its robustness, security, and seamless user experience. Its cross-chain capabilities have also received praise, as it allows users to trade assets across different blockchain networks without friction.

Uniswap, on the other hand, has gained popularity for its simplicity and user-friendly interface. It has been widely praised for its decentralized nature and ability to provide liquidity through automated market-making (AMM). The platform’s reliability and efficiency have contributed to its high ratings among users.

Community trust and engagement

Community trust plays a vital role in the success of any decentralized platform. In this regard, both Thorchain and Uniswap have developed strong communities that actively engage with the platforms. Thorchain boasts an active community of developers, contributors, validators, traders, and enthusiasts who regularly participate in discussions about the project’s development roadmap, improvements, and potential partnerships.

Similarly, Uniswap has fostered a vibrant community of supporters who actively contribute to its growth by providing liquidity or developing new features on top of the protocol. The community-driven nature of Uniswap has helped it establish itself as one of the leading decentralized exchanges in terms of volume traded.

Reviews from industry experts

In addition to user reviews, industry experts have also weighed in on Thorchain and Uniswap. Many experts recognize Thorchain’s innovative approach to cross-chain trading as a significant step forward for interoperability in the blockchain space. The platform’s unique design has garnered attention from notable figures within the cryptocurrency industry.

Uniswap has also received praise from experts for its impact on decentralized finance (DeFi) by revolutionizing token swaps through AMM technology. Its open-source nature has allowed developers to build on top of the protocol, leading to a vibrant ecosystem of decentralized applications (dApps) and integrations.

Trustworthiness and security

Trustworthiness and security are paramount when dealing with decentralized platforms. Thorchain has implemented various security measures to protect user funds and prevent unauthorized access. The platform’s native token, RUNE, plays a crucial role in securing the network through staking and governance mechanisms.

Uniswap, too, prioritizes security by leveraging smart contract audits and bug bounties to identify vulnerabilities. The platform has undergone multiple security audits conducted by reputable firms to ensure the safety of user funds.

Training Resources and User Guides

Thorchain vs Uniswap: What’s the Difference?

So you’ve heard about Thorchain and Uniswap, but you’re not quite sure what sets them apart. Let’s dive into the training resources and user guides for both platforms to get a better understanding.

Thorchain Training Resources

There are several resources available to help you get started. The official Thorchain website provides a comprehensive user guide that covers everything from setting up your wallet to making trades on the platform. This guide is written in a beginner-friendly language, making it easy for new users to follow along.

There are various video tutorials available on platforms like YouTube that walk you through the process of using Thorchain step by step. These videos often provide real-life examples and practical tips to enhance your understanding of how the platform works.

Thorchain also has an active community forum where users can ask questions, share their experiences, and receive support from other members. This forum is a great place to connect with fellow traders and gain insights into different trading strategies.

Uniswap Training Resources

Similarly, Uniswap offers a range of training resources for users looking to familiarize themselves with the platform. The official Uniswap documentation provides detailed instructions on how to use the platform’s features, such as swapping tokens and providing liquidity.

In addition to written guides, Uniswap also hosts regular webinars and workshops where users can learn directly from experts in the field. These interactive sessions allow participants to ask questions and gain practical knowledge about utilizing Uniswap effectively.

Uniswap has a strong online presence with active social media channels where they regularly share educational content, updates, and tips for navigating the platform. Following these channels can keep you informed about any new features or changes happening within the Uniswap ecosystem.

Choosing Your Learning Path

When deciding which platform to learn, consider your personal preferences and goals. If you prefer written guides and a supportive community, Thorchain might be the better fit for you. On the other hand, if you enjoy interactive webinars and staying up-to-date through social media, Uniswap could be the platform of choice.

Remember that both platforms have their strengths and cater to different types of users. It’s always a good idea to explore multiple resources and gain insights from various perspectives before making a decision.

Price Predictions and Market Trends

Rising Popularity of Thorchain vs Uniswap

The cryptocurrency market has been buzzing with excitement around two popular decentralized exchanges: Thorchain and Uniswap. Both platforms offer unique features and benefits, making them attractive options for traders and investors. Let’s take a closer look at the price predictions and market trends for these platforms.

Thorchain’s Potential for Growth

Thorchain (RUNE) has gained significant attention in recent months due to its innovative cross-chain capabilities. As more users recognize the value of interoperability between different blockchain networks, Thorchain is poised for substantial growth. With its ability to facilitate seamless swaps across various cryptocurrencies, Thorchain offers a promising solution to the liquidity challenges faced by many decentralized exchanges.

Investors are optimistic about Thorchain’s potential, as evidenced by its impressive price performance. The token has experienced substantial gains in recent times, demonstrating strong market demand. This upward momentum suggests that the project is gaining traction among both retail and institutional investors.

Uniswap’s Dominance in DeFi

Uniswap (UNI), on the other hand, has established itself as one of the leading decentralized exchanges in the booming world of decentralized finance (DeFi). Its user-friendly interface and efficient trading experience have made it a go-to platform for many crypto enthusiasts. As a result, Uniswap has captured a significant share of the market.

Despite facing competition from other DeFi protocols, Uniswap continues to dominate due to its first-mover advantage and robust liquidity pools. The platform’s native token UNI has seen remarkable growth since its launch, reflecting investor confidence in its long-term prospects.

Market Trends: A Battle for Supremacy

The battle between Thorchain and Uniswap reflects an ongoing trend in the cryptocurrency space – fierce competition among decentralized exchanges vying for supremacy. Traders and investors are closely watching these platforms as they seek opportunities for profitable investments.

Market trends indicate that both Thorchain and Uniswap have the potential to thrive in the evolving crypto landscape. However, it’s important to note that the market can be highly volatile and unpredictable. Factors such as regulatory developments, technological advancements, and user adoption can significantly impact the future performance of these platforms.

The Importance of Conducting Due Diligence

When considering investments in Thorchain or Uniswap, it is crucial to conduct thorough research and due diligence. Analyzing market trends, studying project fundamentals, and understanding the risks involved are essential steps for making informed investment decisions.

Furthermore, it is advisable to diversify one’s portfolio rather than relying solely on a single cryptocurrency or exchange.

Conclusion

In the battle of THORChain vs Uniswap, both platforms have their unique strengths and weaknesses. THORChain offers a decentralized cross-chain liquidity network that allows users to swap assets across different blockchains seamlessly. On the other hand, Uniswap has gained popularity for its user-friendly interface and extensive token offerings.

When choosing between THORChain and Uniswap, it is crucial to consider your specific needs and preferences. Are you looking for a broader range of tokens or seamless cross-chain swaps? Do you prioritize user experience or community trust? By carefully evaluating these factors, you can make an informed decision that aligns with your goals.

To stay ahead in the ever-evolving world of decentralized finance, it is essential to stay informed about the latest developments and advancements in the space. Keep exploring new platforms, learning from user guides and training resources, and engaging with the community to expand your knowledge and understanding. Embrace the opportunities presented by THORChain, Uniswap, and other emerging platforms to take part in shaping the future of decentralized finance.

FAQs

What is the difference between Thorchain and Uniswap?

Thorchain and Uniswap are both decentralized exchanges, but they have some key differences. While Uniswap primarily focuses on ERC-20 tokens on the Ethereum network, Thorchain is a cross-chain protocol that supports multiple blockchains. Thorchain uses a unique algorithm called Continuous Liquidity Pools (CLPs) to provide liquidity, whereas Uniswap relies on automated market makers (AMMs).

How does Thorchain ensure security?

Thorchain employs a robust security mechanism through its Byzantine Fault Tolerant consensus algorithm. This ensures that malicious actors cannot manipulate or compromise the network. Furthermore, Thorchain utilizes threshold signatures and multi-signature schemes to protect against potential attacks.

What are the benefits of using Uniswap?

Uniswap offers several advantages for users. It provides easy access to a wide range of ERC-20 tokens, allowing for seamless token swaps without relying on traditional order books. It offers high liquidity due to its large user base and incentivizes liquidity providers through yield farming opportunities.

Can I use any cryptocurrency on Thorchain?

Yes, you can use various cryptocurrencies on Thorchain as long as they are supported by the platform. Currently, it supports assets from networks like Bitcoin (BTC), Ethereum (ETH), Binance Smart Chain (BSC), and more. However, it’s essential to check the specific asset support before conducting transactions.

Is there a fee for using Uniswap or Thorchain?

Both Uniswap and Thorchain charge fees for their services. These fees typically include transaction fees and liquidity provider fees. The exact fee structure may vary depending on factors such as network congestion and transaction size.