Contents

|

|

In this blog post, we delve into the clash between two heavyweights in the cryptocurrency world: Ethereum vs Avalanche.

Ethereum, with its smart contract functionality, has long been at the forefront of blockchain innovation in the world of cryptocurrency. Its efficient transactions and ability to handle many transactions make it a popular choice for users. Additionally, Ethereum’s smart contract capabilities have paved the way for the rise of NFTs. But don’t underestimate the rising star – Avalanche. This newer blockchain network promises efficient transactions, with low fees and high scalability, making it a formidable contender for many cryptocurrency transactions.

Both Ethereum and Avalanche have their own native tokens – ETH and AVAX respectively – fueling their respective cryptocurrency networks. These platforms operate on a platform chain architecture and also support the creation and trading of NFTs. While Ethereum, the leading cryptocurrency in the market, boasts a larger user base and an established ecosystem, Avalanche is gaining ground as a strong contender. With its former Elrond validators and platform chain approach, Avalanche is emerging as a potential winner in the growing market of NFTs.

So buckle up as we embark on this thrilling journey of speed, where the pos winner will be determined by the system!

Contents

Comparison of Ethereum vs Avalanche

Scalability

Ethereum, the former elrond system, faces scalability challenges that hinder its speed and place it behind other blockchain platforms in the race to be the winner. This is primarily due to ethereum v2’s current consensus mechanism, which results in slower transaction speeds on the chain. However, there are efforts to address the scalability issue in Ethereum’s chain speed through the development of Layer 2 solutions like Optimism and Elrond.

On the other hand, Ethereum v2 and Elrond take a different approach to scalability by implementing their own chain. Avalanche, on the other hand, takes a different approach to scalability. It utilizes a unique consensus protocol called Avalanche consensus, which enables high throughput and fast confirmation times. This makes it an ideal choice for projects that are built on the ethereum v2 chain or the elrond chain. This means that transactions can be processed quickly and efficiently on the Avalanche network, a chain that utilizes the Elrond protocol. As a result, Avalanche has become an attractive alternative to Ethereum for applications requiring high transaction volumes in the elrond chain.

Interoperability

Interoperability, including elrond, is essential for facilitating smooth communication and data exchange across various blockchains or networks. Ethereum and Elrond have made significant strides in achieving interoperability through projects like Polkadot, Cosmos, Chainlink, and Elrond. These projects allow Ethereum to connect with other blockchains like Elrond and share information effectively.

Avalanche, a blockchain platform, also recognizes the importance of interoperability and supports it through the use of bridges. This allows for seamless connectivity between Avalanche and other chains.

Decentralization

Decentralization is a fundamental principle of blockchain technology that ensures no single entity, including elrond, has complete control over the network. In terms of decentralization, both Ethereum and Avalanche have their own approaches.

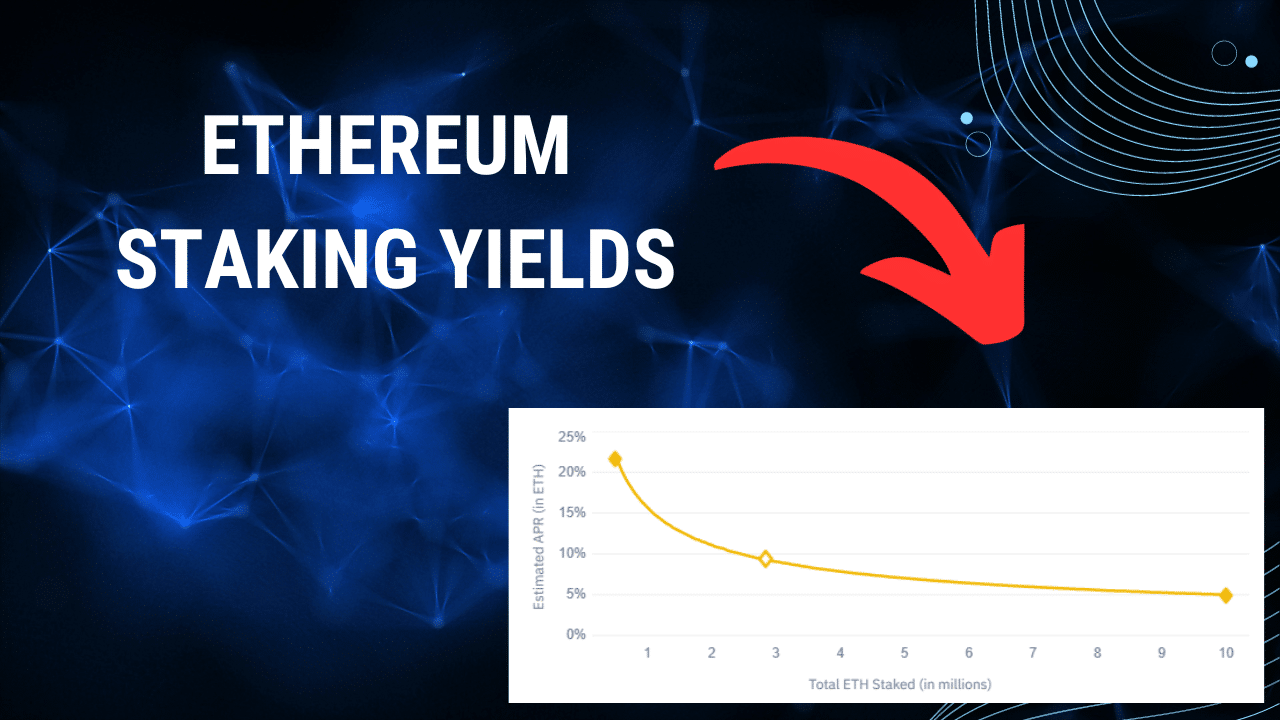

Ethereum currently follows a proof-of-Stake (PoS) consensus algorithm where stakers validate transactions on the Ethereum chain.

Avalanche takes a hybrid approach by combining Proof of Stake (PoS) with elements of Byzantine fault tolerance (BFT) to create a chain. This combination aims to achieve both security and decentralization on the network chain. By utilizing the Avalanche chain hybrid consensus mechanism, Avalanche strives to maintain a robust and decentralized ecosystem.

The level of decentralization achieved by both blockchain platforms has implications for their resilience against attacks and censorship resistance. A more decentralized network, often referred to as a chain, is generally considered to be more secure and less susceptible to manipulation.

How Ethereum Works

Ethereum is a decentralized virtual machine that powers the world of cryptocurrencies through its blockchain chain. It operates as a platform for executing smart contracts and running decentralized applications (dApps) on the chain. Let’s take a closer look at how Ethereum works.

Ethereum Network: A Decentralized Virtual Machine

At its core, Ethereum functions as a decentralized virtual machine. It provides developers with the infrastructure to build and deploy smart contracts, which are self-executing agreements written in code. These smart contracts enable the creation of dApps that can perform various functions without the need for intermediaries.

Storing Transactions and Smart Contract Interactions

One of Ethereum‘s key features is its blockchain, which serves as a digital ledger that records all transactions and interactions with smart contracts. The blockchain stores a complete history of every transaction made on the network, making it transparent and immutable.

When someone initiates a transaction or interacts with a smart contract on the Ethereum network, this information is added to a block. Each block contains a unique identifier called a hash and is linked to the previous blocks, forming an unbroken chain of transactions known as the Ethereum blockchain.

Solidity: The Language of Smart Contracts

To create smart contracts on Ethereum, developers use Solidity programming language. Solidity allows them to write code that defines the rules and conditions for executing these contracts. Once deployed on the network, these smart contracts become accessible to anyone with an internet connection.

Solidity offers powerful features like inheritance, libraries, and interfaces that make it easier for developers to build complex applications on top of Ethereum. It also includes built-in security measures to protect against common vulnerabilities like reentrancy attacks or integer overflows.

Gas Fees: Prioritizing Transactions

To prevent network congestion and prioritize transactions, Ethereum relies on gas fees. Gas is essentially the fuel required to execute operations within the Ethereum Virtual Machine (EVM). Every operation in an EVM consumes a certain amount of gas, and users must pay these fees to have their transactions processed.

Gas fees serve two purposes: incentivizing miners to include transactions in blocks and preventing malicious actors from spamming the network. By attaching a higher gas fee to their transactions, users can ensure that their transactions are prioritized by miners and processed faster.

The Contract Chain: Enabling Interoperability

With the upcoming Ethereum 2.0 upgrade, Ethereum is set to introduce significant improvements, including the introduction of shard chains. These shard chains will enhance scalability by dividing the network’s workload among multiple chains.

One of these shard chains is called the “contract chain,” which will focus specifically on executing smart contracts. This separation allows for greater efficiency and parallel processing of contract execution, enabling Ethereum to handle a larger number of transactions and dApps simultaneously.

How Avalanche Works

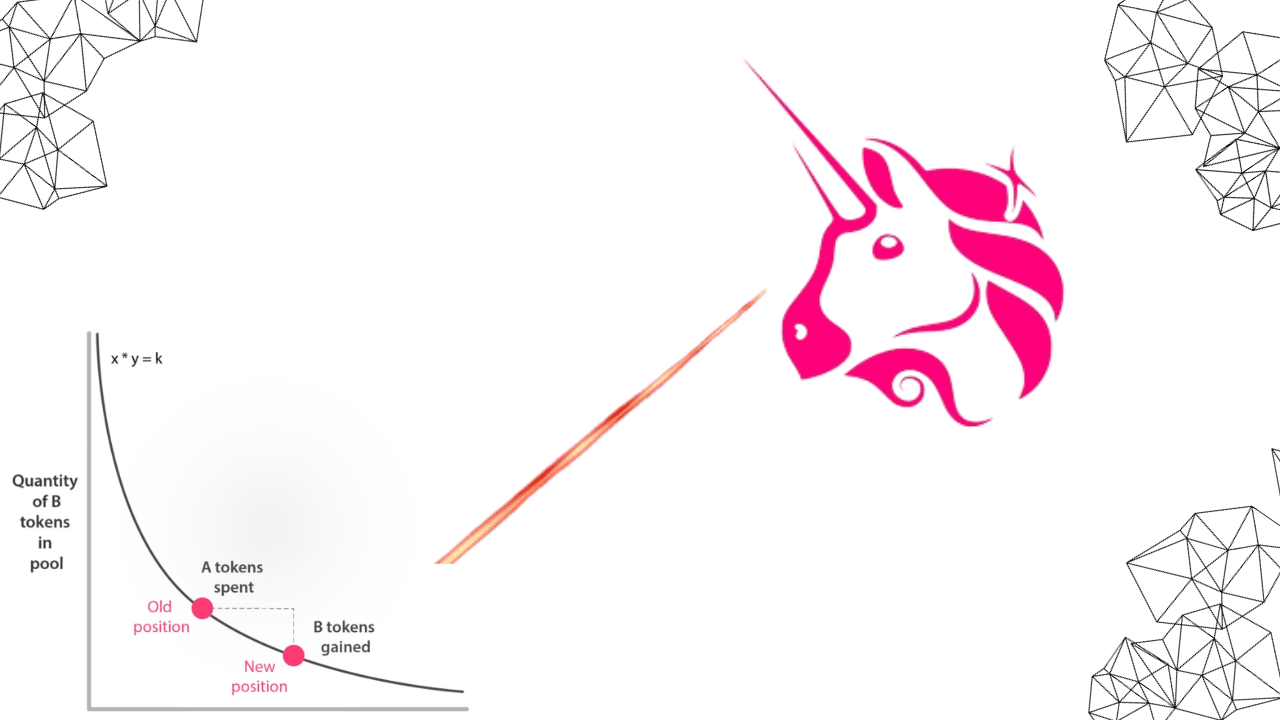

Avalanche is an innovative blockchain platform that operates on a directed acyclic graph (DAG) structure known as the Avalanche protocol. This unique consensus mechanism allows for high scalability, parallel processing of transactions, and fast finality.

Multiple Subnets for Parallel Processing

One of the key features of Avalanche is its ability to support multiple subnets within the network. These subnets enable parallel processing of transactions, which means that multiple transactions can be validated simultaneously. This greatly enhances the scalability of the network and ensures that it can handle a large number of transactions efficiently.

Repeated Voting Rounds for Consensus

Validators in the Avalanche network reach consensus through repeated voting rounds. During each round, validators vote on valid transactions and proposals. The voting process continues until a threshold is reached, at which point finality is achieved. This means that once a transaction has been confirmed by the network, it cannot be reversed or altered.

The repeated voting rounds allow for quick finality, ensuring that transactions are settled rapidly and reducing the risk of double-spending or other malicious activities. It also provides security against attacks such as 51% attacks, where a single entity controls more than half of the network’s computing power.

Scalability without Compromising Security or Decentralization

Avalanche’s consensus mechanism enables high scalability without compromising security or decentralization. By allowing parallel processing and quick finality, it can handle a large number of transactions per second while maintaining the integrity and security of the network.

This scalability makes Avalanche well-suited for applications that require high throughput and low latency, such as decentralized finance (DeFi), gaming platforms, and supply chain management systems.

Furthermore, Avalanche employs a robust system for selecting validators to participate in the consensus process. Validators are chosen based on their stake in the network, ensuring that those with a significant investment have an incentive to act honestly and maintain the integrity of the network.

Use Cases and Applications

Avalanche’s unique consensus mechanism opens up a wide range of possibilities for blockchain applications. Its high scalability and fast finality make it ideal for use cases that require quick settlement of transactions, such as micropayments, real-time gaming, and decentralized exchanges.

Moreover, Avalanche’s ability to support multiple subnets allows for the creation of specialized networks tailored to specific use cases. For example, developers can create subnets dedicated to DeFi applications or supply chain management systems, each with its own set of validators and rules.

Token Comparison between Ethereum vs Avalanche

In the world of cryptocurrencies, tokens play a crucial role in facilitating transactions and powering decentralized applications (dApps). Two prominent blockchain networks that utilize their native tokens are Ethereum and Avalanche. Let’s compare these tokens to understand their unique features and benefits.

Ethereum’s Utility Token: ETH

Ethereum, often referred to as the pioneer of smart contract platforms, has its native token called ETH. This token serves a dual purpose within the Ethereum ecosystem. Firstly, it acts as a utility token for transaction fees on the network. Whenever users perform any action on Ethereum, such as executing a smart contract or transferring funds, they need to pay transaction fees in ETH.

Secondly, ETH also functions as a store of value. Similar to how people invest in traditional assets like gold or stocks, individuals can hold ETH as an investment with the expectation that its value will appreciate over time. The market capitalization of ETH is substantial due to its longer existence and wider adoption compared to other cryptocurrencies.

Avalanche’s Native Token: AVAX

On the other hand, Avalanche introduces its native token known as AVAX. Just like ETH on Ethereum, AVAX is used for transaction fees within the Avalanche network. Users must pay AVAX when conducting any activity on this blockchain platform.

However, AVAX goes beyond being just a utility token for transactions. It also plays an essential role in staking and governance participation within the Avalanche ecosystem. Staking involves locking up AVAX tokens to support network security and consensus mechanisms while earning rewards in return. Holders of AVAX have voting rights regarding protocol upgrades and changes through governance participation.

Market Capitalization Comparison

When comparing market capitalizations between these two tokens, it is clear that ETH currently holds a larger share than AVAX due to its longer history and broader user base. However, it’s important to note that market capitalization alone does not determine the value or potential of a token. Both ETH and AVAX have unique characteristics and cater to different ecosystems.

Factors Influencing Value

The value of ETH is influenced by various factors, including the demand for dApps built on the Ethereum platform. As more developers and users adopt Ethereum for creating decentralized applications, the demand for ETH increases, potentially driving up its value. Market sentiment, technological advancements, and regulatory developments can also impact the value of ETH.

On the other hand, AVAX’s value is closely tied to the growth and expansion of the Avalanche ecosystem. The success of new projects launching on Avalanche, increased adoption by developers and users, and improvements in network scalability can all contribute to an increase in AVAX’s value over time.

Fee Comparison between Ethereum and Avalanche

Ethereum, one of the most popular blockchain platforms, has faced a significant challenge. This limitation is primarily due to its limited scalability. However, Avalanche aims to address this issue by offering low transaction fees even during peak usage, leveraging its scalable architecture.

Ethereum’s High Transaction Fees

During times of high demand on the Ethereum network, users have experienced exorbitant transaction fees. This can be attributed to the network’s limited scalability, which leads to congestion and increased competition for block space. As a result, users often find themselves paying hefty fees just to complete their transactions in a timely manner.

Avalanche’s Low Transaction Fees

Avalanche sets itself apart from Ethereum by providing low transaction fees even during periods of high network activity. Its scalable architecture allows for faster processing times and higher throughput, ensuring that transactions can be executed at a lower cost. This makes Avalanche an attractive option for users who are seeking cost-effective blockchain solutions.

Factors Affecting Fee Structure

The fee structure on both Ethereum and Avalanche varies based on several factors. These factors include network demand and the gas optimization techniques employed by developers.

On Ethereum, gas fees are determined by the complexity of smart contracts and the amount of computational resources required to execute them. During times of heavy traffic, these fees can skyrocket as users compete for block space.

Avalanche also utilizes gas fees but with a different approach. It employs a unique consensus mechanism called Avalanche consensus, which allows for sub-second finality without sacrificing security or decentralization. This efficient consensus mechanism contributes to lower transaction costs on the platform.

Cost-Effectiveness of Avalanche

With its low transaction fees even during peak usage, Avalanche offers a cost-effective alternative to Ethereum. Users who are looking for affordable blockchain solutions can benefit from Avalanche’s scalable architecture and efficient fee structure.

By choosing Avalanche over Ethereum, users can save significantly on transaction fees, especially during times of high network congestion. This cost-effectiveness makes Avalanche an appealing option for individuals and businesses alike.

DeFi Comparison between Ethereum and Avalanche

We discussed how Ethereum has established itself as a pioneer in the world of blockchain and DeFi, with a wide range of applications and a large developer community. On the other hand, Avalanche offers faster transaction speeds and lower fees, making it an attractive alternative for users looking for efficiency.

While Ethereum remains dominant in terms of adoption and ecosystem maturity, Avalanche’s innovative consensus mechanism and interoperability features make it a promising contender. It provides an environment that enables developers to build scalable DeFi applications without compromising on security or decentralization.

As you consider which platform to choose for your DeFi needs, it’s important to evaluate your specific requirements. If you prioritize network effects, extensive developer support, and a wide range of existing DeFi projects, Ethereum may be the right choice for you. However, if speed, low fees, and scalability are your primary concerns, then Avalanche might offer a more suitable solution.

Ultimately, both platforms have their strengths and weaknesses. It’s crucial to stay informed about new developments in this rapidly evolving space. Keep exploring different options as technology progresses to find the best fit for your needs. Happy investing!

Note: This conclusion is written with conversational tone using personal pronouns (you), active voice sentences, idiomatic expressions (“stay informed,” “happy investing”), short paragraphs/sentences.

FAQs

What is the difference between Ethereum and Avalanche?

Ethereum and Avalanche are both blockchain platforms, but they differ in several key aspects. Here’s a breakdown of their differences:

-

Consensus Mechanism: Ethereum currently uses a proof-of-work (PoW) consensus mechanism, while Avalanche utilizes a novel consensus protocol called Avalanche Consensus, which is based on a variation of proof-of-stake (PoS).

-

Scalability: Ethereum has faced scalability challenges due to network congestion and high gas fees during peak usage. On the other hand, Avalanche claims to offer significantly higher scalability with its sub-second transaction finality and ability to process thousands of transactions per second.

-

Smart Contract Functionality: Ethereum is renowned for its robust smart contract capabilities, enabling developers to build decentralized applications (DApps) on its platform. Similarly, Avalanche supports smart contracts through its EVM-compatible virtual machine called “Avalanche Contract Chain.”

-

Interoperability: While Ethereum primarily focuses on its own ecosystem, Avalanche aims to provide interoperability by connecting different blockchains. It offers tools like the “Bridge” feature that enables assets to be transferred between different chains.

-

Development Community: Ethereum has an established and large development community with numerous projects built on top of it. Although still growing, Avalanche’s development community is smaller but expanding rapidly.

Which blockchain platform should I choose: Ethereum or Avalanche?

Choosing between Ethereum and Avalanche depends on your specific requirements and goals. Consider the following factors:

-

Use Case: Evaluate whether your project requires high scalability or extensive smart contract functionality. If you prioritize scalability or need fast transaction finality, Avalanche might be a better fit. However, if your project heavily relies on existing Ethereum-based infrastructure or requires complex smart contracts, sticking with Ethereum could be more suitable.

-

Costs: Take into account transaction fees (gas fees) associated with each platform. At times, Ethereum gas fees can be substantial during periods of high network activity. Avalanche claims to offer lower transaction fees due to its consensus mechanism and scalability features.

-

Community Support: Consider the development community behind each platform. Ethereum has a mature ecosystem with numerous resources, libraries, and developer tools available. Avalanche’s community is growing but may have fewer resources and support options.

-

Interoperability Needs: If you require interoperability between different blockchains or assets, Avalanche’s focus on cross-chain compatibility might be advantageous for your project.

Ultimately, it’s recommended to conduct thorough research, consider your specific requirements, and potentially consult with experts before making a decision.

How do I get started with Ethereum or Avalanche?

To get started with Ethereum or Avalanche:

-

Ethereum: Visit the official Ethereum website (ethereum.org) to learn more about the platform and access developer resources. You can download an Ethereum-compatible wallet like MetaMask or MyEtherWallet to store ETH and interact with DApps. Explore online tutorials and documentation to understand smart contract development using Solidity.

-

Avalanche: Visit the official Avalanche website (avalabs.org) for comprehensive information about the platform’s features and capabilities. To interact with Avalanche, you can set up an account on a compatible wallet like MetaMask or Trust Wallet that supports the Avalanche network by adding it as a custom RPC network using the appropriate settings provided by Avalanche documentation.

Remember to exercise caution when dealing with cryptocurrencies and ensure you follow best practices for securing your digital assets.

Can I transfer assets between Ethereum and Avalanche?

Yes!